The stock market sell-off at the end of last week was for the most part due to a dismal inflation report and the resulting rise of interest rates with the yield on 10-year U.S. treasury bonds hitting 2%. However, there was another factor at play - the potential for war in Ukraine. Towards the end of the week, the warnings from the U.S government became increasingly dire and I think they spooked investors.

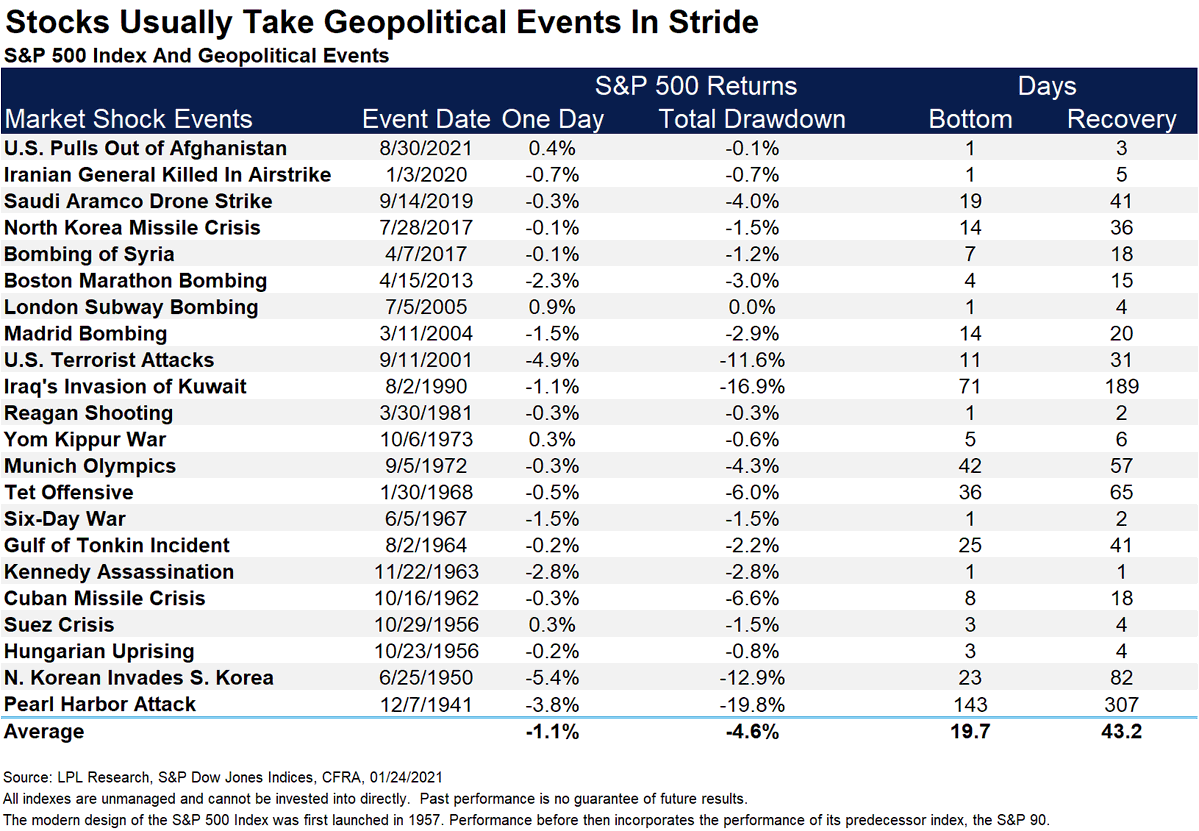

What is the impact of geopolitical events such as the outbreak of war on the stock market? Probably not as dramatic as you would expect. This table looks at a number of these events and it suggests the impact is generally short-lived and the drawdowns not very deep. So, should Russia indeed invade Ukraine, my advice would be to sit tight.

Inflation Watch

Well, it wasn't good news as inflation. The CPI rose to levels not seen in decades and higher than most prognosticators had forecasted. Interest rates rose, bonds and stocks fell in response. This article from Morningstar sums it up well: 7 Charts on the Big CPI Rise.

Earnings Reports

It was another busy week of earnings reports. Overall, companies continue to report results exceeding forecast as the Factset report suggests. Some of the highlights last week included Disney which, on the strength of their streaming service, reported exceptional results. The stock responded with a significant gain. Coca-Cola also reported better than expected results as earnings popped on strong unit volume growth but there wasn't much fizz in the stock price. Finally, CVS fourth-quarter results were better than expected thanks to strong prescription and front store sales. Unfortunately, CVS shares sold off on Amazon's (well-timed) announcement to expand further in the retail healthcare market. You can head on over to Investing.com to find more earnings reports.

Here are some of the reports on tap for the week of February 14:

Not a lot of excitement on the dividend front last week...

Growing Wealth

This short article by Morgan Housel of Collaborative Fund, After The Fact, has some good lessons on how one builds wealth over time. It's a quick read and well worth it, that is unless you already have enough money in the bank.

The Semiconductor Shortage

We've been dealing with a worldwide semiconductor shortage for more than a year now. It has had a significant impact across our entire economy from automobiles to healthcare. In a recent conference call with investors, the CEO of Global Foundries, Thomas Caulfield said: “I think for the better part of the next five years, we'll be chasing to put capacity on, not demand, and doing everything we can to get a better balance." The CEO of ON Semiconductor, Hassane El-Khoury, told analysts: “The current supply/demand imbalance in the semiconductor industry will likely persist through 2022 and continue into 2023.” And he indicated it was taking as much as 45 weeks(!) to fulfill customer orders.

How can we as investors take advantage of this supply/demand imbalance? Well, I'm betting there are opportunities in both the manufacturers of the chips and the suppliers of the equipment used to make them. Hmmm... sounds like an idea for a white paper. Stay tuned!

Under A Buttonwood Tree Updates:

- There are some new books in our bookstore. One I'm looking forward to reading: The Founders: The Story of Paypal and the Entrepreneurs Who Shaped Silicon Valley.

- Given the market's volatility, consider checking in at the Market Laboratory. Click on the captions to link to updates on valuation, cross-market performance, and momentum indicators. There's been some deterioration but the long-term trend remains up - for now.

- Interested in bitcoin? I've added a research report from Fidelity to our archives. It can be found in the research report section but here's a link to save you a couple of clicks: BITCOIN FIRST.

- There's a new Chart Attack! to look at on our home page. Remember, it's only for subscribers of this newsletter. If you'd like to get Chart Attack! as a weekly email let me know via the "questions and comments" button below...

And Finally...

Although it looks more like Christmas outside my window, I hope everyone has a happy Valentine's Day tomorrow! Though not recommended, good luck tonight if you've made an "investment" on one of the Super Bowl teams!

Thank you for reading this week's newsletter! You can find previous newsletters and more information by heading over to our Home Page. And be sure to visit our Bookstore, Market Laboratory, Resources, and Archive pages.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, just click the subscribe button. It's free! (Well, not exactly. After all, it does take several minutes of your valuable time to read. But we hope you will find spending that time worthwhile!)

I'm always interested in your feedback, ideas for topics, and questions. So please click the button below.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com