Thanksgiving week is usually a good one for investors. The market is closed on Thursday and only open for a half-day on Friday so we get some time off to gorge ourselves on turkey then watch all those football games! And generally, stocks do well this holiday week and continue their advance through year-end.

Jerome Powell Gets Another At Bat

Looks like President Biden has nominated Fed Chair Powell for another four-year term. This is likely good news for markets eliminating uncertainty about the direction the Fed will take in the coming months.

A Reason for Optimism?

I thought this chart from Valens Research was interesting. It is measuring the ratio of the value of property, plant, and equipment (pp&e) net of depreciation versus the gross value over time. A falling ratio suggests that pp&e is aging and will ultimately need to be replaced. It also seems likely that some manufacturing that had been offshored over the past couple of decades may come back home due to the supply chain catastrophe we've been experiencing. Finally, as a nation, we're about to embark on a major infrastructure spending spree. So it seems there will be a significant opportunity for companies involved (directly and/or indirectly) in capital spending in the coming years.

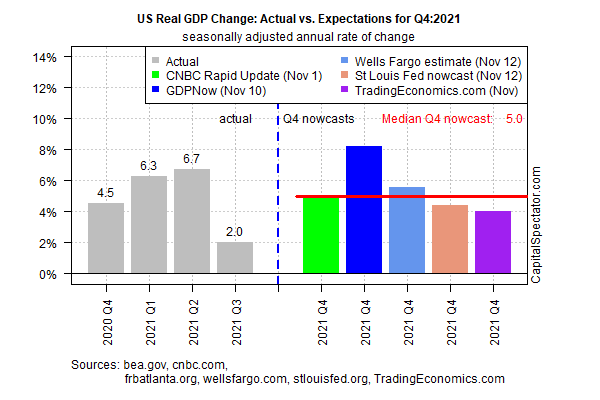

Re-acceleration?

This survey of fourth-quarter forecasts by The Capital Spectator suggests a nice snap-back for the economy after a disappointing third quarter. Remember that these forecasts are based on real-time data and will fluctuate as new information becomes available.

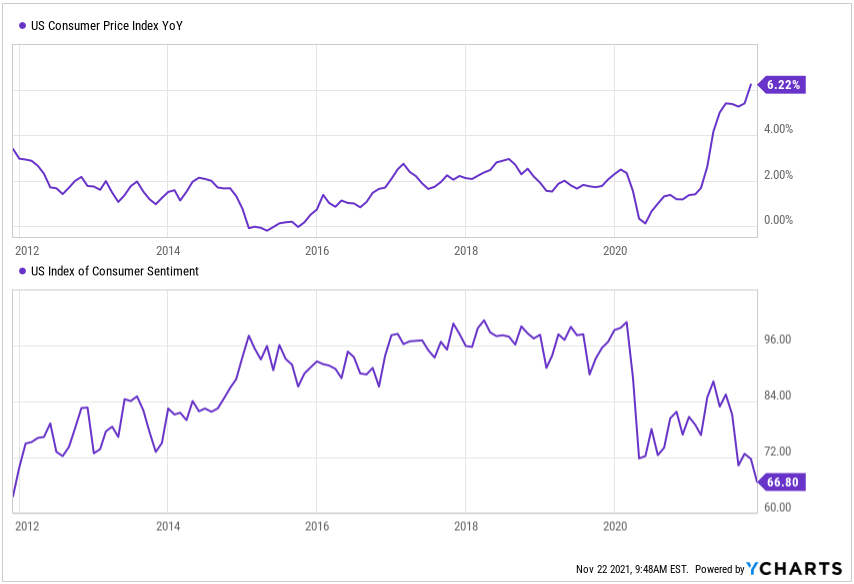

Inflation Running Hot

Also from The Capital Spectator, this chart of inflation. I don't think a lot of commentary is required. It just looks bad.

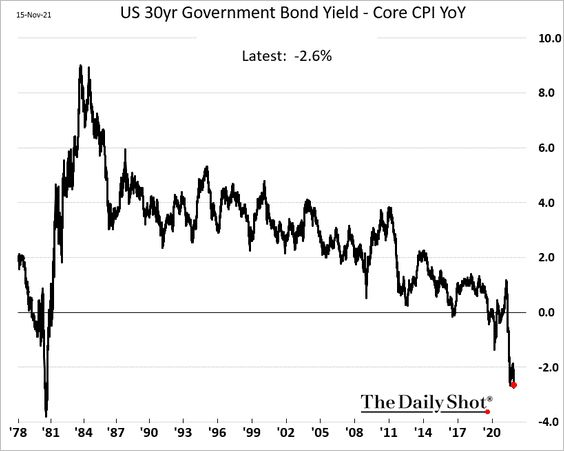

Real Interest Rates Fall

Real interest rates (nominal rate less inflation) have plunged recently, hitting lows that haven't been seen since Jimmy Carter's presidency. Why? Just look at the chart above. Nominal yields on bonds have been fairly stable so soaring inflation results in the chart below. While this is maybe good news for borrowers, I'm not so sure it's good for the rest of us...

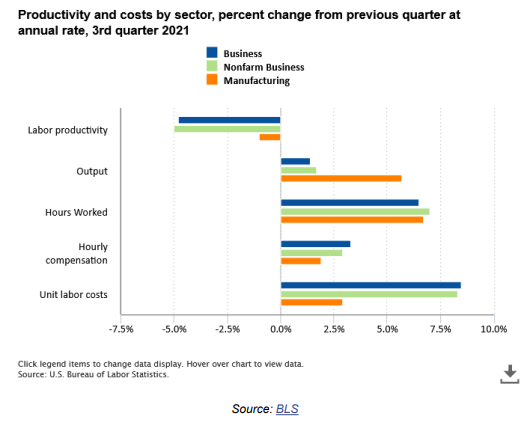

Productivity Plunges

As you can see in the chart, third-quarter productivity fell sharply from the prior quarter. Falling productivity is not good news as it drives up the cost to operate a business, costs that are eventually passed along in the form of higher prices.

Divergence

Note the significant divergence in consumer sentiment (blue line) and investor sentiment (black line - S&P500). I don't know how much predictive value this chart has but I'd put it in the cautionary column...

However, look at this chart comparing retail sales to the same consumer confidence measure.

Falling consumer sentiment doesn't seem to be affecting retail sales. But, perhaps, falling consumer sentiment reflects rising prices.

Taxes Matter!

I started working on my tax returns for 2021 this past weekend. Why not wait until next April? I am trying to get a handle on my potential tax liability for 2021 and considering ways to reduce the amount of tax owed in the last few weeks of the year. There are still steps you can take like loss harvesting, deferring income, increasing charitable giving, etc. Check with you tax advisor/accountant soon. We're running out of time!

And Finally...

Welcome new subscribers. Thank you! You can find previous newsletters and more information by heading over to our Home Page.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, visit the Home Page to sign up. It's free!

Got questions or comments? Send them to under.a.buttonwood.tree@gmail.com.