October 18 - 22

It's Here!

ProShares has introduced its new Bitcoin Strategy ETF (BITO). You can click on the link for more information. It's important to note that this fund does not invest in actual bitcoin but in bitcoin futures. This may result in meaningful deviations in performance between bitcoin and BITO. I think this fund will be interesting to track but I'd consider it highly speculative (don't invest if you can't afford to lose it all) from an investment perspective.

Of course, had you been smart or lucky enough to invest $10,000 five years ago, it would be worth $939,340 today! Here is the chart:

But remember, past performance does not guarantee future results!

Inflation Watch

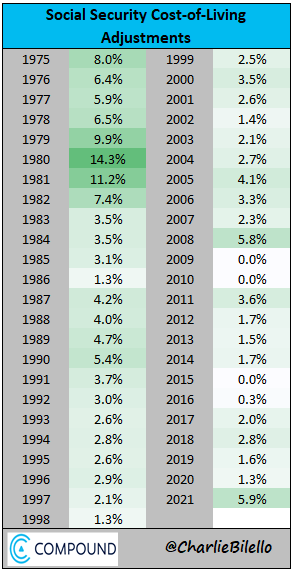

Last week Social Security announced a 5.9% COLA, the largest since 1981! The last time it was above 5% was in 2008. So while good news for Social Security recipients, it's another indication of the inflation problem we currently face.

Looks like you may be needing more than a 5.9% increase to deal with soaring food costs. Take a look at this article in the Epoch Times: Billionaire Supermarket Owner Warns: Food Prices Will Go Up ‘Tremendously’. Since you may need a subscription to read the article, here's a quick synopsis: John Catsimatidis, the billionaire New York supermarket owner, expects food prices "to rise over 10 percent in the next 60 days” and blamed rising inflation on supply chain bottlenecks. And Catsimatidis doesn't expect this inflationary trend to end "anytime soon". So if you see a deal on your favorite foods, better stock up now!

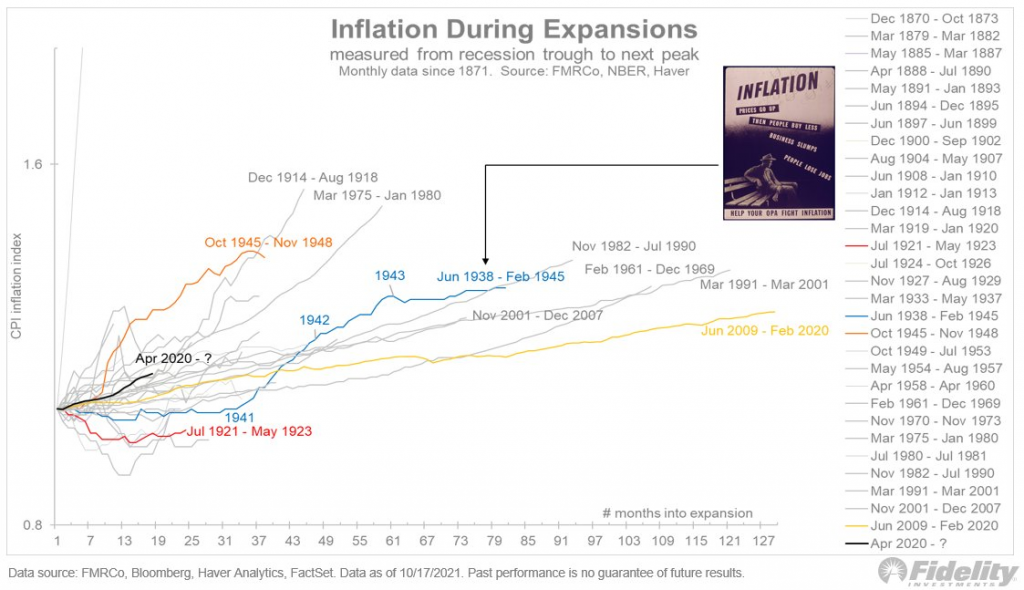

Here's an interesting chart from Fidelity Investments showing inflation from the end of one recession to the start of the next. Looks like our current experience (the black line) is fairly typical. So far...

The weekend edition of the Wall Street Journal (no, I don't have better things to do on the weekend than read the Journal) has this: Powell Signals Heightened Inflation Risks, WSJ, 10/23/2021.

The Economy Appears To Be Slowing:

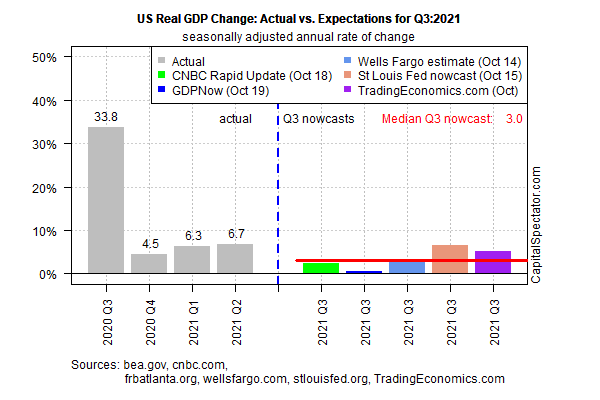

There are a number of organizations that provide real-time updates of quarterly GDP forecasts based on actual reports of economic activity. These updates seem to suggest that the recovery of the US economy has slowed sharply. Here is the latest compilation from The Capital Spectator:

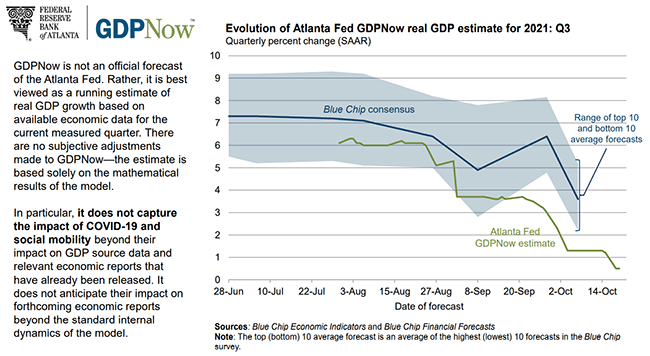

And here is the detailed view from the Atlanta Fed's GDPNow which currently (10/19) has the lowest forecast of the group suggesting that third-quarter GDP will be up about 0.5% while the "experts" are still expecting GDP to grow north of 3.5%. I'm guessing the Atlanta Fed is closer to the mark.

When I see slowing growth and rising inflation, the first word that comes to mind is stagflation. So let's hope the forecasters are wrong about growth slowing and the Fed is right about inflation being temporary. Otherwise, we are ______. (I'll let you fill in the blank!)

A Little Bit Of Good News:

It seems the Democrats are having some issues getting their spending bills through Congress, in part because of objections within their own ranks to increased taxes. Should they fail to get the increases passed, particularly increased taxes on capital gains, the downward pressure on equity valuations will ease a bit. (We'll still have to deal with rising interest rates.)

Earnings Update...

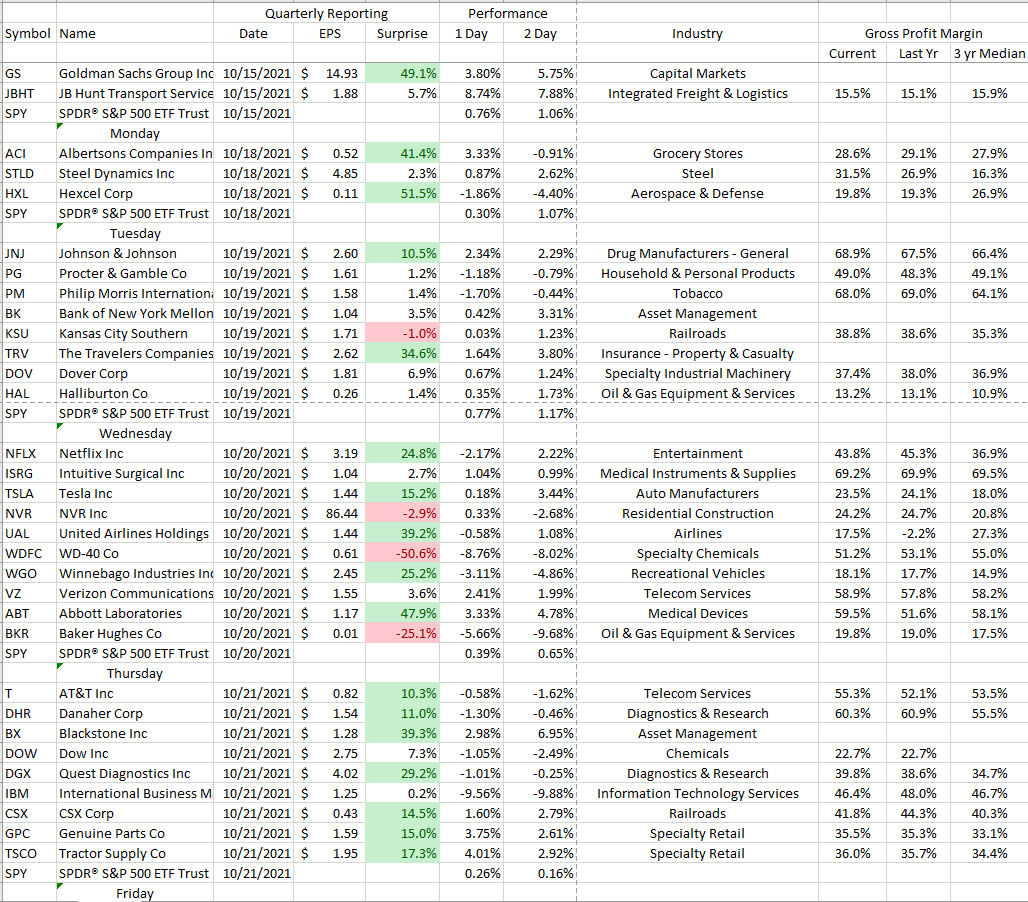

Here's our table of earnings updated through Thursday:

A couple of quick comments: 1. Earnings reports were generally better than expected with some notable exceptions including Baker Hughes and WD-40; 2. While IBM's results met expectations, investors obviously didn't like what they saw in the report including the slip in gross margins from last year and/or management's forecast for the balance of the year. 3. Overall, the gross margin picture is mixed so far suggesting that some companies are able to adjust more quickly to the changing environment. However, many companies are citing increased costs, supply chain disruptions, and labor shortages as reasons for missing numbers or lowering forecasts for the balance of the year.

Next week is another big week for reports. Stay tuned...

From The Garden:

This ninebark's leaves have turned a pretty pale pink.

And Finally...

I'd like to welcome our new subscribers. Thank you! You can find previous newsletters and more information by heading over to our Home Page.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, visit the Home Page to sign up. It's free!

Got questions or comments? Send them to under.a.buttonwood.tree@gmail.com.