March 12, 2023

Something just broke...

Where's my Chart Attack!? Well, last week it was derailed by a very late return from a trip south, so I decided to wait until this week. Then this happened:

So this week I have combined Chart Attack! with Under A Buttonwood Tree to go into greater depth on the past two weeks' events.

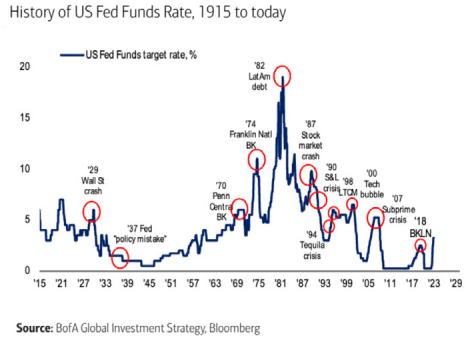

Perhaps you remember this chart from a prior Chart Attack! It highlights some of the financial accidents that have occurred after the Fed raised rates. Most occurred after a spike in rates and after those accidents, rates typically peaked.

Well, last week, there was another accident - a fairly big one. Here's the headline from Saturday's Wall Street Journal:

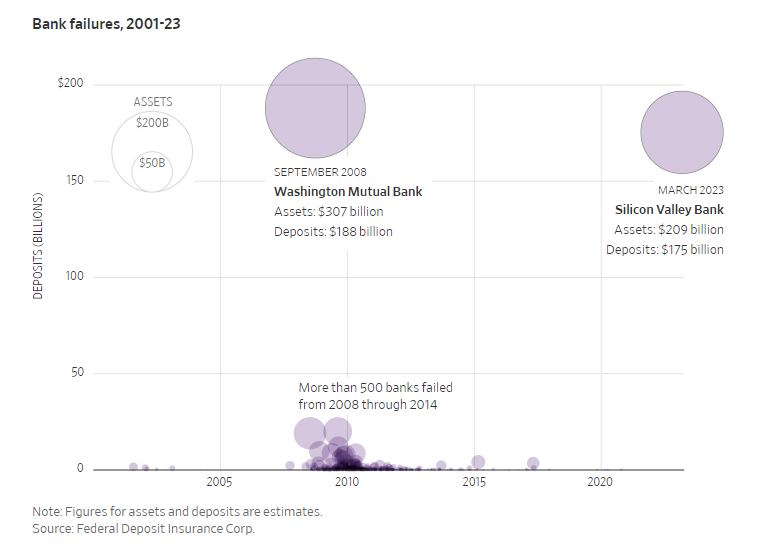

SVB was the 16th largest bank in the U.S. and the second largest failure after the collapse of Washington Mutual as this graphic from the Wall Street Journal shows.

However, unlike Washington Mutual, which was brought down by the poor quality of the assets on its balance sheet, SVB's end came as the result of a liquidity crunch caused by the collapse in the value of its long-term bond portfolio as interest rates rose. In the end, SVB was unable to fund the withdrawals.

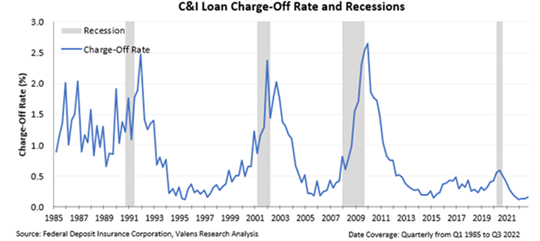

More generally, credit quality in the banking sector remains good with only a slight rise in loan charge-offs.

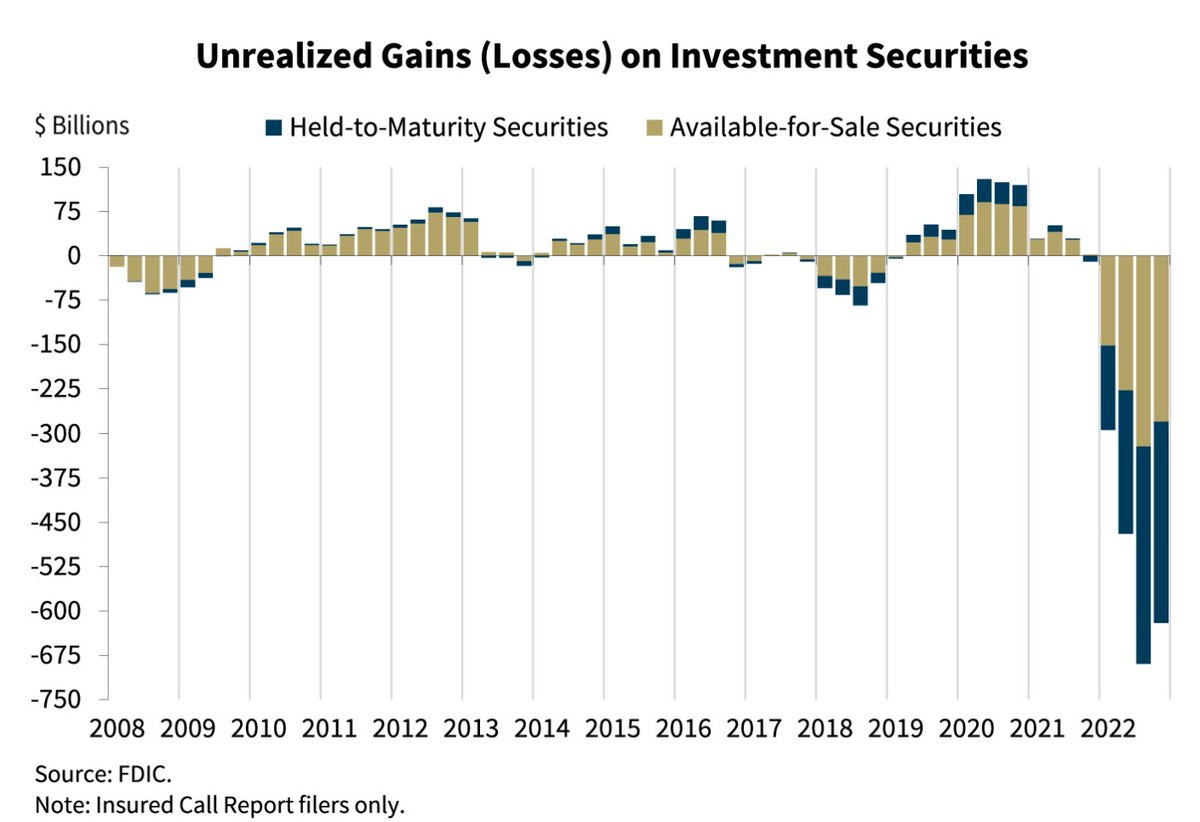

The problem appears to be the decline in the value of banks' holdings of investment securities as interest rates rose throughout 2022 and so far in 2023.

Of course, there were many more factors that made SVB vulnerable and I certainly don't have the expertise to identify and explain them all. So I you want more information, in addition to the articles in the Wall Street Journal, I suggest these two:

and Silicon Valley Bank Failure, Michael Cembalest, J.P. Morgan Private Bank, March 10, 2023.

I suspect we will feel the impacts of SVB's demise for quite some time.

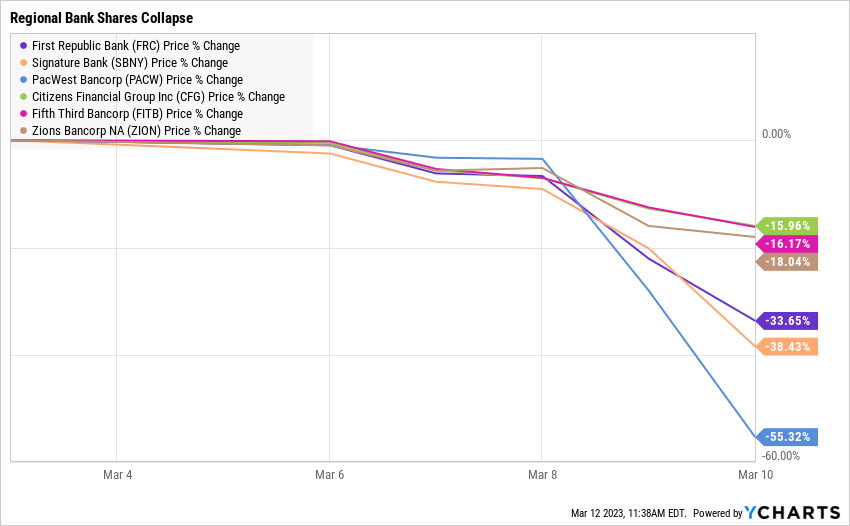

We've already seen it with the collapse of SVB's shares which had traded as high as $738(!) in January 2022 and are now essentially worthless (the last price before trading was halted, $106, is not indicative of the shares' current value).

The SVB panic spread to the shares of other banks seemingly suffering from similar balance sheet issues. Here is the impact on share prices for a sampling of regional banks. (One of them is my bank, ugh!)

Of course, the effects of SVB's failure will be widespread. Already we are hearing about problems meeting payroll from some of SVB's customers. One can imagine the discussions taking place in corporate boardrooms: how will we pay suppliers, should we defer or cancel a planned investment, will we be able to fulfill our customers' orders, or how will we be able to raise more capital? All these issues and more will have an impact on our economy.

It will take some time for these questions to be resolved. The vast majority of SVB's deposits were uninsured. Some of that money may be lost for good but I bet most of it will be recovered as the bank is liquidated. It is, however, unlikely this will happen overnight.

How will the Fed deal with this crisis (in many ways of their own making)? Will they pause rate hikes or flood the banking system with cash? Will they be able to act quickly enough to prevent panic from spreading?

Breaking news:

Right now, these are all unanswered questions. So while we wait for answers, what can we do with our cash?

- If you hold balances in any bank in excess of the amount guaranteed by the FDIC, consider moving those excess balances to another bank. You can find more information on FDIC insurance on their website.

- Consider opening a checking account at a second bank even if your balance is fully covered by the FDIC at your current bank. Should something unexpectedly happen at one bank, you will still have access to banking services at your secondary bank. (This is something I'm doing today.)

- Consider money market funds that invest only in U.S. government securities as an alternative or in addition to a bank checking account. They are offered by a number of firms including Fidelity and Vanguard and right now, yields on these funds are fairly attractive. (Note: Money market funds are not insured by the FDIC and there is always a risk of loss, albeit a very slight one.)

Not surprisingly, markets have been in turmoil. In addition to SVB, the employment numbers (reported 3/3) were stronger (in some respects) than expected, raising inflation concerns. Here are some charts:

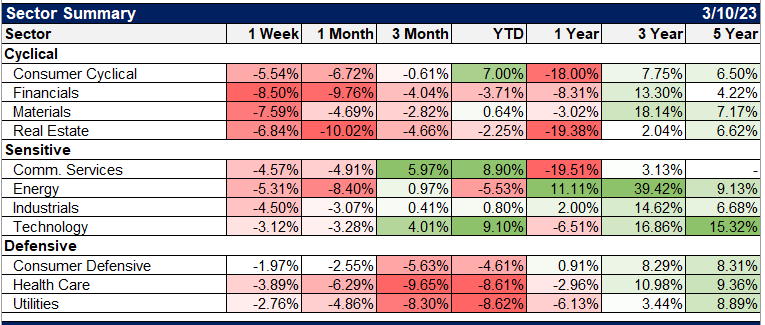

Stocks, commodities, and REITs suffered sharp declines while most bonds benefitted from a flight to safety.

Also not surprisingly, the financial sector suffered the most last week:

Download all the latest market stats below:

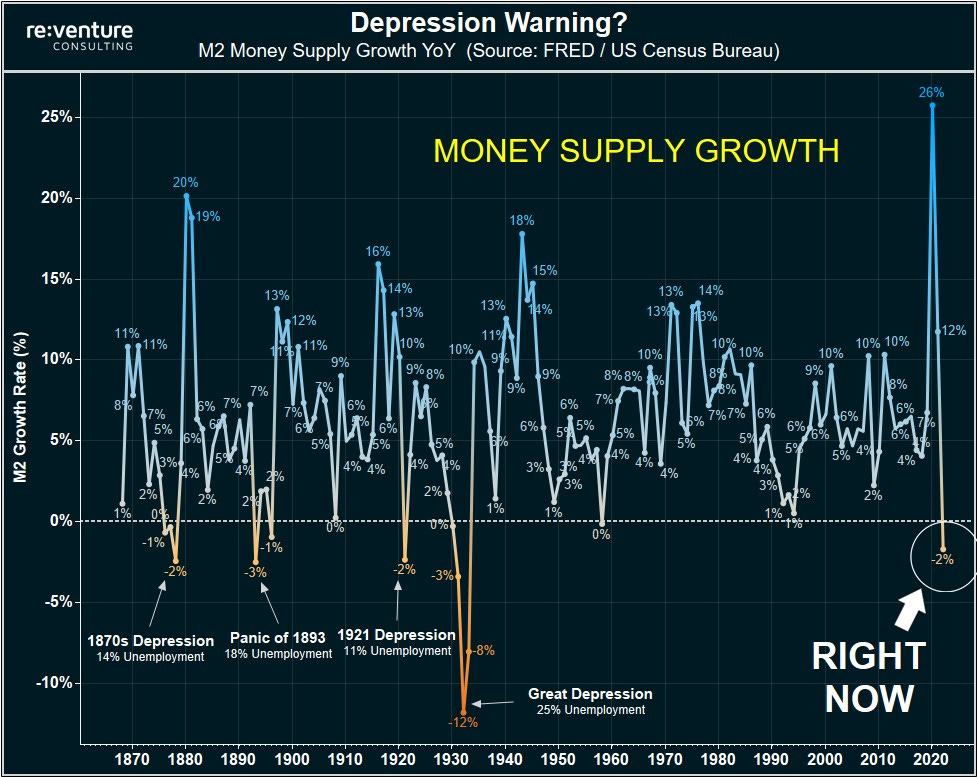

In the last 150 years, there have only been five instances of money supply declines of 2% or more. Four of them resulted in a depression. What will happen this time?

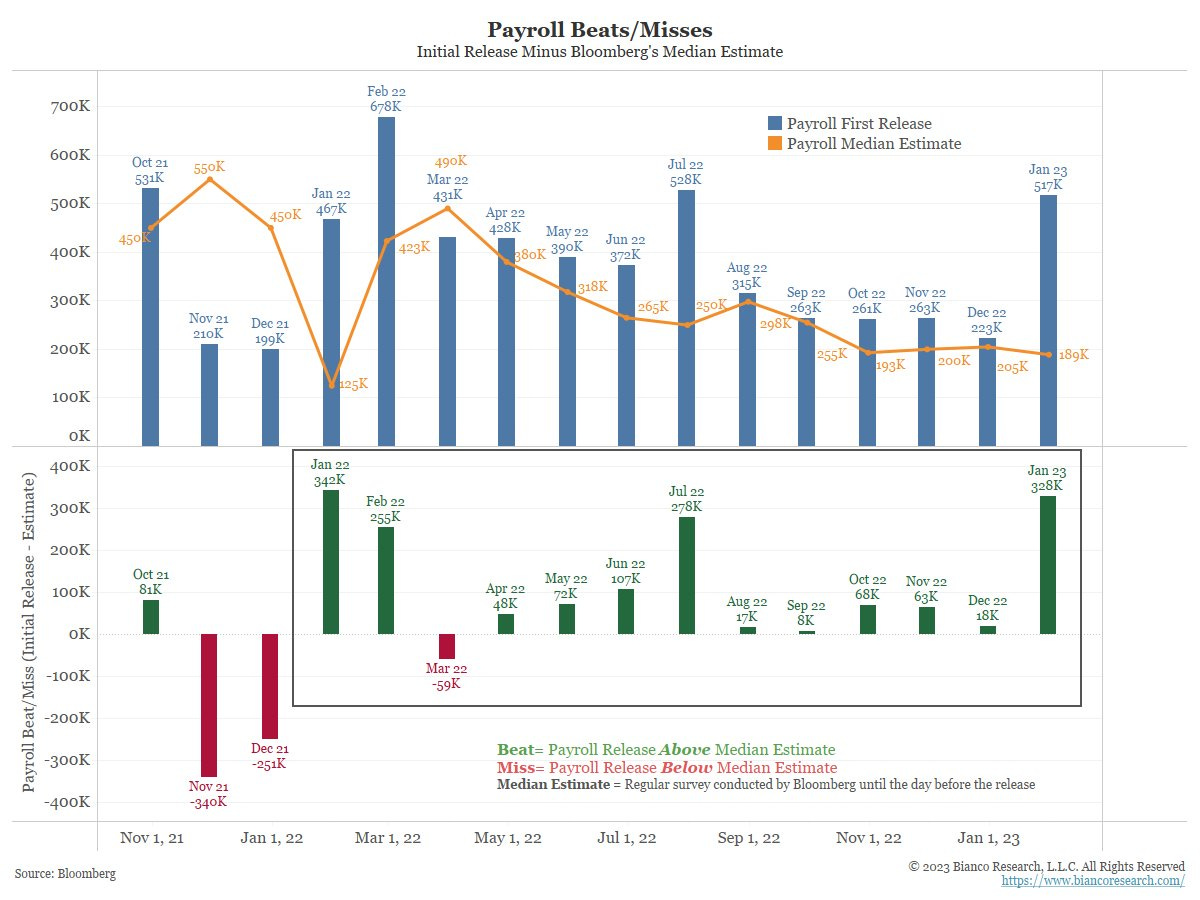

Here's the payroll data that spooked the markets last week (reported on 3/3).

More breaking news:

Now we wait to see what tomorrow brings. Let's hope financial markets calm down and the Feds take appropriate actions to lessen any damage to the banking system and our economy. Buckle up!

Thank you for reading! I hope you found something of interest in this week's special Chart Attack! Find more Chart Attack!s on the Under A Buttonwood Tree homepage.

Chart Attack! is only available to subscribers of our newsletter, Under A Buttonwood Tree. If you're not a subscriber and would like to be, click the subscribe button and sign up. There is no cost for either the newsletter or Chart Attack! (You can also subscribe on the Home Page.)

Are you receiving too many emails and would rather read Chart Attack! on our website? Just let me know by email and you will be removed from the mail list.

Our email address is under.a.buttonwood.tree@gmail.com

Remember, Chart Attack! is only available to subscribers of Under A Buttonwood Tree, so be sure to subscribe for access!