As we discussed in Sunday's Chart Attack!, a CPI report for January above 0.3% (especially core CPI) would be viewed negatively by the market. Well, that's just what happened. CPI was up 0.3%, core CPI rose 0.4%, while stocks and long-term bonds have dropped more than 1% this morning.

Even more concerning, the "super-core" CPI rose 0.7% in January, its fastest rate since September 2022. For the last twelve months, super-core is up 4.4%. Remember, super-core excludes food, energy, and shelter, the most volatile components of the CPI. Think of super-core as the stickiest component of the CPI.

ZeroHedge has a good summary of the CPI report:

Here is a link to Wells Fargo's analysis of the January CPI Report.

Mike Shedlock has some interesting thoughts on the shelter component of CPI.

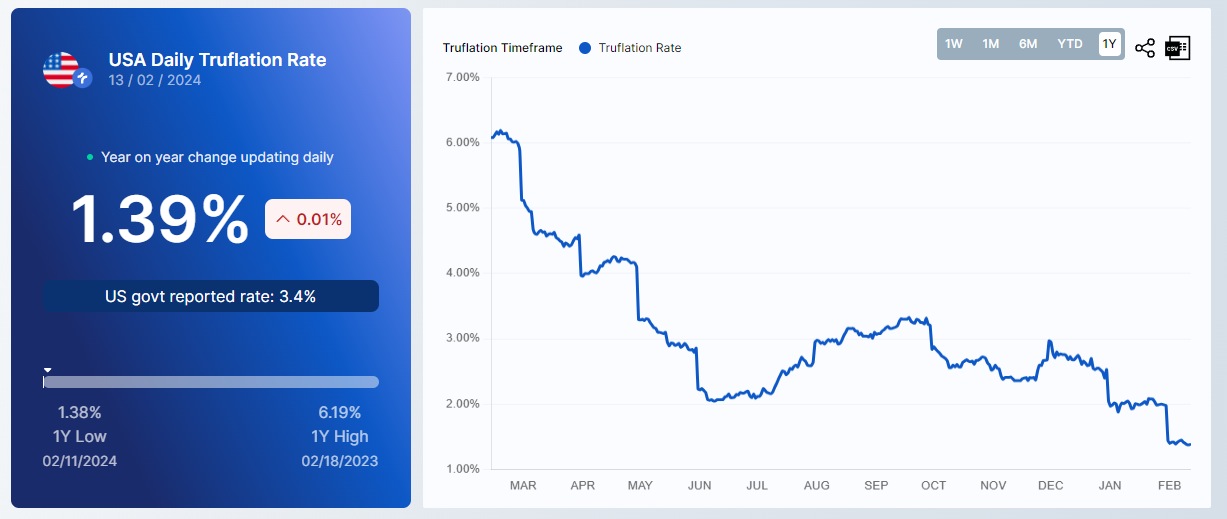

Interestingly, Truflation's CPI measure is two percentage points lower than the government's measure.