I recently received an email from a friend with a question about the investment merits of Tractor Supply (TSCO). So I thought this would be a good time to start describing how I look at individual stocks and hopefully help my friend decide what to do with TSCO at the same time. (This is likely to be a longer than normal newsletter, so scroll to the end if all you want is my conclusion.)

Investment Framework:

Let's start with our investment framework. As the Venn diagram describes below, I believe a good investment should be based on three basic factors: favorable fundamentals, reasonable valuation, and positive momentum. In a nutshell, if you can find a stock with good fundamentals, selling at a reasonable valuation (price-earnings ratio, etc.), and with a rising price trend, you have likely found yourself a winning stock. In future newsletters I will describe these factors in more depth but I think you will get the basic idea as we discuss TSCO.

For those who don't know, Tractor Supply is the largest operator of retail farm and ranch stores in the United States. The company targets recreational farmers and ranchers and has little exposure to commercial and industrial farm operations. Currently, the company operates 1,943 stores in 49 states and 184 Petsense stores. Stores are typically located in towns outside of urban areas and in rural communities. In fiscal 2020, revenue consisted primarily of livestock and pet (47%), hardware, tools, and truck (21%), and seasonal gift and toy (21%).

Let's look at the stock within our framework. . .

Fundamentals

Fundamentals, in my view, are those characteristics that define how a company operates, how it grows, how it makes a profit, how it treats its customers, suppliers, employees and its investors, and how well it does all these things. Fundamentals also embody the company's industry characteristics, how it is positioned in that industry, and how it competes with others in its industry. And, fundamentals include an assessment of management's skill, depth, turnover, etc.

In the interest of your time, we can boil all these factors down into a few metrics:

Growth: Over the last three years, revenues have grown 13.5%/yr while net income has grown 21.0% annually over the same period - indicative of strong growth with expanding profit margins. Dividends have also grown at a 12.6%/yr over the same three year period while shares outstanding actually shrank slightly - a sign of management's shareholder focus.

Profitability: Gross profit margins have been steady, ranging from 34.3% to 35.4% over the last five years. Net margin has ranged from 6.5% to 7.1% over the past five years. Last year's net margin of 7.1% is the highest achieved over the past ten years. Rising margins are almost always good.

Balance Sheet: While TSCO has almost $1 billion of long term debt on its balance sheet, its debt/equity ratio is a reasonable 53%. And given the company's strong cash flow generation, it should be no problem for the company to service its debt.

Wealth Creation: One of my favorite measures is comparing the company's return on invested capital (ROIC) to its weighted average cost of capital (WACC). Simplistically, if the company is earning more on its capital than it costs for that capital, then management is creating wealth for the shareholder. If not, wealth is being destroyed. I don't know about you but I'd rather own wealth creating company than a wealth destroying one.

In Tractor Supply's case, ROIC at 21% is well above WACC at 4%. Not only is the 17 point gap quite favorable, it is well above its 3 and 5 year averages. This solid performance supports the continuing growth of the company.

Competition: TSCO has two formidable competitors, Home Depot (HD) and Lowe's (LOW). However, TSCO has carved out a niche serving a more rural customer base of recreational farmers as noted above. Their retail assortment is significantly different than HD and LOW as a result and thus direct competition is limited.

Management: I think I'll let you answer the question: has management done a good job.? (Hint: Heck yeah!)

Valuation

There are so many ways to value a company's shares and quite frankly, choosing the best valuation metric can be as much art as science. For this exercise, I'm going to choose one of the easier ones, the Price/Earnings Ratio.

Over the past five years, TSCO's P/E has ranged from a low of about 17x to a high of about 30x. Based on the last twelve months results, the stock's current PE is 25. TSCO is estimated to earn $7.75/shr in 2022 and perhaps $8.50/shr or more in 2023. If the current P/E holds, it would be reasonable to expect TSCO to trade in the low 200's. For example, applying a 25x P/E to $8.50, you get a target of $212.50 or a total return (including the dividend) of about 20% over the next 6-12 months. Not bad.

Momentum

Simply put, it's very hard to make money buying a stock that is going down. It is not unusual to find a stock with good fundamentals at a reasonable valuation. However, if the stock price is falling (for whatever reason), you aren't going to make money (duh!). That's why I look for a favorable price trend in addition to the other two factors.

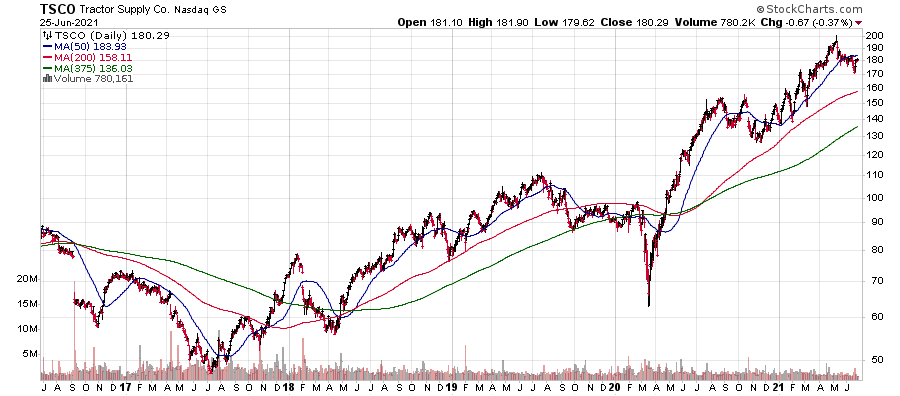

I determine that price trend by looking at the stock's 50, 200, and 375 day moving averages. Here's a look at these three moving averages for TSCO:

Ideally, we'd like to see the stock price above all three moving averages (the solid lines on the chart) and all with an upward slope. In that case, you should have clear sailing. However, in this case, TSCO is currently just below the 50 day moving average. Going below this shorter term moving average is indicative of the stock's recent correction. Given the company's strong fundamentals, fairly reasonable valuation, and a bull market, I'm not too concerned. If, however, TSCO continues to fall to below the 200 day moving average (about $158), I would consider selling, particularly if the overall market weakens. Finally, if the stock actually trades below the 375 day moving average, simply avoid the stock - it's in its own bear market.

Conclusion

Let's give TSCO a grade on the three factors in the Venn diagram:

Fundamentals: There aren't too many retailers with better results that TSCO so I give it an A+.

Valuation: It would be nice to get the stock a bit cheaper but that's almost always the case with a great company. Like anything in life, you have to pay up for quality. A-

Momentum: The stock is about 10% below its recent high and just below the 50 day moving average. If you really want to be cute, you could wait for the stock to go back above before buying. But it is such a strong retailer. . . B

Total Grade: A- (I'll leave it to the reader to decide what to do with the stock but I think it's pretty clear that at the very least, you are unlikely to get into a lot of trouble with TSCO.)

Housekeeping

If you aren't already a subscriber, you can sign up here. After all, it's free!

Sources used in this newsletter: ycharts.com, stockcharts.com, New Constructs

The author does not currently hold a position in Tractor Supply common stock or any related securities.