Week of March 4, 2024

Wednesday, March 6, 07:06

Torsten Slok, Apollo Global's Chief Economist, makes these arguments for a strong February employment report:

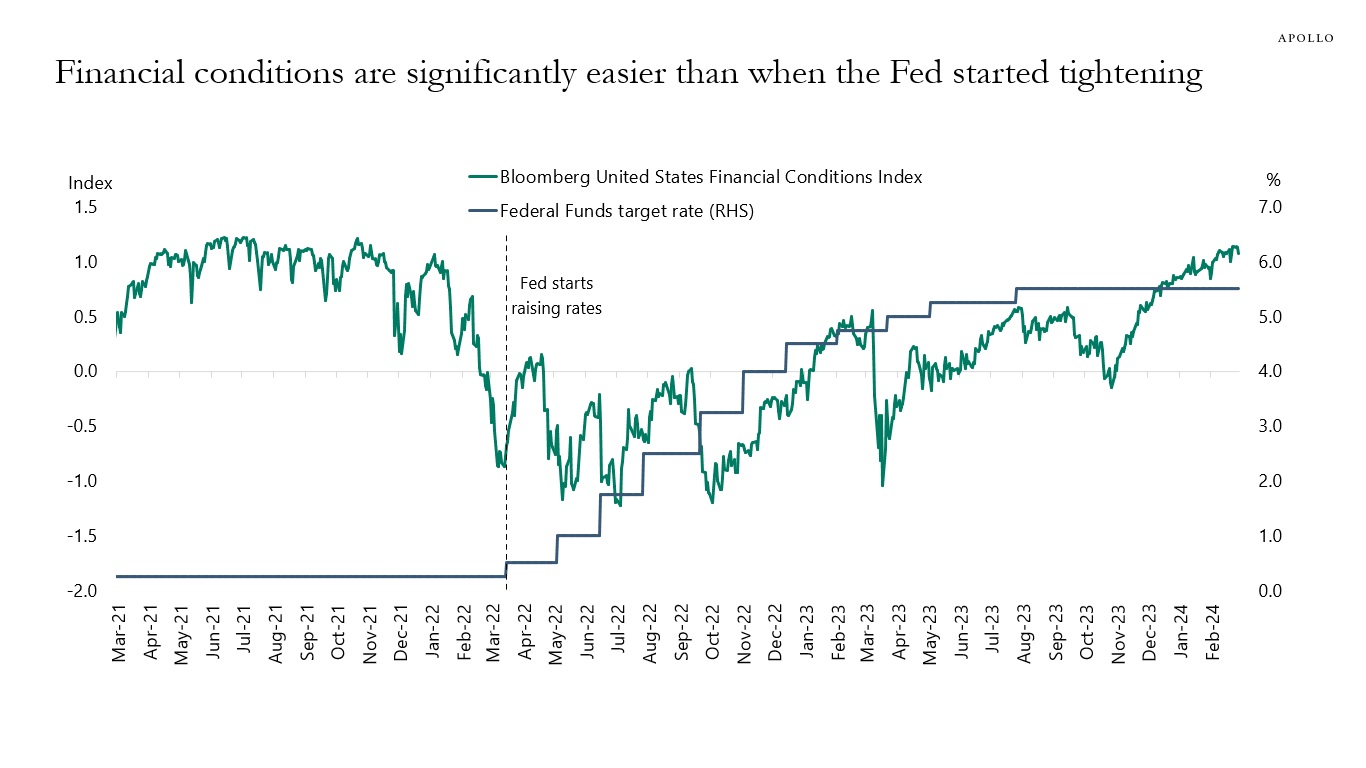

1) Financial conditions have eased dramatically since the December FOMC meeting, with the S&P 500 at all-time highs and very tight IG and HY spreads. Significant wealth effects and lower borrowing costs are a major tailwind to consumer spending and capex spending, see the first and second charts.

2) Jobless claims remain very low, around 200,000, and the economy remains surprisingly resilient, with households and firms having locked in lower interest rates during Covid, see the third and fourth charts.

3) The fiscal deficit is running at a high 6% of GDP for an expansion, driven by the CHIPS Act, IRA, and Infrastructure Act, and associated positive effects on manufacturing construction, energy investments, and infrastructure investments.

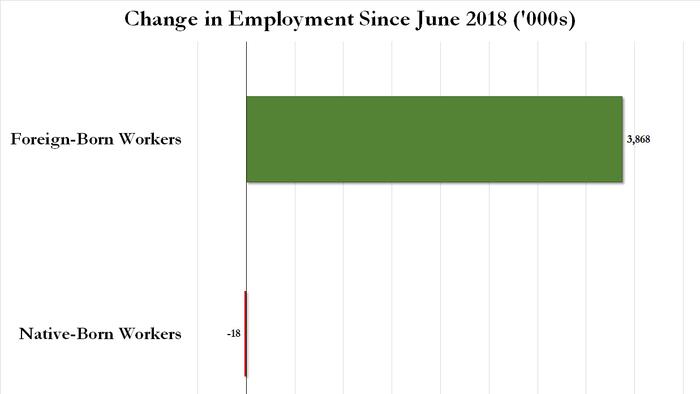

4) The employment-to-population ratio is almost a full percentage point lower than pre-Covid, and immigration continues to be strong, suggesting there is still more upside potential to employment.

Here's the entire report:

Wednesday, March 6, 08:30

ADP has just reported that private payrolls rose by 140,000 in February. This is slightly less than the 150,000 gain that was expected. It will probably be interpreted as good news. Here is CNBC's report:

Wednesday, March 6, 08:30

While not directly related to employment, Fed Chairman Powell, in prepared remarks for today's Congressional testimony stated that “The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

I'm not sure the ADP is a confidence builder...

More from CNBC:

Wednesday, March 6, 10:30

Few surprises in the Department of Labor's JOLTS report for January this morning with openings down a bit. Of note, both the hiring and quit rates fell, symptomatic of a slower economy.

ZeroHedge analyzes the report here:

Thursday, March 7

These two posts from Jeff Weniger raise concerns of a softening labor market...

1/2

— Jeff Weniger (@JeffWeniger) March 7, 2024

The Challenger report reveals collapsing hiring intentions.

The Jan + Feb total is the lowest since 2008, when the system was a half-year into the credit crisis that commenced July 2007. Additionally, due to population growth, the US has more people to *not hire* now. pic.twitter.com/iFDmGjiiXR

2/2

— Jeff Weniger (@JeffWeniger) March 7, 2024

February's job cut announcements amount to 84,638 workers, a level we haven't seen since 2009. To find a bright side in this, it is still below the numbers registered in the era we refer to as the "jobless recovery" years that came after Dot-Com imploded. pic.twitter.com/phYlNOb4LB

Friday, March 8 08:31

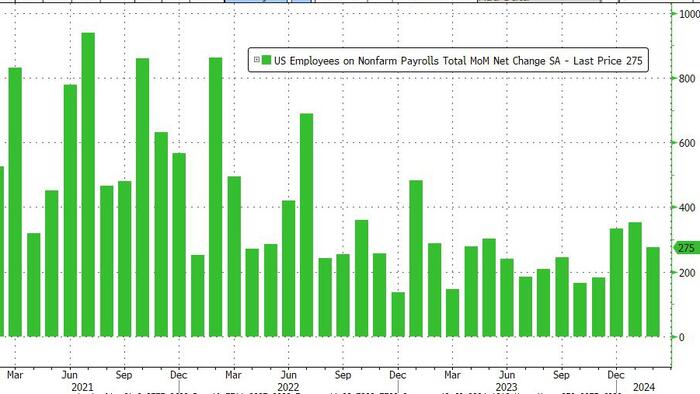

The numbers are out. Here's the headline from CNBC:

Job growth was much higher than the 200k expected.

Friday, March 8 10:10

ZeroHedge is out with their analysis. Note the big downward revision to January's employment number and February's jump in the unemployment rate.

Here's Mike Shedlock's analysis:

And here's what Wells Fargo had to say:

February Employment: The Devil Is in the Details

Some more analysis by ZeroHedge: