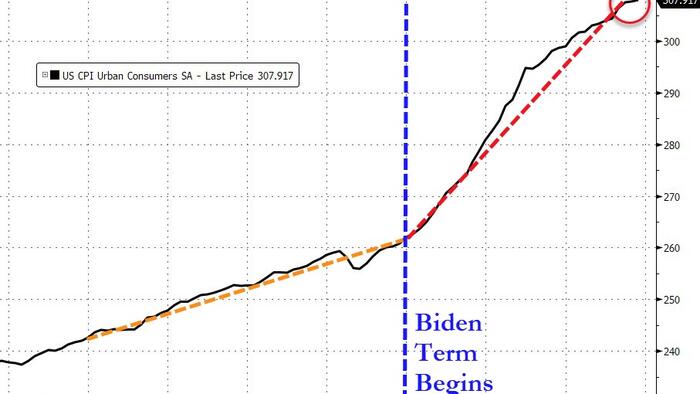

Today's inflation report was essentially in line with expectations. Headline CPI for November was up 0.1% while core CPI rose 0.3%. Over the last twelve months, CPI is up 3.1% while core CPI is up 4.0%. Finally, the so-called "super-core" CPI, which excludes shelter along with food and gas, rose 0.5% and is now north of 4% for the last twelve months. Bottom line, I don't think these results will move the Fed to alter its current strategy. Unless our economy starts to slip into a recession or core inflation falls meaningfully below 3%, I expect interest rates to remain higher for longer.

Here is ZeroHedge's analysis:

And here is Mike Shedlock's take:

And another thing.

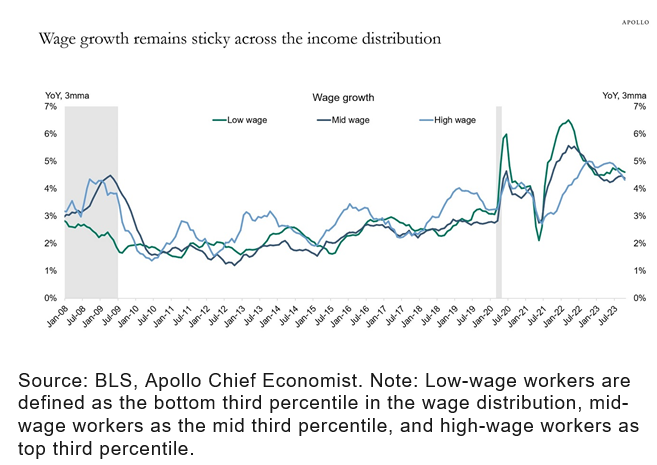

Wage inflation tends to be sticky as workers demand increases to keep up with inflation. This chart from Torsten Slok tracks wage growth over the years. As you can see, it is currently running in the 4-5% range. I suspect this is going to be a problem for the Fed until wage growth falls closer to the Fed's overall inflation target of 2%.