Stock markets got pummelled Friday on news that a new, highly virulent strain of COVID-19 (Omicron - the WHO skipped Xi for some reason) had been identified in Africa. As I noted in Friday afternoon's update, there is a lot we don't know and investors don't like uncertainty. So, market action is likely to be choppy for a while. However, given what little we do know at this point, I don't see a reason to panic.

I will continue to keep you updated on news regarding this latest strain of COVID and its impact on markets as is warranted.

COVID-19 Updates:

First, a couple of comments:

- It looks like the first patients identified in Botswana were "fully vaxed".

- South Africa’s medical chief Dr. Angelique Coetzee described the panic as a “storm in a teacup,” adding that she had only seen “very very mild cases” of the variant so far.

Here are links to some of the recent press reports on the new Omicron variant.

What’s known and unknown about Omicron..., STAT News, 11/26/21

Omicron Identified as Covid-19 ‘Variant of Concern’, Triggering Global Fears, Wall St. Journal, 11/26/21

Omicron Variant First Detected in Four People Who Were Fully Vaccinated, Summit News, 11/26/21

Goldman Slams Omicron Panic: "This Mutation Is Unlikely To Be More Malicious; No Reason For Portfolio Changes", ZeroHedge, 11/27/21

A Couple Of Charts On The Economy

Note: I collected these charts before news on Omicron.

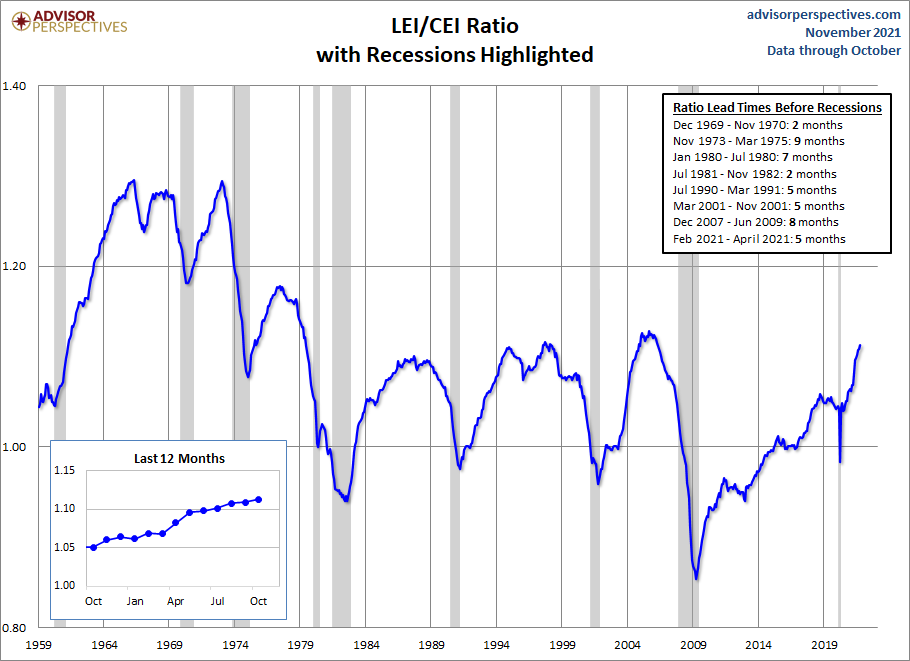

Here is a chart of the ratio of leading to coincident economic indicators. The data is from The Conference Board while the chart is provided by Advisor Perspectives. You will note that recessions (the grey bars) are often preceded by a sharp decline in this ratio which continues until the end of the recession. Over the last year, the ratio has steadily risen suggesting that the chances of a recession in the foreseeable future are low.

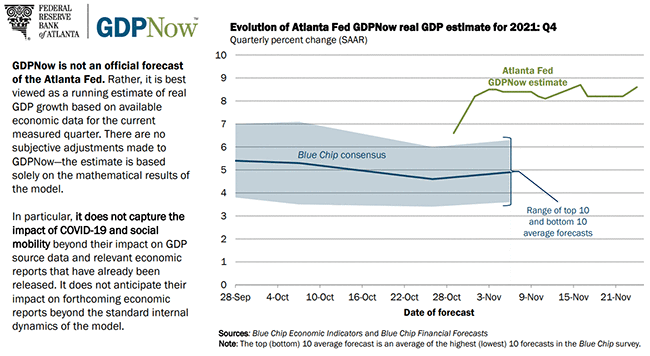

And the latest update of the Atlanta Fed's GDPNow forecast suggests significant acceleration from the third quarter.

Let's hope this holds up as we finish out the year!

Downside Risk

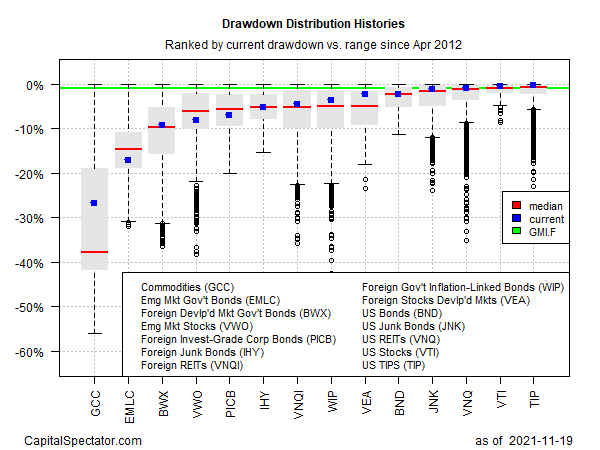

I thought this chart from CapitalSpectator was interesting and (unfortunately?) timely. It's rather busy but in essence, it is describing the potential downside risk of various asset categories based on the last ten years of history. Clearly, commodities have the greatest downside risk while US bonds have the least downside risk. Of course, historical performance does not guarantee future results, but at least you can get an idea of where the risks may be in your portfolio.

Oil Prices

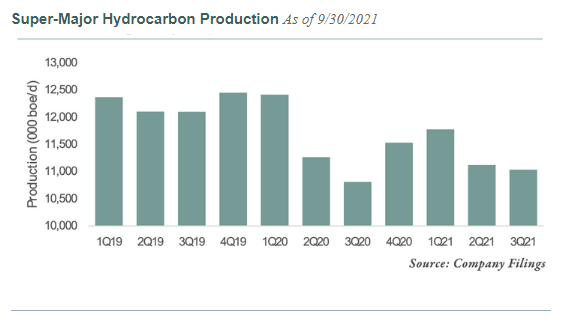

Thanks to the Omicron variant, oil prices crashed on Friday. However, this may only be a short-term respite. As you can see from the chart, oil production from the largest producers is down significantly from pre-pandemic levels.

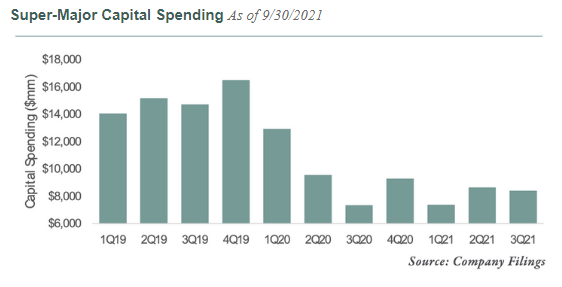

More concerning, these same producers cut back their capital spending in early 2020. Despite increased prices and demand, capital spending remains low suggesting that oil supplies will remain tight (and prices high) for some time to come.

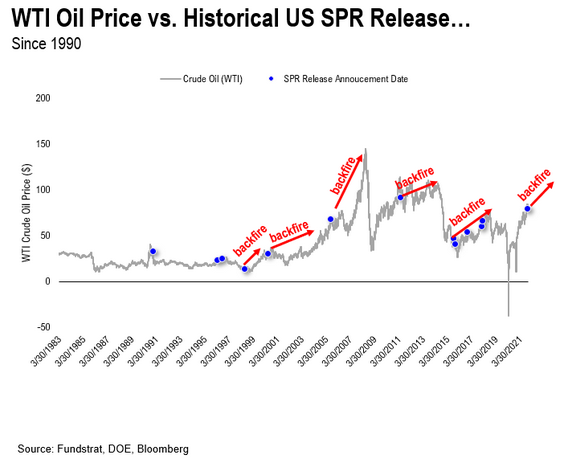

And finally, the release of oil from the Strategic Petroleum Reserve announced last week is unlikely to have the desired effect on prices given historical precedent. Never has...

The Buttonwood Tree Bookstore Is Open!

Check out our new bookstore. We're starting out with just a few books to get started. But we'll be adding new titles regularly, so check in often. Who knows, maybe there's a Christmas gift idea for your favorite investor! For example, The Code Breaker by Walter Isaacson, a biography of Jennifer Doudna, is well written, engaging, and very timely.

Follow this link or look for it at the top of our homepage.

And Finally...

Welcome new subscribers! Thank you! You can find previous newsletters and more information by heading over to our homepage.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, visit the homepage to sign up. It's free!

Got questions or comments? Send them to under.a.buttonwood.tree@gmail.com.