December 10, 2023

Except for all the employment reports, it was a fairly quiet week. I'll be brief so you can get back to your holiday shopping! Don't forget to visit our website for additional information!

Stocks, Bonds, Bills, Oh My!

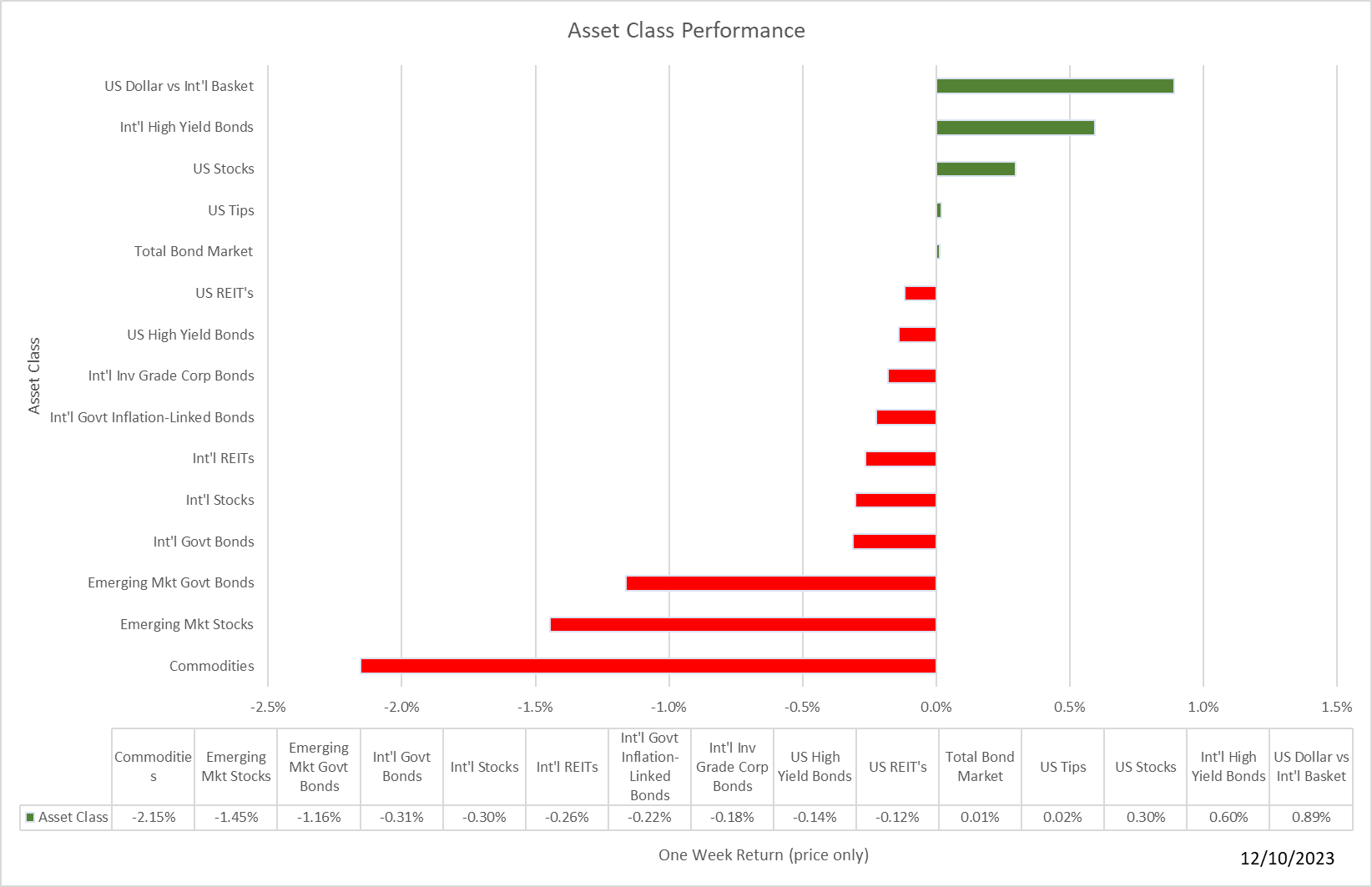

U.S. stocks inched higher this week. However, almost everything else retreated as you can see here:

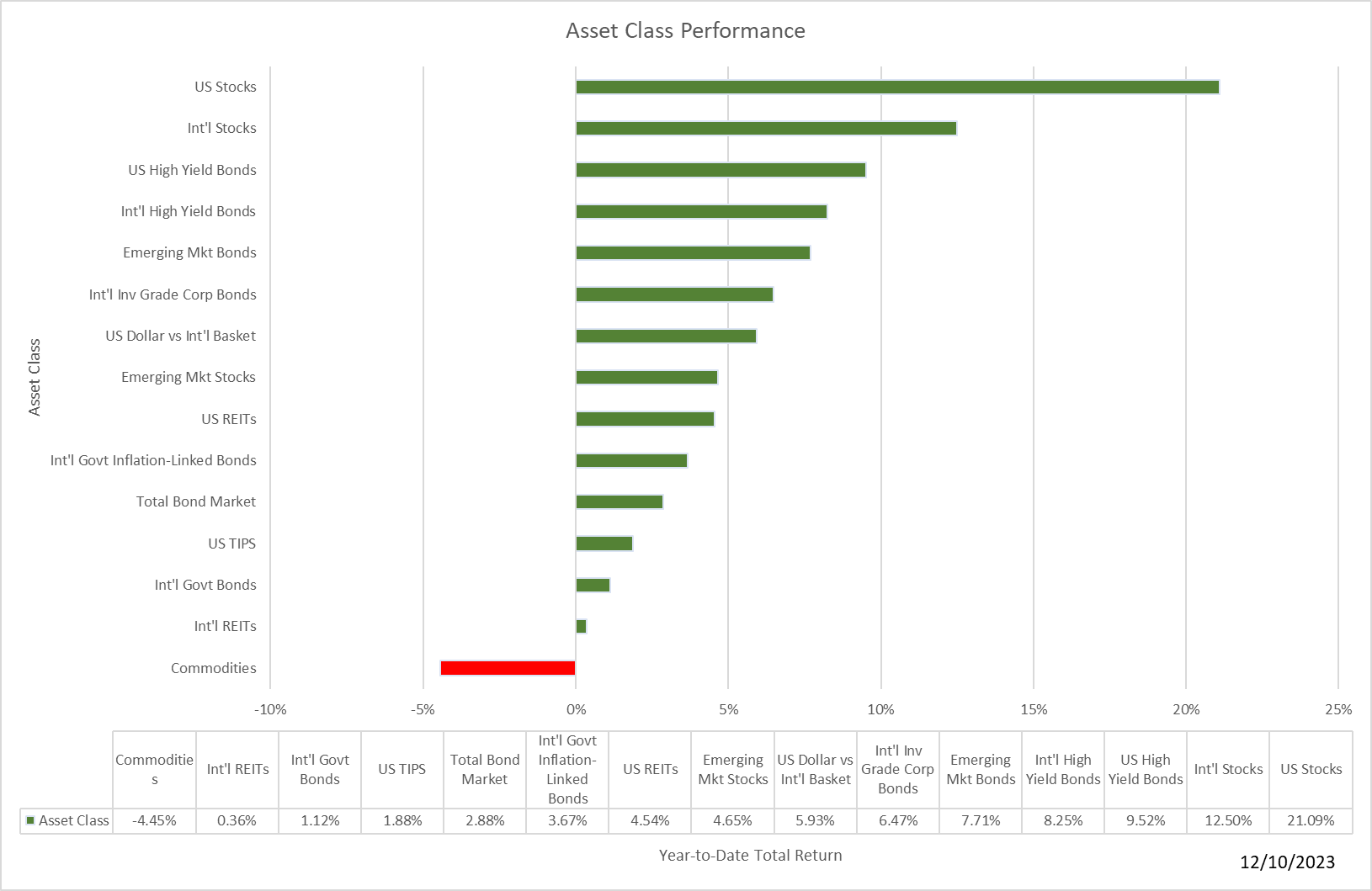

But we're still looking good year-to-date!

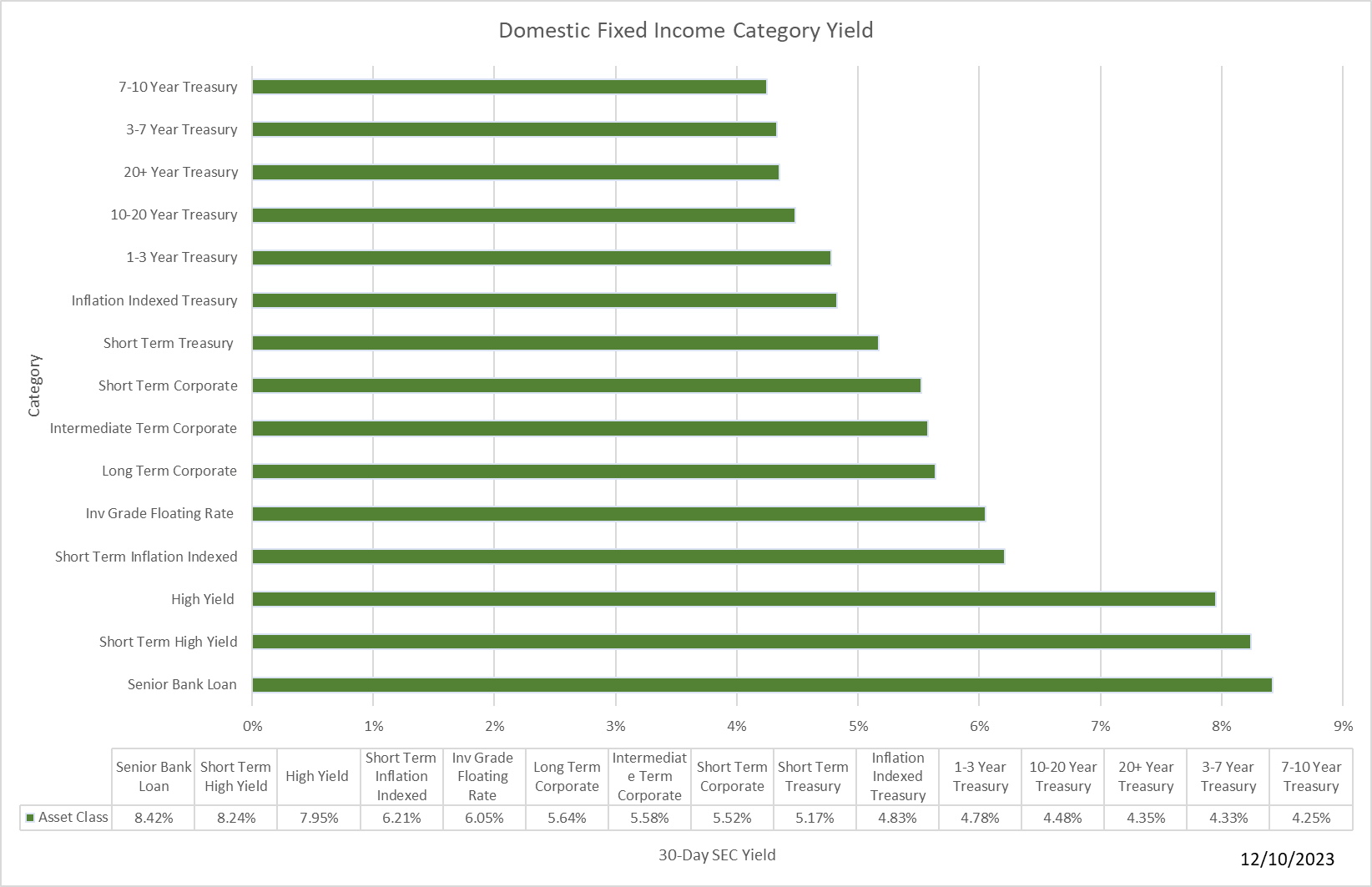

While interest rates have backed off recently, fixed-income investments still offer inflation-beating yields.

Download the market update for a more complete review of last week's action.

Several companies are reporting quarterly results this week. Three I'm keeping an eye on are Oracle, Adobe, and Costco. Costco, in particular, should give us a good read on the consumer as the year draws to a close.

Michael Mauboussin is one of the best investment thinkers and educators today. Enjoy this relatively brief podcast on the topic: Why do companies die?

Take Five

One of the many reasons I enjoy the Christmas season is the beautiful music. Here is one of my favorite carols.

The Dismal Science

The big news this past week was employment. Several reports including JOLTS, ADP, and Friday's BLS employment report, didn't move the needle much on the economic outlook, in my view. Here are a couple of our posts with all the details.

Click to View

Click to View

Get ready for inflation week with both the CPI and PPI being reported on Tuesday and Wednesday, respectively. The Fed Board of Governors meets for the final time this year. The betting is no change in the discount rate when the Fed makes its announcement on Tuesday afternoon.

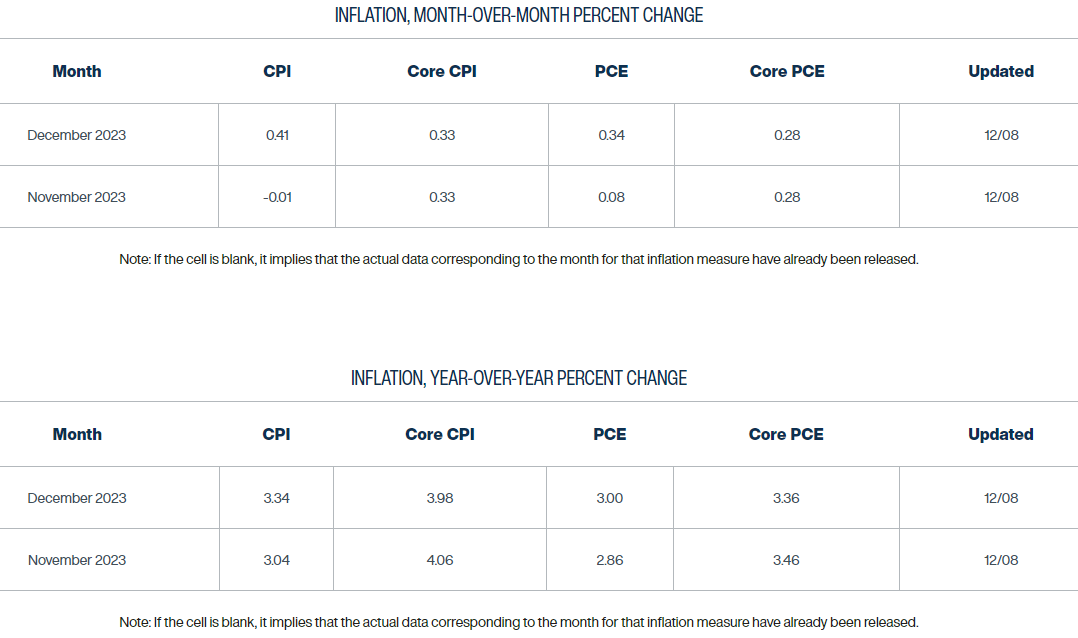

Here's Truflation's latest read on inflation:

The Cleveland Fed's inflation "nowcast" shows similar trends. Note: Headline CPI is expected to fall in November thanks to falling energy prices. However core CPI remains close to 4% and like the graph above remains stuck in a range well above the Fed's 2% target.

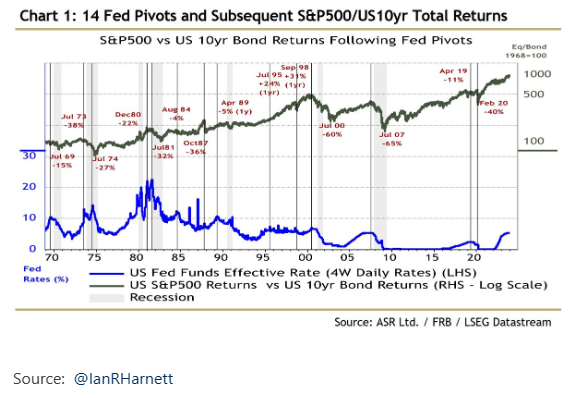

For those of you hoping the Fed will cut rates, be careful what you wish for - from Callum Thomas' ChartStorm:

This chart maps the path of stocks vs bonds when the Fed pivoted to rate cuts. Typically it sends the stock/bond ratio lower, conceptually this makes sense: lower rates are good for bonds, and lower rates are often in response to weaker growth (bad for earnings, sentiment: stocks lower). From an asset allocation perspective if you believe the Fed will pivot to rate cuts then the historical probabilities favor underweighting stocks, overweighting bonds.

Finally, here is Capital Spectator's survey of 4th quarter GDP nowcasts, averaging 1.2% with one month left in the quarter.

Topics in Personal Finance

The rise of interest rates has given retirees a lot more flexibility in managing their finances. This article from Barron's magazine offers a few ideas.

Click to View

Also from Barron's is this article on last-minute ways to save on 2023 taxes.

Click to View

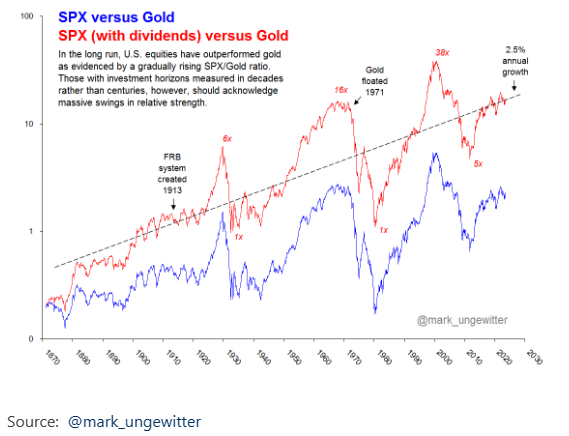

Gold has been on a roll lately. While I don't object to holding some gold in your portfolio as a crisis hedge, it is not a great long-term investment when compared to stocks. Specifically, when you include dividends, stocks are the hands-down winner despite periods of significant outperformance by gold.

The podcast embedded in this post is well worth the time. It is a conversation, between Howard Marks, Chairman of Oaktree Capital, and Annie Duke, author of Thinking In Bets, discussing risk.

Click to View

And Finally,

Click to View

Thank you for reading! Feel free to forward this email to a friend or colleague.

We've updated our website's homepage to make it easier to read the individual posts. They are now laid out in a grid. Just click on the bold title to read the entire post. The most recent Chart Attacks! are found at the top of the page. Scroll through the list to find the one you're looking for or use the search function (spyglass, upper right). Visit often!

Did some kind soul send you this Chart Attack!? To get your very own copy delivered to your email every week, click the subscribe button. Remember, there's no charge but you must be a subscriber to have access to the weekly Chart Attacks! and our Under A Buttonwood Tree website.

Are you receiving too many emails and would rather read Chart Attack! on our website? Just let me know by email and you will be removed from the mailing list but retain your access to the site.

Our email address is under.a.buttonwood.tree@gmail.com