August 30 - September 3

Seven In A Row!

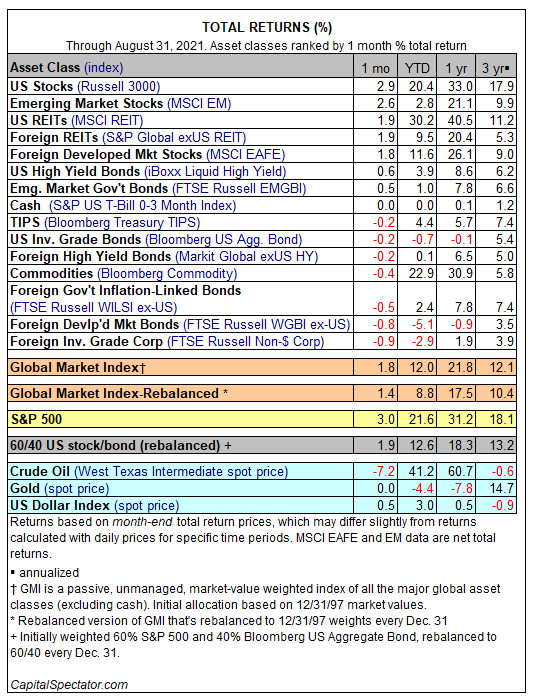

Recently, I noted how rare is a six-month stretch of positive returns for the stock market. Well, make that seven! Will September be eight in a row? We'll know in 30 days!

Be forewarned, this streak will end... someday.

This Could Be A Problem:

The August payroll report was issued on Friday (9/3). It was a disappointing increase of 235,000 versus expectations of an increase of more than 730,000 jobs. Some suggest this shortfall was due to a shortage of labor rather than a lack of job opportunities. Casual observation would suggest this may be the case given all the stories of businesses struggling to find help. The fact that wages were reported up at a 7.2% annualized rate would also confirm the labor shortage thesis. But here's the problem:

If there is indeed a labor shortage, wages will continue to rise as businesses try to attract the workers they need. These rising wages will put downward pressure on profit margins unless businesses are able to raise prices for the goods and services they provide. The result could be even more inflation in the coming months.

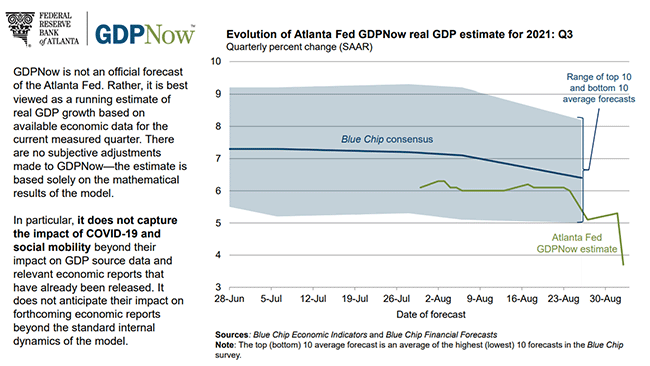

Perhaps, however, the economy is slowing down. Take a look at this graph from the Atlanta Fed suggesting a sudden and sharp decline in the expected growth rate for the economy in the current quarter.

Falling growth and rising cost pressures are a toxic mix and likely to wind up hurting corporate earnings in the future. Probably not a good thing with the stock market making new highs...

Cognitive Bias:

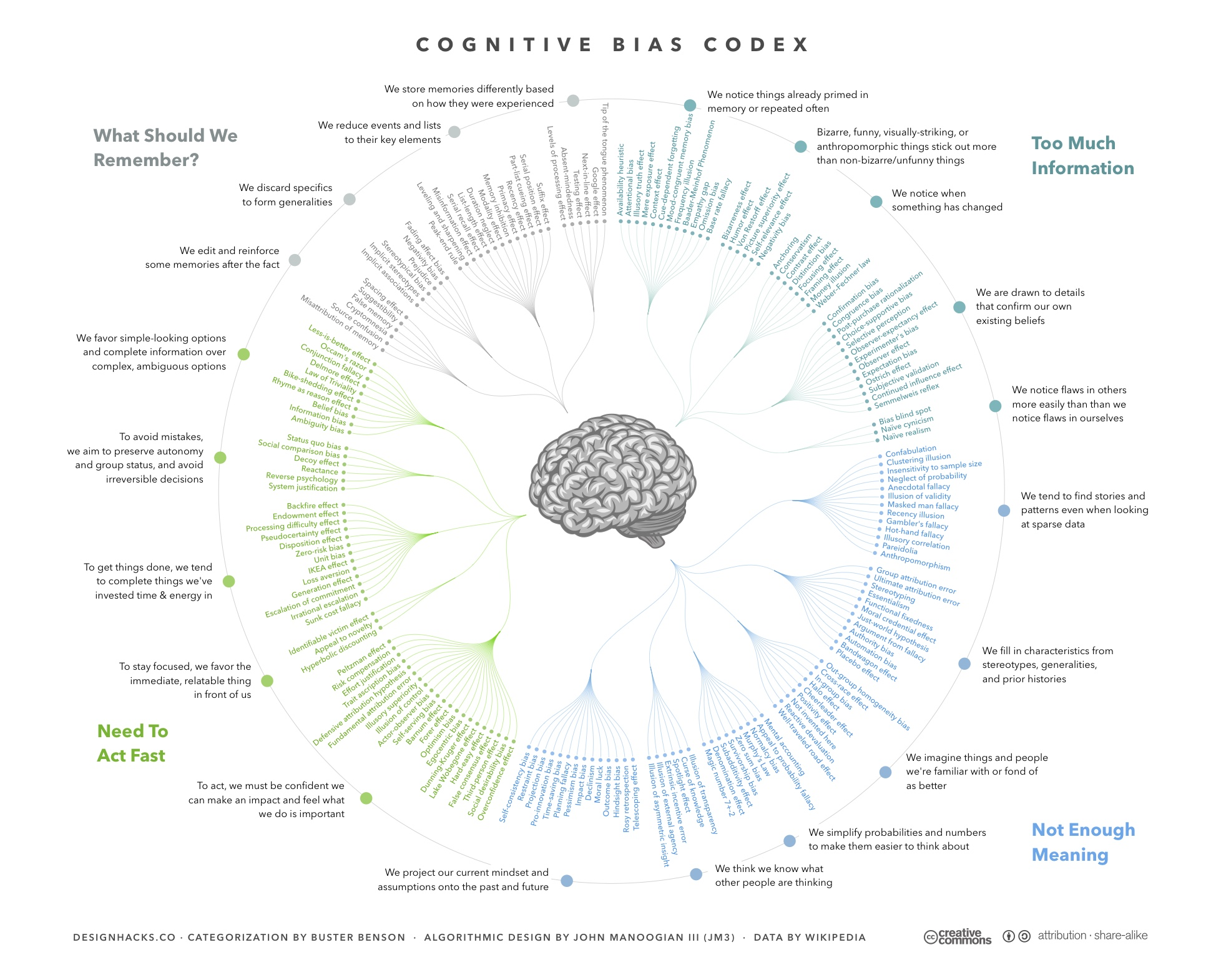

Look at all the ways our minds can get in the way of a successful investment strategy!

No wonder it is so hard to beat the market! Learn more about this codex here. And here is a link to learn more about behavioral finance. (Sometimes I think it should be called misbehavioral finance because that's what most investors do!)

Gaining Insight From Sectors:

In the Market Lab, we explore several "cross-market" indicators. One of them is the performance of utility stocks versus the S&P 500. This article, Stock Market Turns Cautious as ‘Defensive’ Shares Surge, in the August 30, Wall Street Journal helps to explain why we track this relationship.

On Fed Chairman's Jackson Hole Speech:

Wall Street waited with bated breath for Fed Chairman Powell's speech on August 27. Turns out it was a yawner with very little new information or surprises. That's probably good news for the markets in the near term but it also raises concerns that the Fed may be late or not aggressive enough dealing with inflation.

Here's a small sampling of the commentary:

Fed Keeps Options Open, but Not Too Open, Wall Street Journal, 8/30/21

A Conditional Signal from Jackson Hole, Rabobank, 8/27/21

Why Jerome Powell's business-as-usual Jackson Hole speech was the best possible outcome, Business Insider, 8/27/21

And for you gluttons for punishment, here's the full transcript!

This Doesn't Sound Good:

Just now (8/31) from CNBC: Social Security trust funds now projected to run out of money sooner than expected. . .

Another China Warning:

In an earlier issue, I raised some concerns about investing in Chinese stocks. Here is an article in the Financial Times: George Soros: Investors in Xi’s China face a rude awakening. Admittedly, I'm not a fan, but I do think Soros, who knows a thing or two about investments, identifies important risks in the Chinese economy and stock market.

What to do? I would certainly review your portfolio for exposure to Chinese stocks, both individual holdings and Chinese exposure in any ETFs you may own. Perhaps it makes sense to avoid Chinese stocks for the time being or at the very least, limit exposure to an amount you could afford to lose.

Think Traffic Is Bad in Your Town?

And Finally:

Have you noticed that when you click on a link, the newsletter disappears? Unfortunately, this publishing platform doesn't allow me to correct the problem. However, you can simply use the back arrow on your browser to return to the newsletter or even better, "right-click" on the link and you will have the option to open the link in a new tab or page. That way you'll never lose your place or miss any of this incredible content!

Please feel free to forward this email to a friend. And if this was forwarded to you, sign up to get your own free subscription at our homepage.

We welcome your questions or comments. Email us at under.a.buttonwood.tree@gmail.com.

Happy Labor Day!