A Brief Essay on Inflation

Several weeks ago I promised you a more detailed briefing on inflation. This issue is top of mind for me as it has an impact on so many aspects of our lives from the price of food, energy, healthcare, and other essentials, to investing, the focus of this newsletter. What follows is a series of observations, charts, links, etc. that I hope will help you draw your own conclusions about where inflation is headed.

Inflation peaked in June 1980 at 13.6% and began its long slide, eventually hitting a low of 0.6% in October 2010. After hitting that low, inflation remained very stable, fluctuating between 1-2%, until recently as you can see in the graph below.

Look what 40 years of disinflation have done for interest rates. The interest rate on a 10 year US treasury bond has fallen from a peak of 15.2% to about 1.4% today! Remember that bond prices move inversely to interest rates so it's no wonder bonds have been one of the best asset classes for decades. It is, I believe, one of the key reasons the 60/40 stock/bond portfolio became (and remains) the go-to strategy for so many investors.

Has the era of disinflation finally come to an end with the sudden and dramatic increase in prices we've recently witnessed? Or, are these price spikes and shortages simply a result of the pandemic-induced economic shutdown in 2020 and likely to recede as our economy gets back to normal?

Let me remind you why these are such important questions for investors. Rising inflation has a depressing impact on stock valuations pushing down price/earnings multiples as inflation rises. (Here's a link about the issue at Investopedia that's somewhat helpful.)

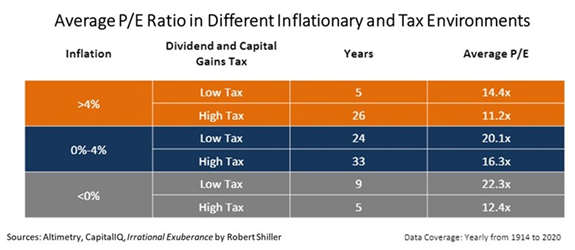

I showed you this table several weeks ago but it's worth seeing it again.

Historically, as inflation rises above 4%, the average P/E falls significantly - from the low 20's to the mid-teens, suggesting stocks could fall as much as 1/3. You can also see the impact rising taxes on capital (dividends and gains) has on valuations. The worst-case scenario of high inflation and high taxes could drive valuations down fifty percent or so. Disturbingly, this "high/high" scenario is becoming more likely given what we are already seeing on the inflation front and with the enormous tax and spend legislation now being debated in Congress.

Now let's take a look at the Shiller CAPE ratio. In particular, look at the period encompassing the late 1970's to early 1980's. For those of us who remember, this was a time of high inflation, shortages, and high taxes. During this period, the market's p/e ratio fell to single digits, a level not seen since the Great Depression. What the table above and this chart below suggest is that a collapse in market valuations could happen again should inflation get out of control.

While not making a forecast, I believe there is a growing body of evidence leading me to the conclusion that the era of disinflation and price stability is over. And more importantly, the risks of sustained inflation above the 4% threshold are significant with the risk of returning to double-digit inflation now measurable.

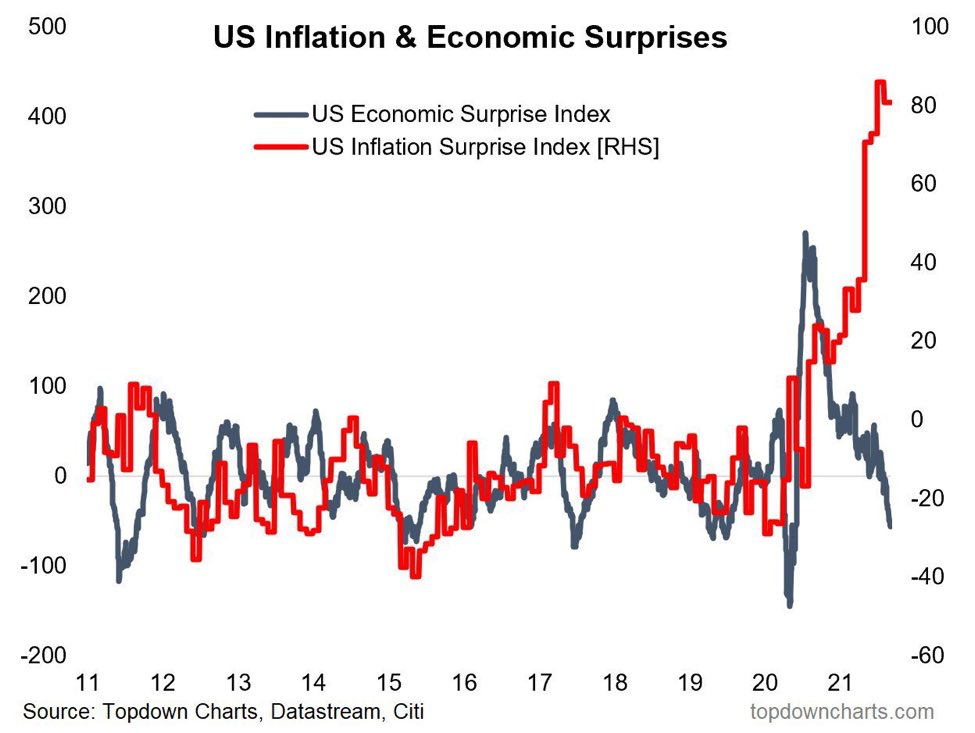

I don't think this is consensus thinking among economists, government officials, market strategists, and pundits, yet. Look at the red line in this graph of the US Inflation & Economic Suprise Indexes maintained by Citibank. It shows clearly inflation reports coming in higher than what is expected. It also shows the economy decelerating at a faster rate than predicted, suggesting that a period of stagflation may be in store for us. (Stagflation is not good, as this article from the Wall Street Journal, What Every Investor Should Understand About Stagflation—but Often Doesn’t, reminds us.)

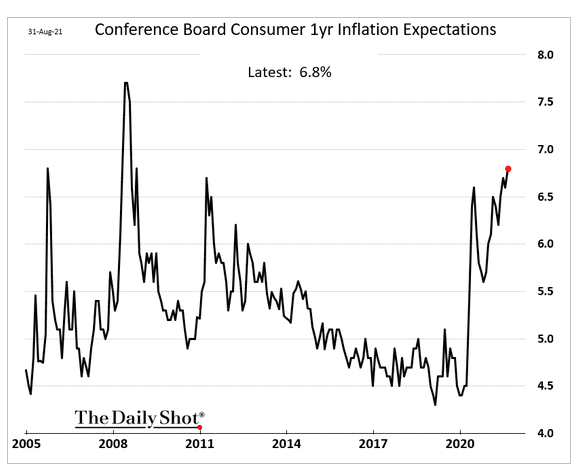

While the experts may be behind the curve on inflation, it looks like consumers are expecting more inflation in the months ahead. They are basing their expectations on what they are spending at the gas pump, grocery store, Home Depot, and their local restaurant. Of concern, rising inflation expectations can become self-fulfilling as consumers start to buy ahead to avoid the next price increase, causing spikes in demand, shortages, and, rising prices. (Here's another take on the impact of rising inflation: Inflation Rips Society Apart.)

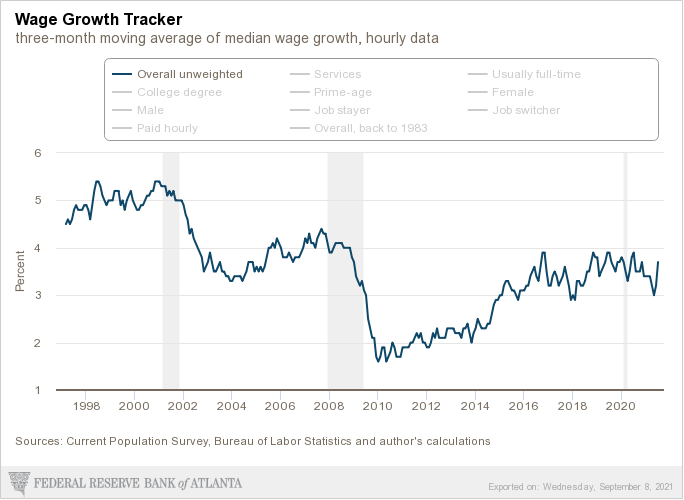

Wages can be a significant contributor to inflation, particularly if productivity growth is weak. Indeed, wage growth is approaching 4% as this chart of hourly wage growth from the Atlanta Fed shows.

Certain sectors of our economy, in particular the service sector, are much more affected by rising wages. For example, take a look at this chart from The Overshoot which shows wages for restaurant workers rising more rapidly than prices. There are very few options for restaurants to maintain a reasonable profit margin, cut back on help, or (more likely) raise prices.

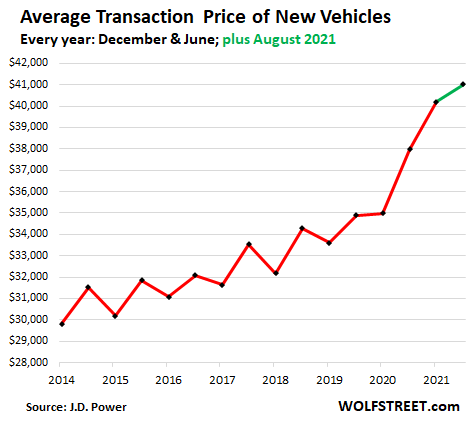

Another area of concern is the lack of supply for goods demanded by consumers. When supply is short, prices generally rise. Below is a chart of the price of a new vehicle. I'm sure you've heard about the shortage of semiconductor chips used in today's cars and trucks. As a result, automobile manufacturers are not able to produce all the cars and trucks demanded by their customers. So look what's happened to the average price of a new vehicle - up about $6,000 in a little more than a year. Hopefully, the chip shortage will abate and automobile production will improve. But if you're in the market for a new car, you are facing significant inflation.

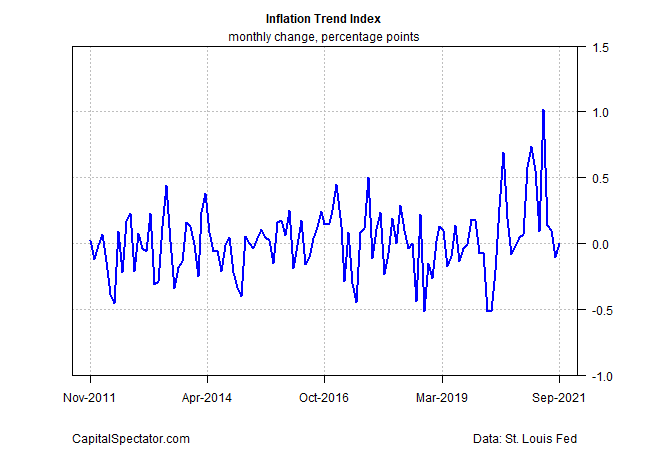

I could list many more examples of shortages and rising prices. The good news - some of this inflation is indeed temporary and should abate as production returns to normal post-pandemic levels. In fact, we are seeing some evidence this is the case. The Capital Spectator's Inflation Trend Index has fallen recently suggesting that perhaps inflationary pressures are easing a bit.

All this information (and a lot more not chronicled here) leads me to the following conclusion: inflation is likely to remain higher than we've been used to for some time to come. Perhaps it will recede some as the Inflation Trend Index suggests but labor shortages, rising wages, and increased demand for services will place a floor on inflation. The increasing level of government involvement (intrusion?) in our economy - higher taxes, more regulation, more debt - will put upward pressure on prices as corporations pass through the increases imposed on them.

This discussion of inflation is not to scare you but rather to make you aware that the decades-long era of disinflation may have finally come to an end. This may require us to rethink our current investment portfolios to protect ourselves from the impact of inflation and perhaps even to benefit.

On The Market:

I don't have a lot of deep thoughts about the market's recent decline other than we are in rarified territory after seven straight months of gains. And early fall is often a tough period for stocks. It is worth noting that both the capitalization-weighted S&P500 (SPY) and the equal-weighted S&P500 (RSP) have fallen below their 50-day moving averages suggesting, perhaps, that a correction is underway. (You can access the relevant charts in our Market Lab. Be sure to use the links to get the most up-to-date version of the chart of interest.)

Corrections are not necessarily bad. So I think the best approach, for the time being, is to wait and see what the rest of September has in store for us. No need to panic. . . yet.

From The Garden:

Here are a couple of pictures of some colorful fruits in the garden. This first picture is a viburnum.

And the second is a magnolia.

As Always:

Please feel free to forward this email to a friend. And if this email was forwarded to you, get your own, free subscription by signing up on our website. Thank you!