Sept 20-24

Markets Sag On Evergrande's Potential Collapse

First, it was COVID19 wrecking economies around the globe, now the potential collapse of China's real estate developer, Evergrande, is sending shockwaves throughout global financial markets this Monday.

From Barron's:

"It’s Crunchtime for Evergrande. The Market Is Worried.

It’s looking pretty bleak out there.

China Evergrande’s ever-worsening situation and the property developer’s slide toward possible collapse had, before Monday, failed to affect global markets. That could be about to change.

Europe’s major indexes were feeling the pressure early on Monday and Dow futures were more than 500 points lower. Closer to the source of the problem, Hong Kong stocks, and property stocks in particular, tumbled on Monday. But it didn’t end there, as banks and insurers were also dragged into the selloff.

Thin trading may be contributing to the selloff—there are holidays in Japan, China and South Korea. China’s two-day holiday, in the midst of all this, complicates the issue or adds to the drama depending on your viewpoint.

That’s not to say the impact won’t be felt across the Western world—BlackRock, UBS, and HSBC are among the largest holders of Evergrande’s bonds. A downturn in China’s economy would also have major implications across the world, particularly for commodities.

It’s also just too early to say at this point. Chinese authorities have already warned banks that the property giant, which owes more than $300 billion, won’t be able to pay debt obligations due Monday, but the real test comes later this week.

Interest payments on two Evergrande notes are due Thursday, the day China also returns from holiday. That will be crunchtime."

—Callum Keown, The Barron's Daily, Sept. 20, 2021

We've discussed some of the risks of investing in China in earlier newsletters and this is another. If you own emerging markets ETF's, global growth funds, etc. you probably have exposure to the Chinese stock market. You may want to check with your financial advisor as I suspect the Chinese stock and bond markets and their economy will be under pressure for some time to come.

This will put Western economies at risk as well as Chinese demand for raw materials, finished goods, and services falls. So an Evergrande collapse may be the excuse for a market correction (already underway?) here in the U.S. We'll be checking our Market Lab regularly and do our best to let you know of any concerns (you can check too!).

Update (9/25): Well, the stock market shook off Monday's Evergrande induced decline, recouping much of its loss by the end of the week. However, we learned on Friday that Evergrande had indeed missed a payment deadline for their offshore bondholders. Apparently, there is a 30 day grace period, so we'll be dealing with this risk for another month. And, I wonder how many other Evergrandes there are in China... Keep your seatbelts loosely fastened as there may be more turbulence ahead!

Is The Market's Health Improving?

Despite the market's decline this week, the Evergrande shock, the China crypto ban, Fed tapering plans, and more news of shortages, the data out of our Market Lab actually improved from the prior week! We'll take a closer look after the end of the quarter next week.

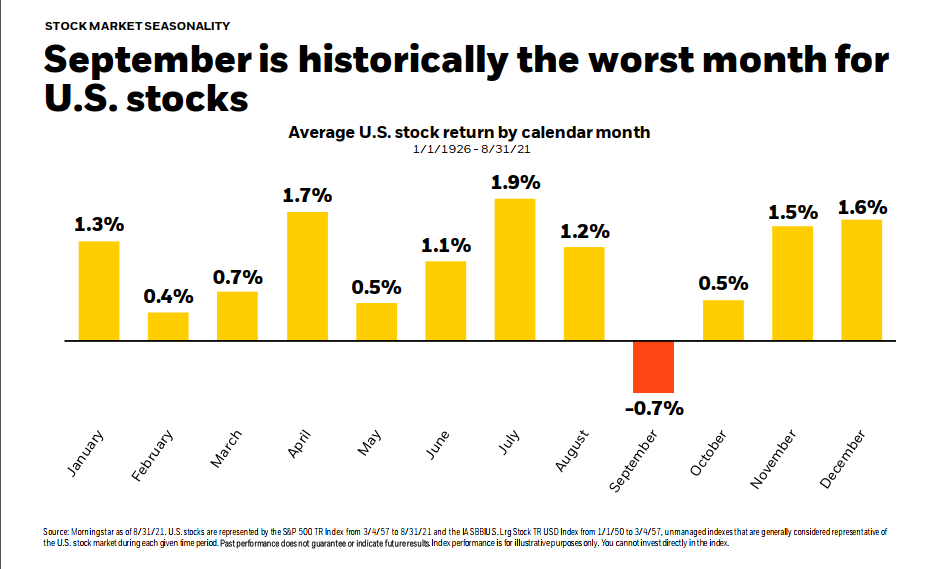

September Woes

Looks like September is keeping with tradition, so far at least:

Inflation Watch

Now that my essay on inflation is out (have you read it?) I thought I'd add this section to the newsletter. It may contain links to articles of interest, the usual charts and graphs, and/or occasionally, my insightful commentary.

Transitory Inflation Can Be a Lasting Affair, Wall Street Journal, Sept. 20, 2021.

Inflation: More Transitory than Expected, John Mauldin, Sept. 18, 2021.

America’s Next Hot Import Might Be Record Energy Prices, Wall Street Journal, Sept. 20, 2021.

The Trouble With Cash (and what to do about it):

A dilemma faced by investors these days is what to do with cash as inflation pushes 5%. If you hold cash earning anything less than 5%, you're losing purchasing power. For example, Fidelity Government Cash Reserves currently pays a meager 0.09% per annum so a balance of $100,000 would grow to $100,900, but you really need $105,000 just to keep even with inflation! So how does one increase the return on their cash balances while retaining daily liquidity?

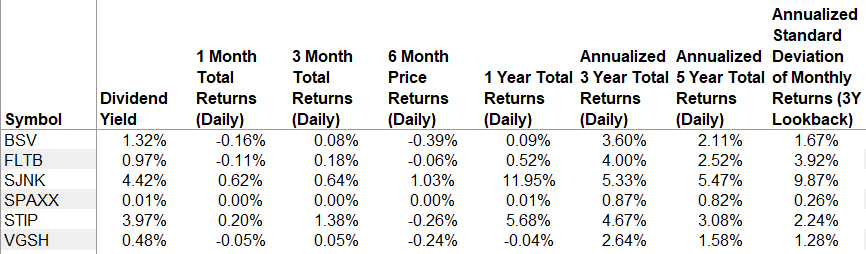

One solution is to consider a short-term bond ETF. This will boost your yield to the low single digits. I have compiled a sampling of five ETFs with links (click on the symbol) to the appropriate web page so you can get started on the research. If you want to broaden your search, check this list of 38 ETFs.

Fidelity Limited Term Bond ETF (FLTB)

iShares 0-5 Year TIPS Bond ETF (STIP)

SPDR Bloomberg Barclays Short Term High Yield Bond ETF (SJNK)

Vanguard Short-Term Bond ETF (BSV)

Vanguard Short-Term Treasury ETF (VGSH)

Here is a table comparing the five funds' results as of 9/26. I have also included the Fidelity Government Money Market Fund (SPAXX) as a proxy for traditional money market funds.

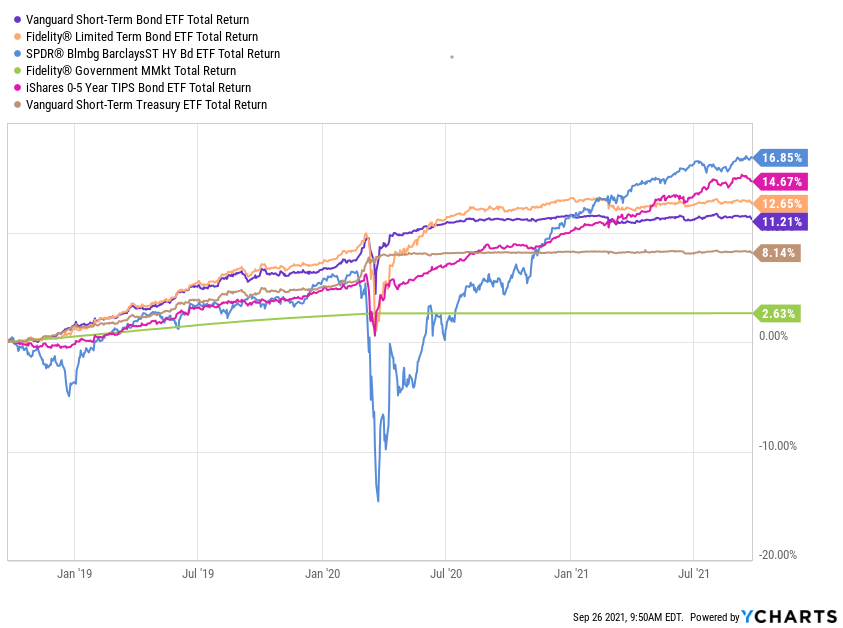

And here is a chart of their 3-year performance.

Some observations:

- All five funds beat the meager return of the money market fund.

- However, all five funds fluctuate daily in value (unlike a money market fund).

- SJNK has the highest yield but is also the riskiest. It suffered a significant drawdown in the 2020 COVID panic. However, it has enjoyed the best total return over the past three years.

- The least risky ETF, VGSH, has the lowest yield and three-year total return. Nevertheless, it still beats the money-market fund.

In conclusion, if you have a significant amount of cash in your portfolio, you may wish to consider a short-term bond ETF for a portion of that cash. However, recognize that these ETFs, unlike a traditional money market fund, will fluctuate in value and there is a risk of loss. Perhaps you should consider still keeping some of your cash in the money market fund so you won't be forced to liquidate the ETF during a sell-off.

Got Questions?

If you have any questions or comments, please send them to me at under.a.buttonwood.tree@gmail.com.

Not A Subscriber?

Please consider subscribing to Under A Buttonwood Tree. It's easy and free! You can subscribe on our homepage.