August 2-6

Friday's Jobs Report:

Today's jobs report (for July) was solid with almost a million jobs added. The unemployment rate fell to 5.4%. You can read more here if you like.

It Can Pay To Keep It Simple:

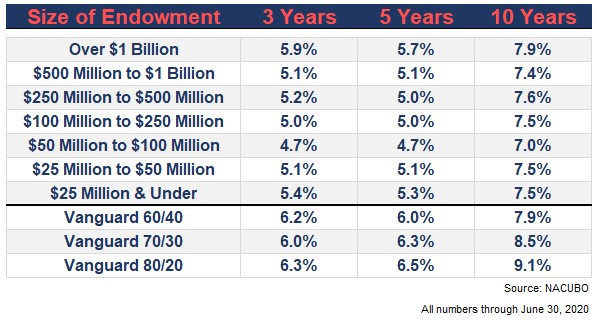

In a recent post on his blog, A Wealth of Common Sense, Ben Carlson displayed a table of returns from college and university endowments comparing them to a simple three-fund portfolio.

The endowments range in size from small to gigantic, many employing teams of consultants and outside investment managers in addition to their own internal staff. They invest in a wide range of asset categories from publically traded stocks and bonds to venture capital and private equity. The money spent on analysis, review, and reporting can be significant.

Here are the results:

Wow! Ben's simple 3-fund portfolio beat the average endowment almost every time. You didn't need to take on a whole lot of risk either. The most conservative 60% stock, 40% bond portfolio beat all but one of the category returns (where it matched). And, although not shown on the chart, the 80/20 portfolio would have landed you in the top quartile of all endowments. That's bonus territory for a professional money manager!

For his Vanguard portfolios, Ben used just three mutual funds: VTSMX - US Stocks, VBMFX - Bonds, and VGTSX - International Stocks. In the stock portion of the portfolio, 60% was US and 40% international. So for example, in the 80/20 portfolio, 48% was VTSMX, 32% was VGTSX, and the remaining 20% was VBMFX. Once each year the portfolio was rebalanced to the original percentages. Simple indeed!

I thought it would be interesting to create our own Simple Portfolios. We can track them over time.

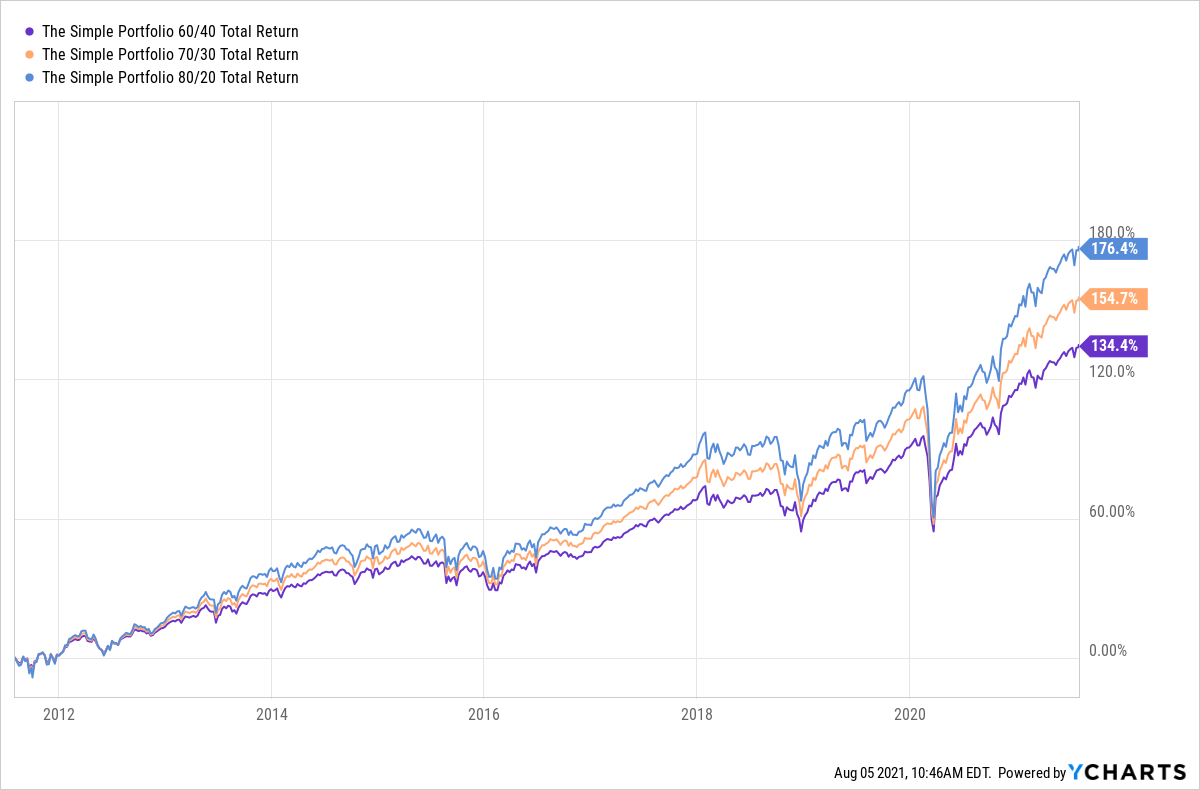

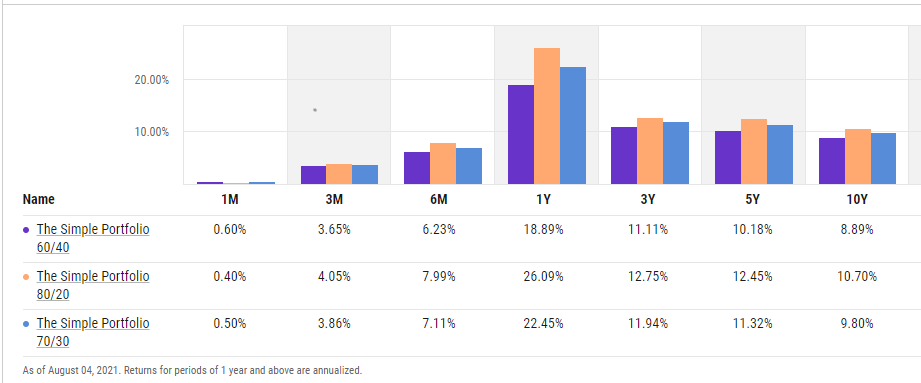

I recreated Ben's portfolios using the equivalent Vanguard ETF's (VTI - US Stocks, VEU - International Stocks, and BND - Bonds) which are a bit easier to buy and sell and can be more tax-efficient than traditional mutual funds. The portfolios are rebalanced once a year. Here are the results:

The returns shown above are not exactly comparable to Ben's table as these returns reflect periods ended on August 4 versus June 30. (I'm trying to get the software vendor to allow me to select end dates for return calculations - no luck yet.) And, of course, they are not the exact same funds.

Stocks (US stocks, in particular) have done very well over the past 10 years. Portfolios more heavily invested in stocks have been significantly outperforming more conservatively managed portfolios as a result. So while not as risky thanks to being diversified, all three of the simple portfolios have lagged the S&P 500 during this bull market. Of course, that could change should stocks head into a bear market (not a prediction!).

The cost of the simple portfolios is very low, about 4-5 basis points (or 0.04%) per year. If you are using a professional manager, I'm willing to bet you are paying a lot more. Also, once set up, the time needed to manage and review these simple portfolios is minimal.

Now, I'm not suggesting you sell all your investments and move to one of these simple portfolios. What I am suggesting from this exercise is that complexity does not always yield a better result (either a higher return or lower risk). I would also suggest that if you employ a professional money manager, or you manage your investments by yourself, your returns should exceed or at least come darn close to those displayed above. If not, it might be time for a conversation.

If you are interested, I would be happy to send you a detailed report including performance with benchmark comparisons on one or all of the simple portfolios. Send your request to under.a.buttonwood.tree@gmail.com.

You should consult your financial advisors before taking any investment action. And always remember when considering any investment, past performance is not a guarantee or prediction of future results.

Spread The Word:

Please feel free to forward this email to a friend. If you are that friend and want your own free subscription, you can find a link to subscribe on our homepage.

A Forecast?

If you've been a regular reader, you know I'm not a big fan of forecasts. Predictions of the future, no matter how rigorously they are made, are more often than not, wrong.

Nevertheless, I am providing this link to Ed Yardeni's most recent earnings forecast for the S&P 500 for those of you who feel the need. I will say, there are several interesting charts and graphs that may help you put the current market in some sort of context. Here's the link: YRI S&P Earnings Forecast.

Howard Marks:

I try to listen to Howard Marks whenever I can. Here is a recent interview on Bloomberg. It runs for about ten minutes.

Quick Market Update:

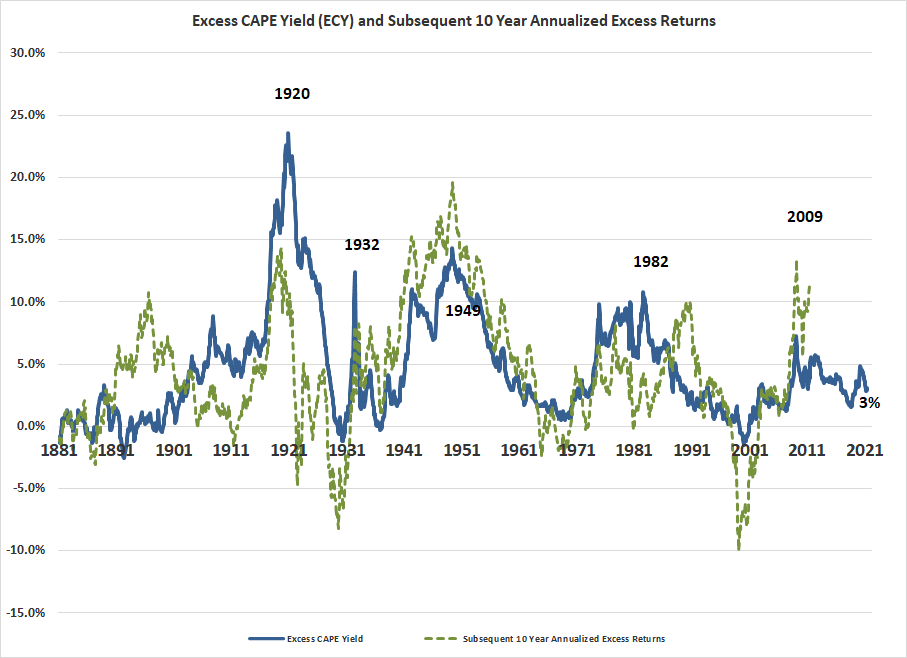

The Shiller Excess CAPE Yield (ECY) sits at 3% as of July 31. As you can see from the graph, a positive ECY has, at least historically, correlated well with positive excess forward ten-year returns. If history is our guide, we should expect positive but perhaps lower returns from stocks in the coming ten years.

The Buffett Indicator (total market value to GDP) tells a different and perhaps alarming story of a stock market significantly overvalued.

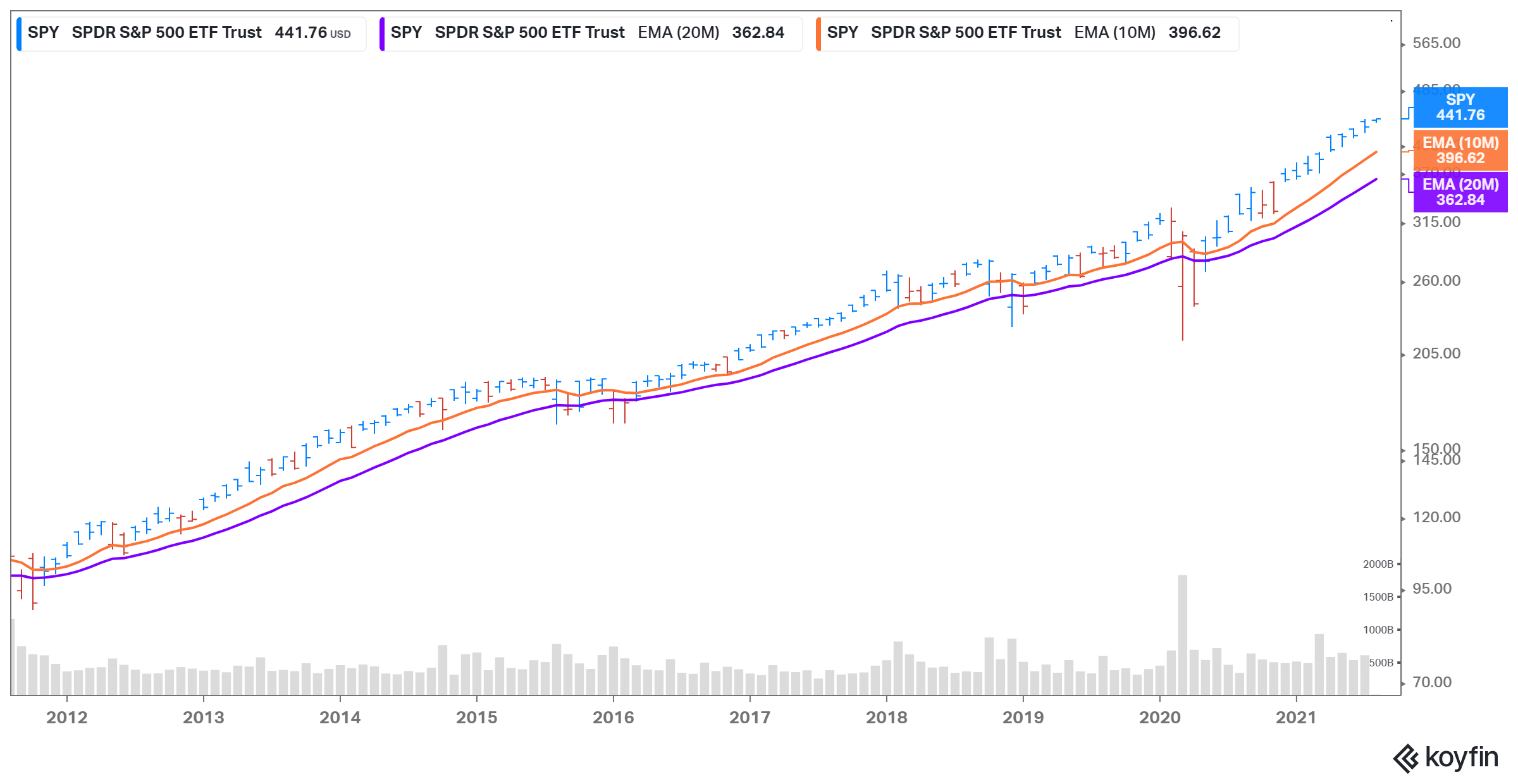

However, the market is still heading higher with the S&P 500 comfortably above its long-term moving averages. The equal-weighted S&P 500 has a similar chart, so at least from a momentum standpoint, the market still looks healthy.

Earnings Update:

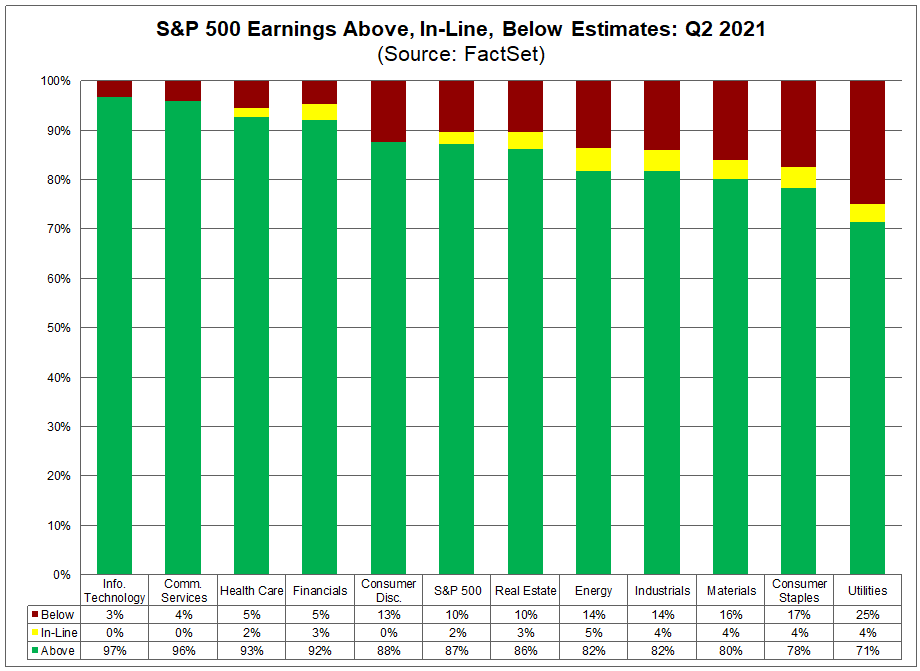

The bulk of the second-quarter earnings reports are now in and it was a tremendous quarter with more than 85% of the companies reporting results that exceeded forecast. Here's a breakdown by economic sector:

Thanks to all those great reports, it looks like earnings grew almost 90% (88.8% to be exact!) over last year's second-quarter results. Of course, last year's results were a disaster thanks to the pandemic which made the comparison pretty easy. Even so, wow!

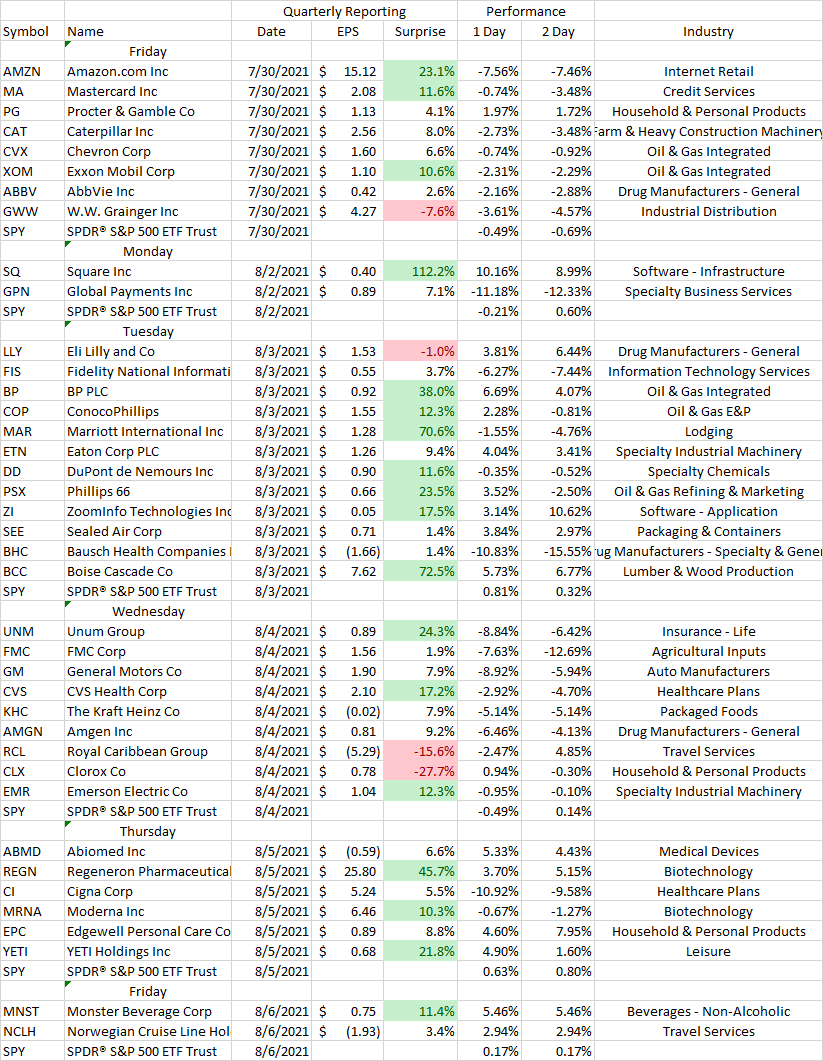

Here is the table of reports through Friday. I think we're done with earnings until October. Phew!

And Finally. . .

Did someone forward this email to you? Want your own free subscription? You can find a link to subscribe on our homepage.

If you have any questions about the contents of this newsletter or any related topic feel free to email me at under.a.buttonwood.tree@gmail.com. I'll do my best to respond directly or in a future newsletter.

This might be a good time to remind you to visit our disclosures page.