February 18, 2024

Monday is Presidents Day. The banks and exchanges will be closed along with the post office and most other government offices.

Performance

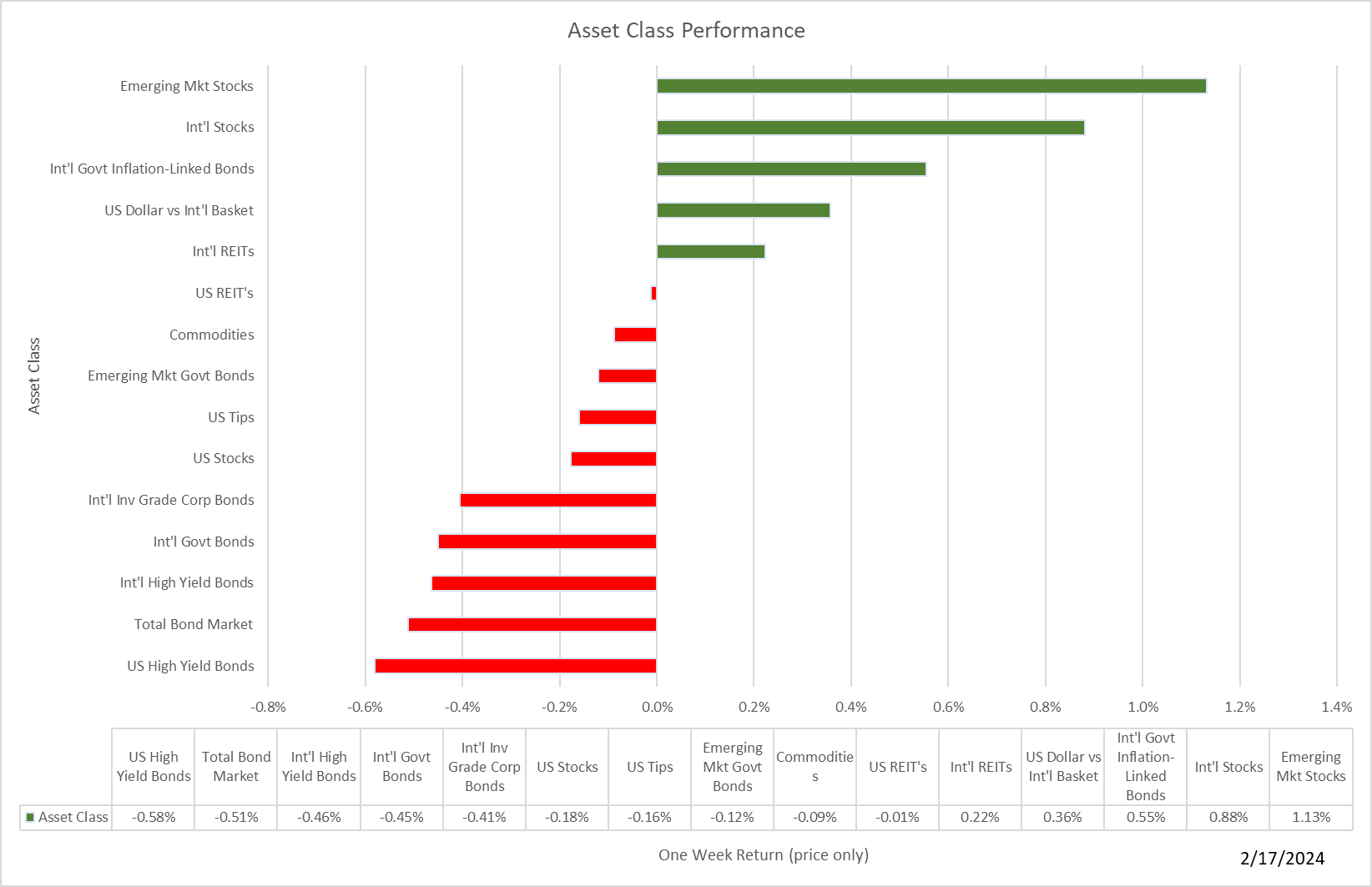

After posting 1%+ gains for five straight weeks, the S&P 500 took a step back, falling 0.4% last week. Bonds also took it on the chin. Here' the weekly look at asset class returns:

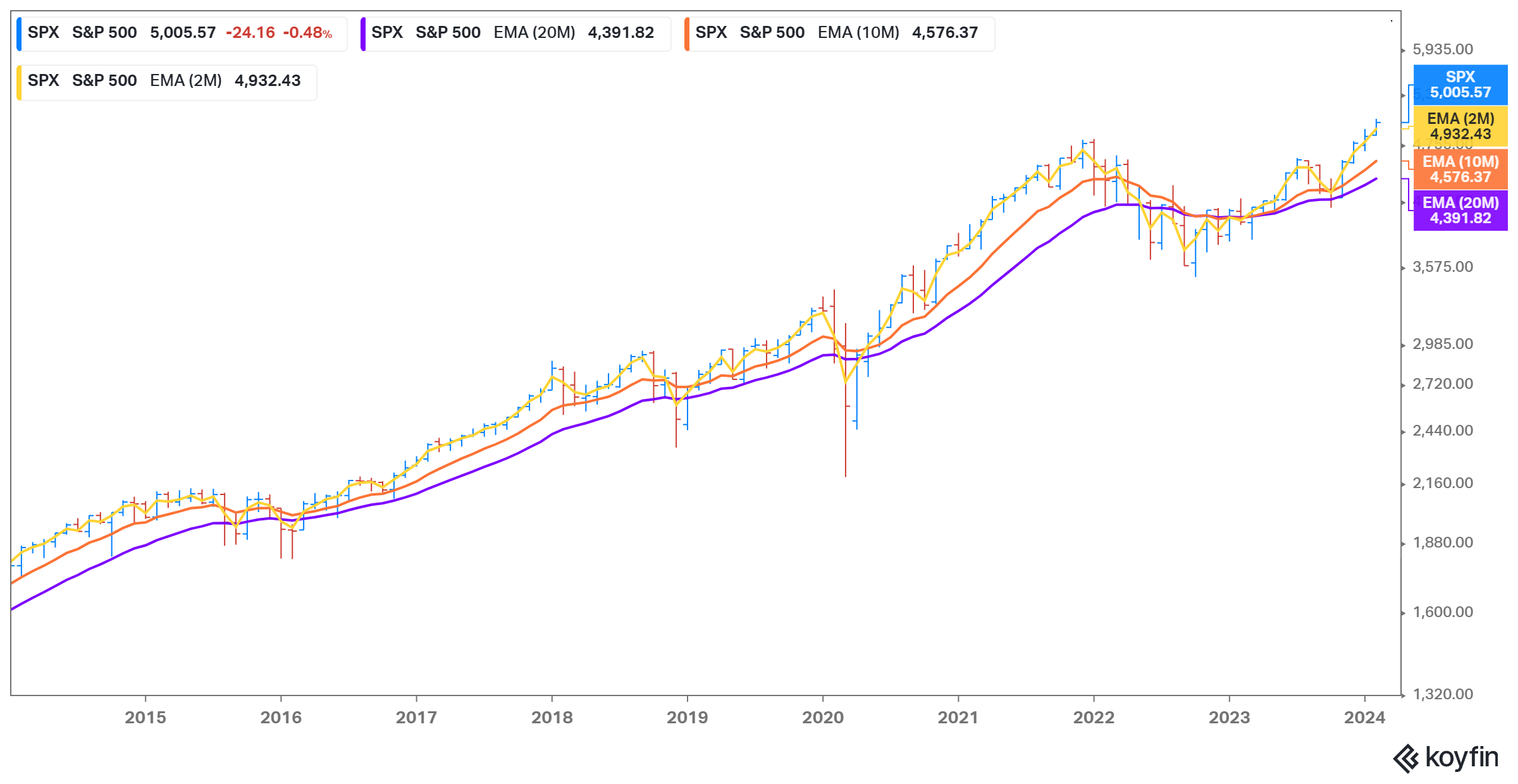

Despite the pullback, the S&P 500 remains comfortably above its long-term moving averages.

Get all the details in the market update report.

The Dismal Science

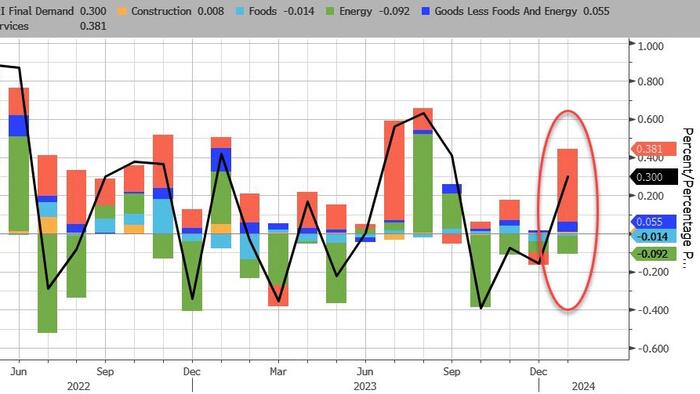

We received bad news on inflation with the CPI and PPI coming in higher than hoped. Stocks and bonds sold off on the news. Here's our post on CPI:

Click to View

Truflation's daily inflation rate is 1.71%, while up from the start of February, is still about half the CPI.

Here is ZeroHedge's take on Friday's PPI report:

Click to View

This updated survey of GDP nowcasts from The Capital Spectator suggests the US economy remains on a growth path.

The bad inflation news coupled with no immediate signs of a slowdown has resulted in expectations of further delays in rate cuts. Indeed, rates on 10-year bonds have increased from 3.8% at year's end to 4.3% today.

Rising rates won't be helpful for the housing market which just posted dismal housing starts numbers. Mike Shedlock explains:

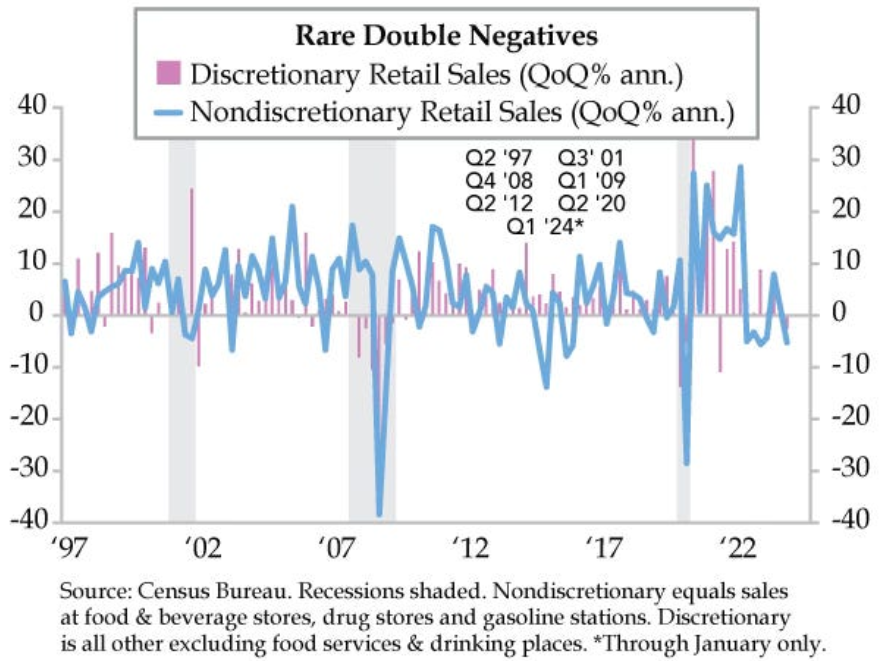

It's unusual to see both non-discretionary and discretionary retail sales both decline in a quarter. It usually happens during a recession. It's starting to happen in the first quarter of 2024. Something to watch...

Stocks, Bonds, & Bills. Oh My!

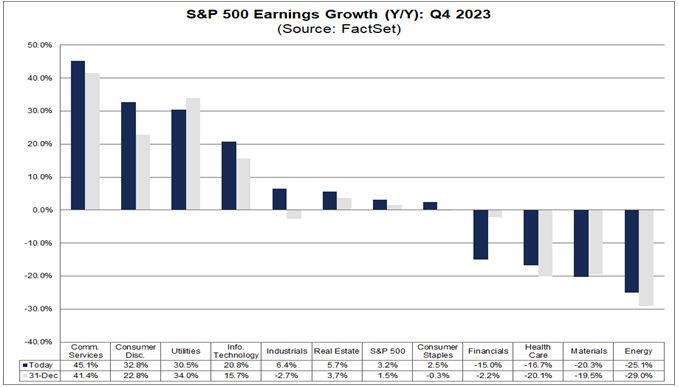

We're just about done with fourth-quarter earnings results. With about 80% of the companies reporting, earnings have come in better than expected, growing 3.2% over last year, more than twice the expected rate.

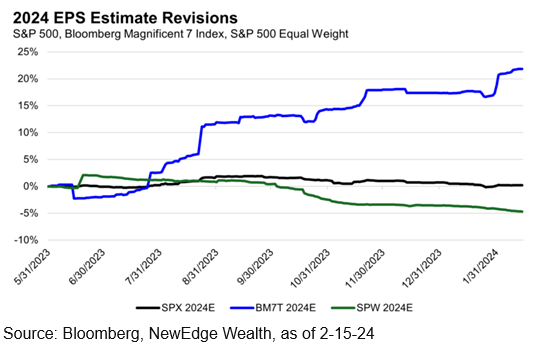

While the last quarter is coming in better than expected, 2024 earnings forecasts for many companies have been falling (the green line).

Here are the expected reports for this week. Perhaps the most watched of the week will be NVIDIA, which could potentially have a significant market impact (good or bad). Also of interest will be the retailers Home Depot and Walmart.

Super Micro Computer has become a poster child of the AI revolution. Its shares have soared from 280 at the start of this year, reaching an interim high of 1,078 early Friday, a gain of 285% in just six weeks. However, after reaching incredible heights, SMCI finished Friday down, 25% leaving its year-to-date return a still incredible 185%.

Does Friday's price action suggest the AI boom is coming to an end? Perhaps. However, I think it certainly suggests caution if you are considering investments in AI at the moment.

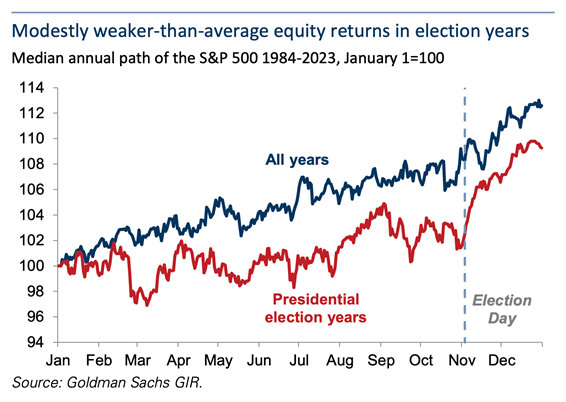

It turns out that presidential election years tend to lag other years until November. We'll see if the historical precedent holds.

Survey of Weekly Research

Of note "Five Retirement Risks to Consider" and DoubleLine's "Monthly Market Update" plus the regular weekly updates. Click below for all the links.

Click to View

And Finally,

Enjoy the long weekend!

Thank you for reading! Feel free to forward this email to a friend or colleague.

Did some kind soul send you this Chart Attack!? To get your very own copy delivered to your email every week, click the subscribe button. Remember, there's no charge but you must be a subscriber to have access to the weekly Chart Attacks! and our Under A Buttonwood Tree website.

Are you receiving too many emails and would rather read Chart Attack! on our website? Just let me know by email and you will be removed from the mailing list but retain your access to the site.

Our email address is under.a.buttonwood.tree@gmail.com