November 1-5

The Stock Market Shines:

It was a good week for stocks! The S&P 500 rose almost 2% last week and small-cap stocks measured by the Russell 2000 index took off, rising almost 6%. Not to be left behind (and despite inflation worries), bonds rose as interest rates retreated. Why?

First, and perhaps foremost, third quarter earnings reports continued to best investors expectations. Also, the Fed finally announced their plans to reduce their bond purchases (the dreaded "taper") by $15 billion per month from their current $120 billion (!) per month. But the taper wasn't that draconian and the Fed kept interest rates near zero suggesting they are still convinced the acceleration of inflation is transitory. And, most of the proposed tax increases on capital (dividends and capital gains) and corporate income appear to be failing in Congress.

So, our twin concerns of rising inflation and tax rates are fading, at least for the time being. Low interest rates and rising earnings are like Santa Claus' milk and cookies for stocks. (And it doesn't hurt that Pfizer announced a potential miracle cure for COVID-19.)

Before you get too excited, remember stocks aren't cheap on most valuation metrics. Indeed some measures are near all time highs. It is not clear yet that inflation is transitory and the markets still expect the Fed to start raising rates sometime next year. So enjoy the stock market's advance. November and December are generally good months for stocks. But don't get too complacent.

Economics Update

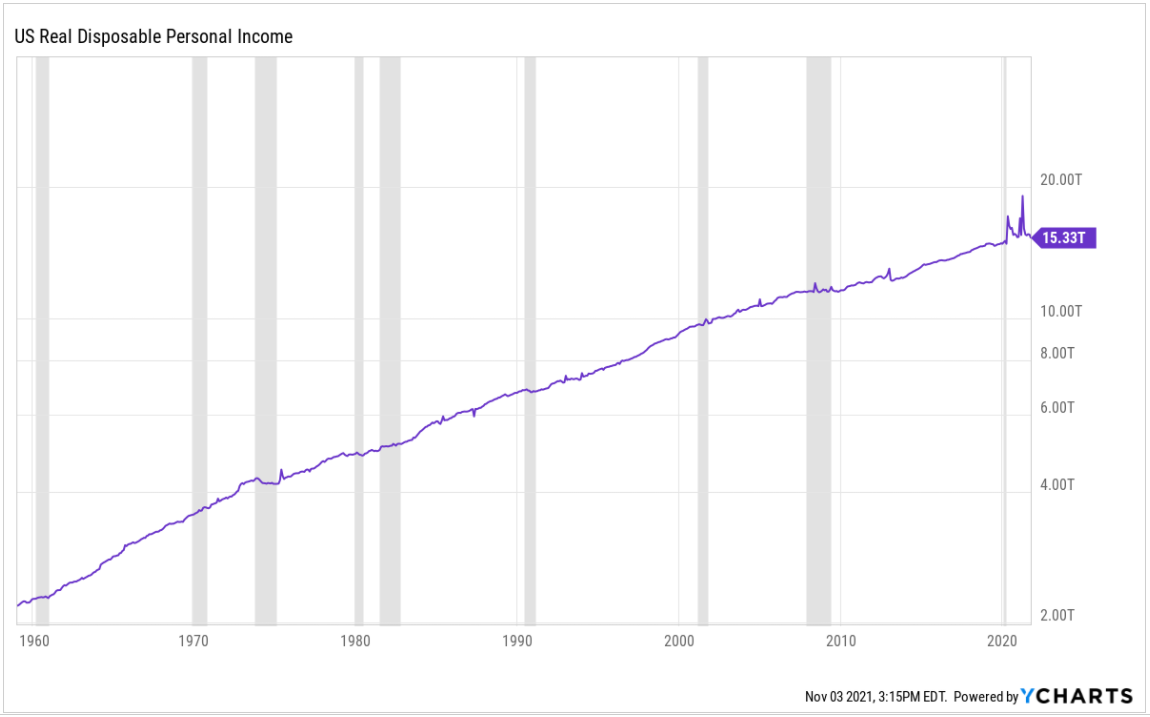

I thought this was an interesting chart of real (adjusted for inflation) disposable personal income.

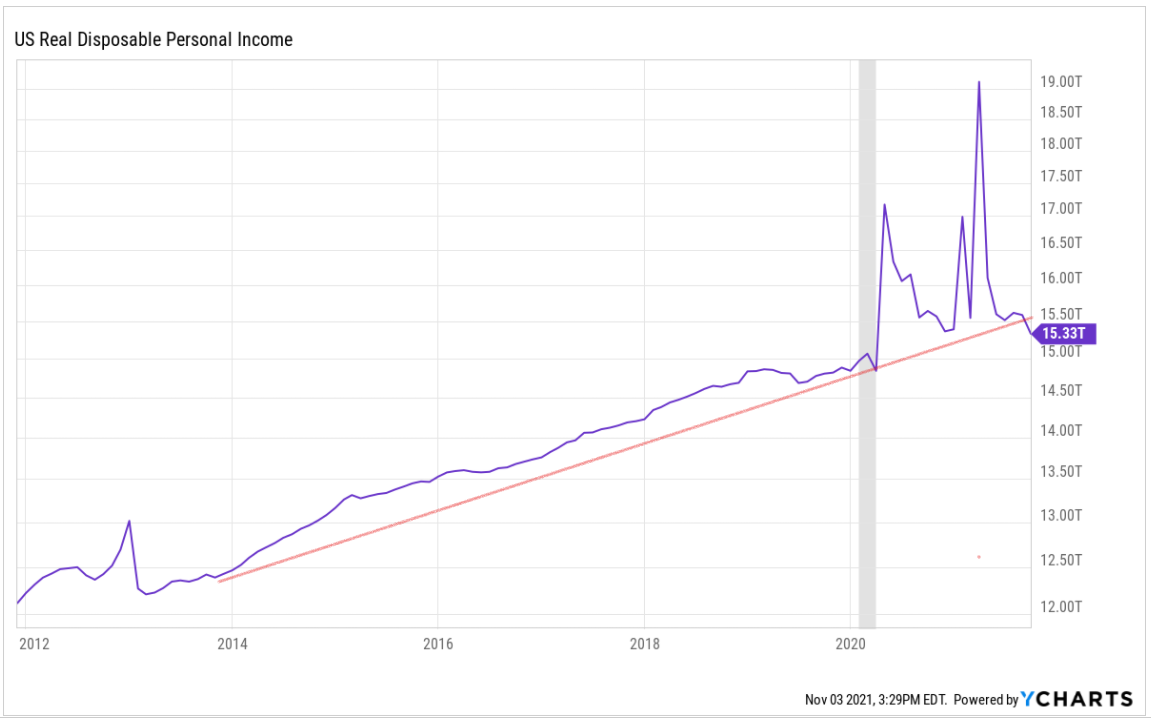

You can see how smoothly the line trends upward with only minor blips, even during recessions (shaded on the chart), since 1960. Until 2020 that is. Since the pandemic began, we've experienced some wild spikes in real personal income, which can be better seen in the chart below. With many of the government programs put in place to offset income lost during the pandemic shutdowns, etc. coming to an end, it looks like real disposable income may return to its historical trendline - even dip below should inflation continue to rise faster than wages. This will have implications for our economy going forward, suggesting slower/sluggish growth next year (at least).

Inflation Watch

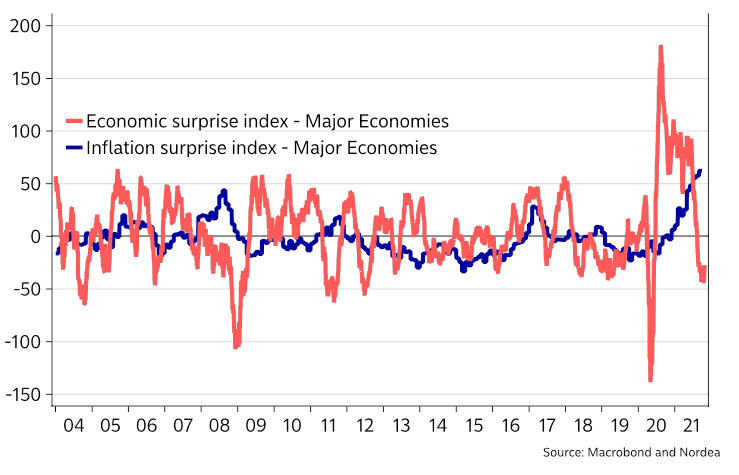

Economists continue to underestimate inflation as shown by the inflation surprise index (blue line). I suppose this is not too surprising given the long period (decades) of falling rates of inflation they've experienced over their careers. Perhaps that's why so many of them expect the recent surge of inflation to be temporary. I hope they are correct. However, the economic surprise index (red line) suggests these same experts haven't got a clue what's going on! Remember, some of these experts are in charge of the Fed...

Earnings Update

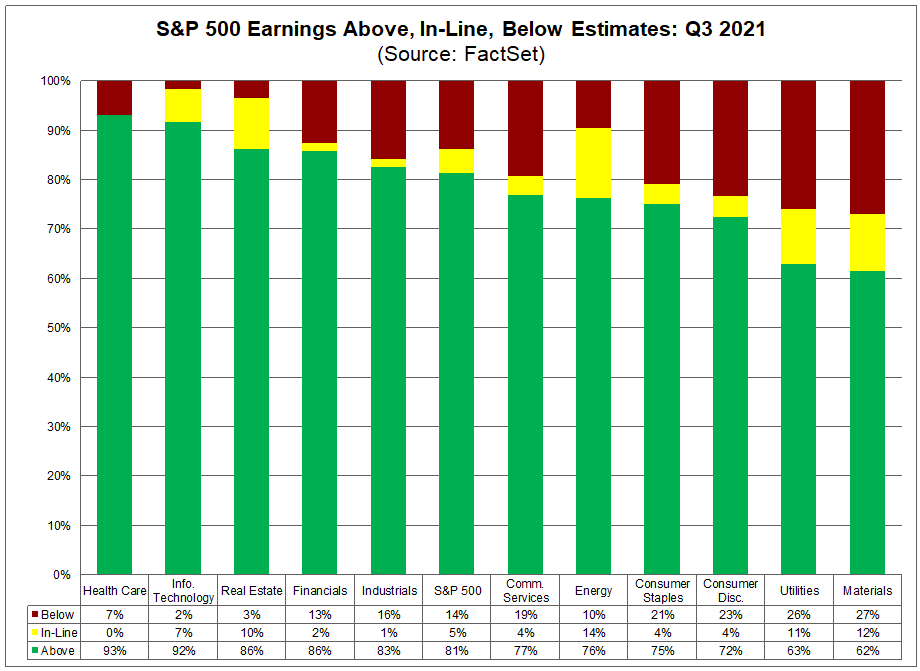

It was another solid week for corporate earnings. To date, more than 80% of the companies in the S&P 500 have reported earnings exceeding investors' expectations! Either investors had low expectations or all these companies had a terrific quarter (I suspect it's both). This chart from Factset breaks down the earnings results by sector.

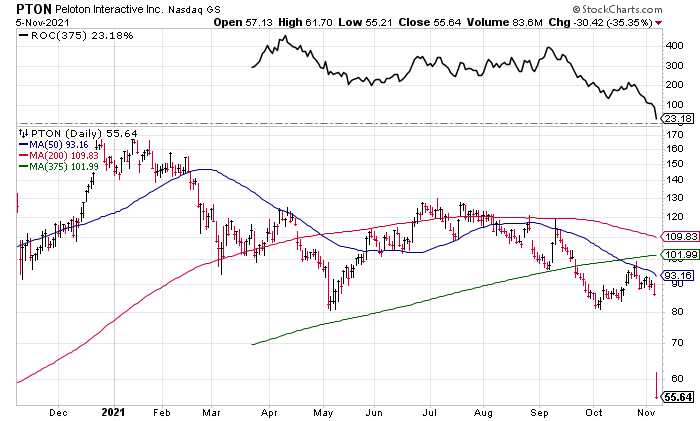

There was one stock that took it on the chin last week after announcing particularly poor results and lowering its expectations for future results - Peloton Interactive (PTON). Peloton had been a high flyer, benefitting from people staying away from gyms during the pandemic, riding the company's $$$$ bikes, and paying for hefty subscriptions. The stock reacted badly to the disappointing news that all of a sudden, people have stopped buying expensive exercise equipment and are heading back to the gym. Peloton's stock fell 35% Friday to $55.64 per share - ouch! Not surprisingly, Wall Street analysts cut their estimates and lowered their recommendations after the fact, citing the company's failure to meet their prior guidance There are several lessons from this report: 1. Company guidance can be way off (good or bad); 2. Wall Street analysts often rely on company guidance in making their forecasts and recommendations rather than using their own judgment and are thus no more or less reliable than the company's forecast; and 3. Selling exercise equipment is a lousy business subject to fads, competition, etc. - I'd stay away...

Friday Night Follies!

Congress finally passed an infrastructure bill late Friday evening. The price tag appears to be north of $1 trillion dollars! In my view, this is at best, mixed news. There will be beneficiaries of the bill - companies involved in road construction, internet infrastructure, and manufacturers of electric vehicle charging stations to name a few. But the bill adds to our gargantuan deficit and will put additional upward pressure on inflation - something we don't need right now. It will be interesting to see how this new legislation affects the financial markets on Monday.

The Reading Room

If you are interested in the origins of index funds and the financial revolution they started, check out this new book by Robin Wigglesworth, Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever. Here's a link to a recent review in the Wall Street Journal. Click on the image to order it from Amazon (paid link).

And Finally...

I'd like to welcome our new subscribers. Thank you! You can find previous newsletters and more information by heading over to our Home Page.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, visit the Home Page to sign up. It's free!

Got questions or comments? Send them to under.a.buttonwood.tree@gmail.com.