January 3, 2022

You've probably already received countless forecasts for 2022, on the economy, the markets, politics, and more. Rather than give you more forecasts, let's look at where we stand today and set forth some expectations for the year ahead. Then, as the year progresses, we should be better able to recognize changes from our expectations and react accordingly.

The comments below are focused primarily on the United States. While I believe it is prudent to be globally diversified, my expertise and experience are here at home.

The Economy

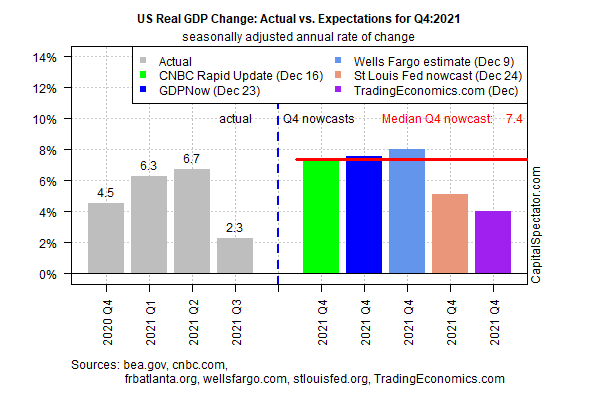

2021 proved to be a strong year for the economy, measured by real (inflation-adjusted) GDP as the United States recovered from (adjusted to?) the 2020 COVID-19 pandemic. This chart from The Capital Spectator shows the prior four quarter actuals (in gray) as well as five forecasts for the fourth quarter. The average of those forecasts is 7.4% suggesting that the final quarter of 2021 will be the strongest of the entire year.

It looks like we will be exiting the year with a strong economic tailwind which I suspect will continue for at least a while in 2022. Why? There seems to be shortages in every corner of our economy - vehicles, housing, energy, and technology, to name a few. Inventories are depleted. Yet demand for these goods remains high thanks at least in part to the income support the government provided during the worst of the pandemic. So we will need to produce even more goods to meet current demand and restock depleted inventories. This should keep factories humming in 2022.

Capital spending should be strong as well thanks to expected infrastructure improvements as well corporate investments in plant and equipment to meet current demand and where there has been underinvestment for many years.

Demand for services has also rebounded. I suspect, however, that services growth could be more volatile than usual should COVID flare up and folks avoid restaurants, travel, etc.

On balance, I think it is reasonable to expect another year of real GDP growth in 2022. I'm not going to forecast a specific growth rate. However, it's hard to imagine that growth in 2022 will be faster than it was in 2021. Nevertheless, 2022 growth should be better than the long-term trend - a good environment for growing revenues and profits.

Inflation

As you know from these newsletters, accelerating inflation has been one of my biggest concerns for some time. It remains so. Inflation, particularly when it is broad-based, is like acid, eating away at our currency, our savings, our standard of living, and our society in general.

Inflation, when it remains at a high level is bad news for investors. It causes interest rates to rise, bond prices to fall, and stock valuations to recede.

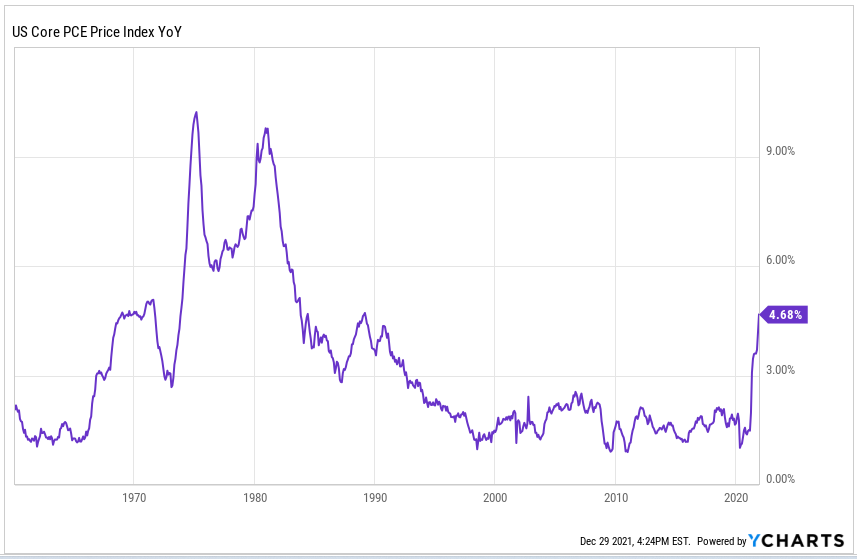

Here's a look at the Fed's favorite inflation gauge, the core personal consumption expenditures price index. It certainly appears that this measure of inflation is accelerating out of control after two decades of stability.

Is this current inflation transitory? The result of pandemic (and government) induced distortions to our economy? To some degree, I think so. However transitory inflation raises inflation expectations which leads to demands for higher wages to offset inflation, which raises the cost of doing business requiring price increases for goods and services for businesses to remain profitable. This vicious cycle then repeats. Thus, even though the root cause of inflation might have been transitory, expectations of rising prices cause inflation to go from being temporary to permanent until the cycle can be broken, usually by raising interest rates and creating a demand-killing recession.

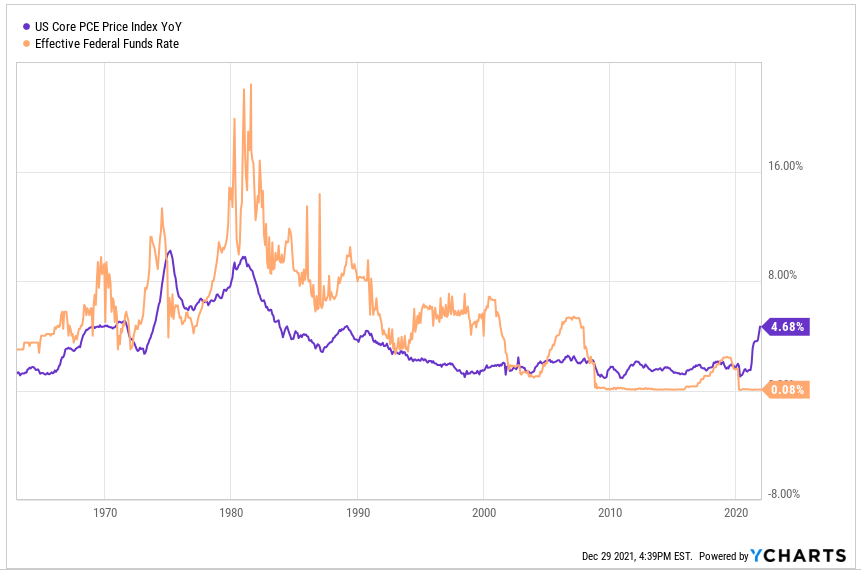

Here's that same inflation graph with the Fed Funds rate overlayed:

Note the huge spike in short-term interest rates (north of 18% in 1981!) needed to quell inflation. And for those readers who weren't around in the late '70s and early '80s, 30-year mortgage rates were in the mid-teens versus about 3% now.

The Fed's December announcement of accelerating the "taper" and plans to raise rates two or more times next year is recognition that inflation is not transitory. Although interest rates have fallen somewhat since that announcement, I think it is best to expect rates to rise throughout 2022.

Fixed Income

This asset category is reasonably straightforward. Bond prices move inversely with interest rates, so it may be a tough year for bond investors as rates rise. (Note: Tough is relative as bonds are less volatile than stocks and an annual loss of more than 5% has been rare.)

Cash in the bank is a loser. With inflation at 5+%, by year's end, $100 will only buy $95 of goods or services. I would suggest, therefore, you keep your cash balances (money in a checking account or under the mattress) at a comfortable minimum.

Stocks

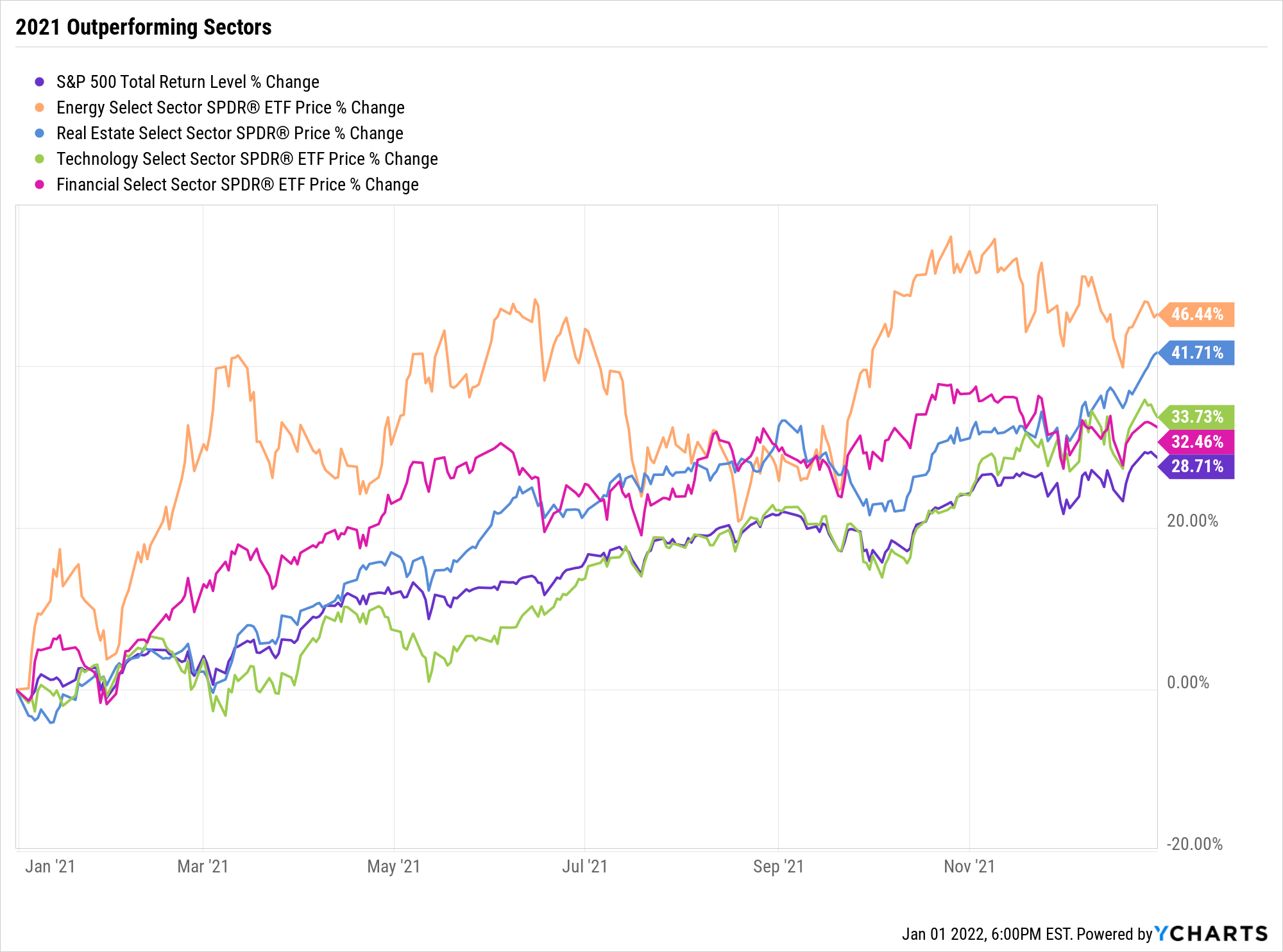

2021 turned out to be a terrific year for equity investors!

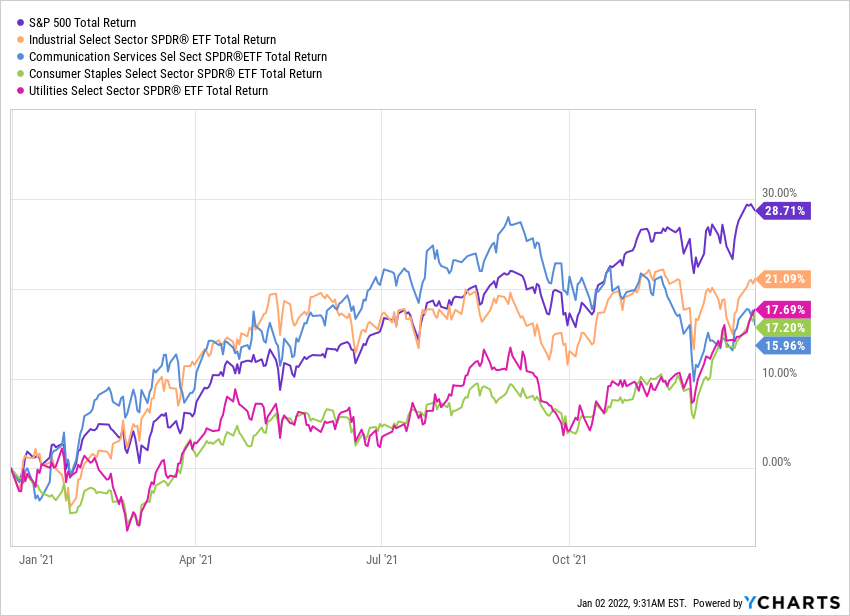

The S&P 500 gained 28.7% led by the energy, real estate, tech, and financial sectors as shown in the chart below:

Four sectors, industrials, communications services, consumer staples, and utilities lagged the S&P 500 last year as you can see in this chart. The worst, utilities, gained "only" 16.0%.

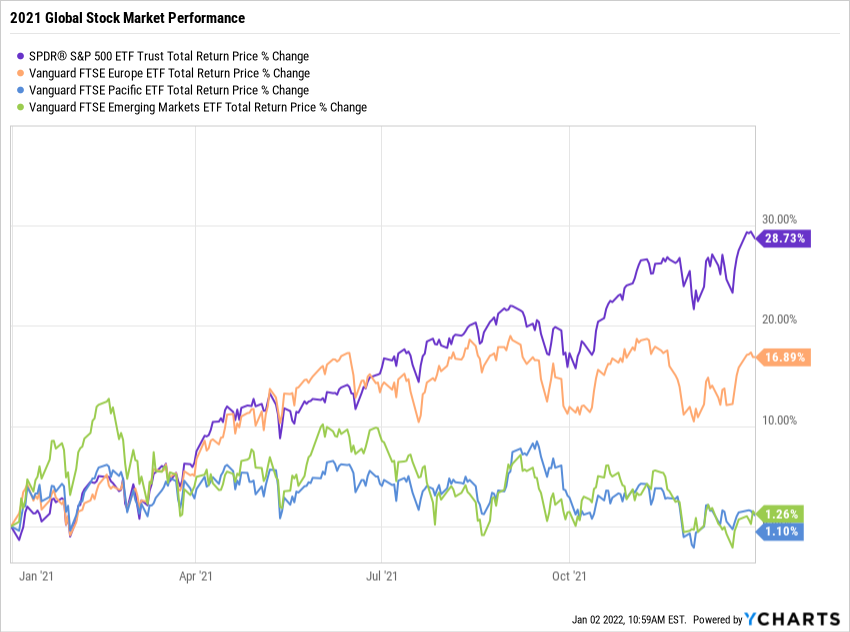

International stocks were unable to keep up with the US market as you can see here:

Can these impressive returns for domestic equities continue in 2022?

While it's hard to imagine 2022 being a better year for the stock market than 2021, I do expect stocks to do better than bonds or cash. How much better? No clue. However, from a planning perspective, I think it is reasonable to expect stock market gains of 0-10% in 2022. Here's why:

As noted above, the economy should continue to grow in 2022. Although inflation will put pressure on profitability, corporate earnings should exhibit some growth - good for stock prices.

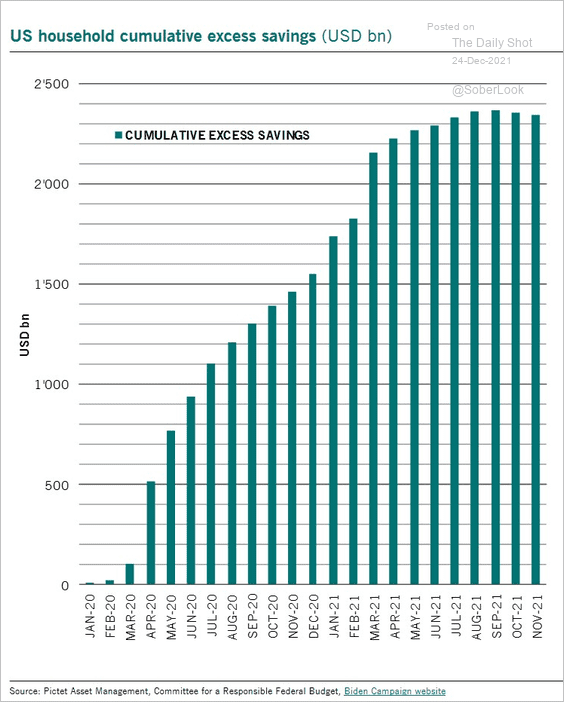

US households have accumulated a huge amount of savings, north of $2 trillion. Some of these savings may already be invested and some will be spent on goods and services but there is still a lot of cash looking for a place to earn a positive return.

If rates are rising bonds don't look so hot in the short run. Cash is a loser thanks to high inflation and low interest rates. So it seems reasonable that at least some of those savings will find their way into stocks in 2022.

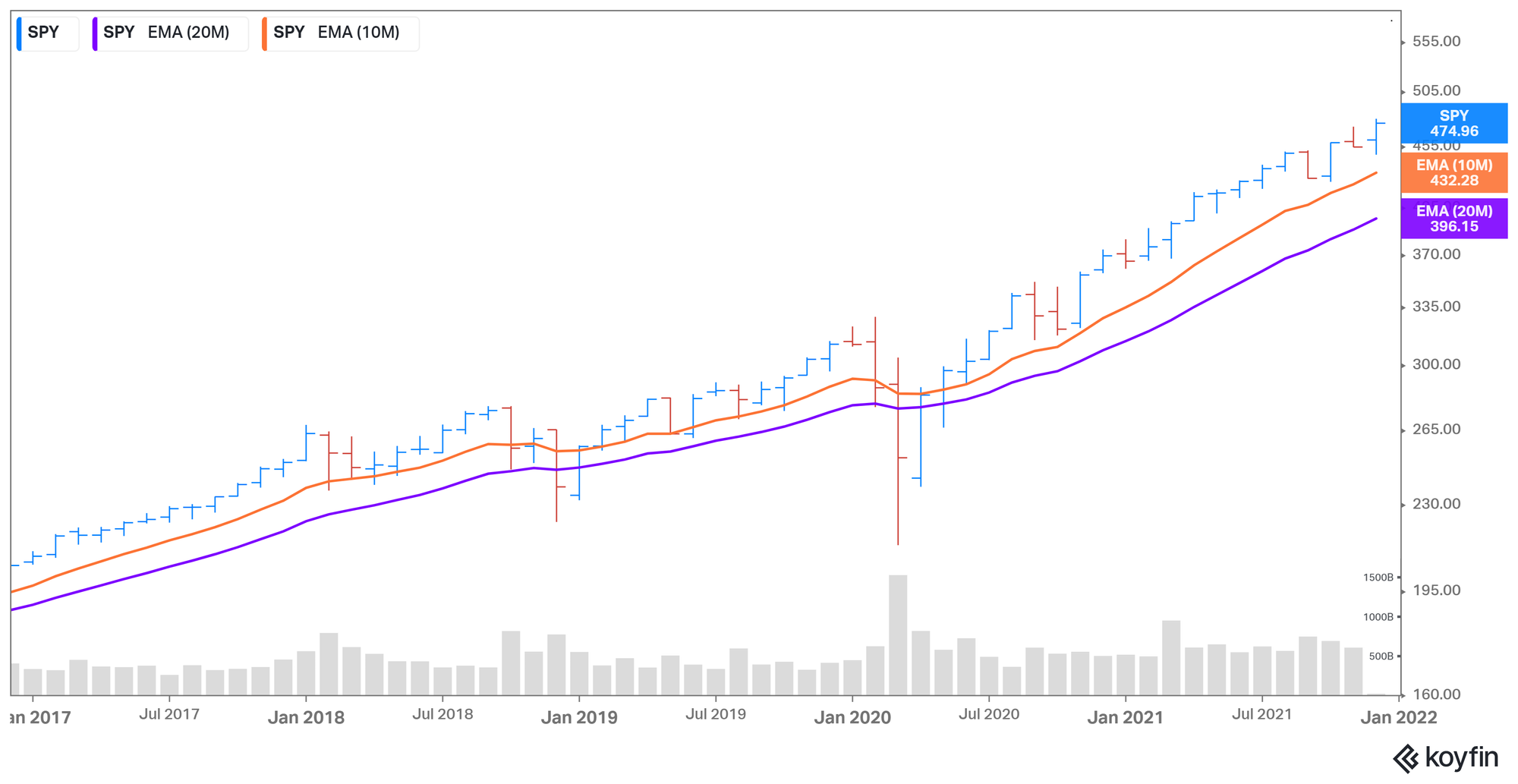

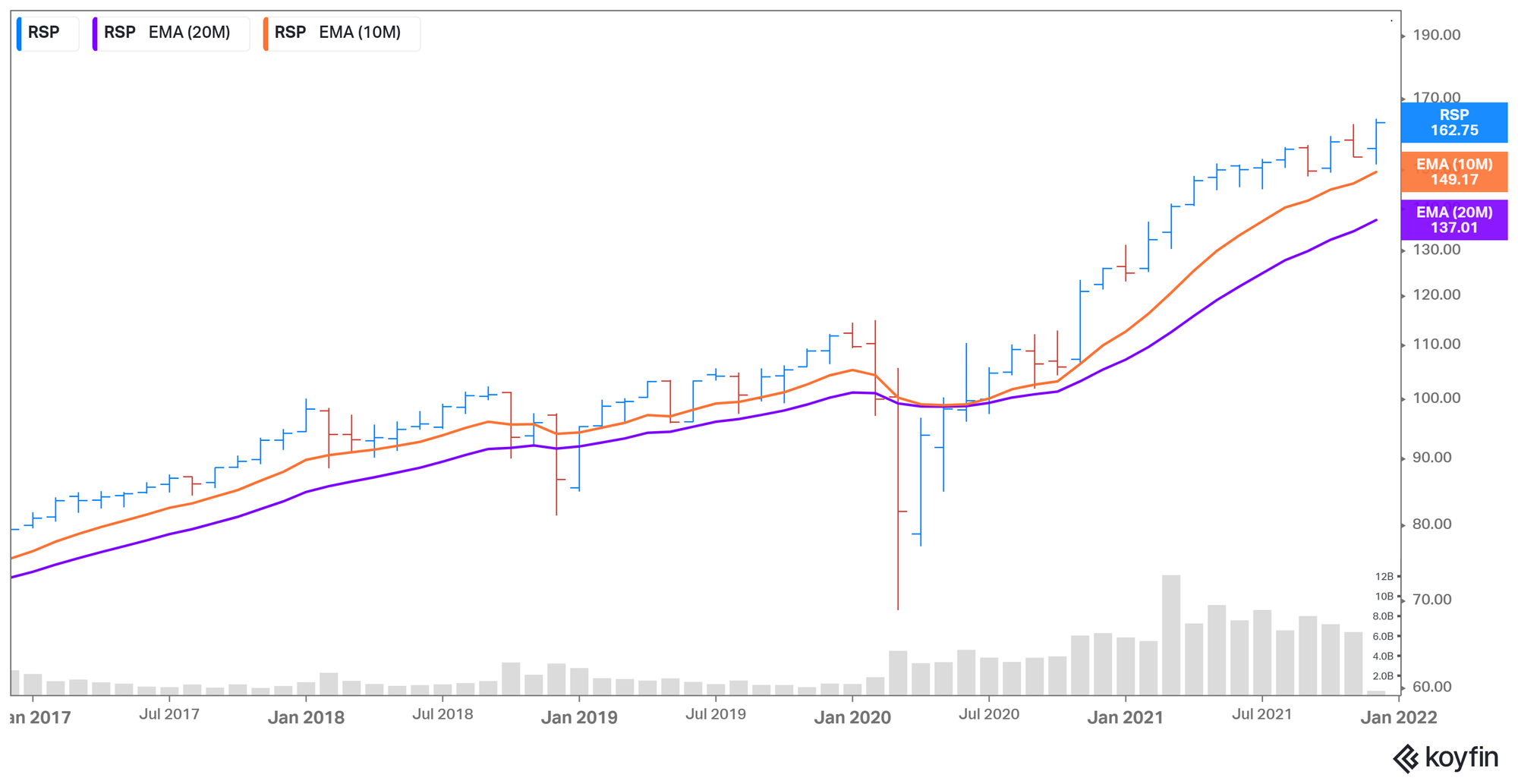

If you spend a little time in the Market Lab, you will note that momentum indicators remain favorable for a further advance with both the capitalization-weighted S&P 500 (SPY) and the equal-weighted S&P 500 (RSP) comfortably above their long term moving averages.

I am confident that the fundamentals and momentum support higher stock prices as we start the new year. Unfortunately, valuation is not as clear. Again, most of the measures we chart in the Market Lab suggest either a very or even dangerously overvalued stock market. And we may have begun to shift into a new valuation environment of lower multiples thanks to higher inflation and potentially rising taxes - a toxic combo for stocks.

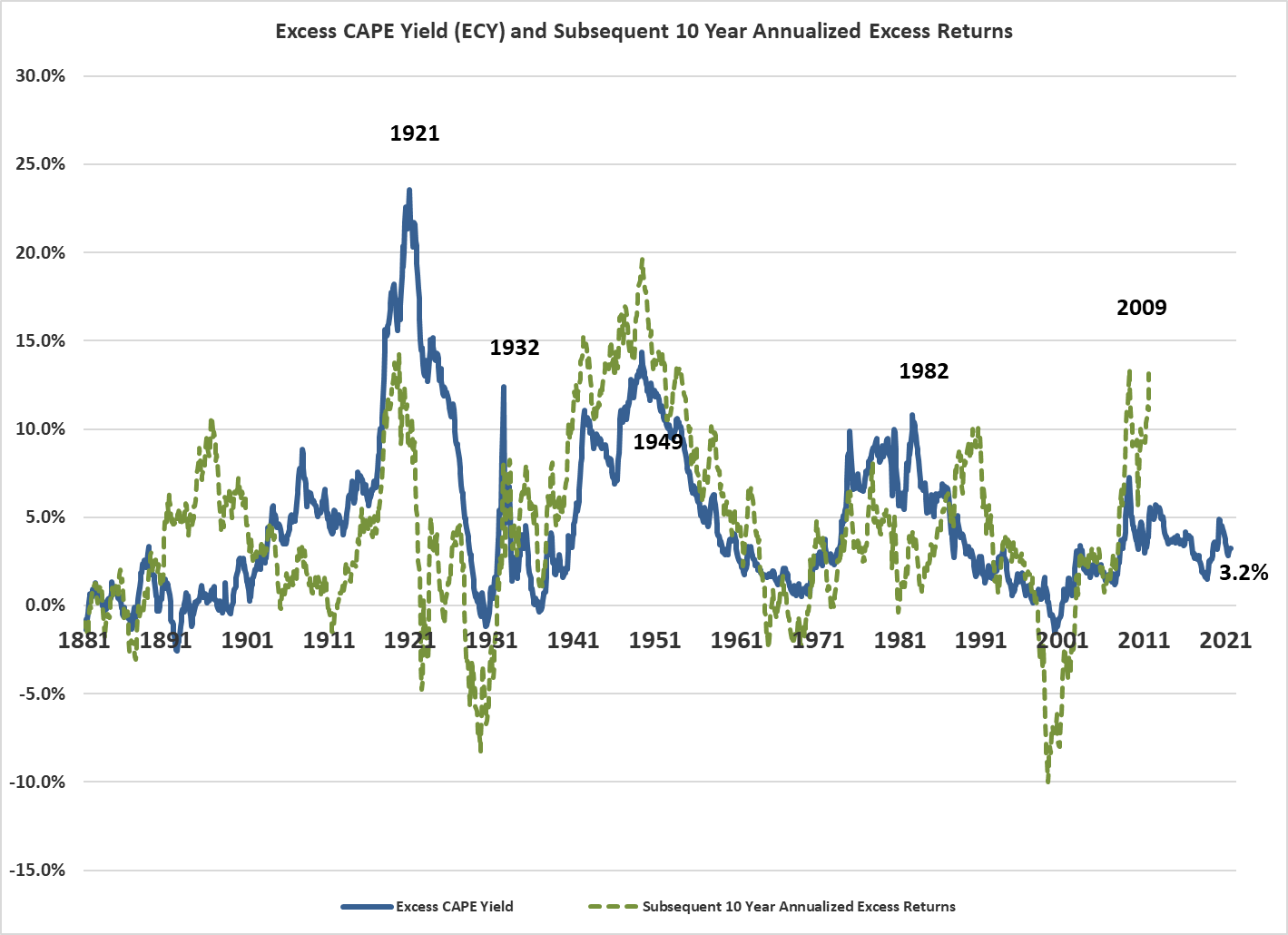

However, at least for the near term, I believe high valuations should not hold back the stock market though we may see a shift away from some of the exceptionally high-valued shares in technology and elsewhere. Why? Interest rates, a key factor in equity valuations remain negative after accounting for inflation. As a result, on an inflation-adjusted basis, the earnings yield on stocks remains above bonds as shown on the chart below. As long as this remains the case, stocks should be able to generate positive returns. However, valuation will become a problem when either fundamentals or momentum turn negative.

So if you add it all up, it looks like the odds favor stocks again this year. But things happen. Here are a few risks to keep in the back of your mind:

- COVID. While it looks like the risks of COVID are lessening there will likely be more flare-ups. Our reaction (or more specifically, the government's reaction) to these flare-ups could be quite disruptive.

- War. Russia and China are becoming increasingly belligerent. There is a growing risk that hot conflicts erupt in Ukraine and/or Taiwan and that the United States is drawn into these conflicts. I am particularly concerned about Taiwan given its importance in global semiconductor production. Any disruption would be potentially devastating the global economy.

- Inflation. It's already bad but should it accelerate further, the Fed will be forced to become even more aggressive, likely causing a recession.

- Taxes: It looks like there will be another attempt to pass legislation including a variety of changes in the tax code in 2022. As I have often noted, increased taxes on capital gains and/or dividends will be a problem for the stock market.

Finally, I think the key to 2022 is to remain flexible and willing to adjust your portfolio if conditions change. As we sit today, I believe the environment is still good for stocks, less so for bonds and cash. Even so, bonds and cash can play an important role in your portfolio, serving as safe havens should one or more of the risks occur or the unexpected happens.

The Year Ahead 2022 can be downloaded as a PDF:

This Doesn't Look Like Good News...

Sorry to be the bearer of bad news, but this chart of US crude oil inventories suggests the is no relief in sight for high energy prices.

Oh my... pic.twitter.com/rOIXHUJBQZ

— HFI Research (@HFI_Research) December 22, 2021

Even More Changes!

Remember The Simple Portfolio, the three ETF portfolio that beat university endowments? Well, I've added two more: The Diversified Portfolio and The Inflation Portfolio. They are not quite as simple but still very manageable and they offer more diversification and better performance historically. (Past performance is not a predictor of future results!) I'm planning to go into greater depth on the new portfolios at a later date.

In the meantime, I've created a separate page on the website: Portfolios. There you can see brief descriptions of all three portfolios as well as reports on their holdings and performance. Check them out.

The Archives page is live and I've done some work on the Market Lab, so they are worth visiting as well.

New books are being added regularly to the Bookstore and I just added a finance course from Yale University to the Resources page. The course is taught by Prof. Rober Shiller. It is a great survey of markets and investing. It can be found in the education section of the resources page and it's free!

And Finally...

Welcome new subscribers. Thank you! You can find previous newsletters and more information by heading over to our Home Page. And be sure to visit our Bookstore and Market Laboratory.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, just click the subscribe button. It's free! (Well, not exactly. After all, it does take several minutes of your valuable time to read. But we hope you will find spending that time worthwhile!)

I'm always interested in your feedback, ideas for topics, and questions. So please click the button below.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com

Have a happy and prosperous 2022!