November 5, 2023

Stocks shot higher in the opening days of November after October's Halloween tricks! Has a Santa Claus rally finally begun or are there some tricks still left in that stale bag of Halloween candy?

I'll try to help you understand what's happening with some charts I've collected this week. There are also some important and timely personal finance tips at the end of this email. Be sure to click on the links provided! Want more? Visit our community website!

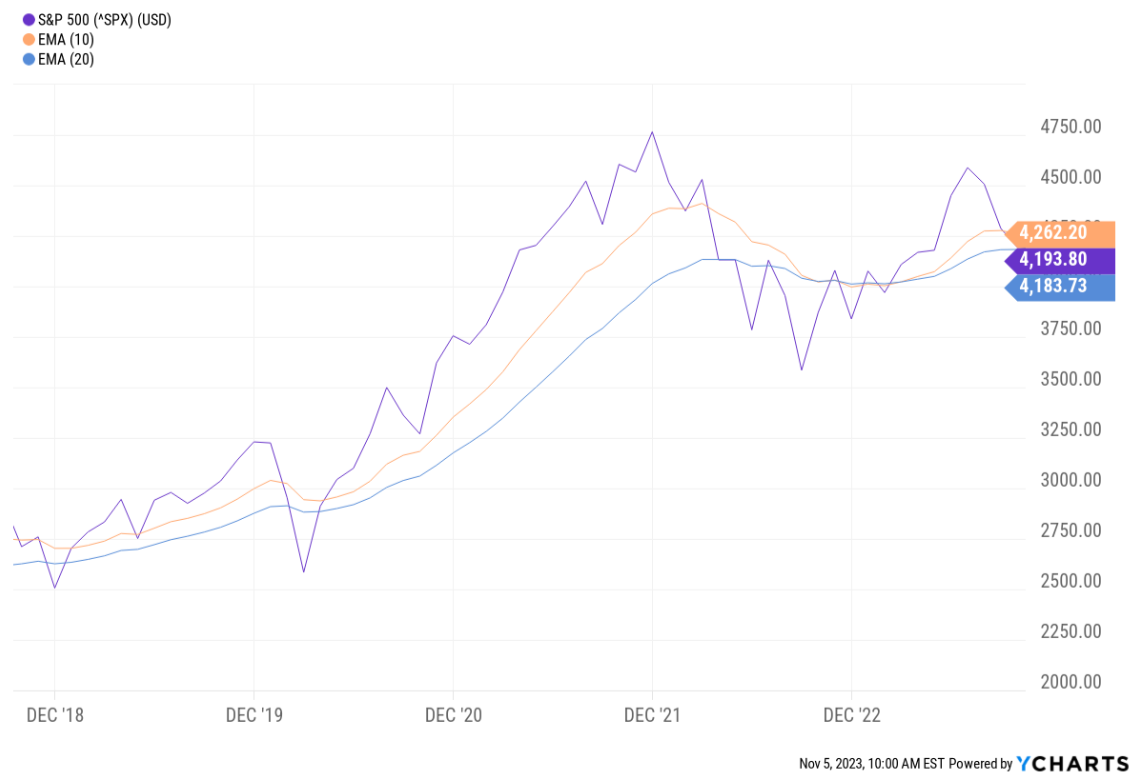

As October drew to a close, I was becoming concerned the stock market was slipping into something worse than a correction. The S&P 500 was trading below its 10-month moving average and was perilously close to falling below the 20-month moving average, a momentum shift typical of the start of a bear market.

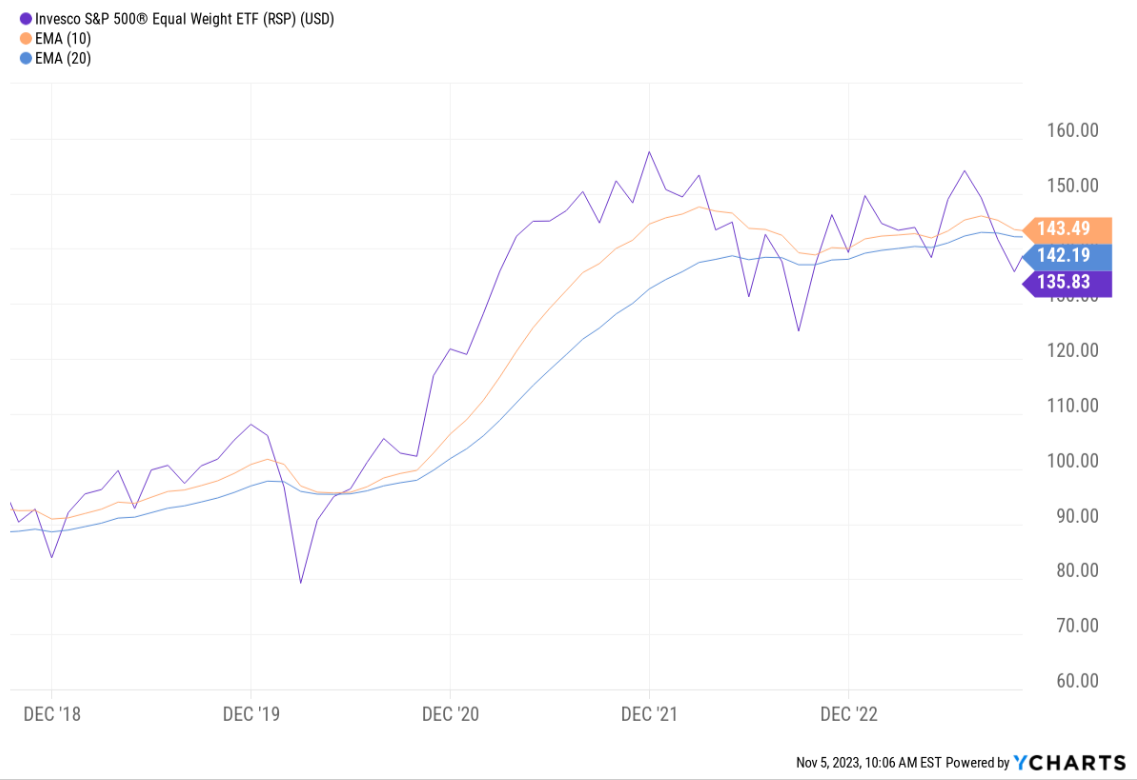

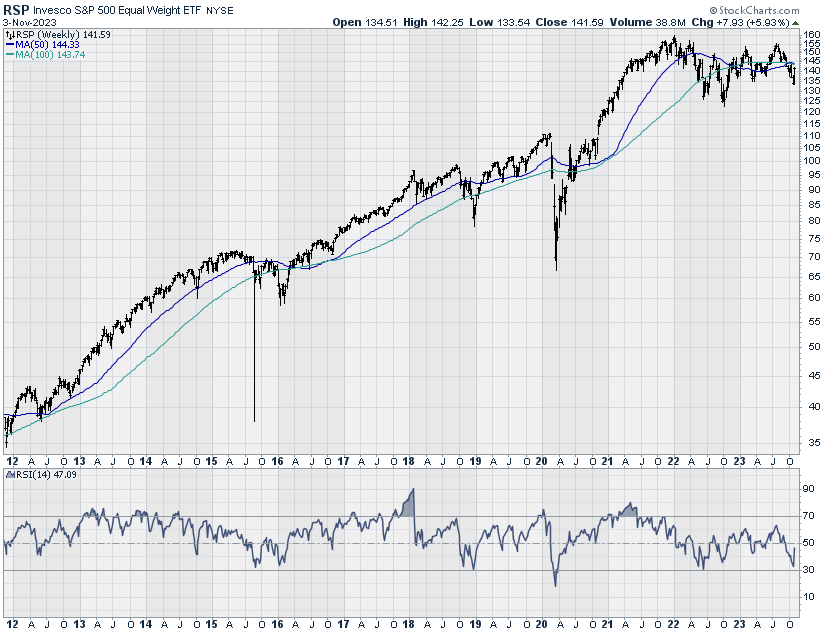

In fact, on an equal-weighted basis (RSP), the moving averages were indicating bear market potential.

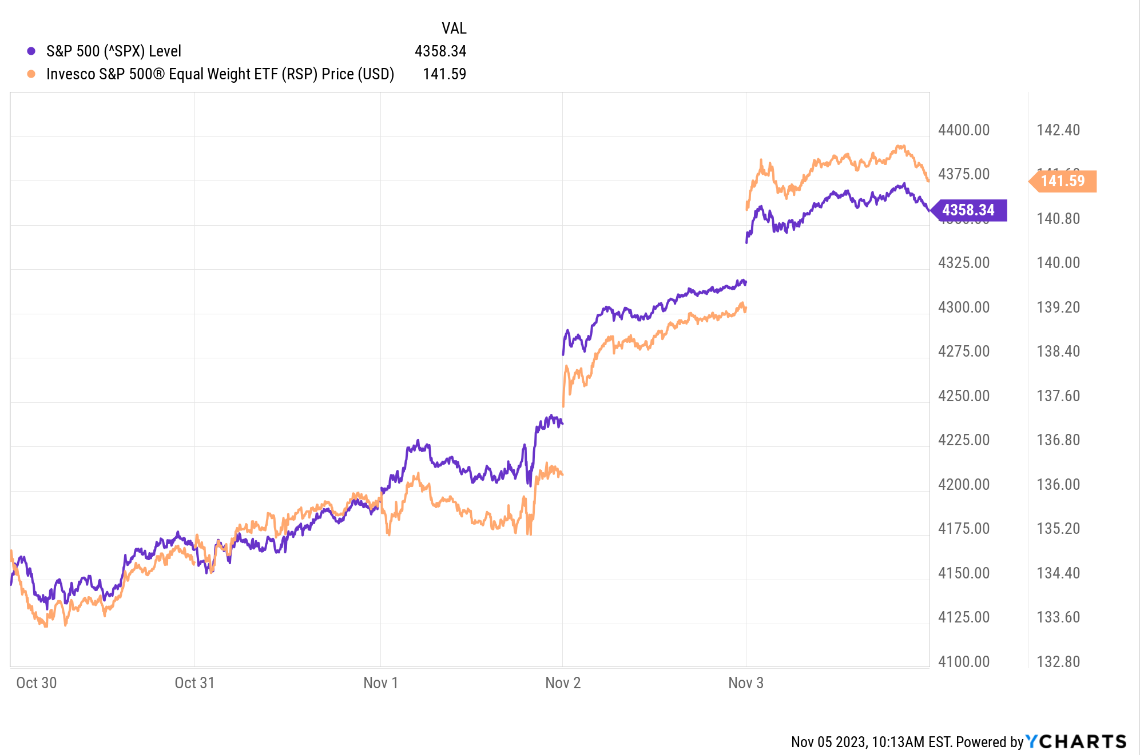

Then this happened last week.

The 5%+ surge in stock prices in the first few days of November has at least temporarily eased my concerns. The S&P 500 is now trading above both moving averages. Unfortunately, RSP, despite its strong rally, is still below its moving averages, suggesting some caution is still warranted.

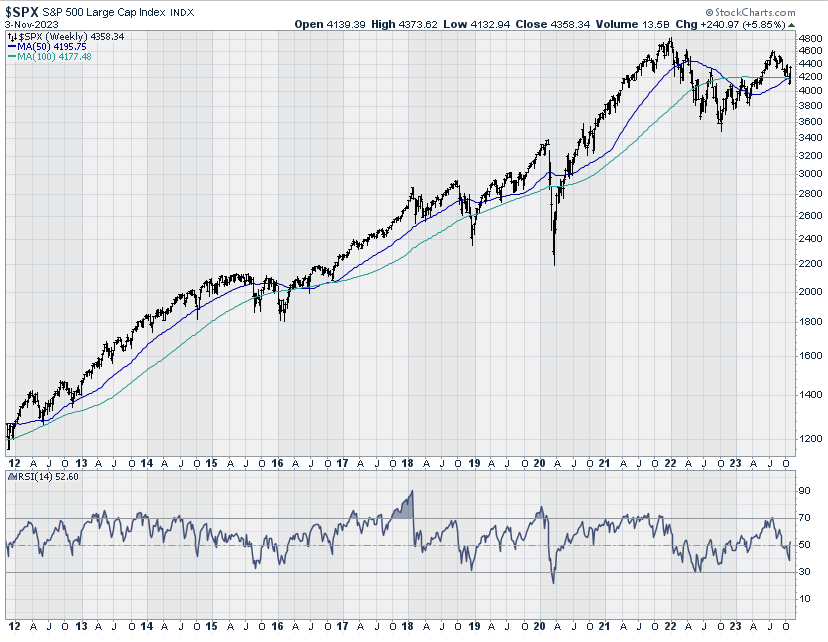

The weekly moving averages also paint a more upbeat picture for the S&P 500.

Although RSP is still somewhat iffy.

Here are the performance tables for the end of October:

Click to View

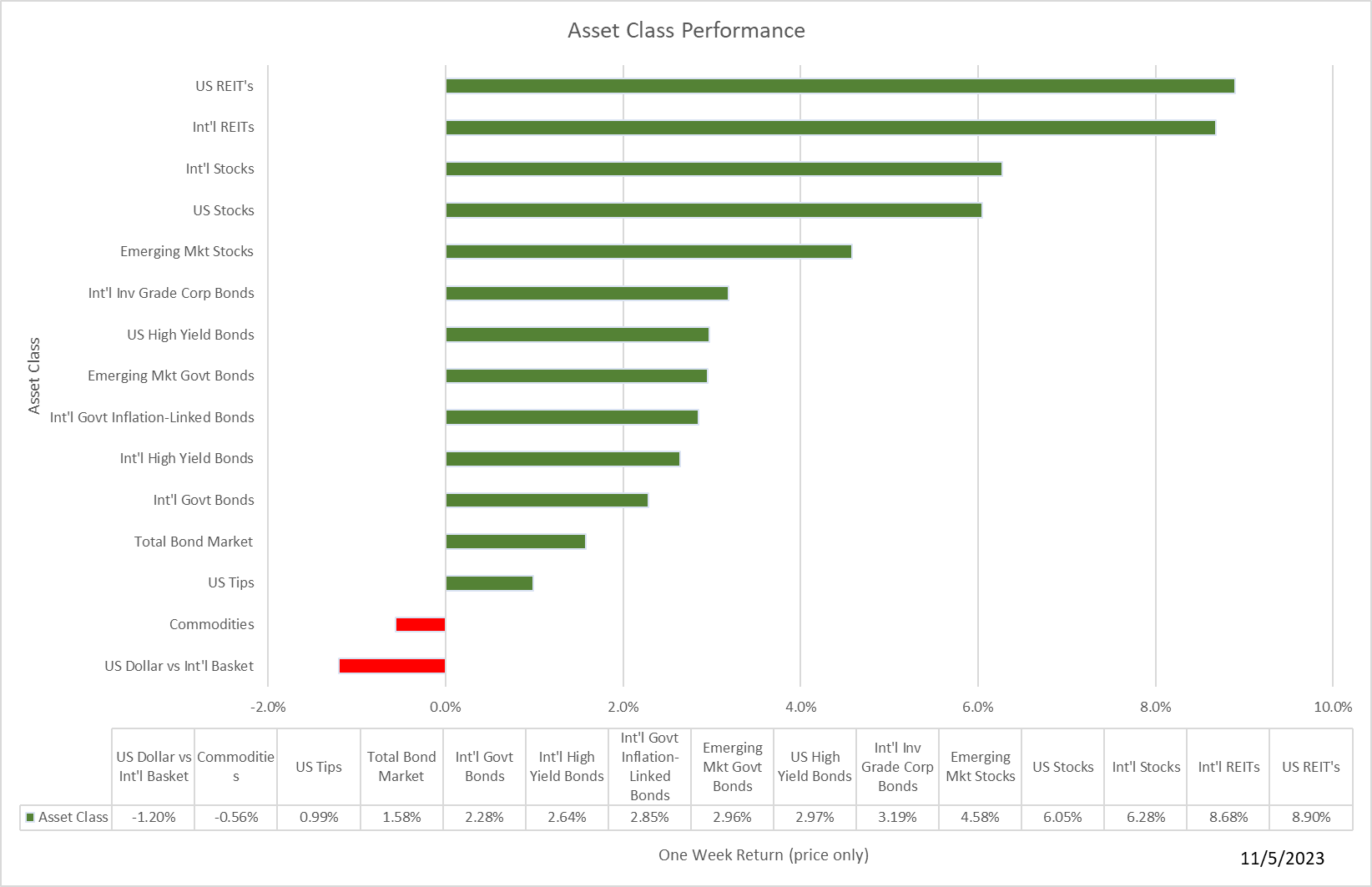

And here is the performance for last week. REITs soared!

A more detailed review can be downloaded here:

Last week's market rebound was driven by investor optimism that interest rates may have peaked.

Click to View

At their November meeting, the Fed left the Fed funds rate target alone.

Click to View

The employment picture softened as payrolls were weaker than expected and the unemployment rate was higher, easing pressure on the Fed to raise rates again.

.jpg?h=90a8dffd&itok=ZCuPK_XU)

Click to View

Of concern, however, is what rising unemployment means for stocks. At least since the start of the 21st century, it has signaled the start of a bear market. It's something to keep an eye on.

Click to View

There was some good news on the productivity front. The report was much better than expected. This is good news for the economy in general and inflation in particular (not to mention corporate profits).

Click to View

Even so, you should expect the economy to slow significantly in the fourth quarter.

Click to View

Analysts continue to lower their estimates after a flood of earnings reports.

Click to View

Here are some of the reporting companies this week. Maybe they can change the downward trend.

I came across this interesting compilation of Time Magazine's 200 best inventions of 2023. It's fun to review and just maybe you'll find a gift idea - Christmas is just around the corner...

Click to View

Do you participate in your employer's 401K plan? You should and to the maximum extent possible! The IRS has just raised the amounts you can contribute in 2024.

Click to View

For those of you who own mutual funds in your taxable accounts, be aware, this is the season for capital gains dividends. Always use caution when buying mutual funds toward year-end. You don't want to be hit with a big capital gain tax bill! Should you already own a mutual fund with an expected capital gains distribution, check with your tax or financial advisor for strategies to minimize the tax hit. (This problem is almost non-existent if you stick with ETFs.)

Thank you for reading! Feel free to forward this email to a friend or colleague.

Please consider joining the Under A Buttonwood Tree community website. There, you will find all the charts and graphs I collect as well as podcasts, videos, book ideas, helpful links to a variety of resources, and much more. Add your own comments, ask questions, or search on a topic of interest. But you must be a member! Click the join button below. We look forward to your participation! (Need help? I can get you started. Let me know by sending an email to the address below.)

If you do not already receive Chart Attack! and our occasional newsletter, Under A Buttonwood Tree, click the subscribe button. Remember, there's no charge but you must be a subscriber to have access to the weekly Chart Attacks!

Are you receiving too many emails and would rather read Chart Attack! on our website? Just let me know by email and you will be removed from the mailing list but retain your access to the site.

Our email address is under.a.buttonwood.tree@gmail.com