It sure looks like a bear market has started...

I waited until last Friday's (6/10/22) CPI report before writing everyone. I wanted to see if inflation was starting to stabilize or even slow down a bit as many of the pundits suggested. And, I wanted to see how the market reacted to the report. Sadly, the CPI came in hotter than expected and the financial markets, not surprisingly, fell sharply.

This week I'll be watching the Fed. In particular, will they hike the Fed Funds rate more than the planned 0.50%? Also, this coming Friday is the options expiration for June so there is the potential for a lot of volatility this week.

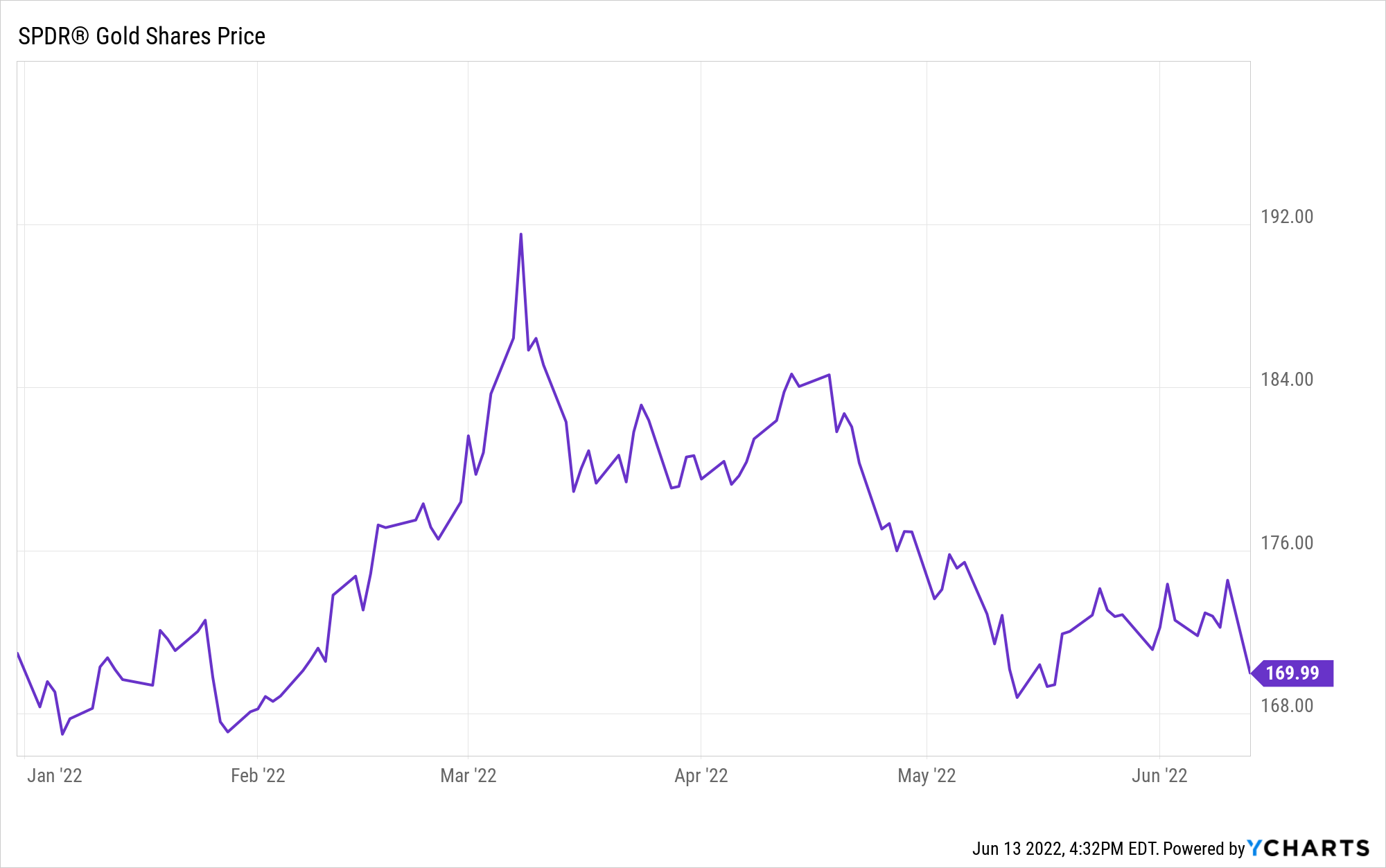

About a month ago, I sent out a quick note on stocks suggesting caution after a couple of really bad days caused all of our momentum indicators to turn negative. Stocks bounced at the end of May after a string of seven weekly declines. Unfortunately, the rally was short-lived as selling resumed in earnest at the start of June. And it's not just equities. Bonds are suffering as well with one of their worst year-to-date performances in memory. Thanks to ridiculously low money market rates, your cash is losing value at an 8+% annualized rate because of inflation. Bitcoin and cryptocurrencies, in general, have collapsed. And finally, gold has gone nowhere, so like cash, it is losing its purchasing power to inflation.

Let's go into more detail on some of these markets:

Stocks

Keep in mind that as I write these comments on June 13, the market's descent seems to be accelerating with the S&P 500 down about 3% at noon.

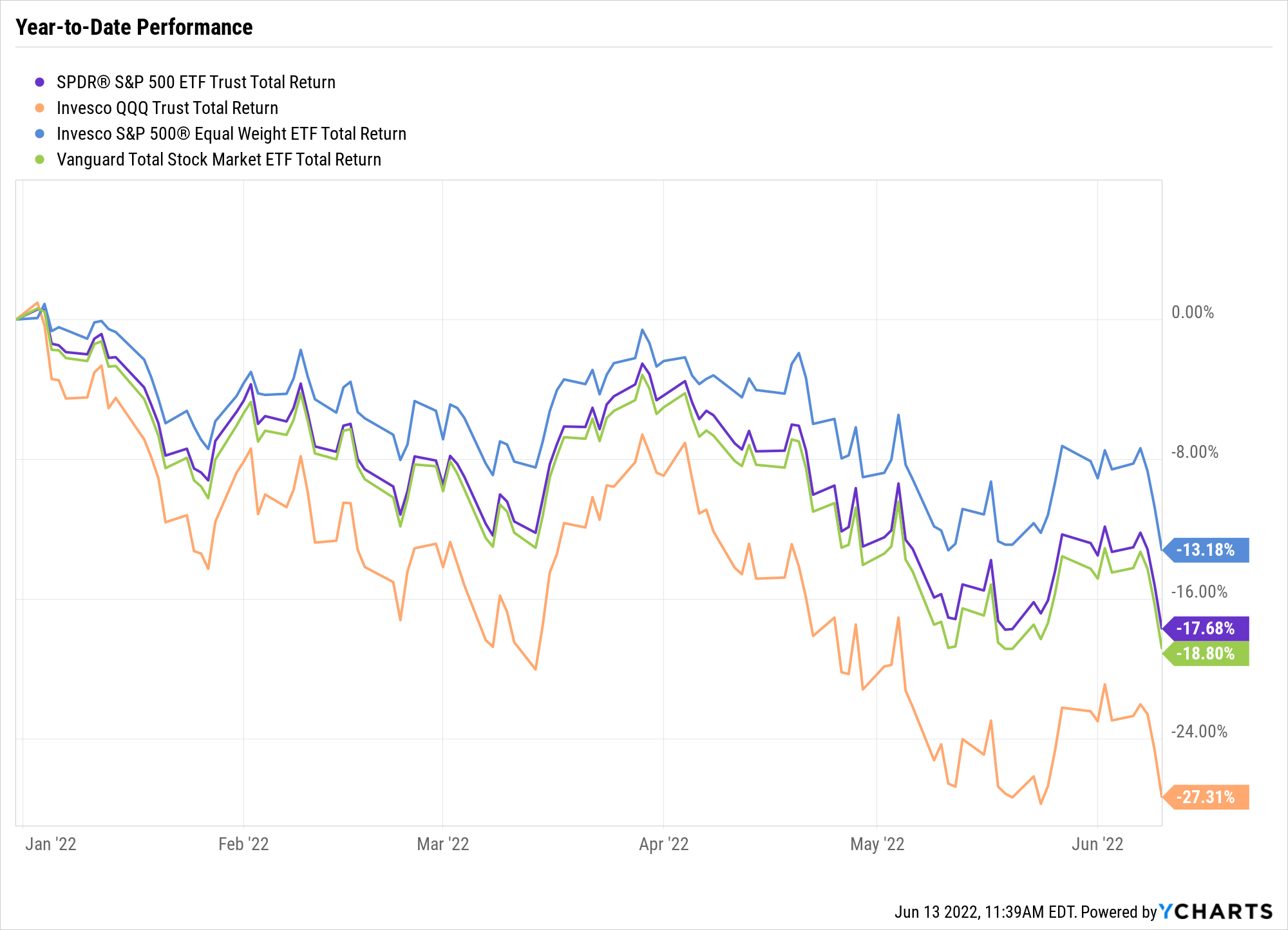

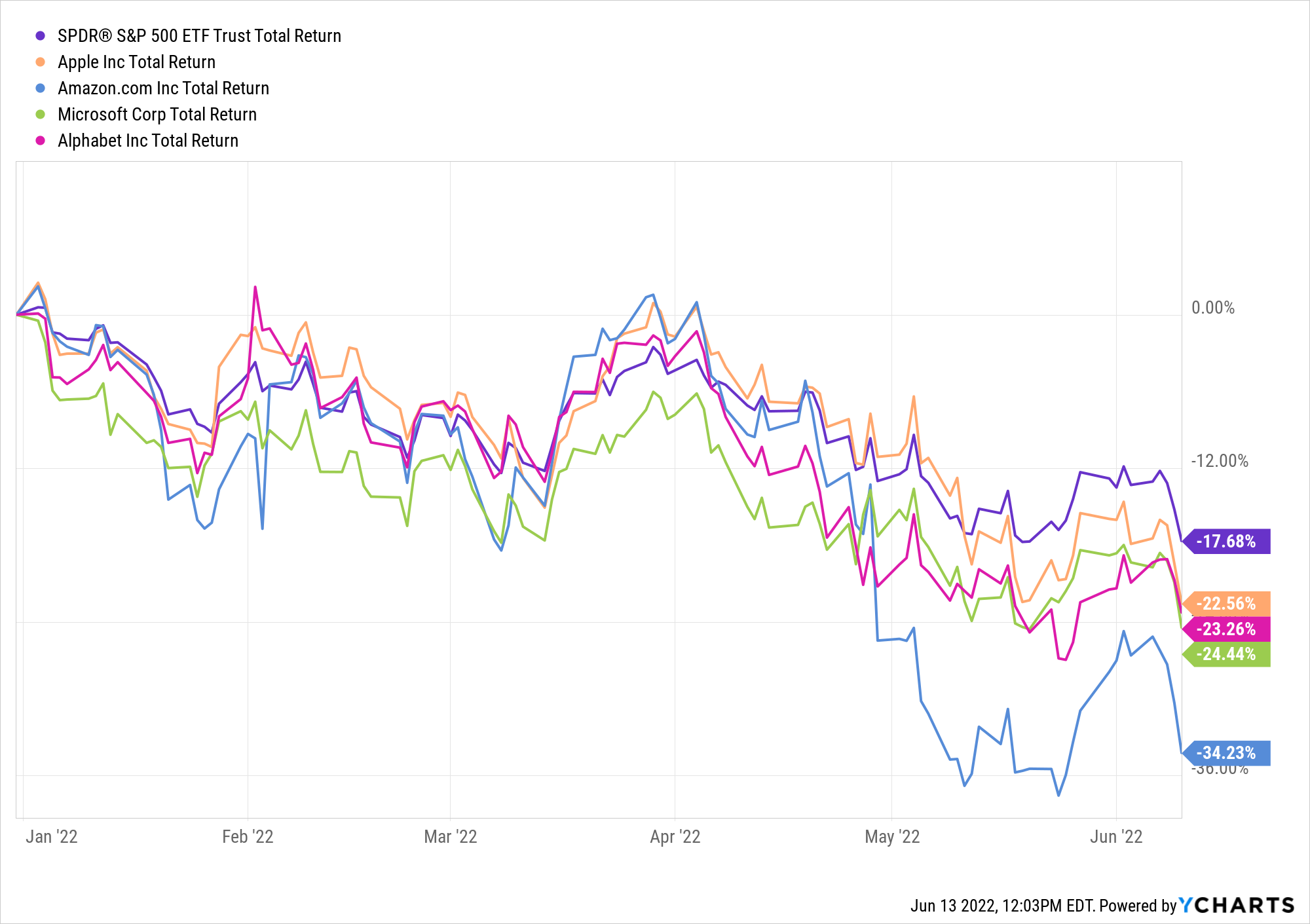

The major equity indexes peaked at the end of 2021. From year-end through last Friday stocks in the U.S. are down about 18% overall. The tech-heavy NASDAQ has done much worse, falling more than 27% (-30% as of right now).

You will note in the chart above that the Invesco S&P 500 Equal Weight ETF is down about 13% much better than the capitalization-weighted S&P 500 ETF whose largest holdings include Apple, Amazon, Microsoft, and Alphabet (Google). Each is down more than 20% so far this year.

Assuming the market fails to rally this afternoon (it did), stocks on a capitalization-weighted basis (S&P 500, NASDAQ 100, etc.) will close down about 20% from their peak, the "official" definition of a bear market. (Don't get me started on why this is the official definition of a bear market - I think it's a silly rule-of-thumb.) Equal weighted, stocks are down close to 20% as well.

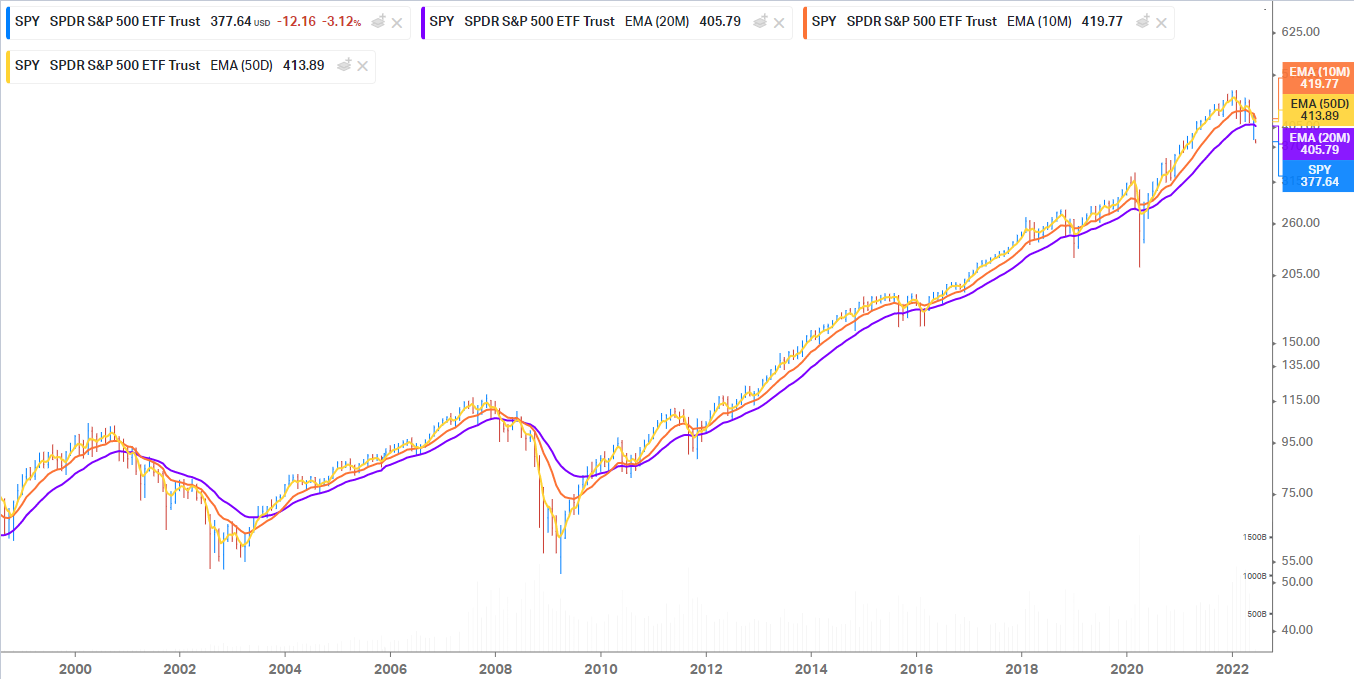

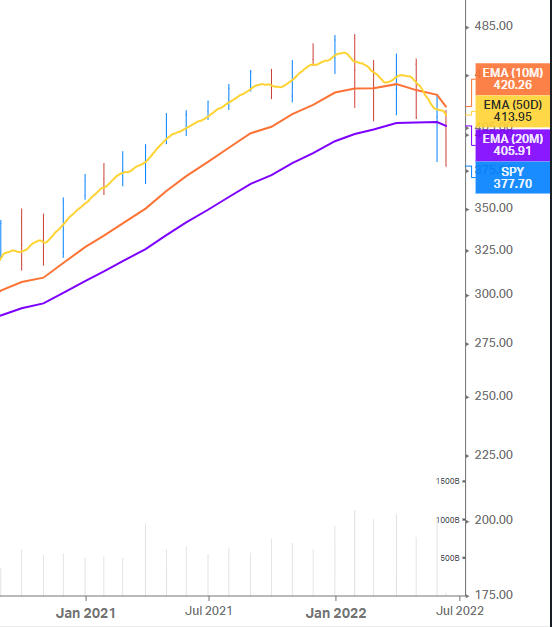

As important, stocks are trading below their 50-day, 10-month, and 20-month moving averages, evidence that the trend of stock prices has changed and stocks are now heading down (that's a bear market). As you can see from the long-term chart of SPY, when stocks trade below these moving averages, they tend to do so for many months or even years, and the declines in value can be significant.

Now, take a look at this snippet of the same chart of SPY. It is now trading well below these moving averages. Also somewhat ominously, the 20-month moving average is curling down, similar to what happened in 2000 and 2008.

We'll get a better reading at the end of the month as intra-month volatility can result in false signals but at the very least, the evidence is building that a bear market is underway.

Let's look at valuation.

Estimates for the S&P 500 for 2022 range between $225 - $230. So at current levels, the S&P 500 has a P/E of 16.5. This is well below the high of 21.0 at the start of the year. So stocks are cheaper - that's good. However, they could get a lot cheaper still.

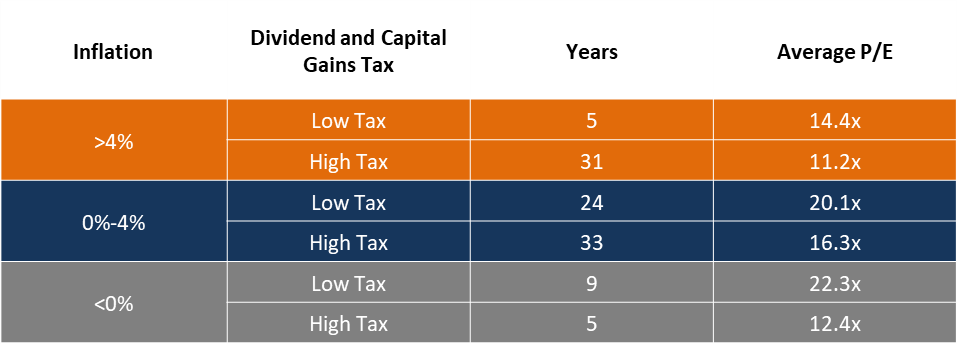

You may remember this table:

With inflation running at 8%+ the P/E ratio could fall further still. At 14.4X (upper right box, high inflation/low tax) the S&P 500 would trade at about 3280 (SPY 328) about 13% lower than today's level.

But this assumes the estimate for 2022 earnings is accurate which it rarely is this early in the year. What if it turns out that 2022 year-end earnings are only $205 per share, unchanged from last year. This wouldn't be that surprising in a recession that seems increasingly likely to occur either this year or next. Applying the same P/E, 14.4 on $205 of earnings, the S&P 500 would fall to 2952 (SPY 295) or down 22% from today's level.

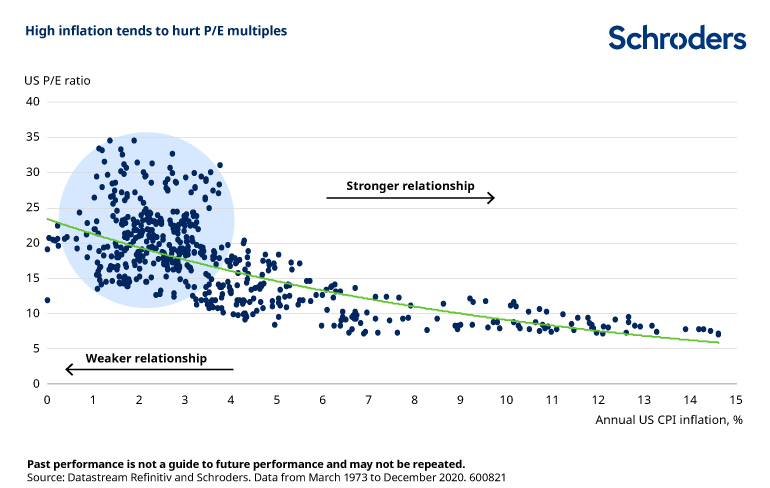

To put a finer point on the valuation issue, look at this graph from Schroders which plots P/E vs CPI:

This suggests P/Es could fall to the single digits given our current inflation rates. I'm living proof this could happen because that's where P/Es were when I got into the business in the late 70s/early 80s. A P/E of 10 and our reduced estimate for S&P 500 earnings of $205 would yield a target of 2050 for the S&P 500 or a 45% decline from today's level.

Bonds

Normally, investors seek diversification (and refuge) in the bond market. Since 1977 the bond market has had only four years with negative total returns - 1994, 1999, 2013, and 2021. But 2022 is not a normal year. We began the year with yields at historically low levels, the 10-year treasury yielded about 1.5%. Thanks to skyrocketing inflation, as of this afternoon the yield is more than double or almost 3.4%. And the value of that bond has been cut by roughly 25% - a bit worse than stocks. The broad-based bond index, Bloomberg Barclays Aggregate, gives a better picture of the overall fixed income market. It's down more than 10% on a total return basis.

This poor performance for bonds is due primarily (in my view) to fixed-income investors adjusting to accelerating inflation and demanding higher interest as a result. Yields in the 3's still leave bondholders falling well behind inflation. I doubt this will be tolerated if we don't soon see inflation moderate, so expect higher rates and lower bond prices as the year progresses.

Bitcoin, etc.

I think it is fair to say that the value of bitcoin and the other cryptocurrencies is directly correlated with the speculative fervor or "animal spirits" of speculators (and perhaps little else). Since it appears the only "spirits" the investor/speculator has these days come from a bottle, it is no surprise that bitcoin has crashed.

Gold

Gold is about where it was at the start of 2022. Compared to the stock market that's pretty good but no better than cash (and a lot more volatile.)

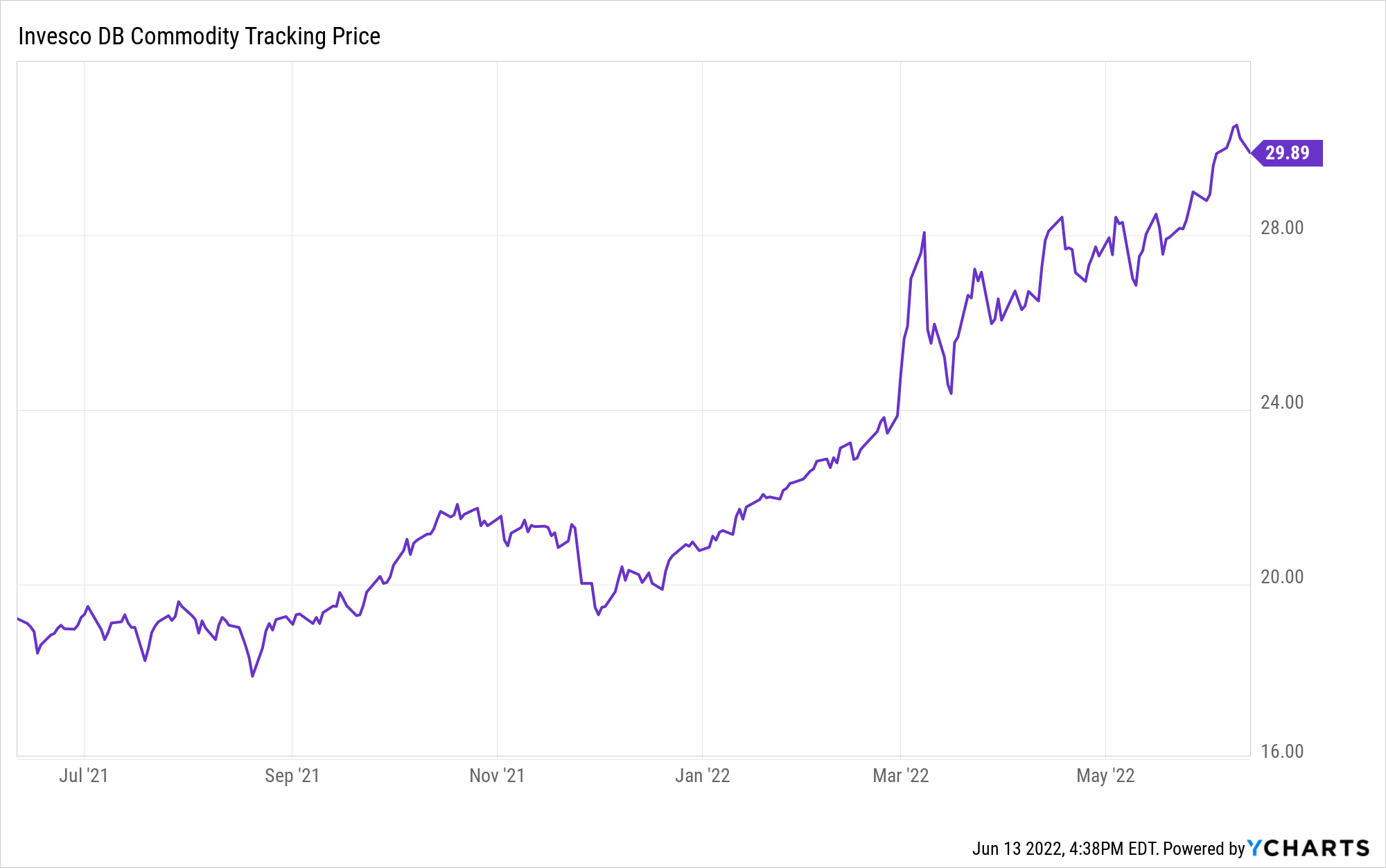

Commodities

Finally, if you are a regular subscriber to Chart Attack! (shameless plug) you know that commodities have been the bright light, soaring more than 50% over the past year. Unless or until the U.S. enters a recession and inflation abates, I suspect commodities will do relatively well compared to the other asset classes I've discussed. However, given their significant move, be prepared for some volatility.

Final Observations and Thoughts

In my view, we are currently experiencing a bear market in stocks, bonds, and cryptocurrencies (if you care). Even bank deposits and gold are losing their purchasing power thanks to inflation and the very low interest rates currently offered. How long this bear market lasts is unknown but I'm leaning towards longer than average.

Most of the indicators I watch (and you can as well in the weekly Chart Attack!) suggest that a recession is just around the corner. This does not bode well for corporate earnings and will hurt both stocks and bonds incrementally.

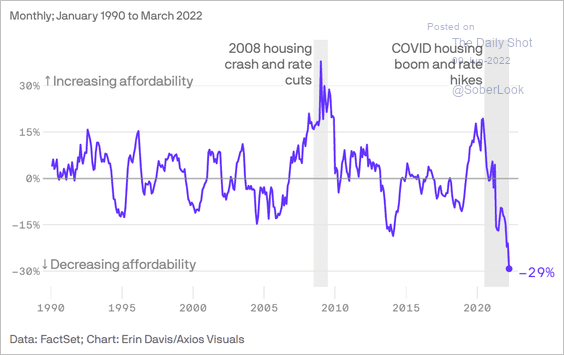

It appears the housing market is slowing rapidly in many parts of the country. High prices and rising mortgage rates are making homes unaffordable for many. And housing is a key driver of the economy.

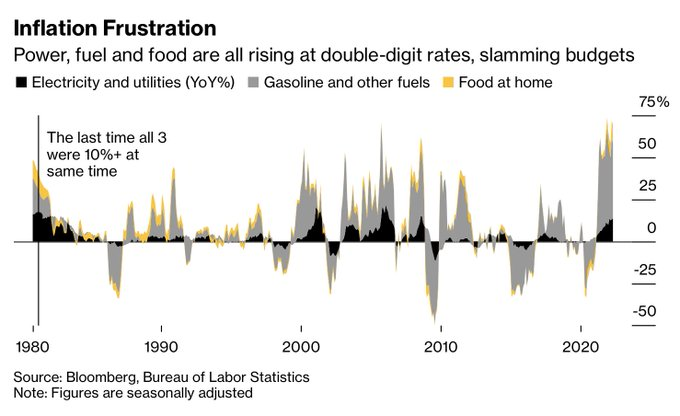

And with food, fuel, and electricity all soaring in price, consumer budgets are being squeezed. Discretionary expenditures are being cut as savings are depleted and credit cards maxed out.

So what do we do now?

If you have adequate cash reserves, a well-diversified portfolio and a time horizon of more than a few years, the best thing to do may be to ride out the storm. If you do wish to raise some cash, start by selling any losing positions. A stock (or bond) down 10% requires an 11% gain to recoup your position. But a stock down 50% will require a 100% gain to recoup.

If you decide to lock in some of your gains as well, fine. Just remember if the gains are taken in a taxable account, you will likely owe Uncle Sam +/- 20% of the gain. For those of us receiving Medicare, your monthly premiums could be affected as well, and not in a good way.

Besides the mattress, where could you put some of your money to work? You may want to consider US Treasury securities. They are guaranteed by Uncle Sam so they are safe as long as the printing presses are well oiled. Series I savings bonds, for example, are a good place to park some money, save for college, or for retirement. As we've discussed in past issues, the interest paid is linked to inflation and is currently pegged at almost 10%. There are limits on the amount you can purchase and restrictions (penalties) for early withdrawals so review the information on the TreasuryDirect website before you invest.

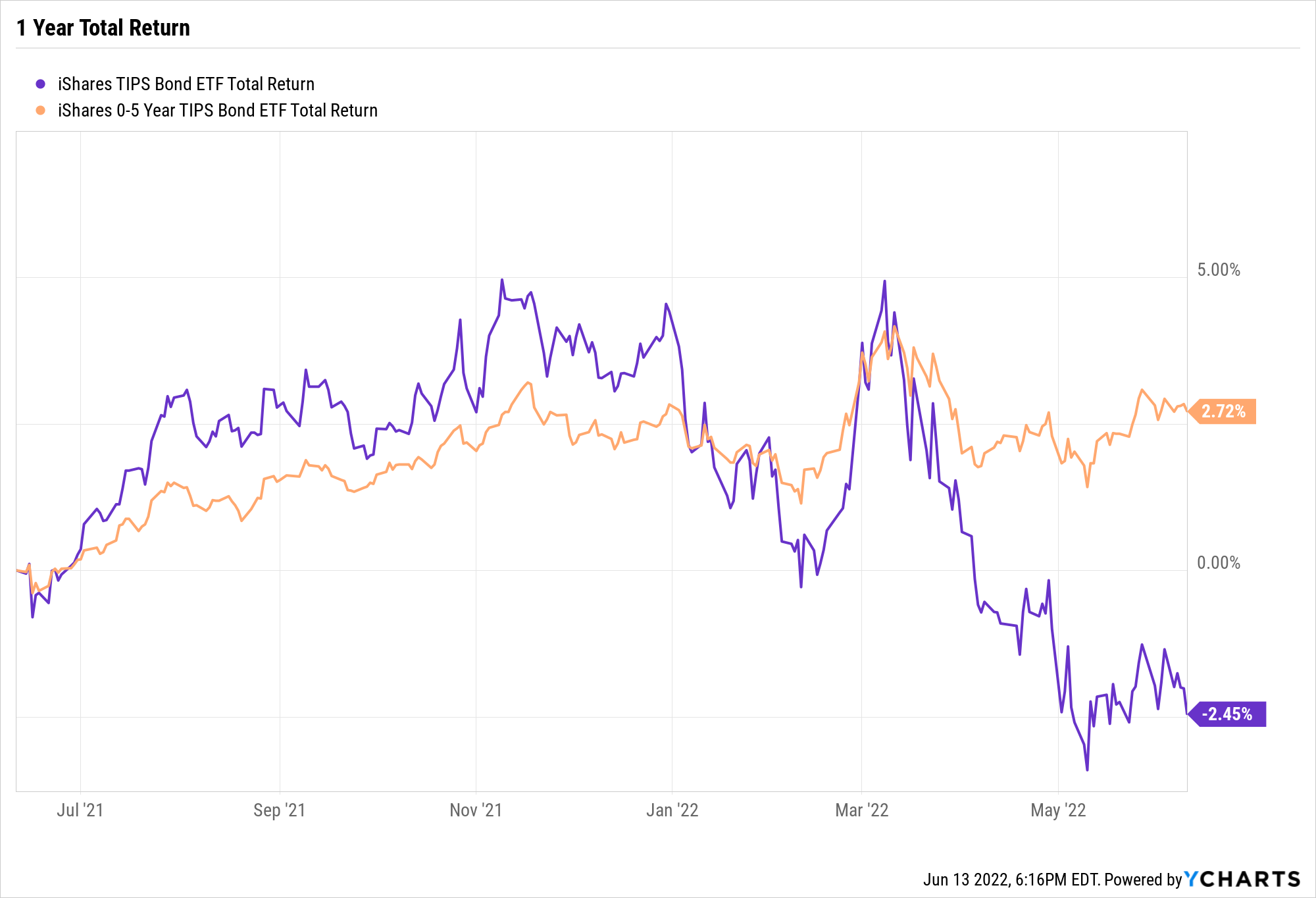

Also at US TreasuryDirect you can purchase bonds, bills, and TIPS (inflation-protected securities). There are also ETFs that purchase these securities. If you are particularly interested in TIPS (solid investments this past year) you might want to investigate these ETFs - TIP: TIPs Bond ETF and STIP: 0-5 year TIPs.

Finally, a couple of cautionary notes.

- Stocks were down big today. As I mentioned earlier, we'll be getting a Fed rate decision Wednesday and Friday is the options expiration date for June contracts. So we can expect a lot of volatility. Be careful not to overreact (up or down).

- If we are in a prolonged bear market, we will experience some significant rallies while the underlying trend remains down. These rallies are generally short and sharp and then quickly reverse. Be careful not to chase stocks in these rallies until the underlying trend (those moving averages) offer evidence of a return to an uptrend.

Reminder!

Quarterly estimated tax payments are due June 15. Don't forget!

Subscribe to Chart Attack!

Yet another shameless plug...

Throughout the week, I collect charts, graphs, tables, and other items of interest. They are displayed with brief comments in a publication I call Chart Attack!

Chart Attack! is only available to subscribers of our newsletter, Under A Buttonwood Tree. If you're not a subscriber and would like to be, click the subscribe button and sign up. There is no cost for either the newsletter or access to Chart Attack! (You can also subscribe on the Home Page.)

Please note: If you would like to receive Chart Attack! via a weekly email, send me your request by clicking below. Otherwise, you can find the latest on our home page.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com and let me know. Thanks!

And Finally,

It was not my intention to frighten or panic you with this latest edition of Under A Buttonwood Tree. As you probably have figured from prior issues, I tend to be an optimist. However, after a 10-year bull market run, a major change in the direction of inflation and interest rates, and a growing likelihood of recession, I thought it was important to review the current unpleasant environment as realistically as possible.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, just click the subscribe button. It's free! (Well, not exactly. After all, it does take several minutes of your valuable time to read. But we hope you will find spending that time worthwhile!)

I'm always interested in your feedback, ideas for topics, and questions. So please click the button below.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com