January 8, 2023

Here is this past week's harvest of charts, graphs, tables, and miscellany with brief comments.

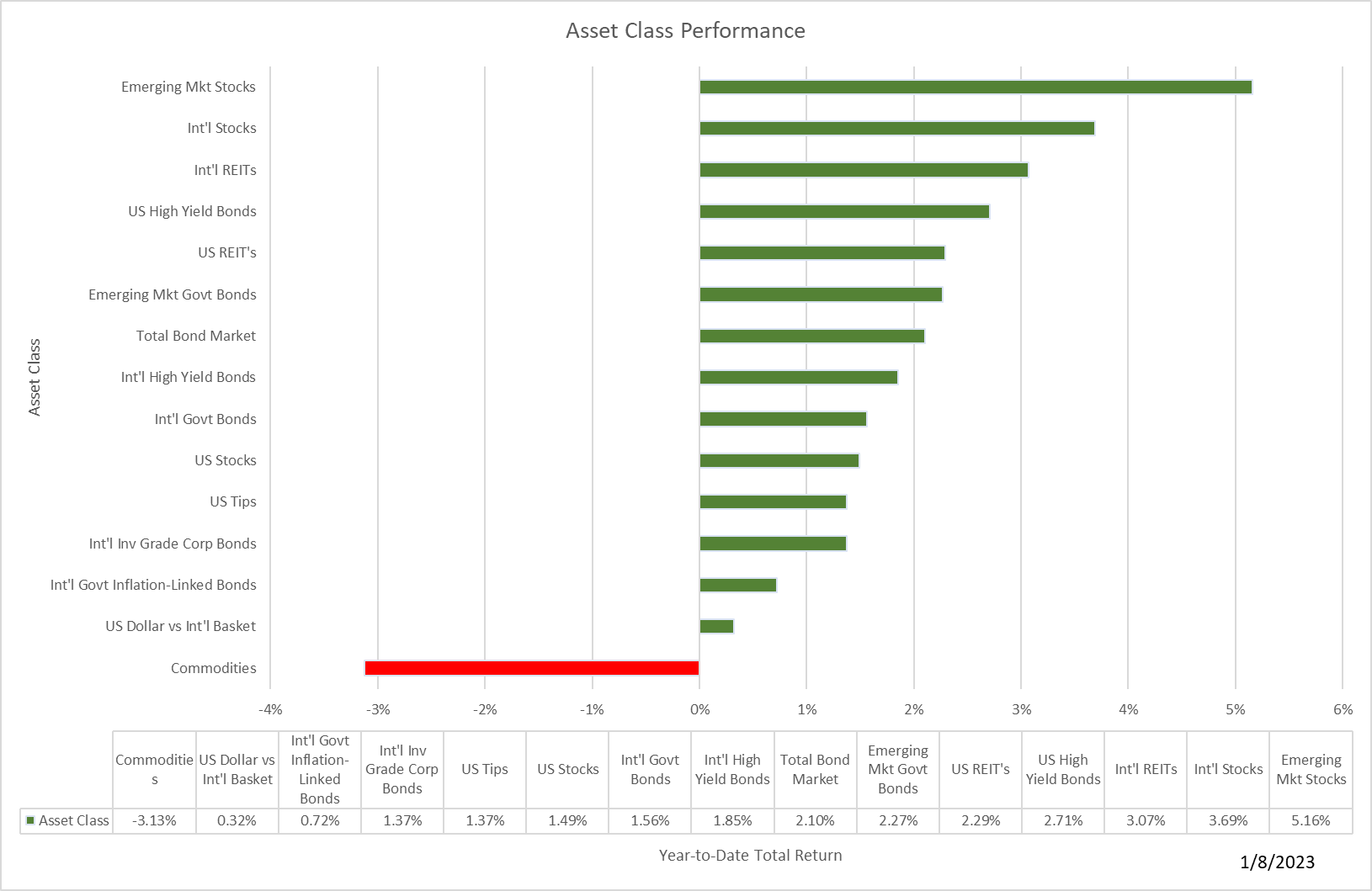

We're off to a good start! Everything is up except commodities.

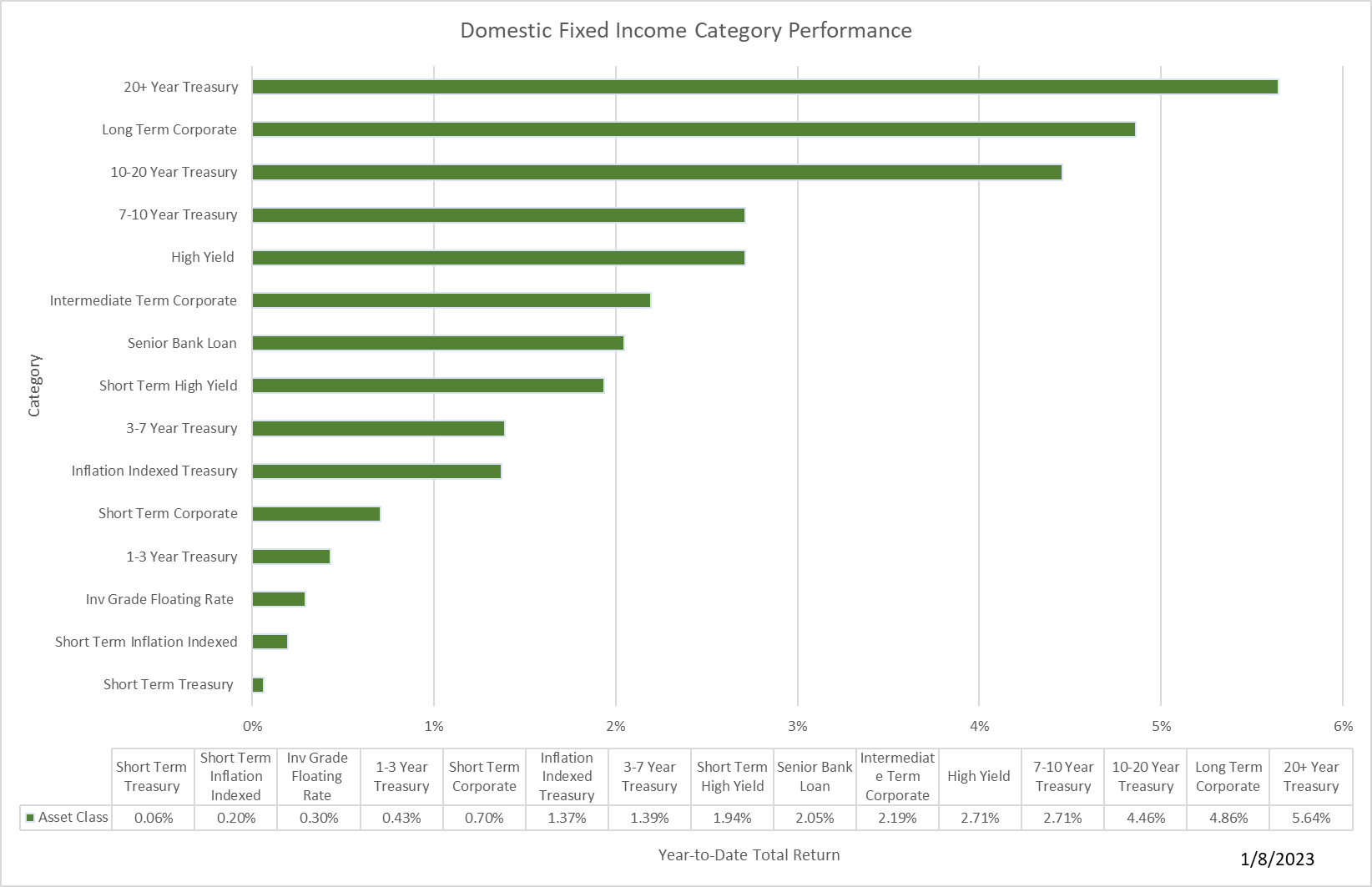

Here's some more detail on bond performance. All good!

Download the market update for more details:

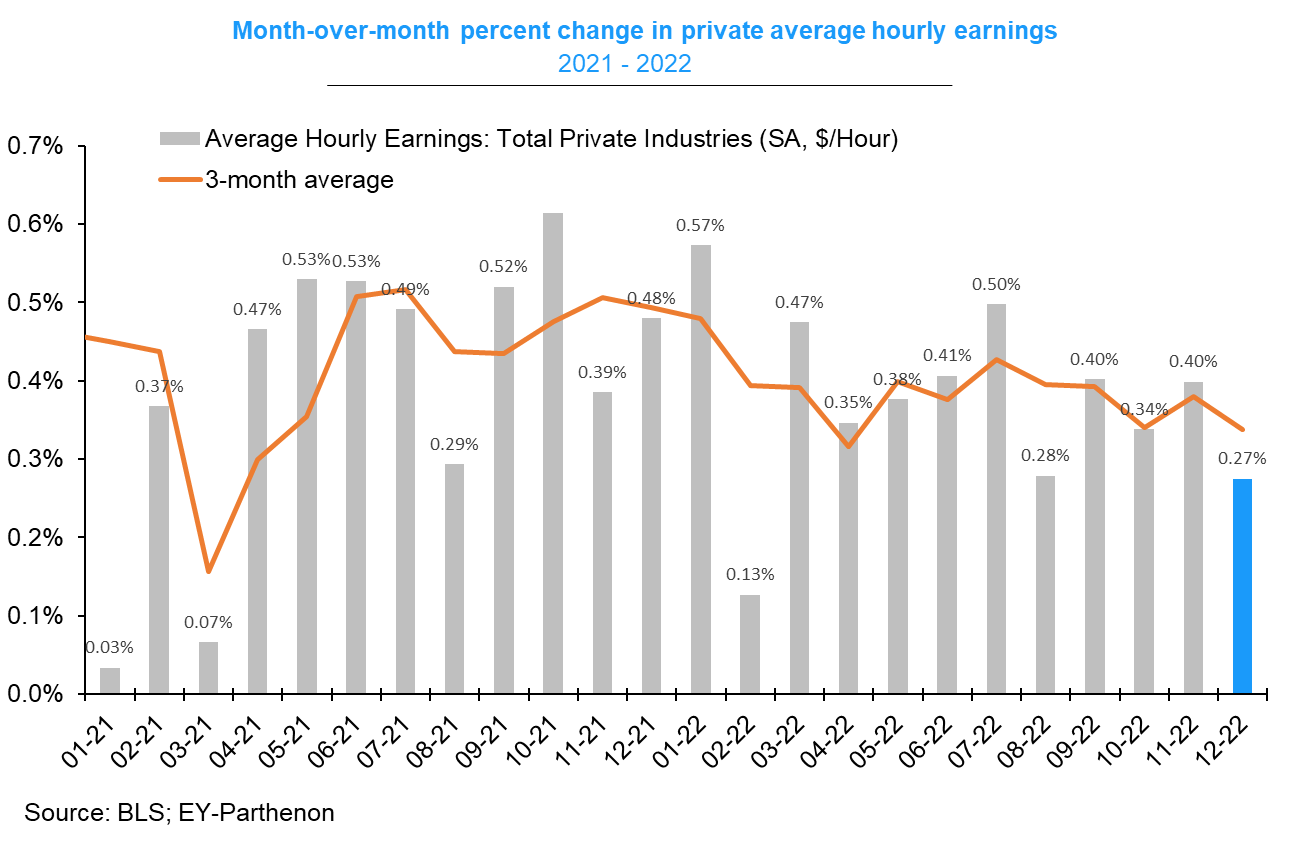

Why the broad-based rally? The Bureau of Labor Statistics on Friday (1/6) reported that growth in average hourly earnings slowed which should be good news for inflation and interest rates.

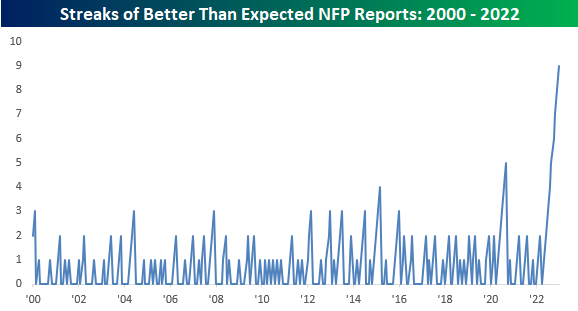

Actual employment was higher than expected, a trend that has continued for a number of months. (NFP is short for non-farm payroll.)

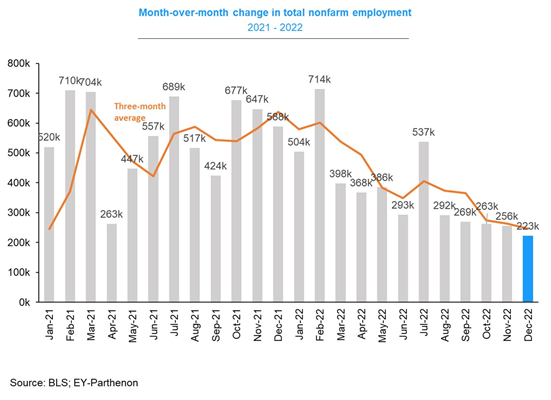

Nevertheless, the trend in job growth is down.

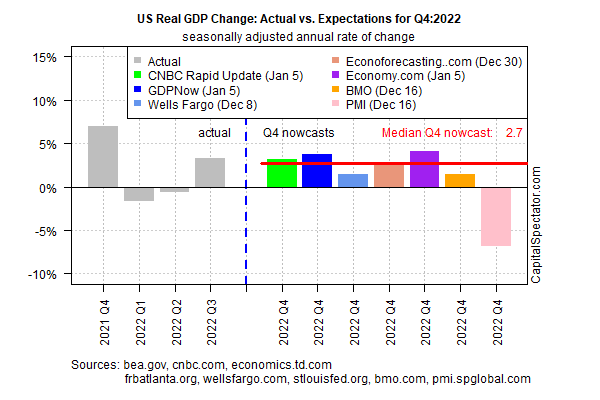

It looks like fourth quarter 2022 GDP will be nicely up if you believe these forecasts. Note, however, that the purchasing managers index is quite negative.

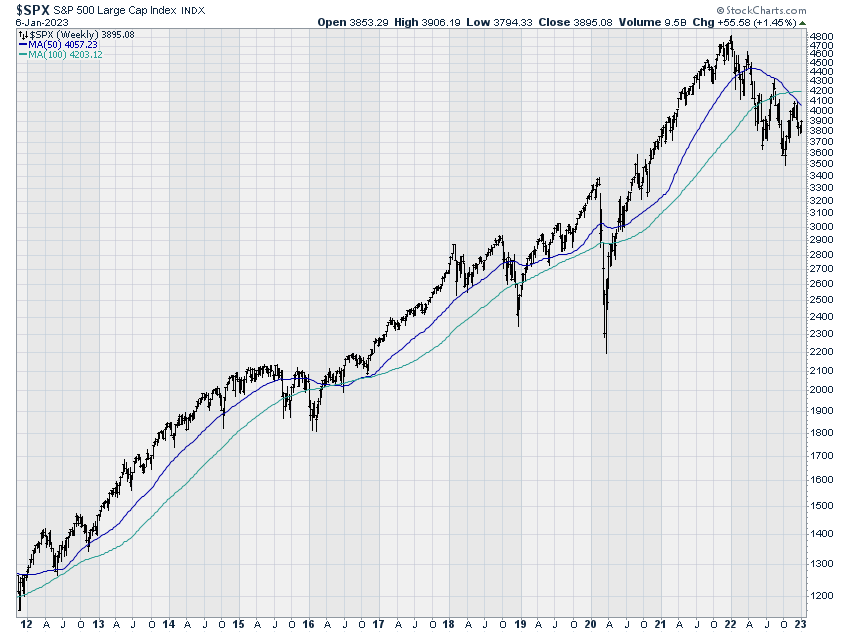

Despite last week's rally, the S&P 500 remains in a downtrend.

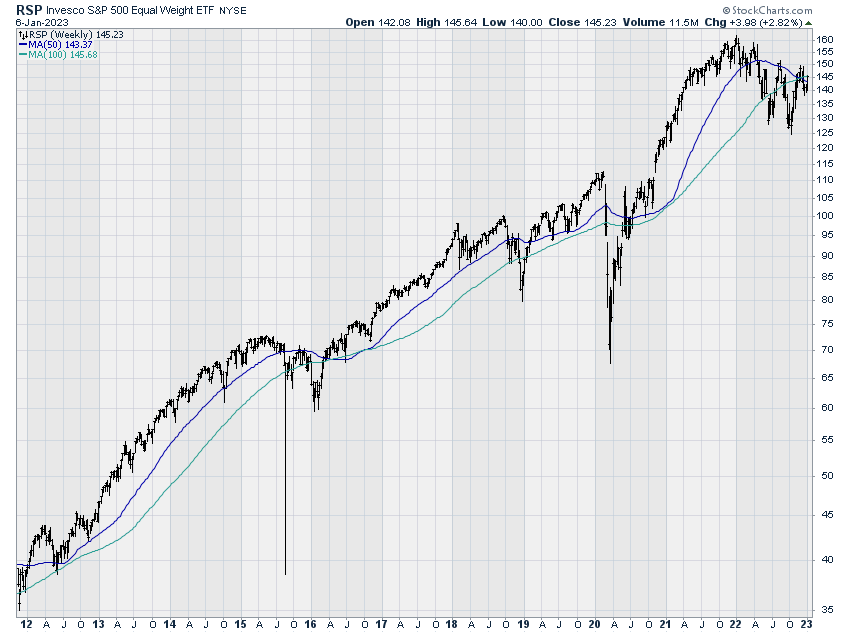

However, the equal-weighted S&P 500, although hard to see on the chart, is now above its moving averages, indicating some further gains for stocks are possible, particularly if we get some decent earnings reports.

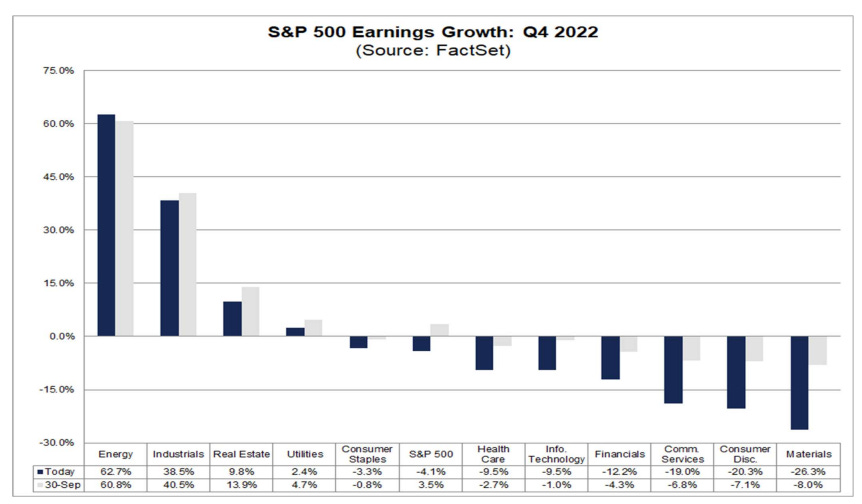

Earnings reports for the last quarter of 2022 will start soon. According to FactSet, analysts are expecting earnings for the S&P 500 to fall about 4%. (They were looking for gains last September.) This chart breaks down expectations by sector with energy being the best and materials the worst.

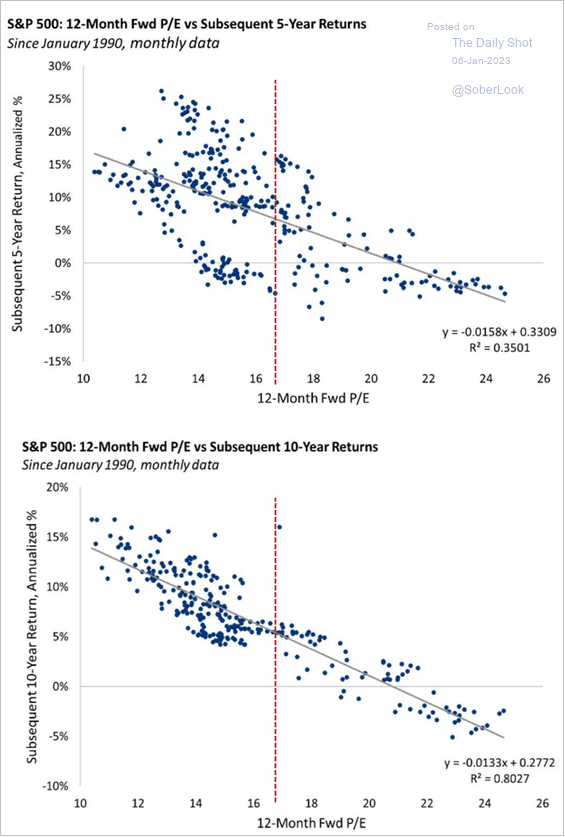

Finally, this set of charts from the Daily Shot reminds us of the link between valuations and subsequent returns. At today's approximate P/E of 17X, stocks are unlikely to produce the returns we had gotten used to over the past decade. Looks like 5%/year is a good forecast for long-term equity returns from current levels.

Thank you for reading! I hope you found something of interest in this week's Chart Attack! Please feel free to share with a friend or colleague.

You can find more Chart Attack!s on the Under A Buttonwood Tree homepage.

Chart Attack! is only available to subscribers of our newsletter, Under A Buttonwood Tree. If you're not a subscriber and would like to be, click the subscribe button and sign up. There is no cost for either the newsletter or Chart Attack! (You can also subscribe on the Home Page.)

Are you receiving too many emails and would rather read Chart Attack! on our website? Just let me know by email and you will be removed from the mailing list.

Our email address is under.a.buttonwood.tree@gmail.com

Remember, Chart Attack! is only available to subscribers of Under A Buttonwood Tree, so be sure to subscribe for access!