October 25 - 29

Earnings Update

The earnings trend didn't really change much this past week with many companies exceeding expectations. The gross margin picture remains mixed but not as bad as I would have expected suggesting that, so far, companies are coping by raising prices and cutting costs. Nevertheless, many cited supply chain issues, labor shortages, and rising input prices as reasons for shortfalls and/or reduced forecasts for the fourth quarter.

Apple Computer is perhaps the most high-profile example of the supply chain issue, reporting disappointing sales in the quarter. (Well, if you can call a revenue gain of "only" 29% to $83.4 billion disappointing...) Tim Cook, Apple's CEO, estimated that supply chain disruptions may have cost as much as $6 billion in lost sales. Despite the lost revenue, Apple was still able to report earnings of $20.6 billion ($1.24/share) up 62% from the prior year!

Not to be outdone, Amazon.com also reported poor results with both sales and earnings missing the mark. Revenues, at $110.8 billion, were about one billion less than what investors had expected - a small miss. However, earnings were down sharply from last year - $3.2 billion versus $6.3 billion and well below the $4.6 billion investors were expecting. Clearly, margins were squeezed in the quarter. Amazon's new CEO, Andy Jassy, commented "we expect to incur several billion dollars of additional costs in our consumer business as we manage through labor supply shortages, increased wage costs, global supply chain issues, and increased freight and shipping costs".

Another big week of earnings ahead...

(I'm having a technical issue with my earnings report table this week. When it gets resolved, I'll post it to the Market Lab.)

October Was A Treat For Investors (Despite Apple and Amazon)

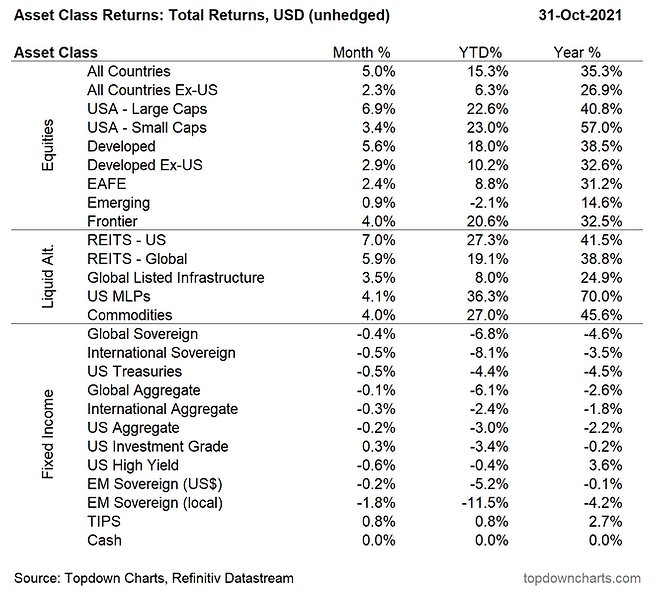

This table from topdowncharts.com shows just how good October was for equity investors. Bonds? That's another story...

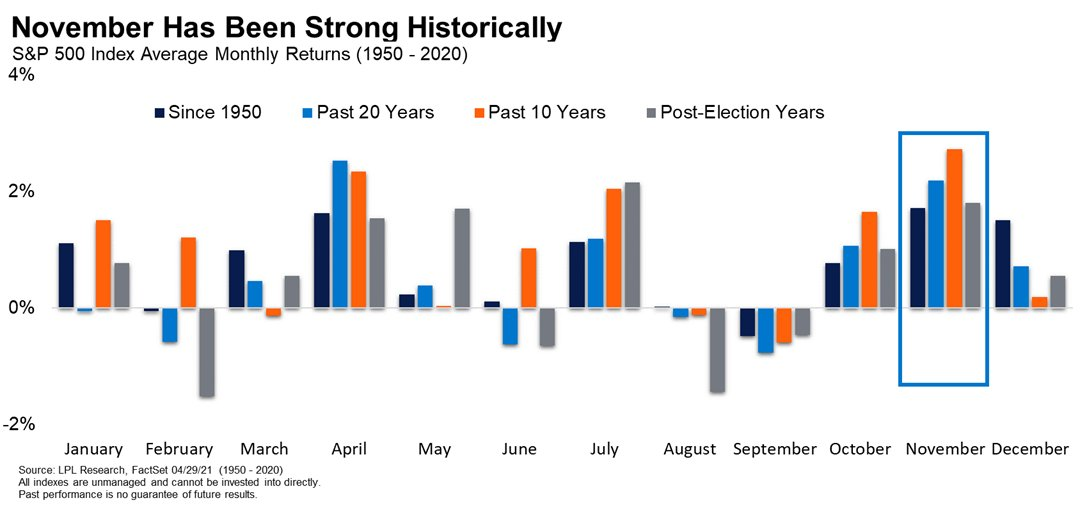

And Here's A Potential Treat For November...

The fourth quarter tends to be a good one for equity investors. And November is one of the best months as this chart illustrates.

Economic News

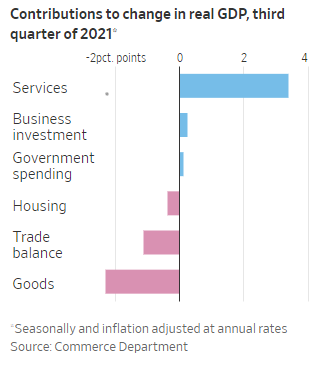

Third-quarter real GDP was reported this week. While not as bad as the Atlanta Fed's GDPNow forecast (discussed last week), the 2.0% gain was less than most forecasters had expected. It was the slowest pace of growth since the recovery began. Services were the primary driver of growth while goods actually contracted in the quarter. Here's the breakdown:

There will be two revisions to this report in the coming weeks. Given all the issues with the supply chain, etc., I would not be surprised to see material changes from the preliminary report.

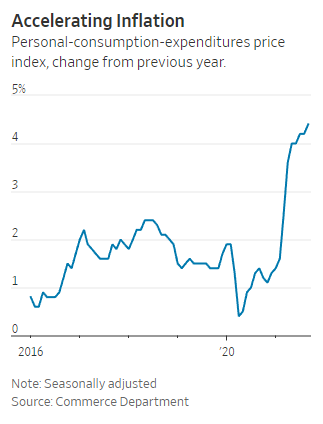

Inflation Watch

The Personal Consumption Expenditures Price Index increased 4.4% in September from the prior year, the fastest increase since 1991. The monthly change was 0.3% or 3.6% annualized suggesting an easing of inflationary pressures. This is one of the Fed's favorite inflation measures.

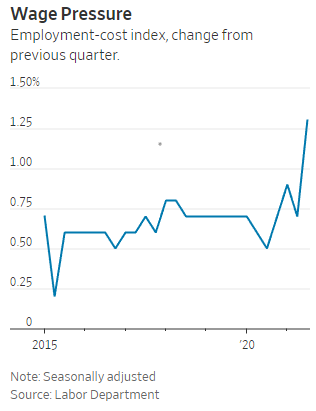

The Employment Cost Index (which measures wages and benefits) was also reported this past week, rising 1.3% for the quarter ended September 30, 2021, the highest gain in 20 years. Annualized, the Employment Cost Index is rising 5.2% and suggests further inflationary pressures ahead as employers raise prices on their goods and services to maintain profitability.

As you know, the supply chain has been a growing problem since the pandemic began in 2020. A significant part of the disruption is the backup at Southern California ports. If you click on the picture below, you'll get a sense of the size and scope of the problem. (The full video from the Wall Street Journal is about 5 minutes in length.)

Here's an interesting article on "skimpflation" from Planet Money: Meet skimpflation: A reason inflation is worse than the government says it is.

Other Stuff...

Interesting technology is being used by the homebuilder, Lennar, to "print" new homes in Austin, Texas. 3-D Printed Houses Are Sprouting Near Austin as Demand for Homes Grows, WSJ 10/26/21. That's a lot of ink!

Need a refresher course on the law of supply and demand? Check out this tutorial from MRU.org.

And Finally...

I'd like to welcome our new subscribers. Thank you! You can find previous newsletters and more information by heading over to our Home Page.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, visit the Home Page to sign up. It's free!

Have questions or comments? Send them to under.a.buttonwood.tree@gmail.com.