A Final Reminder!

2021 fourth-quarter federal estimated income tax payments need to be mailed no later than next Tuesday, January 18. You can also pay online at IRS.gov. And don't forget any state estimated taxes also due!

Uncle Sam has already spent the money so he needs your payment now! As a thank you, your favorite uncle has a special gift for you. Go to covidtests.gov starting January 19 to receive four free covid tests! How thoughtful! They are supposed to ship within 7-12 days. (I'll believe it when I see them in my mailbox!)

We're Off To A Rough Start!

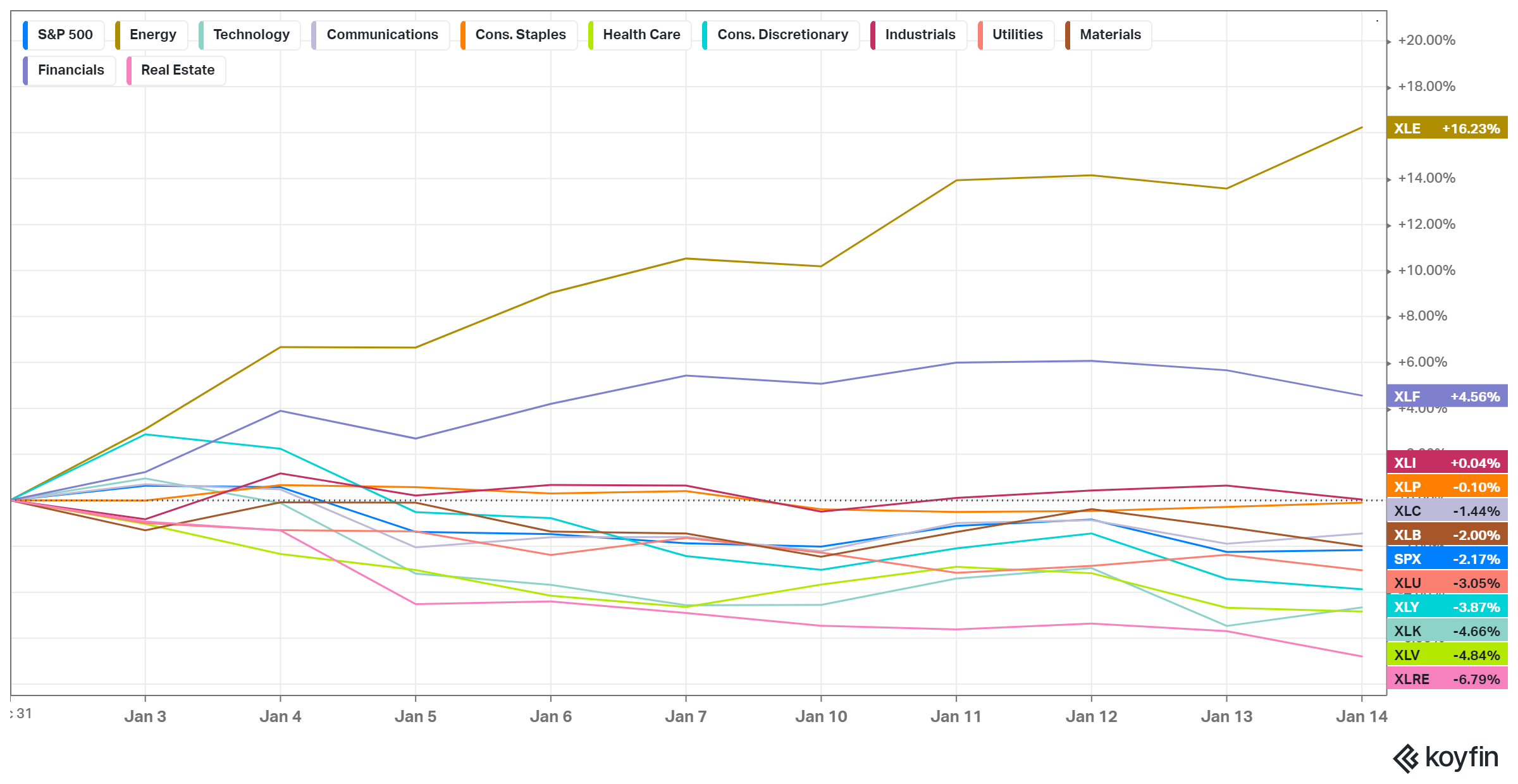

The first couple of weeks of 2022 haven't been the most pleasant for investors with the major indexes posting losses so far this year. Take a look at this somewhat hard-to-read chart of the eleven sectors that make up the S&P 500. Only two, energy (XLE +16.2%!) and financials (XLF +4.6%), have posted positive returns so far. Three sectors, technology (XLK -4.7%), health care (XLV -4.8%), and real estate (XLRE -6.8%) have faired the worst compared to the S&P 500's -2.2% performance.

Inflation Watch

On Wednesday we got the news that inflation in December reached a level not seen since 1982 - 7% (annual rate). This is even faster than November's 6.8% annual rate. Core CPI jumped to 5.5% in December from November's 4.9% annual rate. You can read more of the gory details in this article from the Wall Street Journal.

On Thursday, the producer price index was reported - up 9.7% (excluding food & energy up 8.3%). These dismal numbers were higher than expected but for the inflation optimists, slightly lower than the prior month.

Producer prices rising much faster than consumer prices suggests corporate profit margins may be under pressure as the year progresses. Fourth-quarter earnings reports are just getting started so we will be getting a read on inflation's impact soon.

Not only did the CPI report come in hot for December 2021, but the anecdotal reports are also troublesome:

Netflix raising U.S. prices, standard plan to top $15 a month 1/14/22

60% of S&P 500 companies cite impact of labor costs on Q4 earnings calls 1/14/22

Mortgage Rates Jump to Highest Level Since March 2020 1/13/22

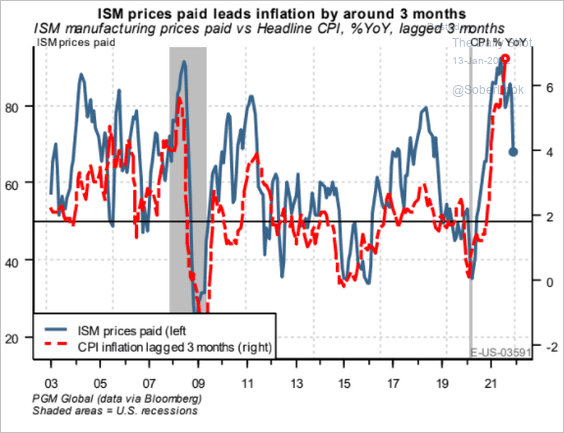

But perhaps there's some good news on the inflation front. The Institute for Supply Chain (ISM) prices paid index has fallen quite sharply from its peak (the blue line). This index tends to lead consumer prices by about three months suggesting CPI (red line) may be peaking soon. Here's the graph:

Creating A Perfect Portfolio

Last summer, Andrew Lo, a professor at MIT Sloan School of Management, and Stephen Foerster, a professor at Western University's Ivey Business School, released their book, In Pursuit of the Perfect Portfolio. The two professors discuss the idea of a perfect portfolio with ten distinguished figures in the world of finance. This MarketWatch article, 7 principles to help you create your perfect portfolio, offers a brief summary. You can find the book in our bookstore or use the link above if you'd like a copy.

We'll be discussing portfolios in upcoming newsletters, so this book might help get you started thinking about your own investment philosophy and "perfect" portfolio...

More Winter Reading!

Last year Michael Mauboussin and Alfred Rappaport revised and updated their book: Expectations Investing: Reading Stock Prices for Better Returns. Mauboussin's books can get a bit technical but they are always worthwhile.

I found this recent review in the CFA Institute's blog, Enterprising Investor, which should help you decide if this book deserves a place in your library. It's in mine.

By the way, links to Mauboussin podcasts and videos can be found in The Archives.

Something For Ray Dalio Fans:

Ray Dalio of Bridgewater Associates fame was recently interviewed on the topic of his new book, The Changing World Order. The video is long but thought-provoking.

More 2021 Leftovers

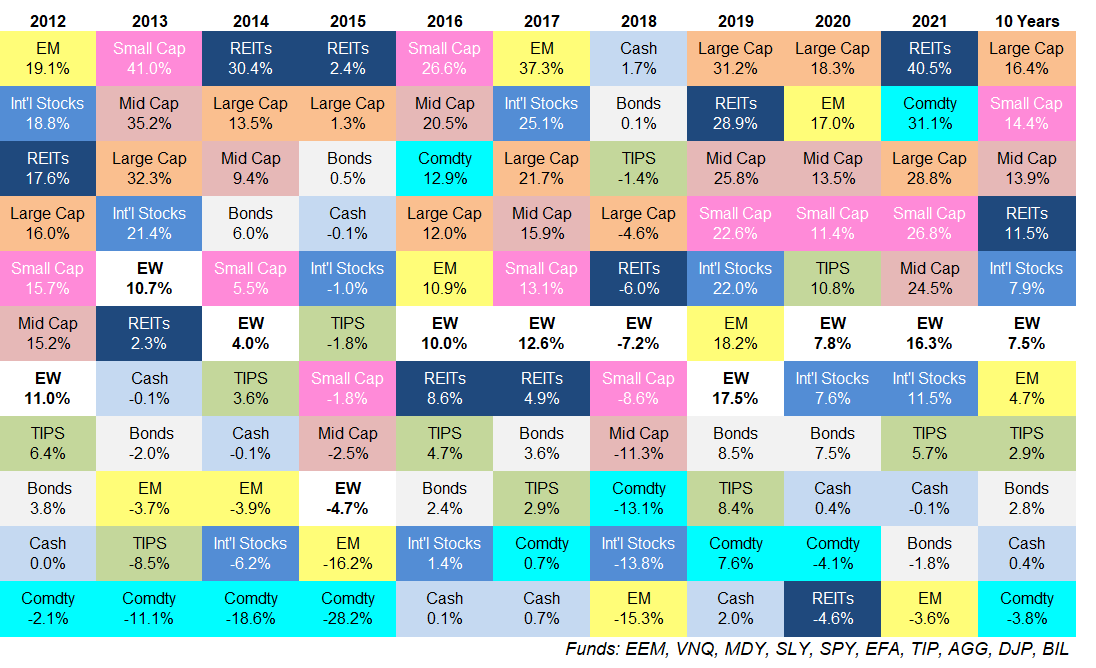

Every year Callan LLC, a leading pension consultant, produces the Periodic Table of Investment Returns which ranks major asset classes by annual returns and displays the results over a number of years. Here is a link to the Callan 2022 Period Table of Investment Returns.

Similarly, Ben Carlson has just updated his annual asset allocation "quilt". He uses ETFs to calculate the performance of the various categories.

One notable category is commodities. After nine years of poor performance, commodities have jumped into second place. Given a rebounding economy and rising prices, I suspect commodities will continue to place in the top ranks for some time going forward.

Oil Supplies Remain Very Tight

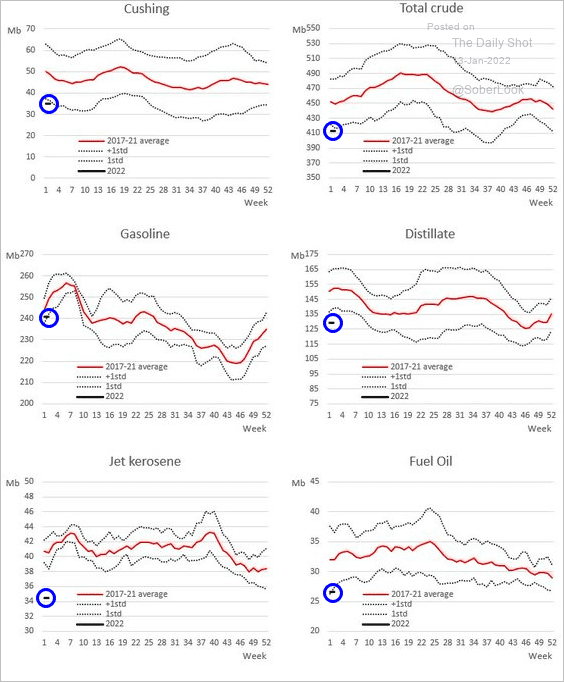

I saw this set of charts in a recent Daily Shot Brief describing the inventory situation for crude oil as well as gasoline, distillate, etc. What it shows in every case is that inventories are starting the year at or below one standard deviation from the average of the past five years. This tight inventory situation suggests oil prices are likely to remain high or move even higher as demand continues to recover. It also leaves us more vulnerable to unexpected demand or supply shocks.

While this is bad news for your heating bill, it's probably continued good news for oil company shares. (You can buy energy ETFs or individual company stocks if you'd like to increase your portfolio's exposure to oil. However, be aware! Energy shares have risen sharply over the past year and could be vulnerable to a correction if oil prices head south.)

What Should We Expect Out of Stocks?

The other day I received this blog post in my email: The Latest Look at the Total Return Roller Coaster, by Jill Mislinski at Advisor Perspectives. It examines annualized real (inflation-adjusted) total returns for the S&P 500 using various time horizons from five to thirty years going all the way back to the late 1800s. Not surprisingly, the shorter the time horizon, the more volatile the returns.

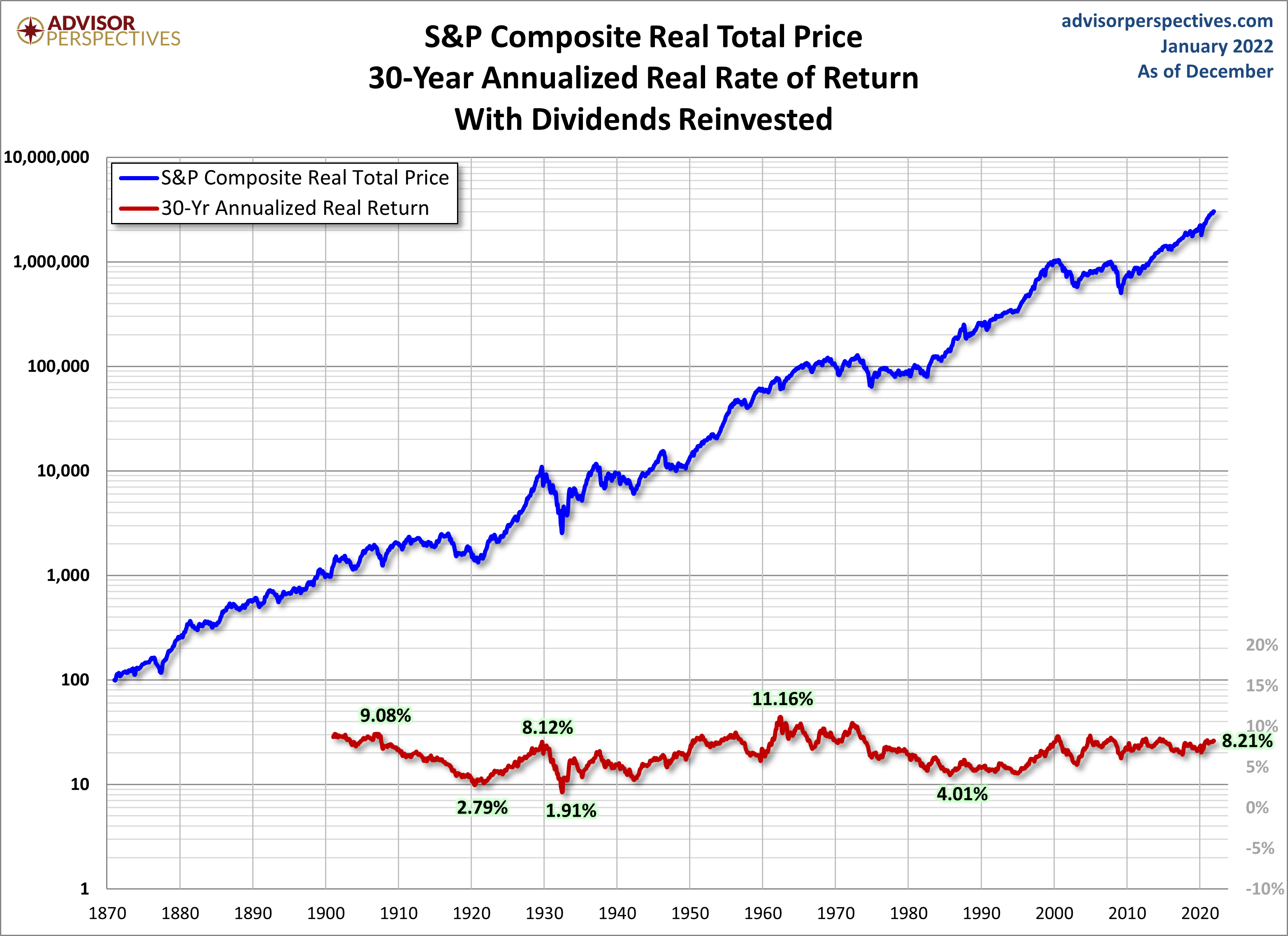

What I found most interesting was the chart of 30-year returns, shown below:

Notice these 30-year returns are positive - always. Even during the great depression of the 1930s. Of late, the returns appear to have been quite stable, finishing 2021 at 8.21%.

If you look at the period from the 1960s on, long-term returns have ranged from a high of approximately 11% to a low of about 4%. From a planning perspective, using the mid-point of that range, 7.5% seems to be a reasonable expectation for the real annualized return of U.S. stocks. In other words, the money invested in the stock market with dividends reinvested should double every nine years before inflation.

However, there is an important caveat. As noted earlier, returns over shorter periods are significantly more volatile and the chances of actually getting a 7.5% return in any given year are quite slim. Stocks will often return significantly more or less than the long-term average. (Take a look at that post!)

So use our 7.5% expected real return forecast for long-term planning not for short-term savings goals! Indeed, if you are looking to save money for a short-term goal like a new car or a vacation, don't put the money in stocks or you may wind up with a smaller car or shorter vacation than you were expecting!

Spring Seems So Far Away

It's just six degrees outside as I write this newsletter. Spring seems like it will never arrive. But the momentum has clearly shifted. The days are getting longer and the sun seems just a little bit brighter. There are more storms and cold days ahead but before you know it we'll be seeing these in the yard rather than forced in a pot:

And Finally...

Welcome new subscribers. Thank you! You can find previous newsletters and more information by heading over to our Home Page. And be sure to visit our Bookstore, Market Laboratory, Resources, and Archive pages.

Always feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, just click the subscribe button. It's free! (Well, not exactly. After all, it does take several minutes of your valuable time to read. But we hope you will find spending that time worthwhile!)

I'm always interested in your feedback, ideas for topics, and questions. So please click the button below.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com

Under A Buttonwood Tree is an Amazon Associate. As such, we earn commissions from qualifying purchases when you use the links to Amazon.com. You will not incur any additional cost using them and the commissions generated will help us to offset the expense of maintaining our website. Thank you!