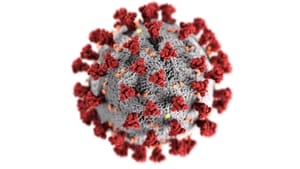

Financial markets around the globe fell sharply to end this holiday week on news that a new variant of COVID-19 (Omicron) had been identified. The S&P 500 dropped 2.23% here in the United States while stocks in Europe fell more than 2.75% and Asian shares were off more than 3%. Not surprisingly, travel and leisure companies plummeted with cruise lines off more than 10%. Commodities were also down sharply with oil falling more than 10% on fears that travel may be significantly curtailed. (Indeed, governments around the globe including the U.S. have announced the suspension of flights from South Africa and several other nations).

Here's what we know as of November 26:

The Omicron variant was identified five days ago - initially in Botswana with subsequent confirmation and sequencing in South Africa with about 100 confirmed cases. Cases have been detected in Israel and Hong Kong and as of this morning, in Belgium. Of concern, the new variant is spreading very quickly, in under two weeks it is now dominating all infections in South Africa, according to reports.

The Omicron variant has a large number of mutations, far more than Delta. Scientists note there are 10 mutations vs 2 in the Delta variant regarding the receptor binding domain, which is the portion of the virus that makes initial contact with cells. Importantly, a significant number of mutations may not necessarily be a ‘negative’ as it is dependent on how these mutations function, which scientists have yet to establish.

This new variant can be identified by PCR test so it should be easily tracked and studied.

Here's what we don't know:

We don't know what the mortality rate of Omicron is compared with the other COVID-19 variants. (It is probably too soon to tell.)

We don't know the rate of hospitalization for Omicron.

We don't know about the symptoms - if they are different than what is currently experienced and/or their severity.

We don't know the demographics of those infected - young, old, healthy, or somehow compromised.

We don't know if the current vaccines are effective (or to what extent they may be effective) on Omicron. (Pfizer has announced they can have a targeted vaccine ready in 100 days.)

We don't know the potential efficacy of current therapeutics (or the new anti-viral medications being introduced by Merck and Pfizer) on the Omicron variant. However, the monoclonal antibody treatments currently in use have shown efficacy with the other known variants.

We will know more soon.

In my view the market action today was driven by fear and the lack of information. I suspect that as more information is learned, markets will settle down and again focus on fundamentals and value.

What if this variant is worse than Delta? I suspect interest rates will fall some more, energy prices may weaken further, inflation could moderate and the Fed could postpone or adjust its recent tapering moves. And stocks may be hurt for a period of time but if the economy isn't seriously affected, they should recover

Bottom line? There is no need to panic but there are reasons to be cautious. We can make adjustments to portfolios when we know more.

And Finally...

Welcome new subscribers. Thank you! You can find previous newsletters and more information by heading over to our Home Page.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, visit the Home Page to sign up. It's free!

Got questions or comments? Send them to under.a.buttonwood.tree@gmail.com.