2022 Begins...

And Santa Has Gone Home...

Stocks sold off in this first week of the new year as fears of accelerating inflation and rising interest rates spread, hitting highly valued growth shares particularly hard. As a result, the tech-heavy NASDAQ fell 4.6% for the week, the S&P 500, also dominated by tech shares, declined 1.9%, while the Dow Jones Industrial Average slipped 0.3%. Not a great start for 2022, let's hope the bear keeps hibernating...

NASDAQ Stocks Have Been Particularly Hard Hit...

Today, approximately 40% of all stocks traded on NASDAQ are down 50% or more from their 52-week highs while the NASDAQ overall is down just 7% from its 52-week high. According to SentimentTrader:

At no other point since at least 1999 have so many stocks been cut in half while the Nasdaq Composite index was so close to its peak.

It's not clear what this means for the stock market going forward. However, SentimentTrader also notes:

When at least 35% of stocks are down by half, the Composite has been down by an average of 47% (!).

At the very least, it suggests some of the speculative froth is coming out of the market as interest rates begin to rise.

Mixed Messages From Employment Data

Friday's (1/7) report on employment was decidedly mixed. Employment growth was less than expected, just at 199,000 new jobs vs. 422,000 anticipated. However, the unemployment rate fell from 4.2% to 3.9% and hourly wages rose 0.6% from the prior month suggesting a still-tight labor market. Bonds have sold off on this news. Nothing in this report suggests the Fed will back off plans to raise rates this year as this article from Guggenheim Investments suggests: Strange Jobs Report Opens Door for March Rate Hike.

Is Big Oil Back?

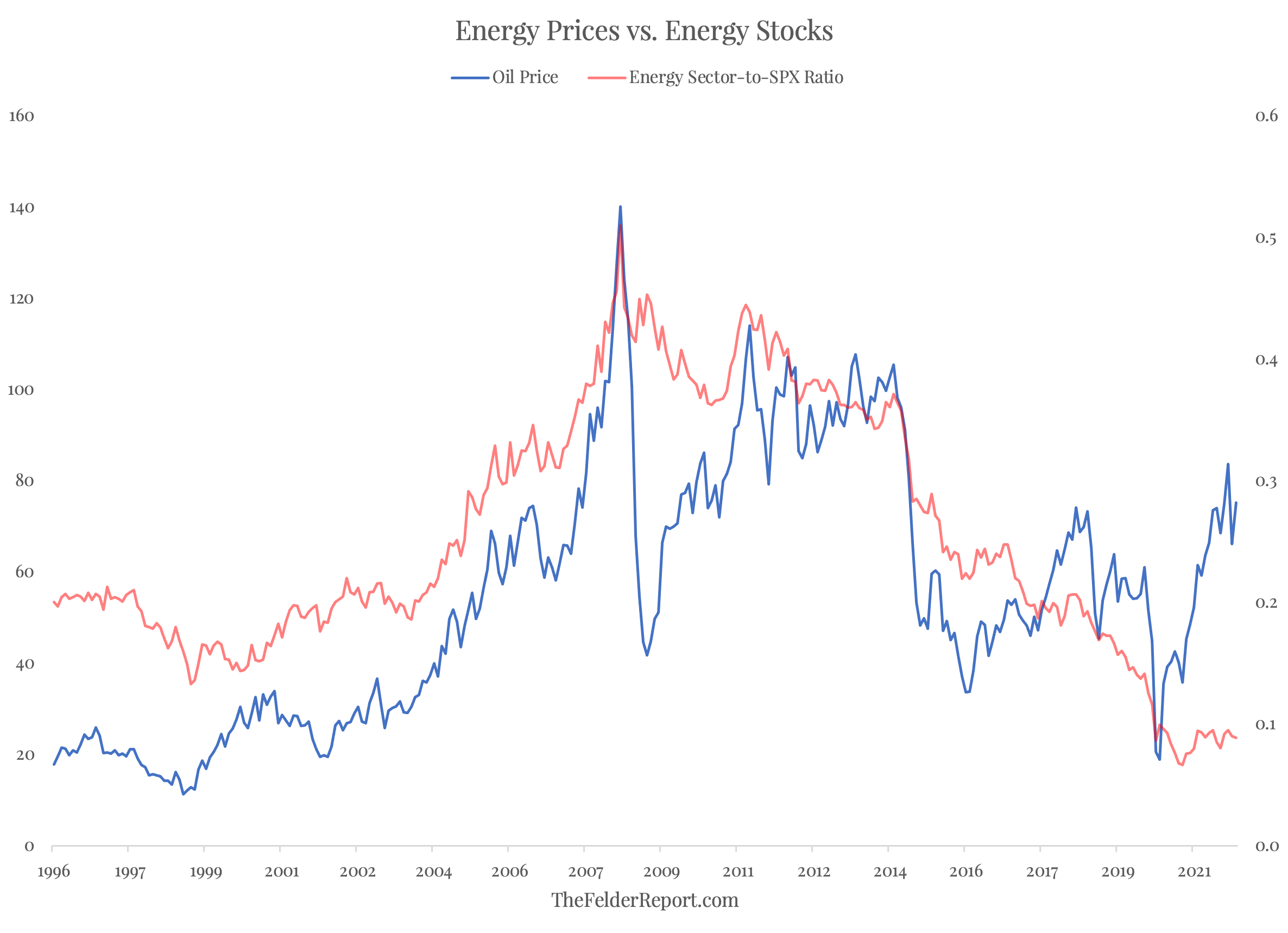

Oil company shares were among the best performers in 2021, significantly besting the overall market. Will the outperformance continue in 2022? Well, here's an interesting chart from The Felder Report which suggests it may...

Over the past 25 years, oil prices (the blue line) and the relative price of energy stocks versus the S&P 500 (the red line) have moved in the same direction (with admittedly some volatility). Until now. In spite of oil prices soaring since their pandemic lows in 2020, the relative price of energy stocks has barely budged.

If oil prices continue to climb, I suspect the relative price of energy stocks will begin to fill the gap that has opened up over the past two years. This will happen in one of two ways: energy shares will continue their strong performance with further outsized gains, or energy shares will stabilize and the overall market will fall. Let's hope it's the first scenario! But either way, adding energy shares could enhance the performance of your stock portfolio.

So, if you don't have exposure to energy stocks you may want to consider adding some, perhaps by investing in an energy-focused ETF, like Energy Select Sector SPDR (XLE), or shares of individual companies.

Guilty!

For Elizabeth Holmes, 2022 got off to a bad start. Found guilty of 4 counts of fraud, she now faces up to 20 years in prison. Here's the account from the Wall Street Journal. If you want to learn more about Elizabeth Holmes and the Theranos fraud, I recommend John Carreyrou's book, Bad Blood. Carreyrou does an excellent job chronicling Theranos' rise and collapse.

It's easy for investors to get caught up in the excitement, wonder, and opportunity of new technology. Investors in Theranos certainly did! The Theranos fraud is an important reminder to investors: when evaluating companies offering new technology, use some common sense, ask questions of experts, and fully understand the risks before making an investment. Most of the investors in Theranos didn't do the work and lost everything...

Another Book Idea:

Laurence Kotlikoff, Professor of Economics at Boston University, is a thought leader in a variety of fields including personal finance, Social Security, retirement, pensions, savings, and insurance. His just-published book, Money Magic, uses the power of economics and advanced computation to deliver lots of interesting but simple money "magic tricks" that can transform your financial future (or at least make it more interesting). Use the link or find Money Magic in our bookstore in the recent releases section.

Predictions:

Byron Wein, Vice Chairman of Blackstone and legendary market strategist, has for many years issued his Ten Surprises for the year. Here is a link to his latest: Ten Surprises of 2022. I guess now we won't be surprised!

Worth Reading!

I thought these two recent Collaborative Fund blog postings were worth taking the time to read.

Does Not Compute

Jan 5, 2022 by Morgan House

A lot of things don’t make any sense. The numbers don’t add up, the explanations are full of holes. And yet they keep happening – people making crazy decisions, reacting in bizarre ways. Over and over...

Be Curious

Jan 3, 2022 by Ted Lamade

There is a great scene in the first season of Ted Lasso in which the show’s antagonist, Rupert Mannion, challenges Lasso to a game of darts. After seeing him make a few poor throws, Mannion is confident that it is easy money. The two play and Mannion appears to be on the verge of winning with Lasso needing two “triple 20s” and a bullseye on his final three shots. Then, just before he throws his darts, Lasso turns to Mannion and says in his Southern drawl...

If you wish to subscribe to their blog, go here and scroll to the bottom of the page.

Let's Play Jeopardy!

Answer: It is a distribution from your retirement account that can really mess up tax planning.

Question: What is the RMD?

Recently, I was questioned by a reader about the required minimum distribution (RMD) from their retirement accounts and how to mitigate the impact on taxes. Here's my response:

First, a caveat. I am not an expert on the subject so I would strongly suggest you consult with a financial and/or tax professional regarding strategies that might work for your individual situation. That being said:

If you have a Roth IRA or 401k there's no need to go further as any withdrawals from a Roth account are tax-free and there is no RMD.

If you have a traditional IRA account, I've identified eight steps you may be able to take to mitigate the RMD's impact on taxes or at least the impact on your psyche. I've prepared a summary you can download or read online.

One last thing, there are new life expectancy tables for calculating the RMD which will result in lower RMDs thanks to your longer life expectancy.

2021 Leftovers

I'm sure by now you have already read my 2022 Outlook article but since then I've found some more interesting tidbits. For example...

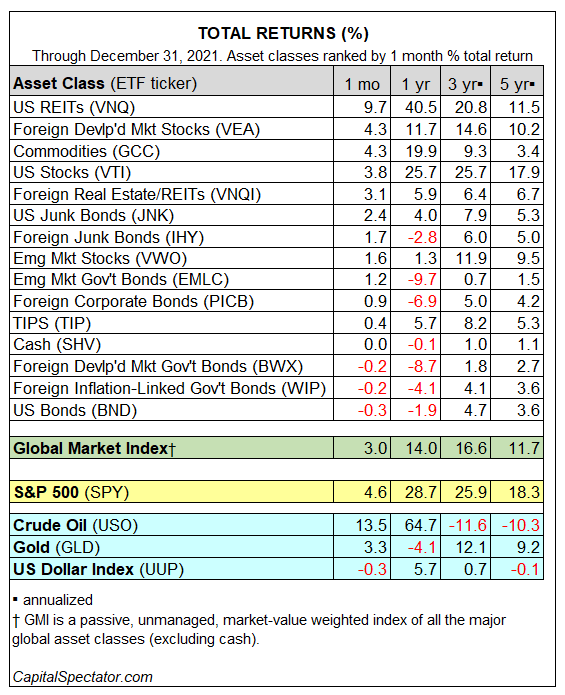

Here is The Capital Spectator's major asset class performance review for 2021. I don't think there are a lot of surprises here.

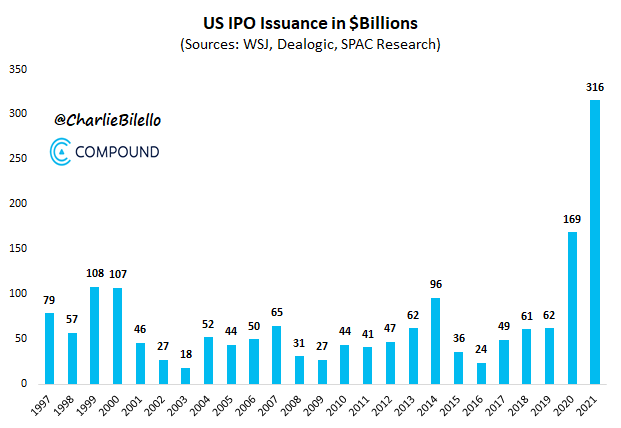

2021 was a huge year for initial public offerings! More than half the money raised was for SPACs (special purpose acquisition company). A high level of IPO activity can be indicative of high levels of speculation. Be very careful if you are buying an IPO or one that has been recently issued!

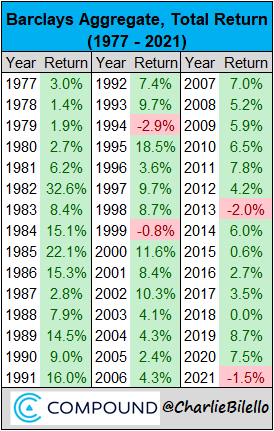

Bonds were down in 2021. The Barclays Aggregate Bond Index total return has been negative only four times in the last 45 years. Last year was one of those years with the index total return falling 1.5%. With the Fed planning to raise rates throughout 2022 and perhaps beyond, this could be another rocky year for fixed income, at least until inflation and interest rates stabilize.

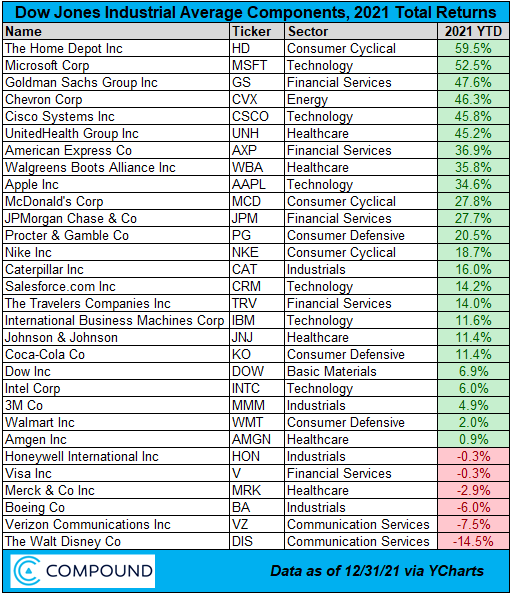

Here's how the Dow Jones Industrial stocks did last year:

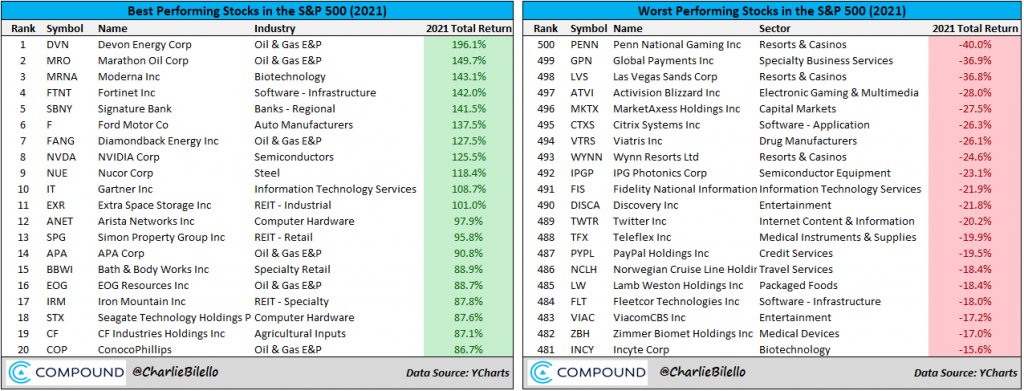

And here are the best and worst of the S&P 500 from last year.

And Finally...

Welcome new subscribers. Thank you! You can find previous newsletters and more information by heading over to our Home Page. And be sure to visit our Bookstore and Market Laboratory.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, just click the subscribe button. It's free! (Well, not exactly. After all, it does take several minutes of your valuable time to read. But we hope you will find spending that time worthwhile!)

I'm always interested in your feedback, ideas for topics, and questions. So please click the button below.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com

Under A Buttonwood Tree is an Amazon Associate. As such, we earn commissions from qualifying purchases when you use the links to Amazon.com. You will not incur any additional cost using them and the commissions generated will help us to offset the expense of maintaining our website. Thank you!