October 11 - 15

But First...

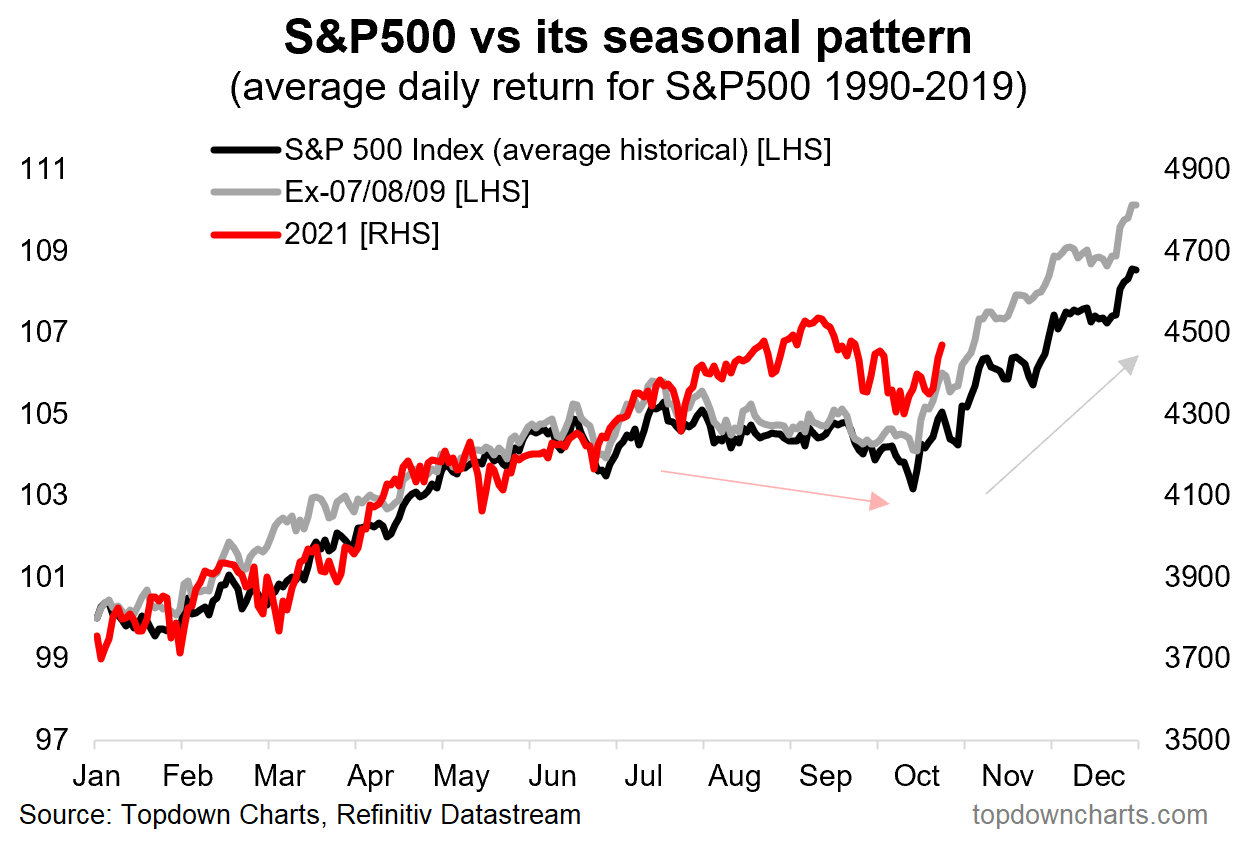

The S&P 500 is up 3.9% so far this October. That's still below its all-time high, but not by much. All of the momentum and cross-market indicators we follow in our Market Lab are once again suggesting further stock market upside potential. And as you can see from the graph below, the market has tended to rise in the fourth quarter...(Note that the gray line excludes the financial collapse years of 2007-2009.)

But let me finish this section with a note of caution. Stocks aren't cheap. Inflation and, ultimately, interest rates are on the rise. Markets can shift rapidly. So use some common sense.

Earnings Reports

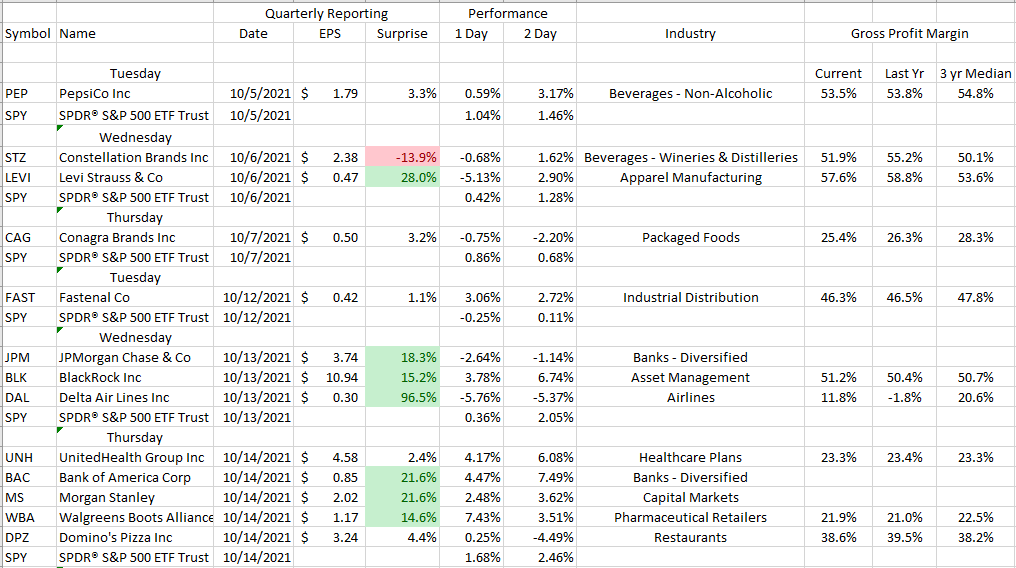

Starting this week and for the next few, we'll be including a listing of companies reporting third-quarter results along with some (very) short-term performance data to gauge how surprised investors were by the report. I've also added some gross profit percentages (sales - cost of goods sold/sales) in an attempt to measure the impact of inflation on results. A stable or (better yet) rising gross profit margin suggests the company is able to pass along some, if not all, of the increased costs of their products or service. Conversely, a falling gross profit margin suggests inflation is having some negative impact on their business. And, I will try to highlight some of the more interesting reports in my commentary.

In general, earnings results have been favorable with the biggest surprises in the financial services sector. Gross margins are indeed down a bit but our sample size is small so I'll hold off on drawing any conclusions for now.

Delta Airlines reported its first profit since the pandemic began. Yeah! Then the company's CEO, Ed Bastian said that soaring costs (including fuel - 20% of expenses) are "going to be a limiter on our ability to post a profit in the (fourth) quarter. At these current fuel levels, it looks like we'll have a modest loss"... Killjoy.

If you want to track earnings by yourself, try starting with the earnings calendar at NASDAQ. You can also find a link to this calendar (and more!) on our Tools webpage.

Inflation Watch

Mixed news on inflation with "headline" CPI rising 5.3% for the latest twelve months. The so-called core inflation excluding food and energy rose 4.0% over the past year. The monthly "headline" number for September was a bit "hotter" than folks were expecting but core inflation was a bit lower than expected for September. Here's the breakdown from BLS if you care: Consumer Price Index Summary

Receiving Social Security? Happy days! Social Security Announces 5.9 Percent Benefit Increase for 2022.

I thought this monthly review from Crescat Capital was worth reading as it focuses on inflation, its impact on corporate performance, and more. Read it here.

And here's a recent article from the Wall Street Journal discussing the impact of rising commodity prices on inflation overall: Oil Price Jumps Above $80, Wall Street Journal, 10/11/2021.

According to the Wall Street Journal, some of the largest retailers are starting to charter private cargo ships in order to alleviate some of the supply chain bottlenecks. Question: Is this good news or bad for inflation? Increased supply of goods should put downward pressure on prices however, the increased costs of shipping could offset any supply benefit if those costs are passed on to the consumer. Anyway, I've linked to the article: Biggest U.S. Retailers Charter Private Cargo Ships..., WSJ 10/11/2021.

As you may know, the Biden Administration has negotiated 24/7 operations at the Port of Los Angeles in hopes of alleviating some of the bottlenecks in the supply chain. However, even if the container ships are able to be offloaded, there may still be a shortage of trucks to move those containers thanks to two California rules that 1. effectively banned trucks more than ten years old; and 2. the effective banning of non-union owner-operators. (This post on Zero Hedge explains this issue more thoroughly: Empty Christmas Stockings? Don't Blame COVID, Blame California.) Needless to say, delays getting shipping containers out of the ports and to their final destination, will continue the shortages and put upward pressure on prices.

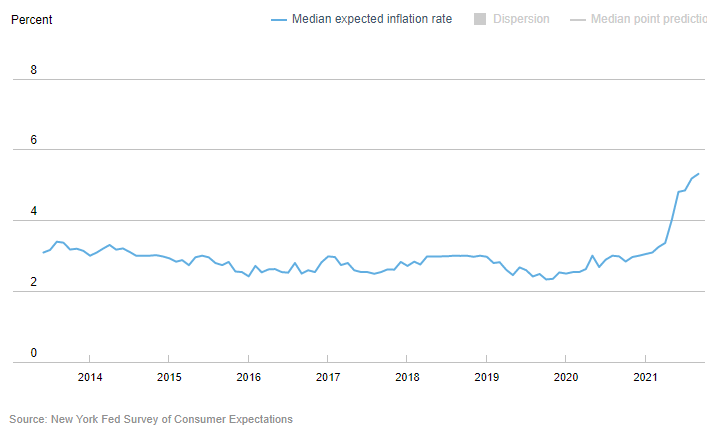

Consumers are expecting more inflation according to this survey from the New York Fed. Not surprising given what they are seeing at the gas pump, grocery store, and hardware store. Not just higher prices but empty shelves as well...

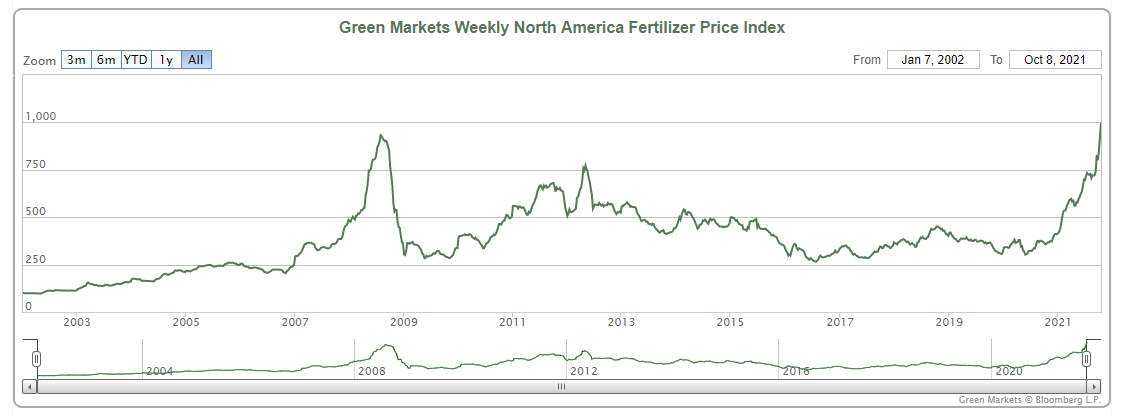

Take a look at this chart of fertilizer prices at record highs. Can't be good for food prices...

And this from the BBC: Kraft Heinz says people must get used to higher food prices, posted 10/10/2021.

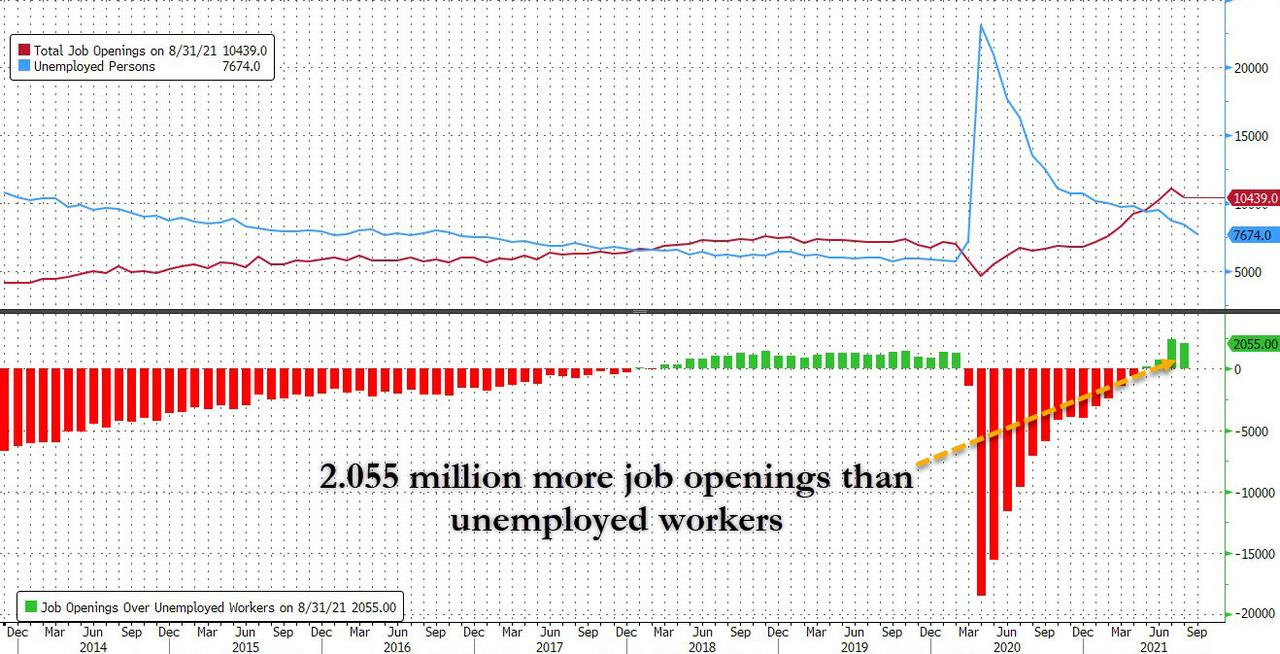

Finally, here's more evidence of the labor shortage that's having a widespread impact on our economy. The number of job openings exceeds the unemployed by more than 2 million! What gets people back to work? Higher wages (which ultimately results in higher inflation).

An Exogenous Risk Not to Forget:

We've been discussing the problems at China's real estate giant, Evergrande, for the past few weeks. The China real estate problem is (of course) potentially much larger in size than an Evergrande default. Should (when?) the market for Chinese real estate collapse, the impact will likely be felt globally in both the bond and stock markets, not to mention global economies. In the last issue, we talked about some of the risks in the stock market today: valuation, rising rates, tax increases, and exogenous risk. This is one of those exogenous risks. Here's a link to the Wall Street Journal's article discussing this issue: Beyond Evergrande, China’s Property Market Faces a $5 Trillion Reckoning, WSJ 10/11/2021.

After I wrote the paragraph above, I discovered the following on the ZeroHedge blog (no, really): "It's A Disastrous Day" - All Hell Breaks Loose In China's Bond Markets, ZeroHedge, 10/11/2021. Our bond market is closed today (10/11) this may have an impact tomorrow. Interestingly after rising in the morning, stocks have begun to sell off, perhaps anticipating problems tomorrow (10/12).

By the way, if you own emerging market, Asia-focused, or global bond funds, you may have indirect ownership in Chinese bonds either currently in or at risk of default. It may be worth a Google search or a call to your financial advisor just to make sure you understand your exposure to Chinese debt as well as equity.

Of Note:

The J.P.Morgan Guide to the Markets (9/30/2021) is available. You can find a link to download it on our Resources page or you can take the easy way out and just click here.

I hope to spend more time on tax-loss harvesting soon but to whet your appetite, here's a note from Columbia Threadneedle on the subject: Be strategic when realizing tax losses. Bottom line, tax-loss harvesting, at least for me, is a continual process throughout the year not just for the last week of December. The Columbia Threadneedle note provides a reason why.

If you are over 65 or will be soon, you have no doubt been inundated with offers from all sorts of insurance companies hawking their various medicare plans. The Wall Street Journal just published this helpful article to help you with your choice. 8 Things to Know When Choosing a Medicare Plan. Good luck!

From The Garden...

This sour gum tree is among the first trees in our yard to turn colors in the fall.

And Finally...

I'd like to welcome our new subscribers. Thank you! You can find previous newsletters and more information by heading over to our Home Page.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, visit the Home Page to sign up. It's free!

Got questions or comments? Send them to under.a.buttonwood.tree@gmail.com.