December 22, 2024

Did the Grinch (a.k.a. Fed Chairman Jerome Powell) just steal our Christmas rally? Or will Santa come to the rescue? We'll discuss below.

This is the last email of 2024 so to all our readers, have a joyous holiday season and best wishes for a happy, healthy, and prosperous 2025!

Performance, etc.

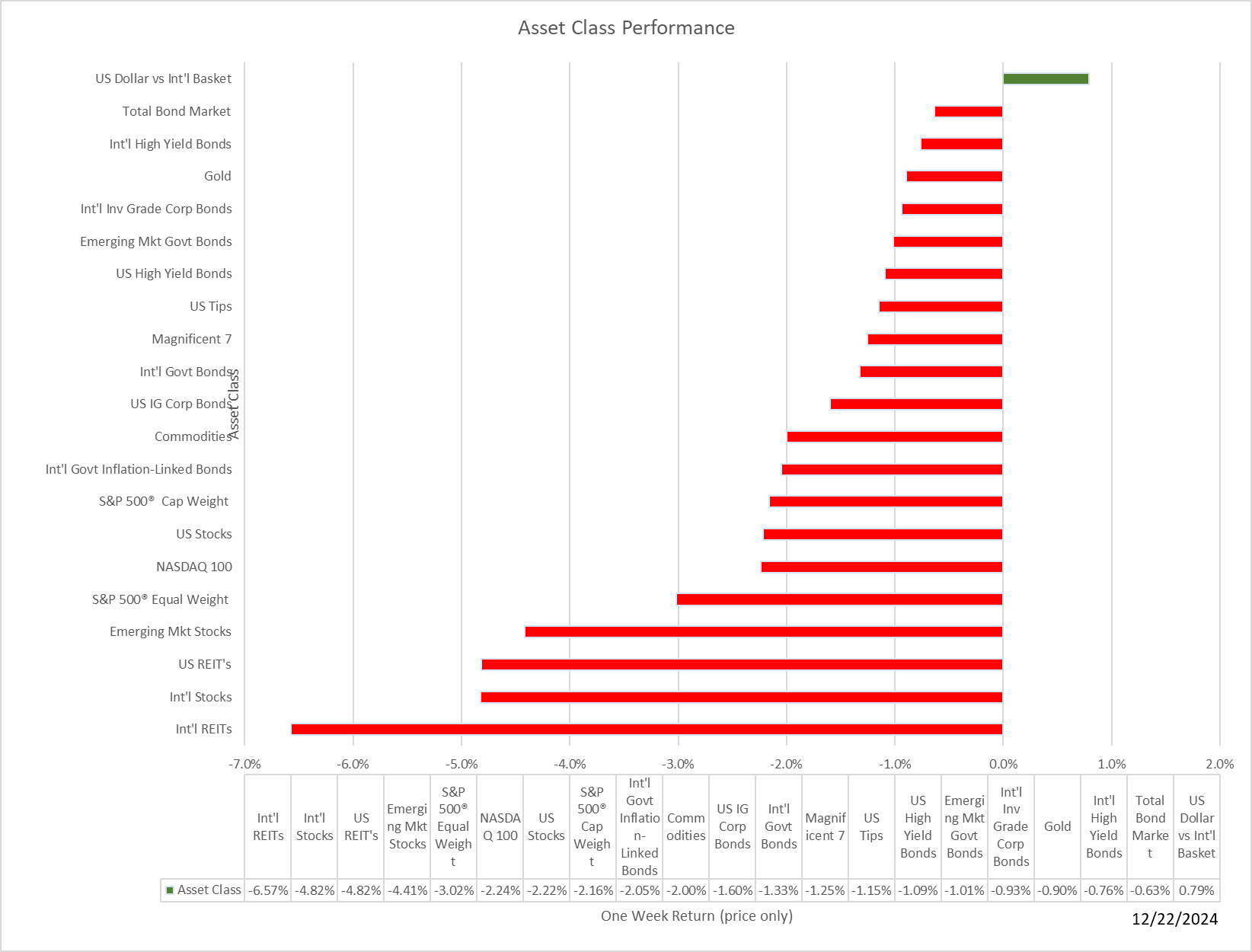

Only the Grinch would like this chart!

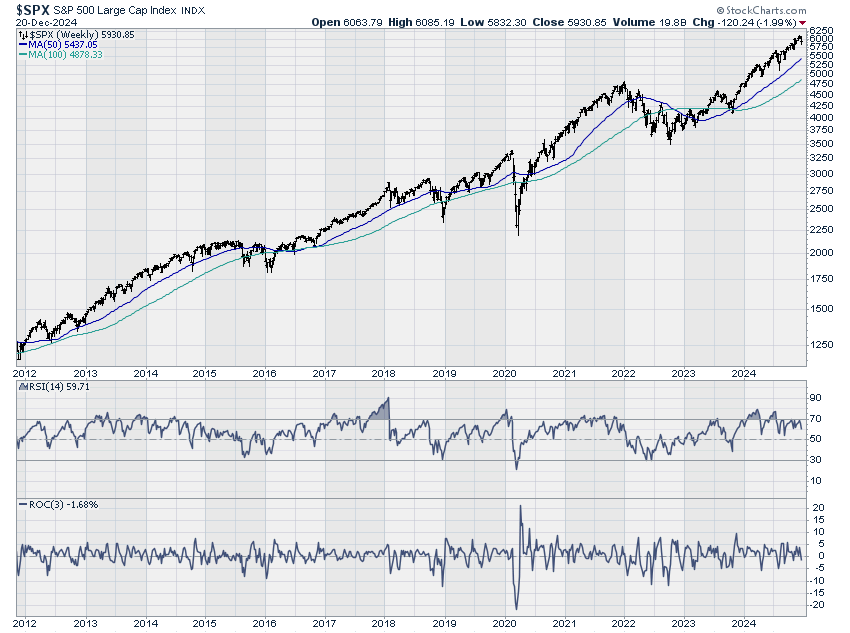

Last week hurt, but looking at the weekly chart, it was only a pinprick.

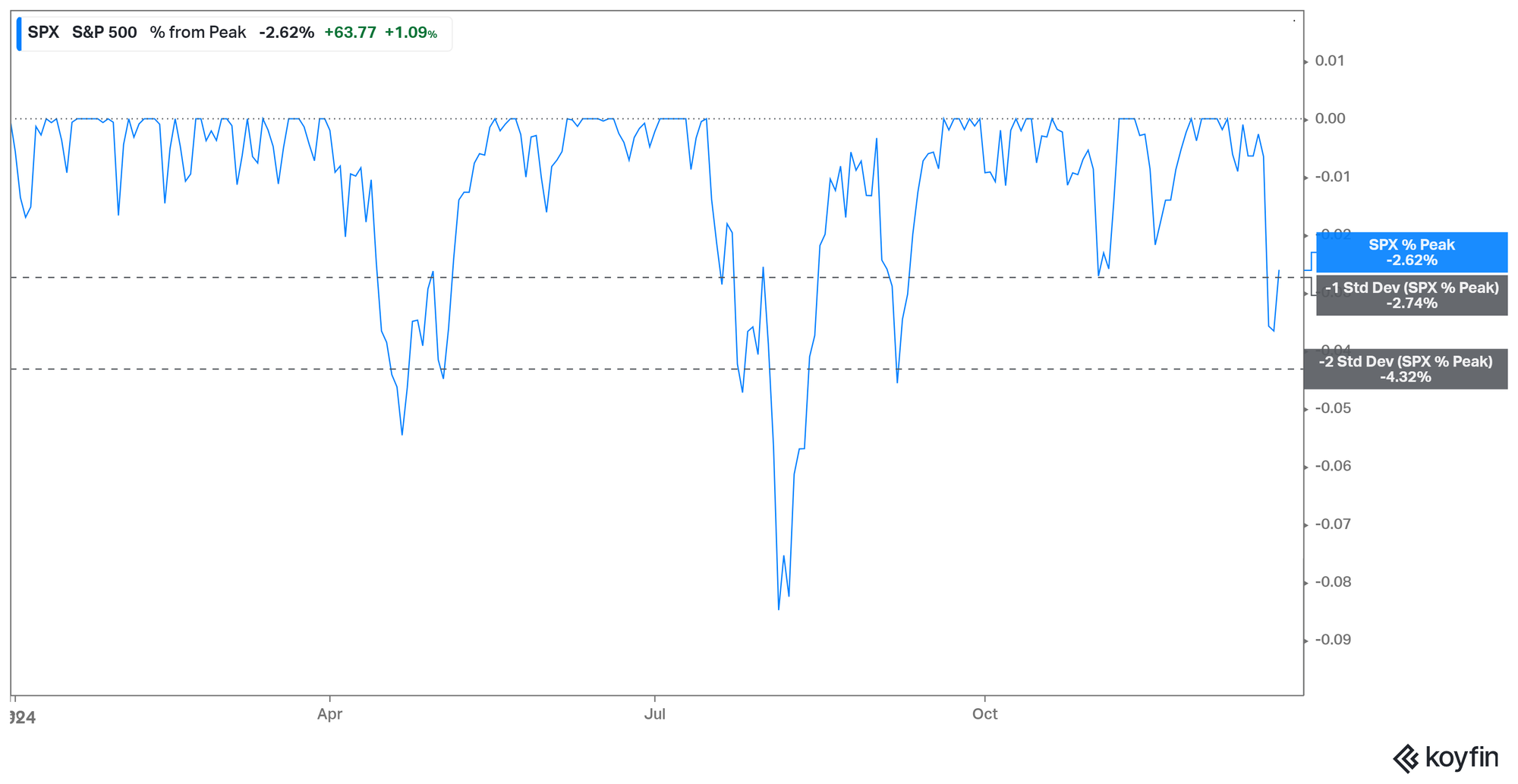

This year-to-date drawdown chart (% change from prior peak) shows the sharp drop in the value of the S&P 500 after the Fed's interest rate announcement Wednesday afternoon. Over two days, the index fell 3%. Although painful, we've had worse drawdowns since the start of the year. Whether Friday's rebound is the start of the Christmas rally or simply a respite in an emerging correction remains to be seen.

Last week's price action has left investors fearful of further declines. The past two times we saw these levels of fear, stocks rallied significantly.

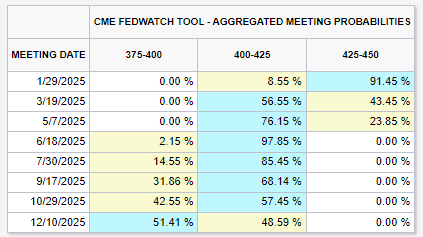

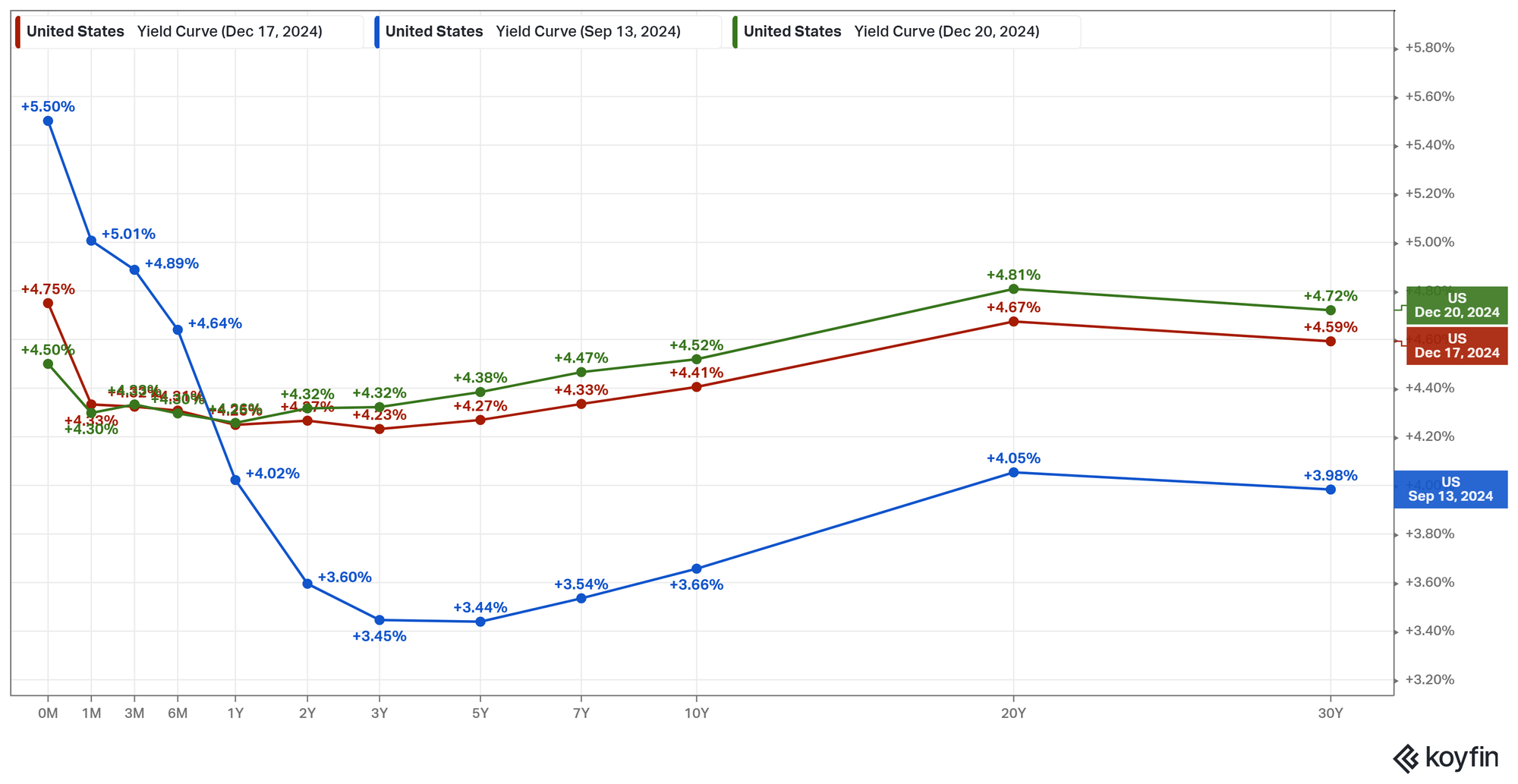

Why did markets collapse? The Fed cut rates by a quarter of one percent as expected last Wednesday. However, in their comments, the Fed noted concern for the stubborn inflation we've been observing for many months. As a result, the Fed warned there may only be two cuts in 2025, far fewer than market participants expected.

As a result, the Fed futures market is now projecting the next rate cut sometime this spring/summer.

Long-term interest rates rose after the announcement.

And there's increasing talk of the 10-year treasury hitting 6% over the next 12 -18 months. Whether this happens is a pure guess. However, given the current economic environment, it's hard to imagine rates falling significantly.

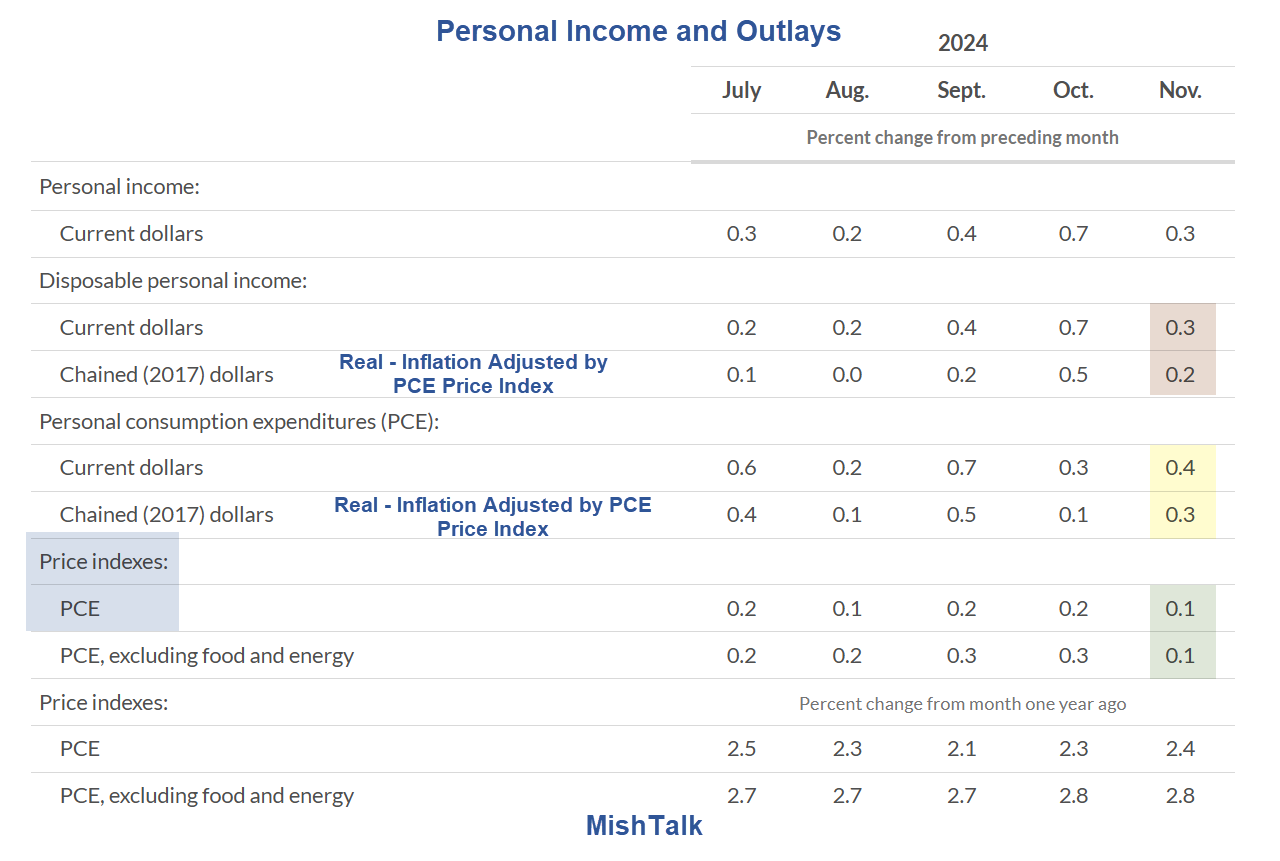

Inflation and rising interest rates are a toxic combination for equity valuations. So it was good news when the Fed's favorite inflation gauge, core PCE price inflation was lower than expected, sparking sharp rallies in the stock and bond markets Friday. I'll let Mike Shedlock explain further:

Maybe Santa will rescue our Christmas rally!

Weekly Research Survey

Jurrien Timmer provides his 2025 forecast in this week's asset allocation review.

Apollo: Daily & Weekly Economic Indicators

Raymond James: Weekly Headings Snapshot

Raymond James: Weekly Headings

Jurrien Timmer: Weekly Asset Allocation Review

And Finally,

I leave you with this performance of Hark! the Herald Angels Sing:

Can't view the video in your email? Use this link: Hark! the Herald Angels Sing

Merry Christmas!

Thank you for reading! Your referrals help us grow our subscriber base. Please feel free to forward this email to a friend or colleague.

Did some kind soul send you this Chart Attack!? To get your very own copy delivered to your email every week, click the subscribe button. Remember, there's no charge but you must be a subscriber to have access to the weekly Chart Attacks! and our Under A Buttonwood Tree website.

Questions? Comments? Contact me at: under.a.buttonwood.tree@gmail.com

Wish to support our efforts? Visit our Ko-fi page. Thank you!