Rhymes with war...

Oil Prices Approaching All-Time Highs

You will find more infographics at Statista

You will find more infographics at StatistaOil prices continue their advance with the price of Brent crude crossing $130 per barrel overnight (3/6). Gasoline is now trading around $3.55 per gallon. Add on taxes, transportation, etc. and you can expect prices at the pump to exceed $4.25/gallon any moment now.

Last Friday, I watched gasoline jump more than $0.25 at a local station in a matter of a few hours. If your tank is running low, don't wait for lower prices for a fill-up, it ain't going to happen for a while.

That said, as you can see from the chart, oil prices can reverse quickly. I suspect this will happen again as soon as oil production increases outside of Russia and/or the conflict is resolved.

Finally, as noted by Tom Lee of FSInsight, oil costs represent only 3% of a consumer's spending so the recent price rise, while painful, is having a relatively minor impact on budgets, so far.

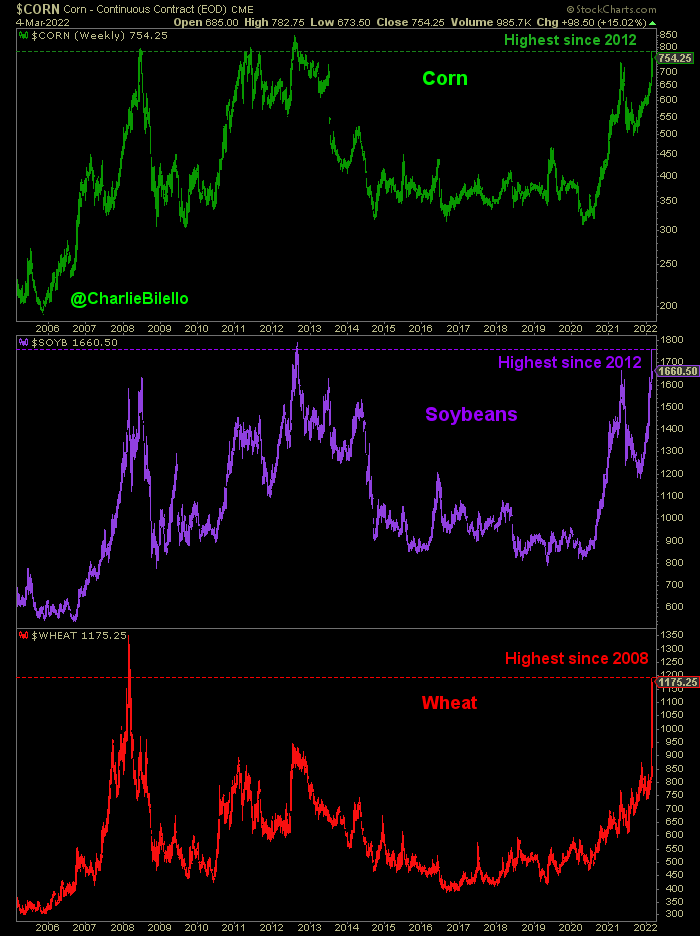

It's Not Just Oil Heading Higher

Russia and Ukraine are known as the breadbasket of Europe. So not surprisingly, grain prices are also soaring. (Perhaps it's finally time to cut back on bread and pasta?)

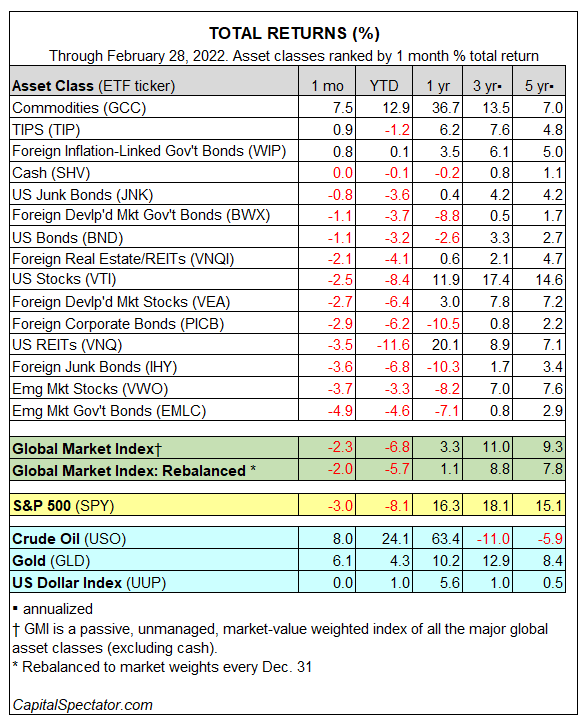

A Tough Month For Investors

One look a the chart below and you'll know how difficult February was for investors. Only commodities and inflation-linked bonds produced positive returns for the month.

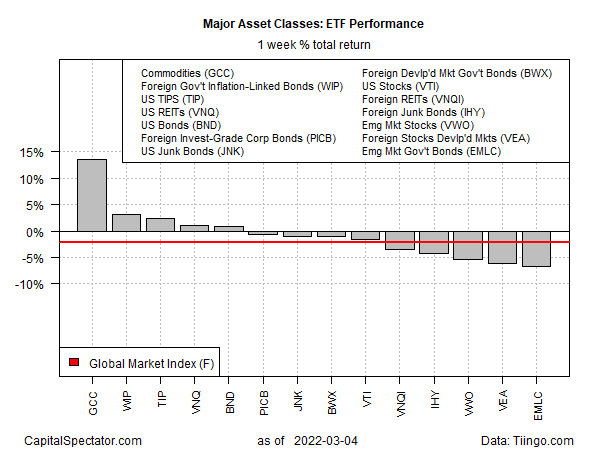

Last Week Wasn't Much Better

Not surprisingly, commodities were once again the standout while just about anything foreign took it on the chin.

By the way, if you are interested in adding some commodity exposure to your portfolio, here are three ETFs (out of many ETFs, ETNs, and mutual fund options) to look at for starters. Use the links to start your research.

Invesco DB Commodity Index Tracking Fund (DBC)

iShares S&P GSCI Commodity-Indexed Trust (GSG)

WisdomTree Enhanced Commodity Strategy Fund (GCC)

Here's how these funds have performed over the past year:

From The Market Lab

As you can see in the chart below from koyfin.com, while the S&P 500 has clearly deteriorated, it remains above its 20-month moving average suggesting that our stock market remains in a long-term uptrend for now. So while I don't think it is time to abandon stocks, it is time to be careful. Make sure your portfolio is appropriately diversified and maintain adequate cash reserves to get you through a rough patch. And keep clicking those links in the market lab for updates...

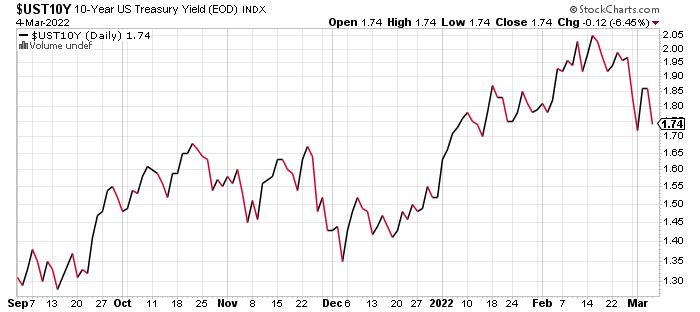

Interest Rates Reverse

Events in Europe have reversed the upward trend of interest rates as investors flocked to US Treasury bonds. However, with inflation running hot, it's anyone's guess how long this new trend will last.

Inflation Watch

Economist Edward Yardeni recorded a recent Zoom webinar on predicting inflation. While it runs about an hour, it's worth the time spent. The link requires a Zoom logon. Ed Yardeni - Predicting Inflation. And here's a link to the chart package.

Medical Costs In Retirement

While this is clearly a marketing piece for the firm providing it, this article on planning for medical costs in retirement is a good, quick summary of your Medicare benefits.

War in Ukraine

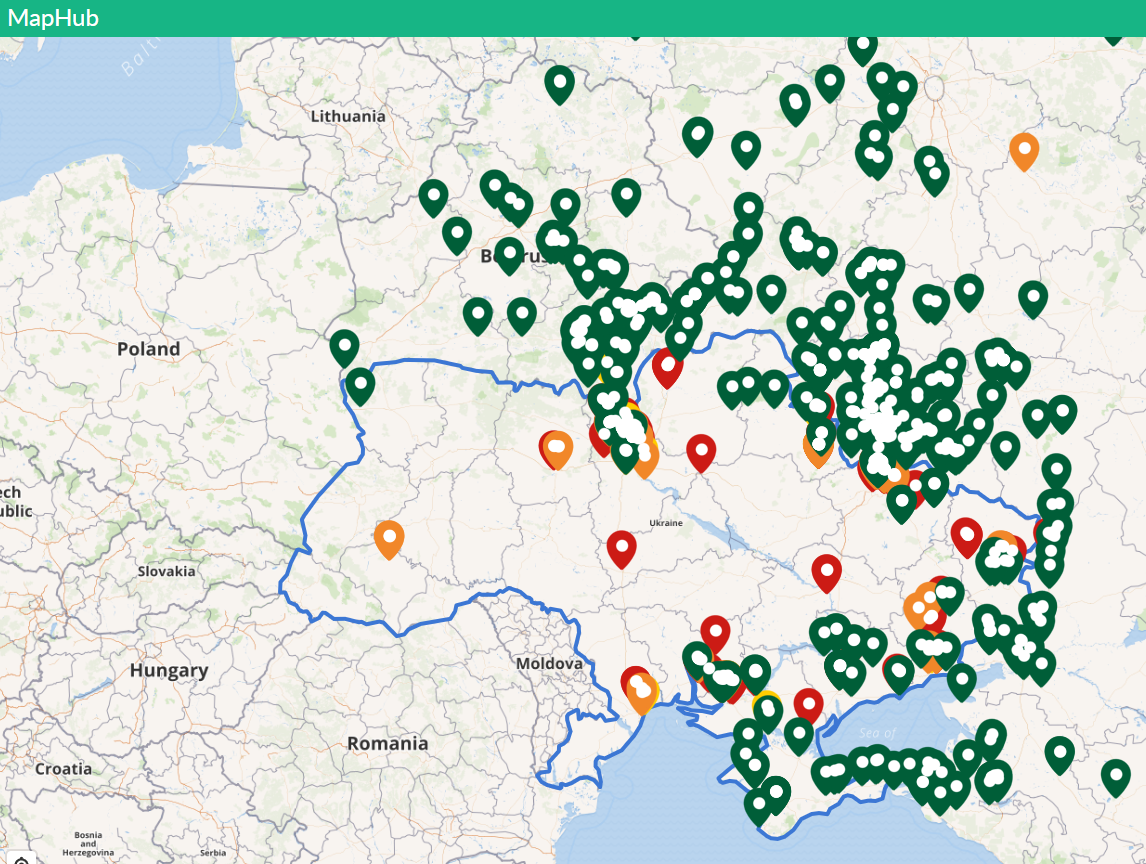

For those of you interested in following war developments, take a look at this: a crowd-sourced map of incidents and activities in and around Ukraine. When you click on the map, you will be taken to an interactive version.

Are You Invested In Russia?

According to Bloomberg, the 10 funds listed below have the largest holdings in Russian stocks. At this point, the value of these stocks has already declined dramatically, but if you want to divest yourself of Russian stocks and own one of these funds, you have a decision to make.

A History Lesson

Given what is potentially another change to European borders with Russia's invasion of Ukraine, here is an interesting video of how Europe has changed over 2,400 years. What's happening today certainly isn't unique in history!

The video is about 11 minutes in length.

Earnings Update:

While the bulk of fourth-quarter earnings reports are now out, more are still expected this week as shown below:

And Finally,

Thanks for reading this week's newsletter! You can find previous newsletters and more information by heading over to our Home Page. And be sure to visit our Bookstore, Market Laboratory, Resources, and Archive pages.

Please feel free to share this newsletter with a friend.

If you're not a subscriber and would like to be, just click the subscribe button. It's free! (Well, not exactly. After all, it does take several minutes of your valuable time to read. But we hope you will find spending that time worthwhile!)

I'm always interested in your feedback, ideas for topics, and questions. So please click the button below.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com