The markets are closed Monday, February 21.

Earnings Update

The flood of earnings reports is starting to crest, but it's not over. Here are some of the reports expected this week:

Rather than focusing on individual reports this week (check your favorite stocks' latest reports at Investing.com), I thought I'd make some observations about the trend in earnings results reported so far.

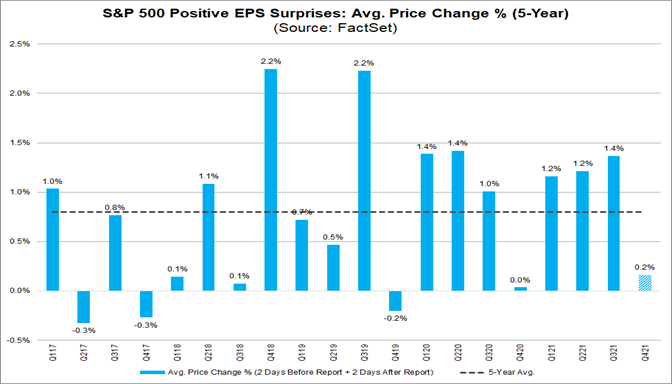

By Friday (2/18), approximately 85% of the companies in the S&P 500 had reported their results for the fourth quarter of last year. More than 75% had results that exceeded investors' forecasts and on average, those results were 8.5% higher than the forecasts. This is similar to what we've seen over the past several years. But this year, investors aren't reacting by bidding up share prices as you can see from this chart from FactSet:

Why? Well, it's not the results that are the problem. What a company reported in the fourth quarter is history. It won't change unless there is a big accounting screw-up or fraud. What investors value is (in the main) the future. And what they have been hearing this quarter is a litany of issues from supply-chain bottlenecks to labor shortages that suggest the future, at least for the near term, is somewhat fraught. The result? Companies and Wall Street analysts are lowering their forecasts for future growth of revenues and earnings. Here's a chart, about a week old, which shows the ratio of companies raising versus lowering earnings forecasts at a 10+ year low.

Lower forecasts feed back into valuation calculations and prices adjust downward, ceteris paribus. (Sorry, I couldn't resist.)

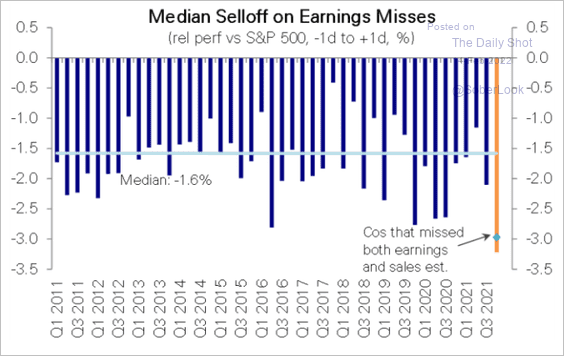

What about the 25% of companies that have disappointed investors? It's not pretty:

Notable Dividend Changes

If you own any of these stocks, you got a pay raise last week!

Advanced Auto Parts (AAP) up 50%!

Barrick Gold (GOLD) up 11%

Devon Energy (DVN) up 19%!

Extra Space Storage (EXR) up 10%

Genuine Parts (GPC) up 10%

Whirlpool (WHR) up 25%!

Inflation Watch

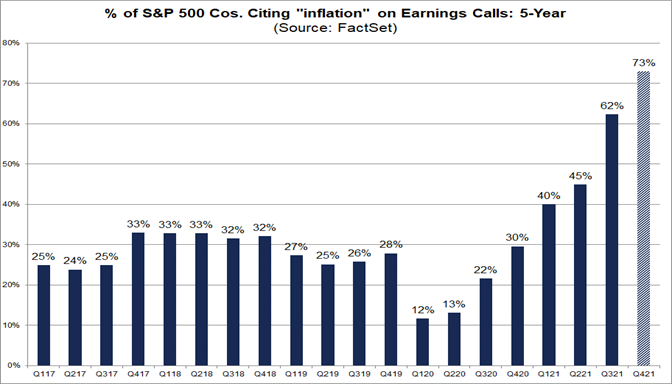

Over the past several quarters, more and more companies have cited inflation on their earnings call. Almost 75% have mentioned inflation in their fourth-quarter calls according to FactSet versus a more typical 25-30%.

Simply put, inflation has become pervasive, pushing up costs for companies in just about every corner of our economy and they are responding by hiking prices wherever and whenever they can.

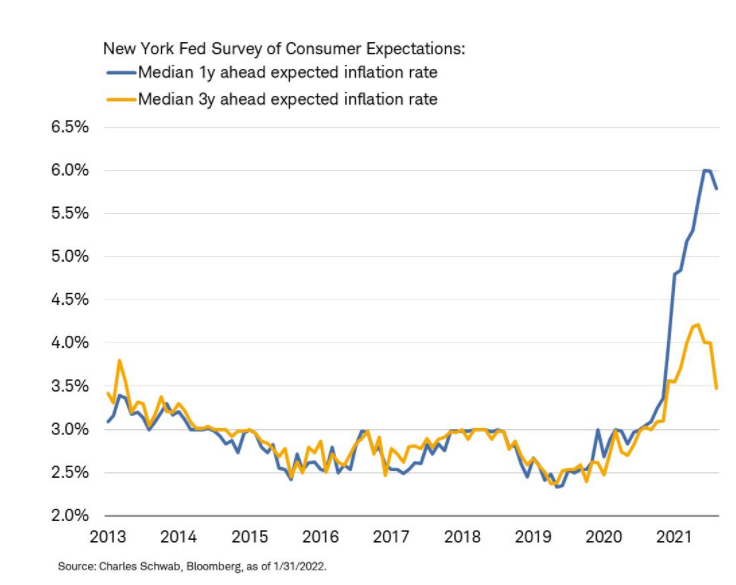

Consumers are not only feeling the impact of current inflation but they are expected more of it as shown here:

Quick Market Thought

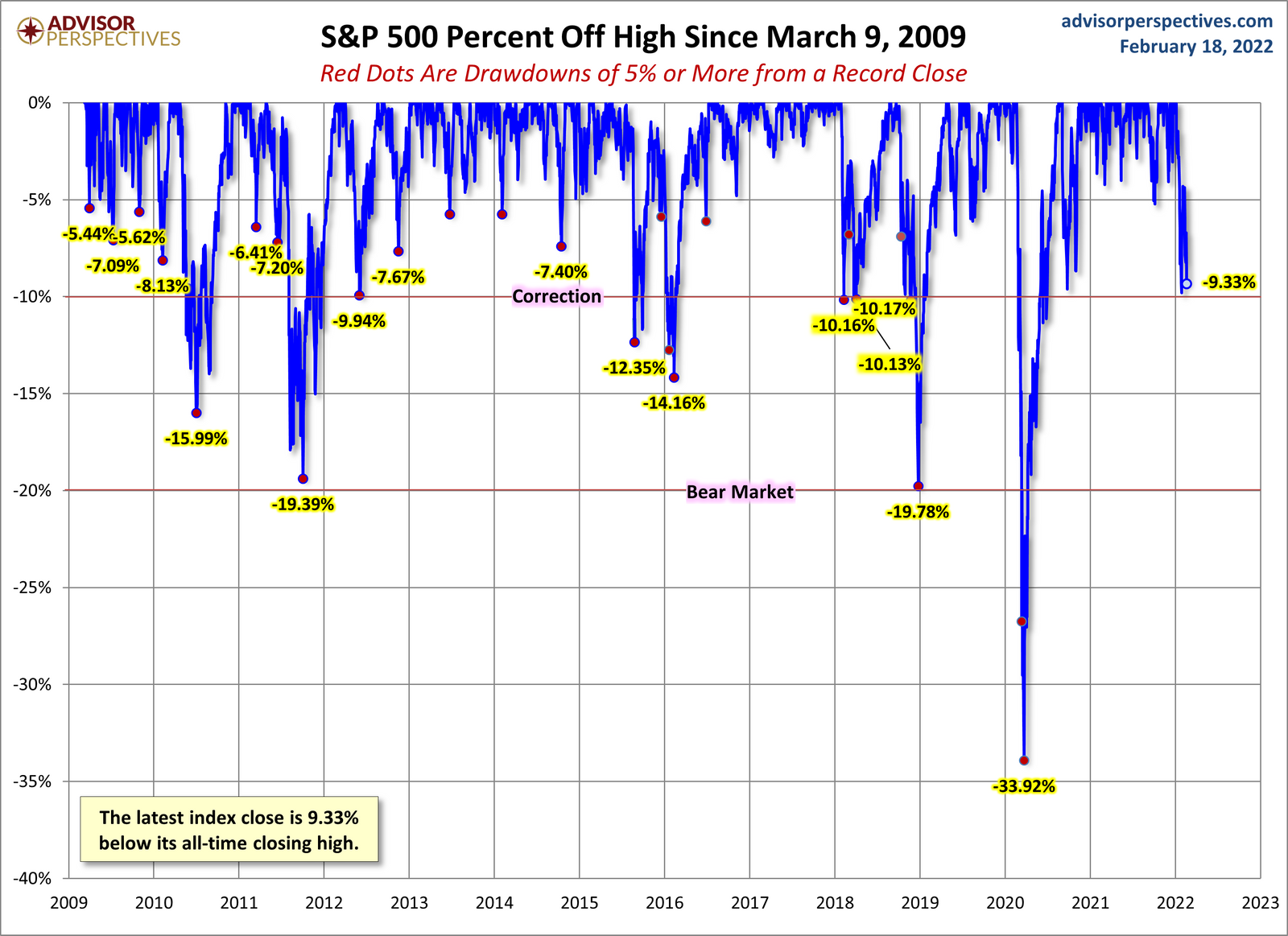

Given all that's going on, here's how I think the stock market backdrop looks currently:

- Fundamentals (economic growth, corporate profits, inflation, interest rates, etc.) are deteriorating but still generally positive.

- Valuations, however you want to measure them, are under pressure which also means stocks are cheaper today than they were at the start of the year.

- Momentum is still positive but closer to turning negative than it's been since the pandemic began.

- Fear is spreading as the drumbeat of war grows louder and more urgent.

Right now, I think this adds up to a stock market in the midst of a correction.

While I'm not ready to throw in the towel just yet, I do think caution is warranted. However, now is probably a good time to start looking for some bargains should the correction deepen.

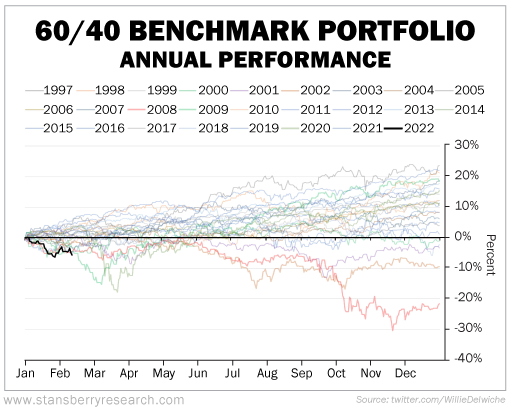

Tough Start For 60/40

Many investors, individuals and institutions alike, utilize a portfolio strategy investing 60% in stocks and 40% in bonds. It has served them well providing solid long-term performance and less volatility than stocks alone. However, as you can see from this chart, the 60/40 portfolio is off to a rough start in 2022 (the black line).

Frustratingly, bonds are doing almost as poorly as stocks (so far).

Hopefully, the correction in bonds will be limited as buyers are attracted to higher yields and the 60/40 strategy will continue to be a solid choice for many investors.

And Finally:

You've made it to the end! Thank you for reading this newsletter!

Find previous newsletters and more information by heading over to our Home Page. And be sure to visit our Bookstore, Market Laboratory, Resources, and Archive pages.

Take a look at the Chart Attack! posts on the home page or the archives. They are only open to subscribers. If you'd like to get them sent to you via email, click on the "send us your comments" button below to let me know. Here's a link to the latest Chart Attack!

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, just click the subscribe button. It's free! (Well, not exactly. After all, it does take several minutes of your valuable time to read. But we hope you will find spending that time worthwhile!)

I'm always interested in your feedback, ideas for topics, and questions. So please click the button below.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com