After months of waiting and speculation, on March 16, the Fed announced the first interest rate increase in more than five years, raising its target for the Fed Funds rate to a range of 0.25%-0.50% from a range of 0.0%-0.25%. The Fed also raised the discount rate to 0.50% from 0.25% and plans to reduce the Fed's holdings of treasury securities (which will put upward pressure on rates).

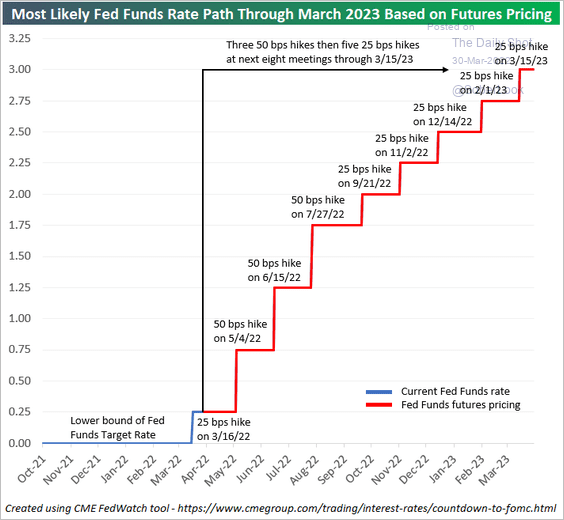

Subsequent to this announcement, Fed Chairman Powell indicated that the Fed may become more aggressive in addressing inflation which suggests the potential for larger or more frequent hikes in the near future. Here's one scenario based on the Fed Funds futures market:

And I've recently seen even higher forecasts.

What does all this mean to us?

Realistically, in the short run, the increase announced on 3/16 doesn't amount to much and is still well below pre-pandemic levels. If you are a saver, the additional annual interest earned on $1,000 is a whopping $2.50, about the cost of one Starbucks large brewed coffee.

If you are a borrower, it's going to cost more for a mortgage or car loan. Here's a chart of the 30-year mortgage rate which is now back to where it was at the start of 2019 and 67% higher than the lows reached at the end of 2020. One has to imagine rates will continue to advance in the coming months.

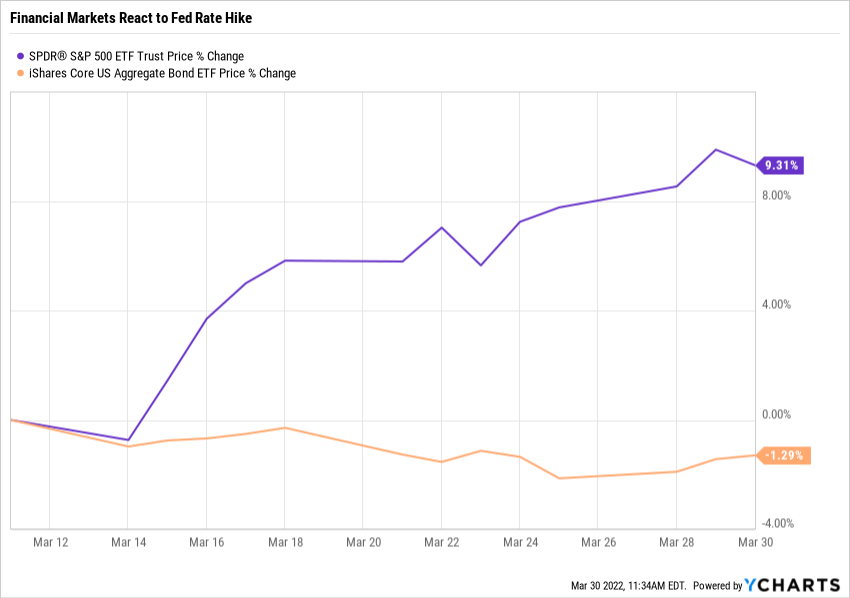

The other impact of the Fed's rate hike is the signal it sends to the financial markets that it is (finally) taking steps to address inflation. The stock market's reaction, so far, has been positive while the bond market remains underwater. (This, by the way, is a fairly typical reaction to the initial steps of an interest rate-raising cycle. If this continues, as it likely will, rising rates will eventually put a hurt on stocks.)

And, to be fair, we're also dealing with the impact of the war in Ukraine on markets during this same time frame so the performance gap between stocks and bonds may be exaggerated.

And The News On Inflation Continues To Worsen...

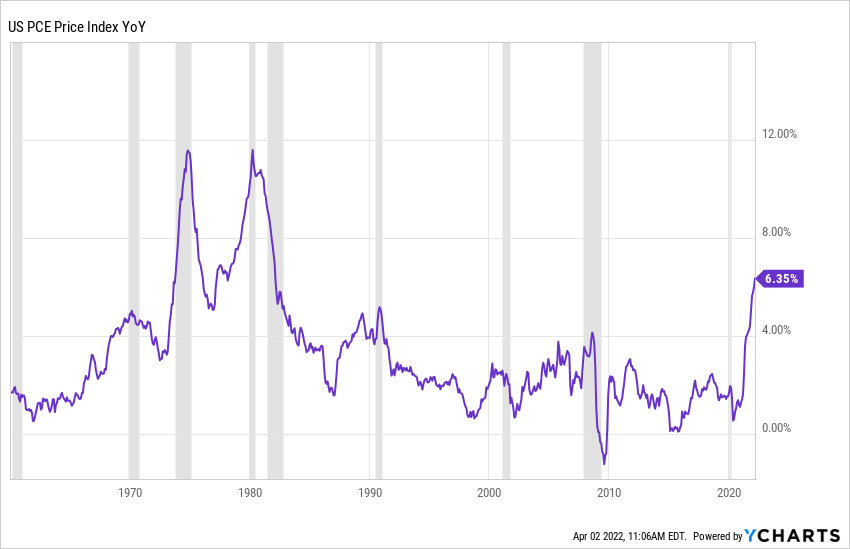

I'm sure you've seen the news on inflation with the CPI now just an eyelash away from 8%. While there is some evidence to suggest that inflation rates will moderate as supply chains debottleneck and availability of goods improves, we haven't yet seen it in the numbers.

The Bureau of Economic Analysis just released the Personal Consumption Expenditures (PCE) Price Index for February 2022. This index, supposedly the Fed's favorite measure of inflation, hit 6.4% in February (5.4% excluding food and energy). This marked its highest level in 40 years! Take a look:

Perhaps this is why Fed Chairman Powell is sounding more hawkish...

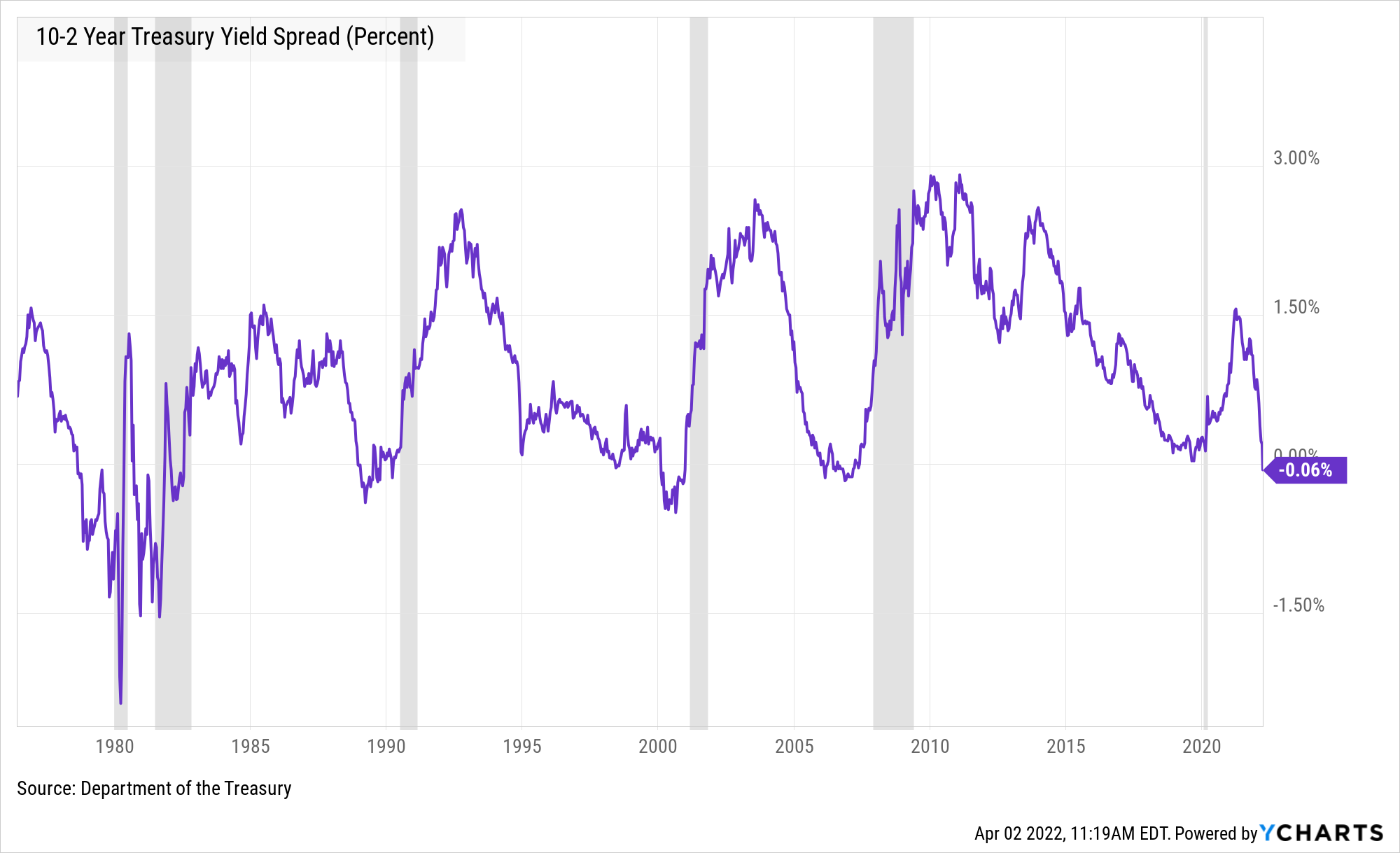

A Recession Warning

The difference between the yield of 10-year US Treasury bonds and 2-year bonds is usually a positive number. In other words, it costs more to borrow money for ten years than two under normal circumstances. However, when this difference turns negative, it suggests an economic downturn in our relatively near future. Well, as you can see on the graph below, the 10-2 yield spread just went negative on April 1 (no fooling!).

A Tumultuous Quarter Comes To A Close

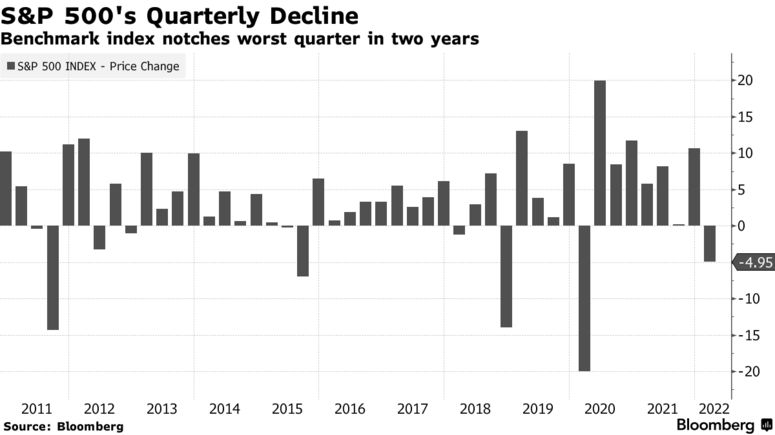

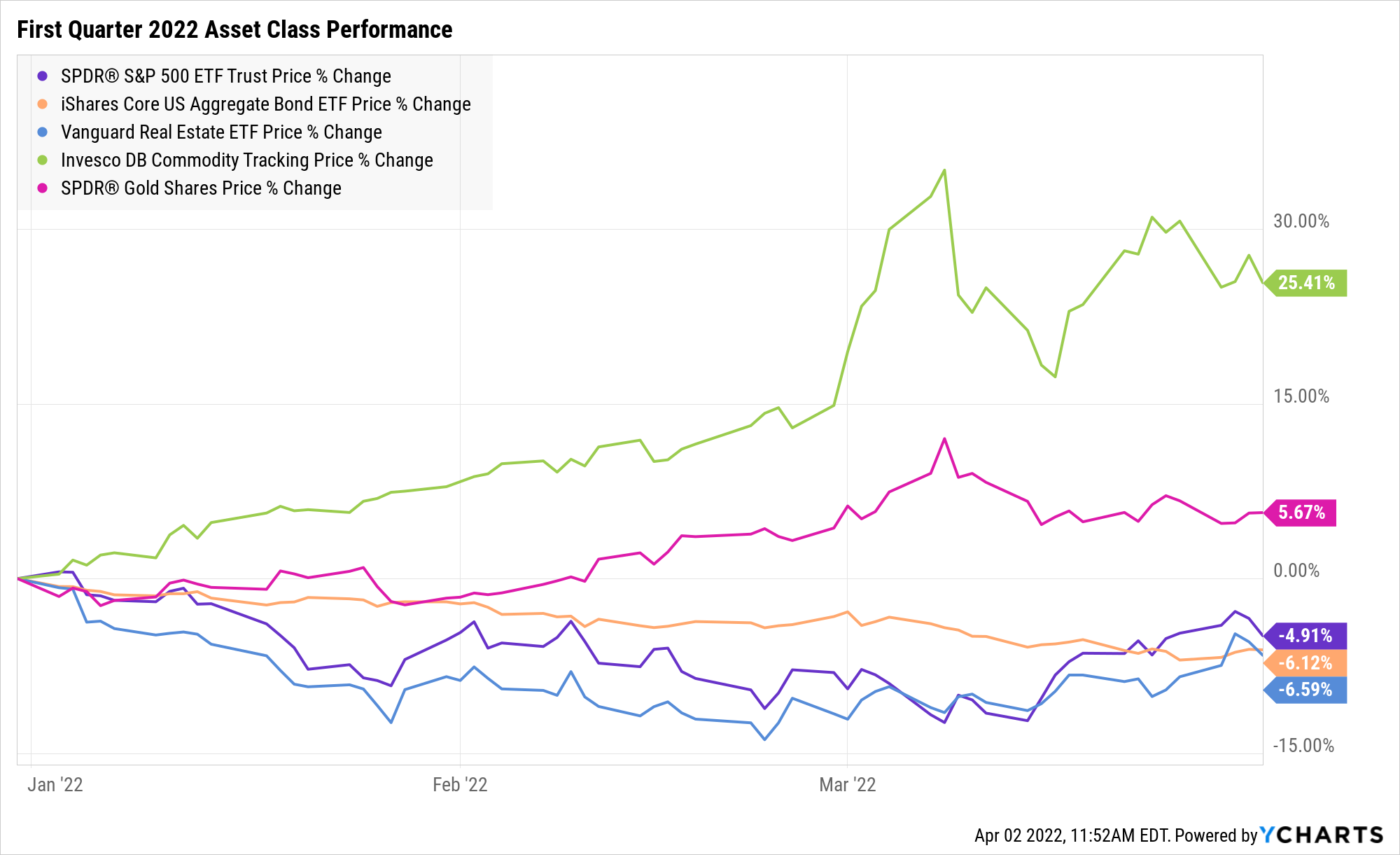

It was a tough quarter for investors in the stock and bond markets. Inflation, rising interest rates, disappointing earnings reports, high valuations, and war in Europe created a perfect storm for stocks pushing the S&P 500 down more than 12% by mid-March. Then, a sharp rally fueled by favorable war news and (perhaps) the Fed's first interest rate hike in five years allowed stocks to recover some of their losses, finishing down 5%. Still, it was the first quarterly decline in two years.

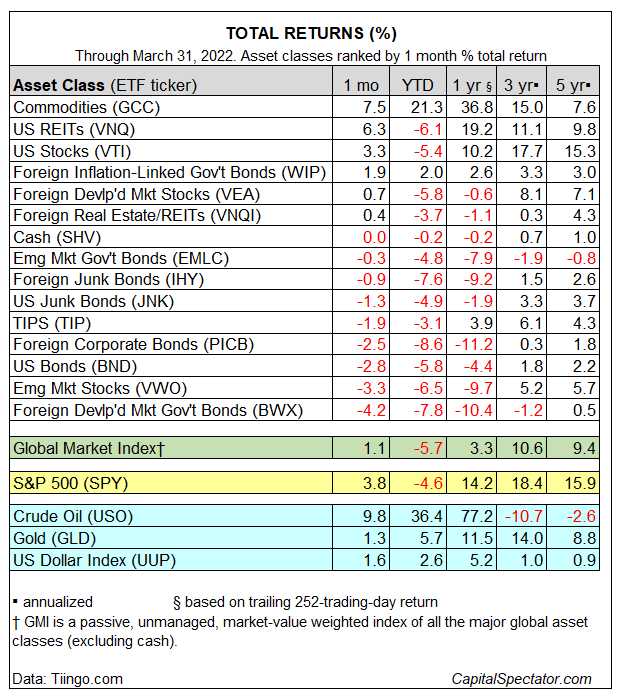

Unfortunately for fixed income investors, thanks to rising rates, bonds did not recover in March and actually finished the quarter lower than stocks as did the interest-rate-sensitive real estate sector. Commodities, driven by energy, soared 25% or so and gold gained almost 6% on inflation and war worries.

Here's a more detailed look at returns compiled by The Capital Spectator:

Interestingly, given the first quarter's market action, you would expect some deterioration in our market indicators. Indeed, our cross-market indicators have turned down but valuation and momentum indicators have actually improved and suggest the stock market may continue its recovery this Spring.

The Buttonwood Portfolios Update

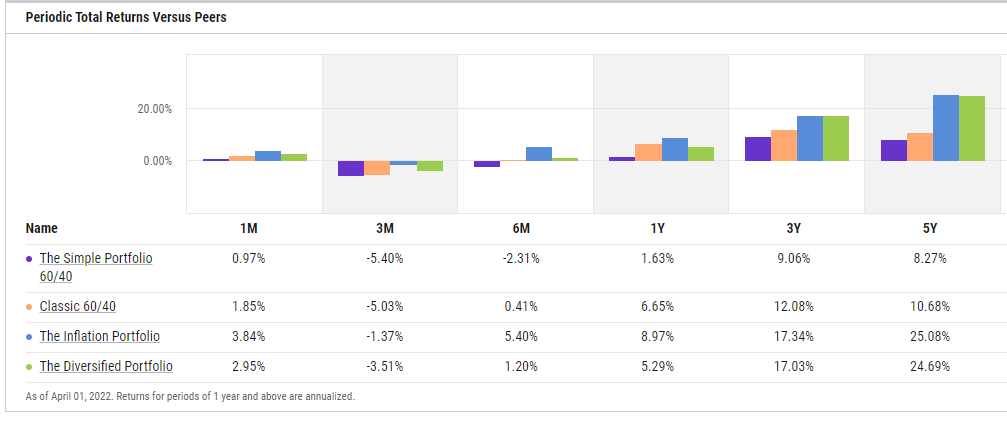

If you go to the Portfolios page of our website you will find updated reports on our three demonstration (not recommendations!) portfolios, The Simple Portfolio, The Diversified Portfolio, and The Inflation Portfolio. Each portfolio is benchmarked against a 60/40 U.S. stock/bond index for comparison.

A couple of quick observations:

- The Simple Portfolio has been a laggard. Remember there are just three ETF holdings in the portfolio - all Vanguard ETFs: Total Bond (40%), Total Stock (36%), and All-World (ex-US) (24%). Non-US stocks have been lagging for a variety of reasons so it stands to reason that this portfolio would be lagging versus the all US benchmark noted above. Hopefully it will do better as international stocks recover.

- The Diversified Portfolio has done well so far this year when compared to the benchmark. No doubt, its exposure to commodities and reduced exposure to bonds and international stocks has helped it do better than The Simple Portfolio.

- The Inflation Portfolio is doing quite well so far this year. In fact, it is the best performing portfolio of the bunch for each period measured in the table above. This is probably due to its focus on dividend paying stocks, adjustable rate bonds (eg. TIPS), and exposure to gold and commodities.

Feel free to download more information on the Portfolios page. Just remember, these portfolios are for demonstration purposes only. I am not suggesting that you invest in any of them. However, they are helpful for comparison purposes and idea generation. Don't hesitate to reach out if you have questions or want more information!

Beware The Ides Of April!

Well, not exactly the ides, but April 18, the day your income tax returns are due, is coming up fast! Unless you live in Massachusetts, then your taxes are due on the 19th. Happy Patriots Day!

Can't make the deadline? You can file for an extension until October but be sure to pay now what you expect to owe or you could be subject to underpayment penalties and interest. Check with your tax preparer.

There's not much you can do at this point to save on 2021 taxes. However, if you are eligible, consider fully funding your (non-Roth) IRA before submitting your taxes. 2021 contributions made in early 2022 can still be deducted from your 2021 reported income. Check with you tax preparer and/or IRA custodian for more details.

Expecting a refund? You can designate on Form 1040 up to $5,000 of your tax refund to be invested in U.S. Treasury I-Bonds. This is in addition to the annual maximum purchase of $10,000 per individual allowed. Remember, I-Bonds have an adjustable interest rate that resets every six months so your savings keep up with inflation. You can learn more about I-Bonds at TreasuryDirect.

Buttonwood Tree Updates

You may have noticed it's been awhile since the last newsletter. This is on purpose as I have decide to change the publication schedule to allow me the time to go more in-depth on topics of interest. So going forward, expect two newsletters per month with occasional extras should events warrant.

Chart Attack!s will continue on a mostly weekly basis. If you would like to receive them (at no cost to you!) in your email, let me know at under.a.buttonwood.tree@gmail.com. You can also read Chart Attack! by going to our home page or the archives page. Remember, you must be a member to have access to Chart Attack!s. If you subscribe to this newsletter, you're a member! If you don't subscribe, please consider doing so!

For those of you who don't know, Chart Attack! is an email filled with charts, graphs, and other items of interest that I gather throughout the week. They are presented as is, without commentary. However, I am hoping to begin adding brief descriptions of the charts and why they may be of interest in the coming weeks.

I continue to add material to the archives and resources page and the bookstore continues to expand. Please check them out along with the market lab and portfolio pages.

And Finally,

Thank you for reading! You can find previous newsletters and more information by heading over to our Home Page. And be sure to visit our Bookstore, Market Laboratory, Resources, and Archive pages.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, just click the subscribe button. It's free! (Well, not exactly. After all, it does take several minutes of your valuable time to read. But we hope you will find spending that time worthwhile!)

I'm always interested in your feedback, ideas for topics, and questions. So please click the button below.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com