August 16-20

A Market Pause?

The stock market has posted positive returns for the last six months in a row. This is a very unusual event, happening just a dozen times since the 1850s! At some point, the market will pause. . . and August may be the month. According to Deutsche Bank, over the past ten years, stocks have declined in August six times, the most of any month. Will this August make it seven out of eleven? Or will the winning streak continue? (The S&P500 is up about 1.1% with ten days to go.)

Did You See This Headline?

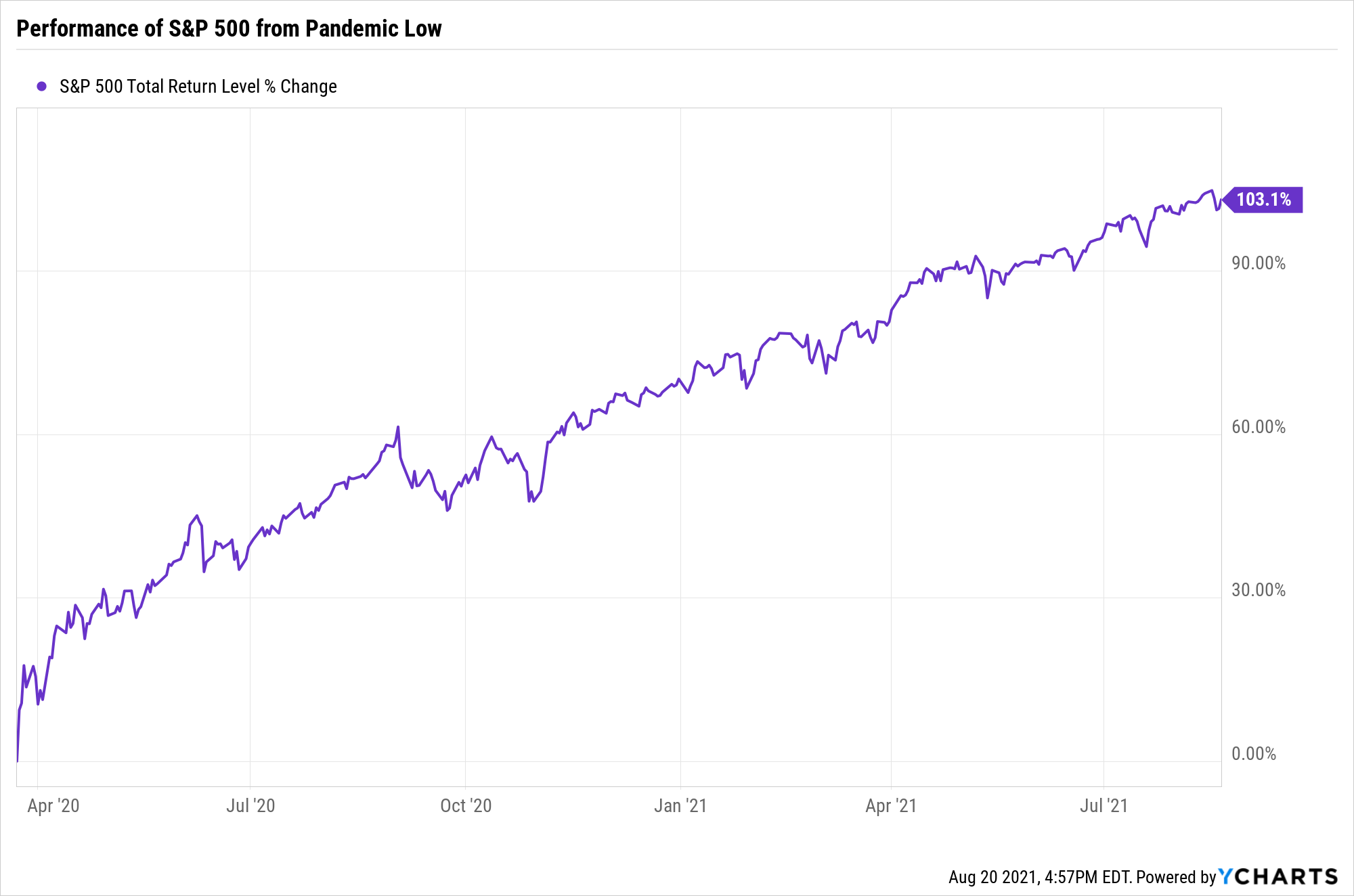

"S&P 500 doubles from its pandemic bottom, marking the fastest bull market rally since WWII" proclaimed the CNBC headline on August 16. Well, it's true. Here's the chart showing the S&P 500 rising over 100% since March 23, 2020.

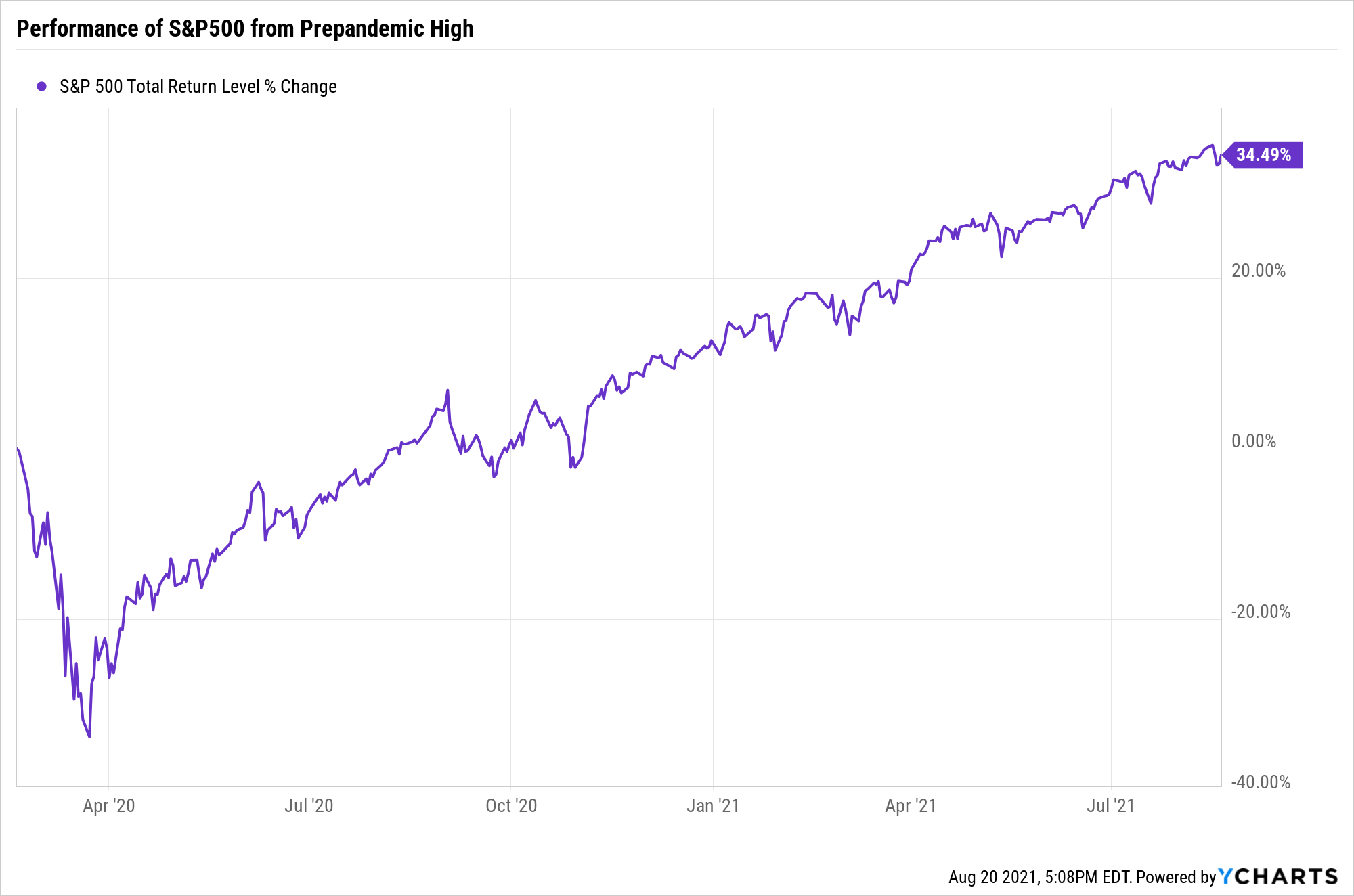

But wait, didn't stocks take a tumble as COVID-19 began its spread around the globe? They sure did, falling 33.8% between February 19, 2020 (the all-time high up to that point) and March 23, 2020! So let's look at the same chart but with a starting date of February 19, 2020:

Why are we discussing this? Context. Whenever you see a crazy headline or even review your portfolio's performance, you need to put it into context. The 100% gain from the pandemic low becomes 34% gain (still pretty darn good!) when you measure the return from the February 2020 high just a month earlier. All of a sudden, that headline doesn't seem as compelling, does it?

A Sign of Market Excess?

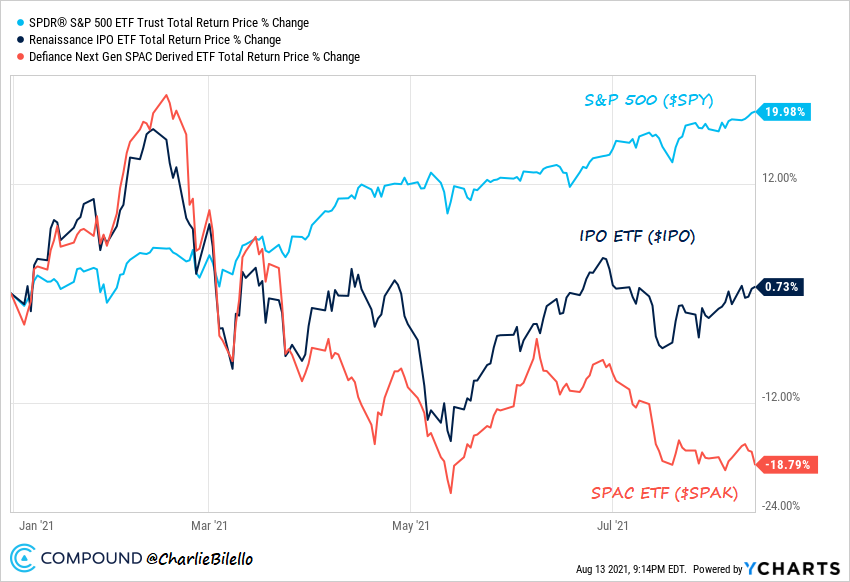

Perhaps. Here are some charts from Charlie Bilello at Compound Advisors regarding IPO issuance. The number of initial public offerings (including SPAC's) is soaring, well above the levels we saw just before the market collapsed in 2000/2001. Here's the chart:

IPO's are easiest to sell when investors "animal spirits" are at their peak. But are they good investments? Well perhaps not if the performance of these two ETF's is indicative.

One bit of advice. Your odds of making money in an IPO are quite low. So let the company come public and trade for six months or so before considering an investment. If it's a great company, you'll have plenty of time to get in on the ground floor (and not wind up in the basement!).

Gold Versus Stocks

This surprised me:

You would be (significantly) better off, even on a total return basis, if you owned gold instead of stocks since the turn of the century. Going forward, who knows?

On My Soapbox:

Whether or not you believe we should have been there in the first place, the chaotic withdrawal from Afghanistan we have witnessed in recent days raises serious concerns in my view. We appear weak and inept to the rest of the world. With the Taliban now in control of the entire country, fortified by an extraordinary cache of weapons and ammunition seized as we fled the country, Afghanistan will become a haven for terrorists to an even greater extent than it was in 2001.

Perhaps even more important, adversaries such as Iran, Russia, and China may become emboldened by our actions in Afghanistan. Will Iran further accelerate their nuclear weapons development? Will Russia invade Ukraine? Will China attack Taiwan? How will the United States react?

Beyond the terrible events in Afghanistan chronicled in the daily news, I am most concerned about the increasing risk of a military conflict between China and Taiwan. Taiwan is a major supplier of semiconductors and high-tech equipment. Any significant disruption of their exports to the U.S. and the rest of the world would have serious implications for our economy and the stock market. One needs only look at the impact of the pandemic-induced supply disruptions we've recently experienced to get a feel for the potential damage to economies around the globe. And should the U.S. become involved in the conflict, the consequences could be much worse.

We can only hope that our government (and corporations) are planning for such a possibility. Given events of the past few weeks, however, I fear hope is about all we have...

Interesting Take On Global Warming:

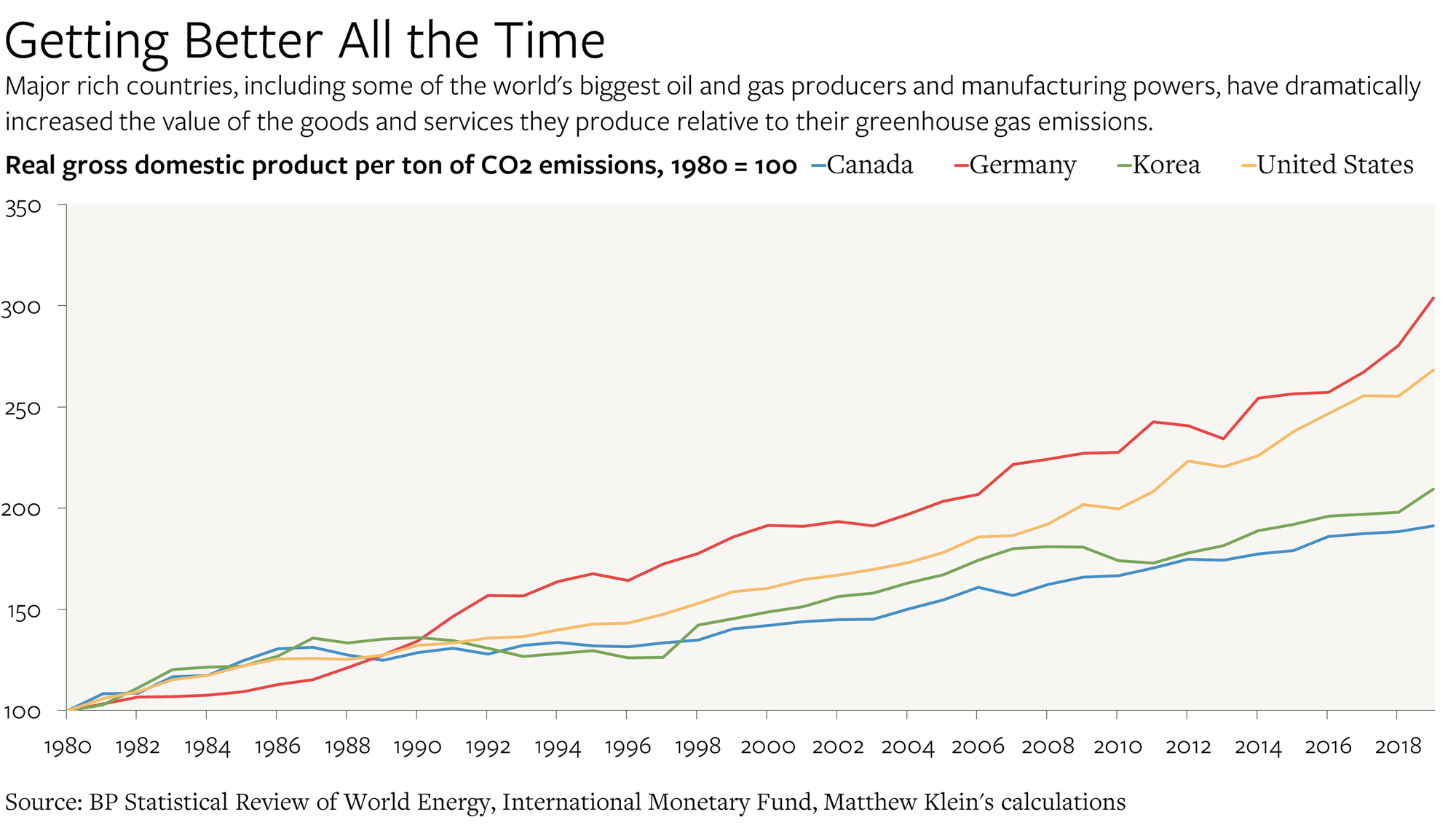

Here's a chart from The Overshoot on the amount of GDP per ton of CO2 emitted. The good news, in my view, is the increasing CO2 efficiency of the major economies suggesting that modern, growing economies are part of the global warming solution, not part of the problem.

Make the IRS Your Partner:

I was recently asked about tax-loss harvesting by one of our regular readers. It raises a larger question about selling in general. So let's briefly discuss both...

I think most investors if asked, will tell you that among the hardest decisions is knowing when to sell a stock. It is for me. So I have some rules I try (not always successfully) to follow. Here are a few:

1. "Take your losses, let your profits run". Whether you need to raise some cash for expenses or for a new investment, the first place to look for a sale candidate is in the loss column. It may seem counterintuitive, but you are almost always better off dumping stocks that are going down rather than selling stocks where you have a profit. Remember you get a tax benefit taking losses if the sale takes place in your taxable account. But if you sell a stock at a profit, Uncle Sam, will expect his cut.

2. Cull small positions. If you've got very small positions in funds or individual stocks, consider selling them if you are looking to raise some cash. These small positions tend to clutter up your portfolio and divert your attention from the larger, more impactful positions in your portfolio.

3. No losses in your portfolio? Terrific! If you still need to sell, start with long-term gains (greater than one year). They are taxed at a lower rate than short-term gains.

4. If you've bought the fund or stock over time, ask your broker to sell the highest-cost shares first.

Of course, if you have a good reason to sell a stock at a profit, tax considerations should be secondary. I'm going to wait for another newsletter to discuss how to identify those potential stock sales from a portfolio of winners.

Back to tax-loss harvesting:

The idea behind tax-loss harvesting is to generate losses by eliminating stocks from your taxable portfolio (this doesn't work in IRA's) selling for less than what you paid for them to offset any capital gains and ultimately ordinary income (up to $3,000 of net losses can be deducted from your income each year). Excess losses can be carried over to be used in the next year.

Most investors tend to wait until year-end to generate their losses. That's fine. However, I view tax-loss harvesting as a continuous process occurring throughout the year as I manage my portfolio with a final "clean-up" at year-end.

I'm sure most of you are aware that the IRS has certain rules about loss taking. One of them is the "wash sale" rule which, simply put, means if you take a loss on a stock or fund and then buy it back within 31 days, the loss is disallowed. (The accounting is a little more complex.) But what if you bought SPY, the S&P 500 ETF, it now has a loss you want to harvest, but you still want exposure to the stock market in your portfolio as you wait out the 31 days? Consider replacing it with a fund that is similar but not identical to SPY, for example, a fund that invests in all stocks like Vanguard's VTI or a fund that only invests in dividend-paying stocks. (Please check with your financial and/or tax advisor to make sure you won't run afoul of the wash sale rule, etc.) You can then wait 31 days and reverse the trade if you like. Your exposure to the market has been maintained and you get a tax benefit from the tax-loss harvesting. You can do a similar trade with individual stocks, swapping them for the appropriate sector/industry ETF.

Not bad when you've got the IRS as your partner!

More questions on this topic or something else? Let me know at under.a.buttonwood.tree@gmail. (Or give me a call if you know my number...)

This Is Not My Essay on Inflation:

This headline, "Microsoft boosts business pricing for Office subscription products", is another inflation canary in the coal mine, in my view. It turns out Microsoft is raising the (per user) prices on its Office 365 business software between 10 and 25% early next year. Looks like inflation to me. Let's see if other tech companies follow suit.

Cryptocurrency:

You may have zero interest in bitcoin and other cryptocurrencies. However, instead of nodding your head knowingly when you haven't a clue what people are talking about, follow this link for a cryptocurrency lesson from Investors Business Daily.

From The Garden:

Our hostas' final curtin call for the season:

The End:

I covered a lot of territory. Hopefully, there is a nugget or two you can use. Again, if you have any questions or comments please drop me an email at under.a.buttonwood.tree@gmail.com.

If this email was forwarded and you would like your own free newsletter subscription, you can sign up here. Thank you!