Are you sitting on a pile of cash and wondering is now the time to invest? After all, the market has done so well, shouldn't you wait for a bear market, or at least a correction? Charlie Bilello of Compound Capital Advisors has just written an excellent post, "A Guide to Moving from Cash to Investments". Read it!

I was struck by a couple of charts in his post:

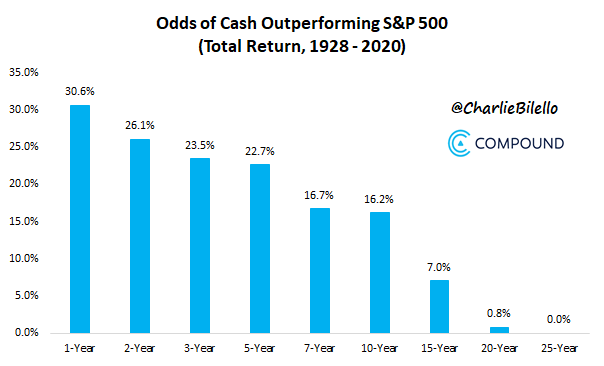

The first is the likelihood of cash outperforming stocks over various time periods. Take a look:

Less than one third of the time will an investment in stocks do worse than cash (these days that means losing money but in more "normal" times it can mean earning a smaller return) in year one. Your odds of doing better with stocks than cash only get better as your time horizon lengthens. What does this means for your returns over time?

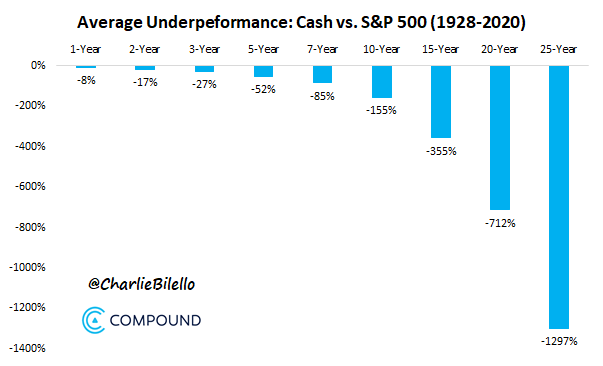

The chart of above clearly demonstrates that the cost of holding cash (or perhaps better put - the lost opportunity of missing out on higher returns from stock) is significant over time. Sure, if you are smart or more likely lucky enough to be in cash during a bear market, there is no cost to holding cash. Nevertheless, that advantage is soon lost if you fail to get back into the market in a timely fashion.

More On My Walk

I was happy to see a number of foxgloves blooming in the woods. But be careful - they are poisonous!