March 12, 2024 08:31

Here's the CNBC headline:

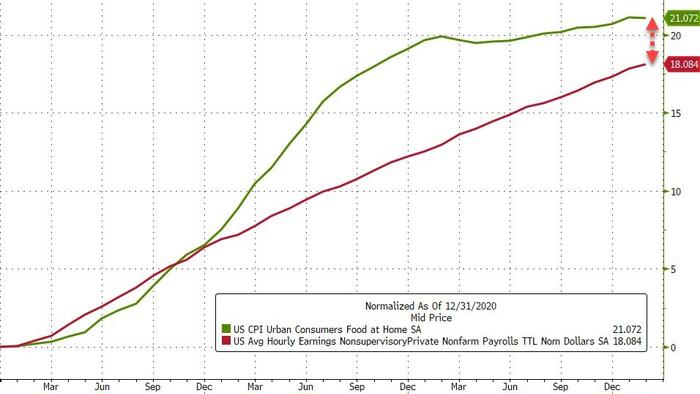

Analysis from ZeroHedge:

Here is Wells Fargo's view:

March 13, 2024 09:20

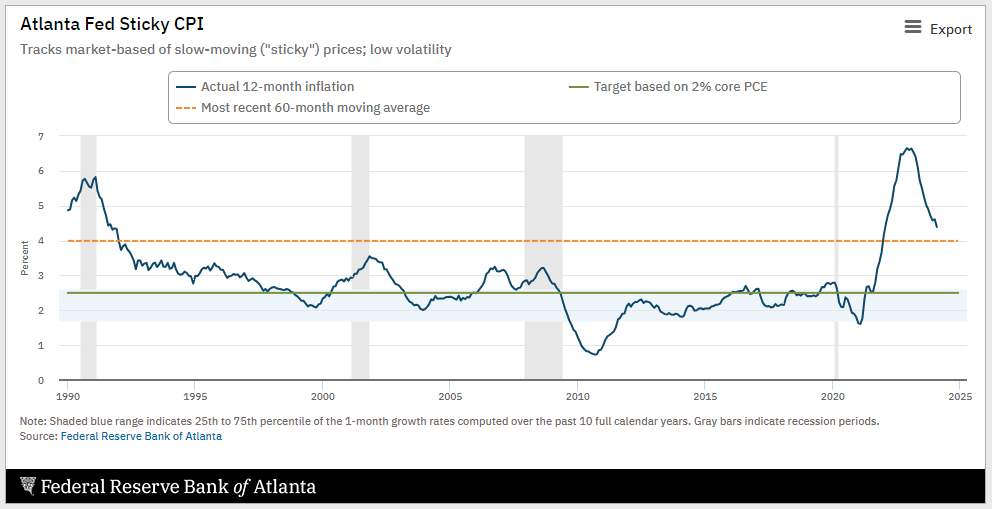

The Atlanta Fed maintains the "Sticky-Price" CPI (who knew?).

As the name suggests, the Sticky CPI contains categories of prices that change infrequently, rent for instance. Sticky CPI is up 4.4% from the prior year, well above the BLS reported numbers.

Mike Shedlock sheds more light in this post:

At the other end of the spectrum, here's Truflation's latest read on inflation:

March 14, 2024 08:36

Headline PPI was 2x the expected rate of 0.3%. Core PPI was +0.3% also higher than the expected 0.2%.

Here is Mish Shedlock's take on the report.

Bottom line? I think investors will continue to be disappointed with inflation's rate of decline. The Fed will continue to push out the date for the first rate cut. Better get used to "higher for longer". (BTW, If you are a net saver, that's not a bad thing.)