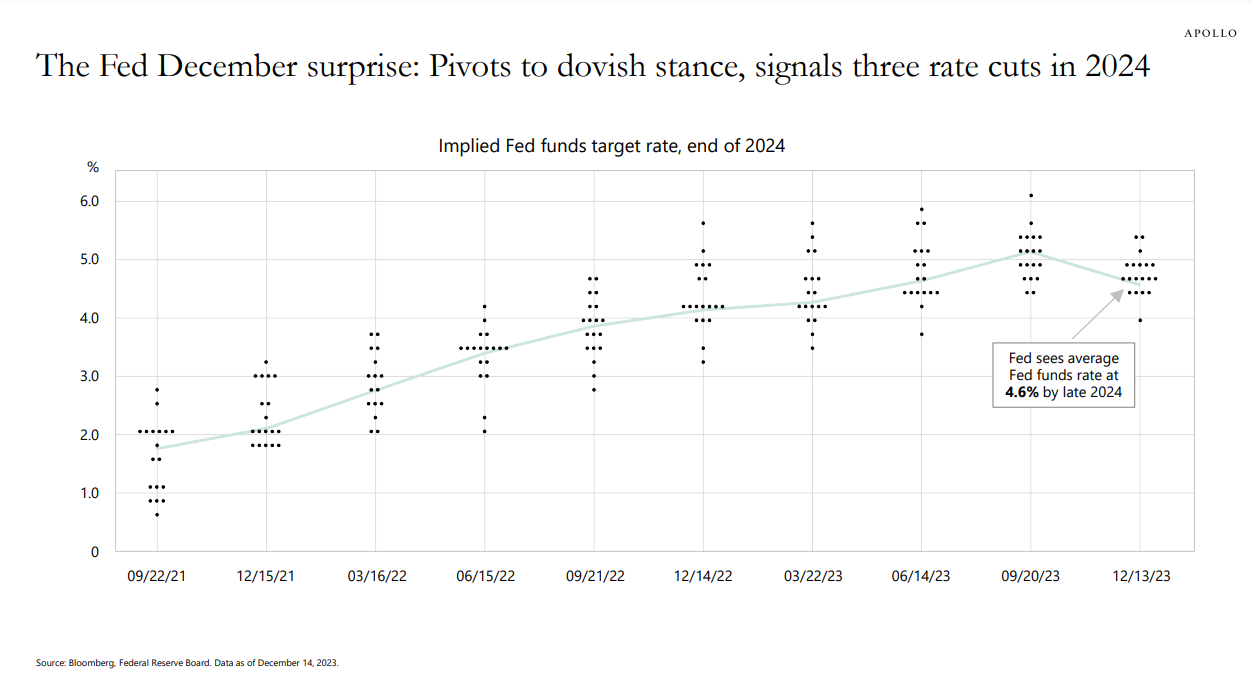

Not surprisingly, the Fed left the discount rate unchanged. The post-announcement commentary seemed to indicate a more "dovish" stance by the Fed. Indeed, the Fed's "dot plot" foresees a 75 basis point (0.75%) drop by the end of next year.

The market reaction was swift with yields tumbling and stocks soaring. Is higher for longer dead? Has inflation been licked? Has the Fed successfully engineered a "soft landing" for the economy?

Let's hope so but I don't think the answer to any of these questions is an unequivocal "yes".

Here's what the Wall St. Journal's Nick Timiraos had to say:

Fed Begins Pivot Toward Lowering Rates as Inflation Declines

The Federal Reserve held interest rates steady and signaled inflation had improved more rapidly than anticipated, opening the door to rate cuts next year.

And here is ZeroHedge's less-than-complimentary analysis of the Fed's announcement.

Now It All Makes Sense

How Jerome Powell destroyed what little reputation the Fed had left…

Finally, here are some observations from MarketWatch:

History shows even the Fed can’t really predict what it does with interest rates a year out

For a second day in a row, financial markets continued to absorb what’s being described as the Great Monetary Pivot, one in which the world’s perhaps most…