July 26 - 30

Shortest Recession Ever!

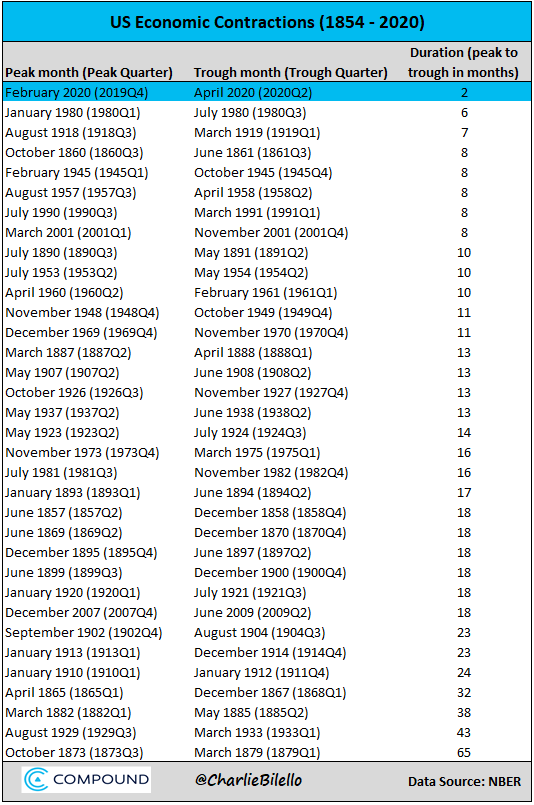

Check out this table from Compound Advisors:

The Covid induced recession of 2020 lasted just two (hellish) months! But there is more to be gleaned from this table.

First, the median length of a recession is somewhere between 13 and 14 months. Second, the duration of recessions has tended to decline over time as our economy has grown more diversified and become less dependent on manufacturing (there isn't much of an inventory cycle in the services sector).

Interestingly, the longest recession since 2000 was the 18 month period between December 2007 and June 2009 caused by the collapse of the housing bubble and ensuing financial dislocation. Is something similar about to happen? Perhaps.

Price Does Matter, Who Knew?

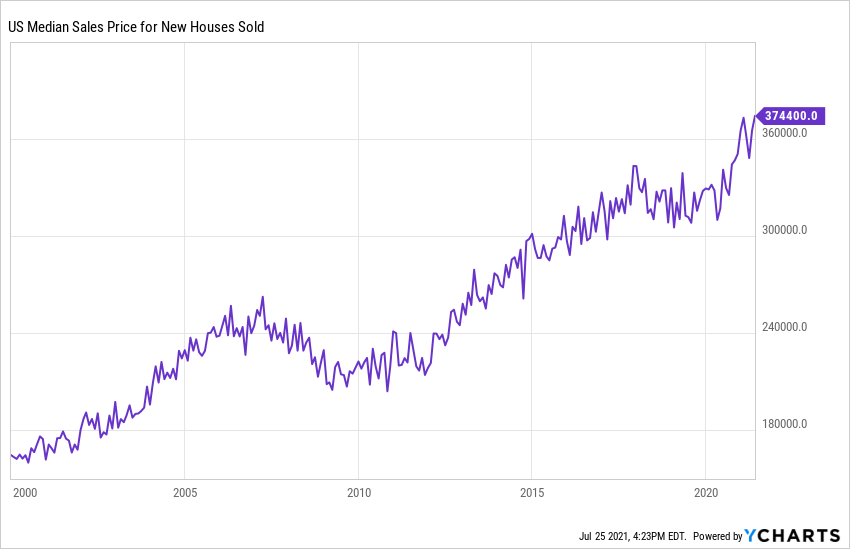

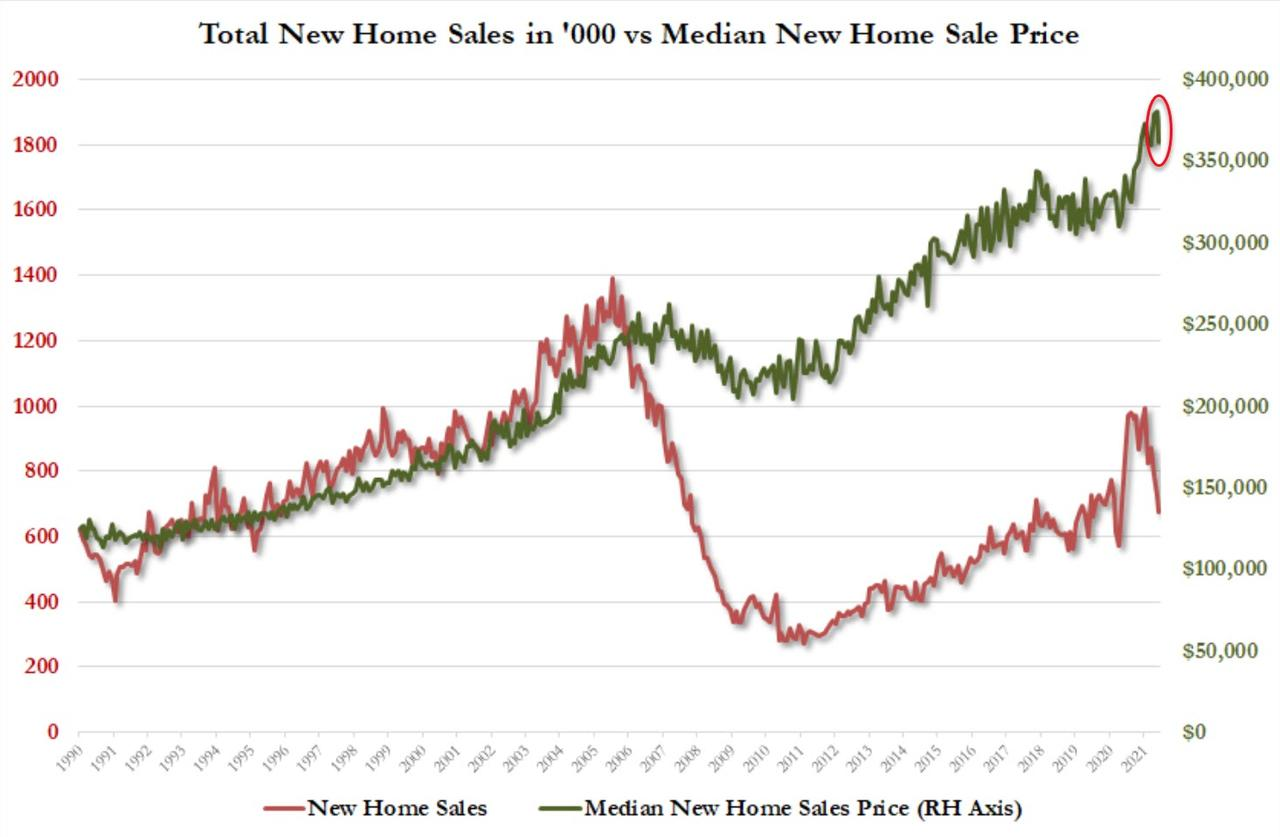

I posted the chart and comments just above showing new home prices on 7/25/21 (yes, really). New home sales for June were out today (7/26) down 6.6% versus expectations of the "experts" of a 3.7% gain. Hmmm...

Second Quarter GDP

The Bureau of Economic Analysis issued (7/29) its advanced estimate of second-quarter GDP of 6.5%. While a big number, economists had been looking for even more growth of 8.5%. (Sometimes I wonder if the definition of an economist is someone who is always wrong.) Nevertheless, 6.5% is darn good and who knows, with two revisions on the way, maybe the economists will be proven right (I doubt it).

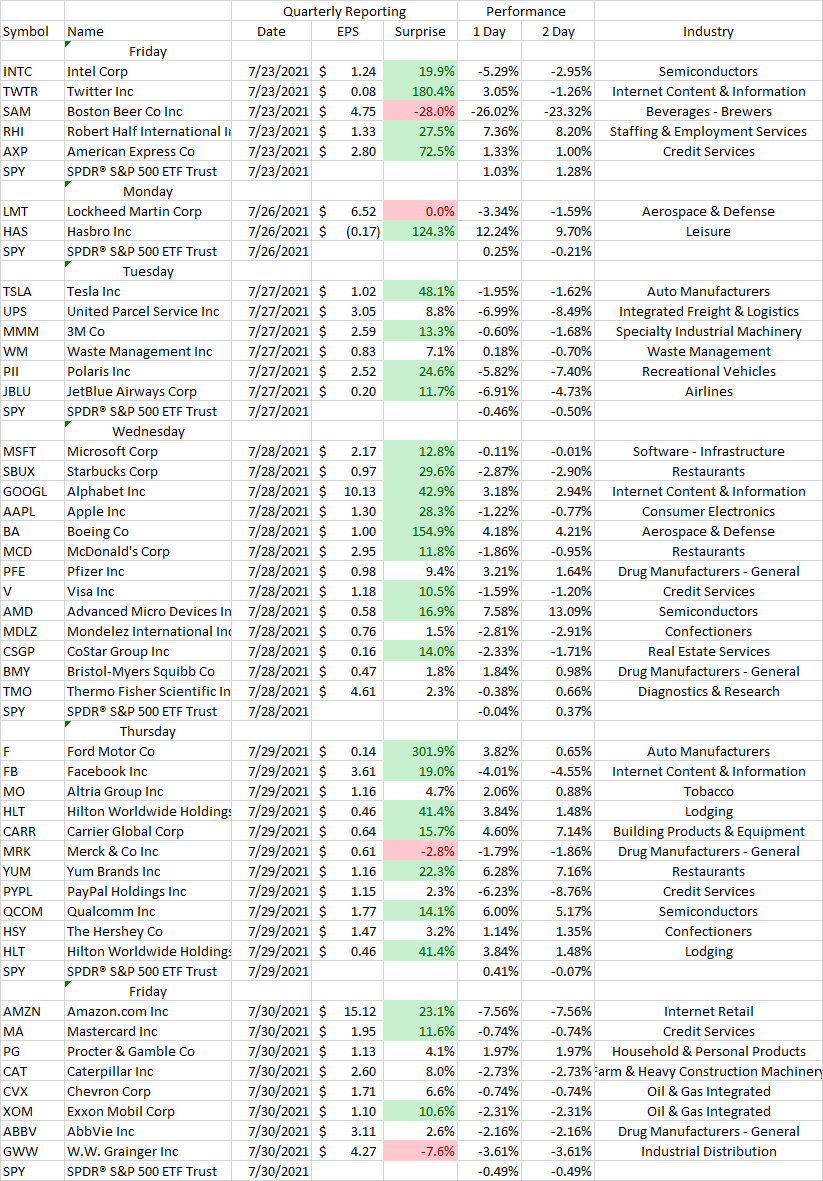

More Earnings Results:

Here is the table of this week's earnings reports. It's more of the same - very few disappointments among a huge number of positive surprises.

Note: Earnings surprises of more than 10% are highlighted in green while surprises of less than 0% are highlighted in red.

Howard Marks Memo

Howard Marks, Co-Chairman of Oaktree Capital, has just issued his latest memo: Thinking About Macro. It's long, more than a dozen pages, but his memos are always worth reading. Just click on the title!

A Book Idea:

There is a new book out on Facebook: An Ugly Truth: Inside Facebook's Battle for Domination by Sheera Frenkel and Cecilia Kang. If you are a Facebook user, investor, or just interested in "big tech", this book is probably worth reading.

Investing in Chinese Stocks? Be Careful!

Thursday (7/29) Mark Grant, Chief Global Strategist, Fixed Income at B. Riley Securities penned the following warning:

Last night some regulators in Beijing held a call with executives of some global investors. These included carefully chosen Wall Street banks and Chinese financial groups. The Financial Times reported that there were about 12 attendees including executives from BlackRock, Fidelity, Goldman Sachs and JPMorgan. From all reports the Chinese government attempted to sooth the water, after their disastrous incursions into the Didi IPO and their change of rules on Chinese educational companies.

In my mind, both incidents proved up several long suspected issues with the Chinese government and their use of the international financial markets. First, there is no “Rule of Law” in China. Second, there is no “Due Process” in China. Third, the government does not allow audited financial statements for a variety of companies, which they claim is based upon national security concerns. They are more than happy to take your money but on their terms and not the terms of normal financial standards.

“Balderdash,” is my response, as I believe it is a cover-up of the worst sort, with the real reason being that they do not want investors to know the actual financial condition of the companies that they own, support, or represent. Bear in mind here, also, that there are really no private companies in China, as the government has their fingers, to one degree or another, in all of them.

Regulations issued by Beijing on various companies have escalated rapidly. Authorities have initiated an overhaul of how Chinese companies list overseas and the country’s cyber security regulator has announced plans to review all overseas listings of larger offerings again, on national security grounds. “National Security,” in my opinion, is the new catch phrase, and it could be used on anything, on everything, imaginable.

No audited financials. No way to confirm any sort of financial accuracy. Government intervention at will. No legal system in place to enforce any stated government regulations. In the wink, and blink, and nod, of some Chinese government official “what was,” which we relied upon to make investment decisions vanishes, and “what is,” which could be anything at all, pops into place, negating all the reasons that you were going to, or had, invested.

The Chinese are telling tales and they are tales that they hope you believe. I don’t believe them, and neither should you. They are spun from taking advantage of you, with a smirk on their face, by taking your money. Do not take them up on their offer.

I'll leave it to you to draw your own conclusions.

Not More Inflation News!?

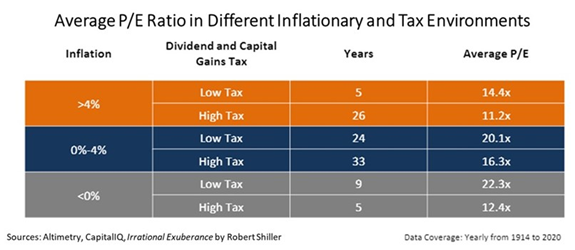

I realize my harping on inflation is getting tiresome. Maybe this table will illustrate my concern as it relates to the stock market. It shows quite clearly that when you move from a low inflation, low tax rate environment like we've enjoyed for a number of years to a high inflation, high tax rate environment, the market P/E tends to fall (collapse might be a better term). This table suggests that should we sustain the current level of inflation (it's running north of 5%) and should capital gains taxes be raised as proposed by the Biden Administration, the market's P/E could fall as much as 50%. I suspect stocks with really high P/E's will be hurt the hardest.

Invest Like A Hawk:

This video of a red-tailed hawk has been making the rounds on YouTube. It got me thinking. Like this hawk being buffeted by the wind but always keeping an eye on its prey, if we could just stay focused on our investment process, despite being buffeted by the news of the day, predictions by market pundits, or the crush of extraneous data, we'd be much better investors in the long run.