If you've been to a grocery store or gas station, listened to the news, or read any number of blog posts, you know prices are rising at rates we haven't seen in many years. Inflation - it's back!

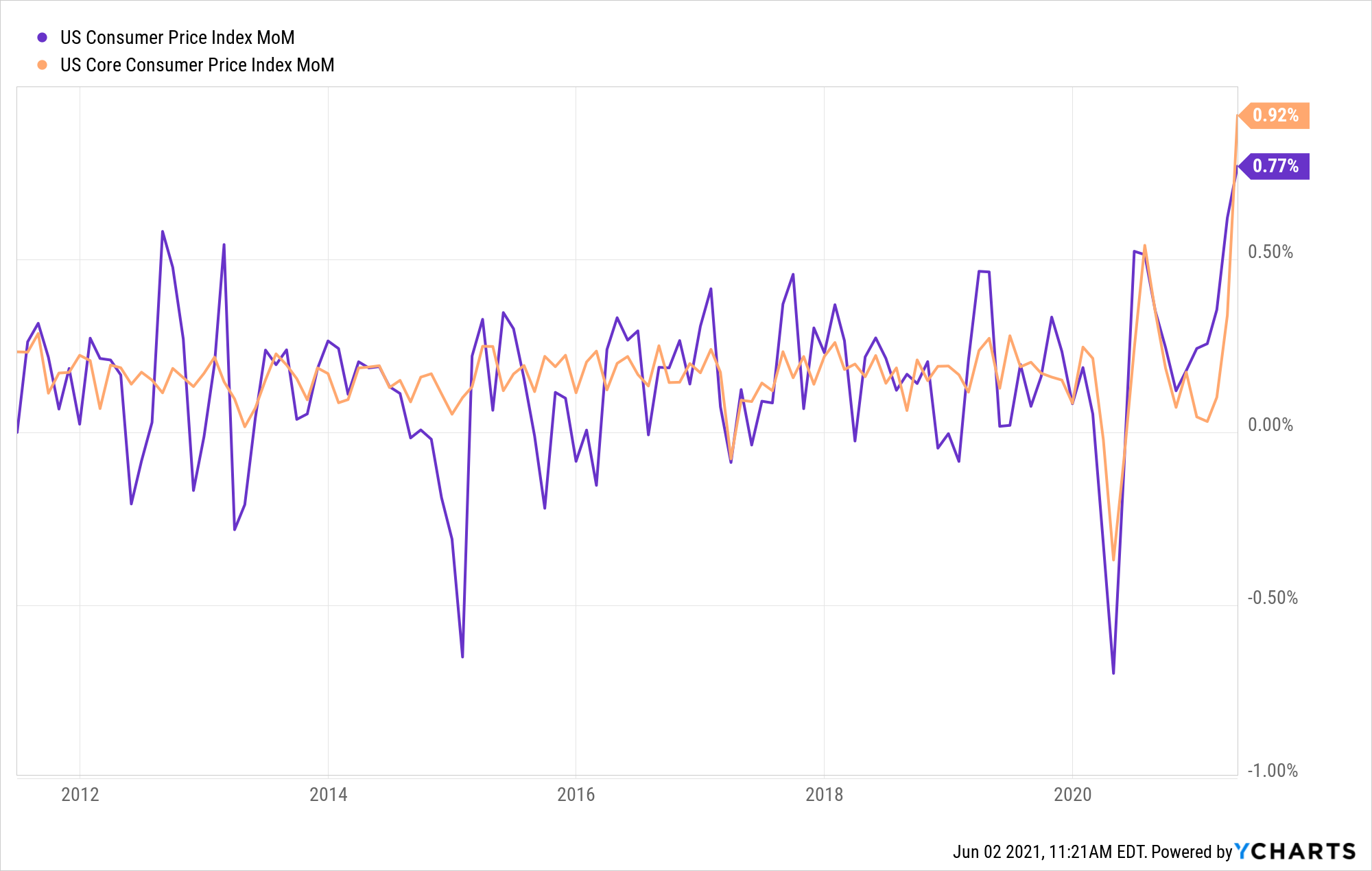

Take a look at this chart of the monthly CPI and Core CPI. Either way, there has been a significant breakout. If you were to annualize last month's core CPI, inflation would be running at north of 10% per year!

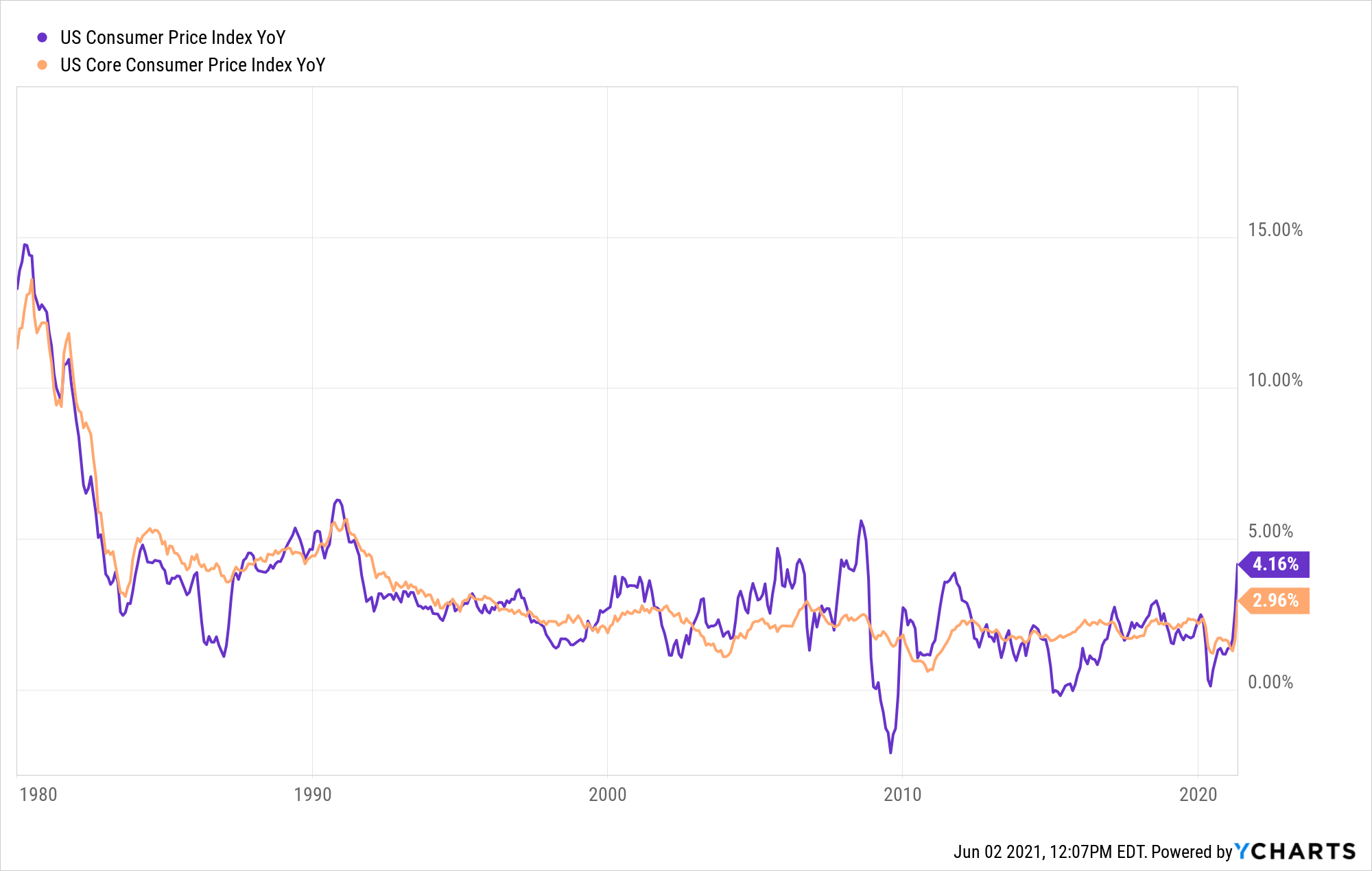

To be fair, the month-to-month change in the CPI is a very volatile series so annualizing any given month will result in a lot of false signals. But take a look this chart of the year-to-year change in CPI starting in 1980.

The recent spike in inflation is quite visible with Core CPI now at 3%, a level we haven't seen in more than ten years.

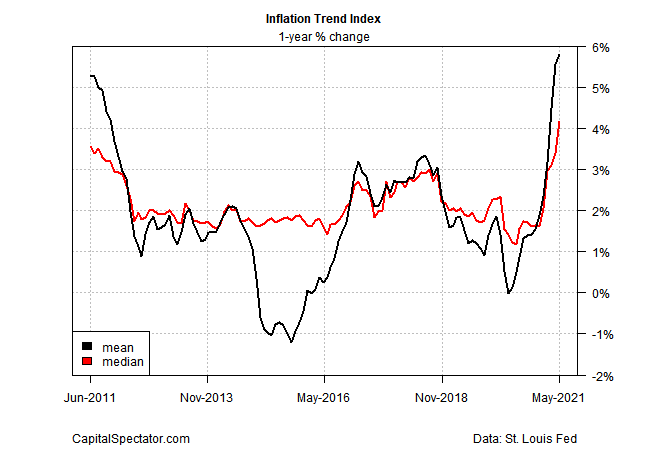

Here's another look at inflation from CapitalSpectator.com which uses a number of inflation indicators to plot inflation over time. It is showing the same trend as above but with an even faster rate of change. (Here's a link to CapitalSpectator's blog post for more information.)

At the very least, this is concerning. Are we seeing a temporary spike in inflation as the economy rebounds from the COVID shutdown? Or, will current fiscal and monetary policy cause further acceleration of inflation and/or make it a permanent fixture in our economy? What will the impact be on individuals, corporations, or the markets? How do we invest to protect our portfolios and potentially benefit from inflation.

At the moment, I believe there are more questions than answers. In future posts, we can address some of these questions. Time will tell...