July 19 -23

More on Inflation:

Perhaps I've become a little obsessed with inflation but I'm concerned that the Federal Reserve, Congress, and the Biden Administration may be on course to make one of the worst economic policy mistakes in more than 50 years, coupling easy money and unprecedented fiscal spending to boost the economy despite what appears to be an already sharply rebounding GDP. This, I fear, could result in a level of inflation most of us have never experienced. So what to do?

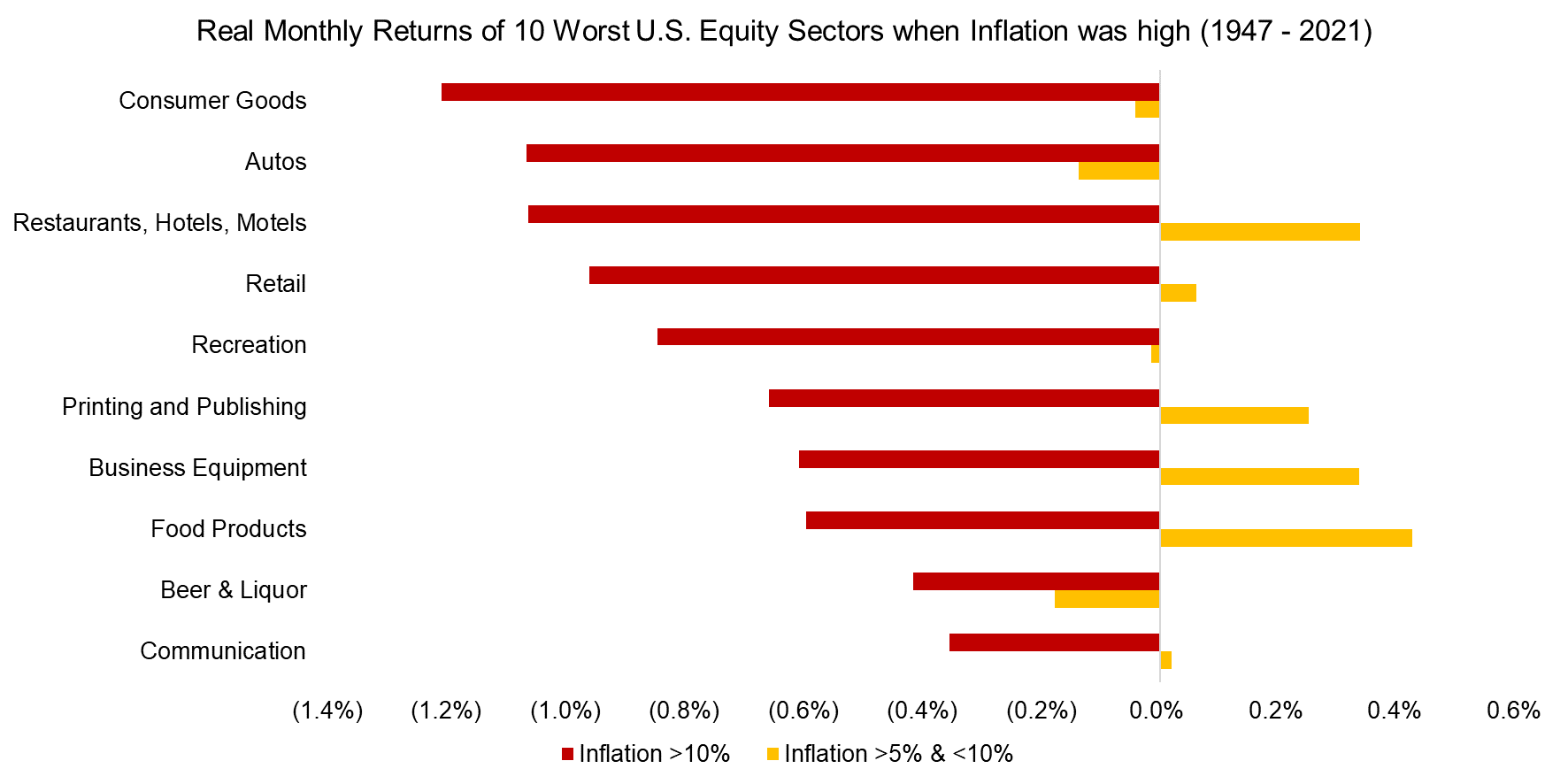

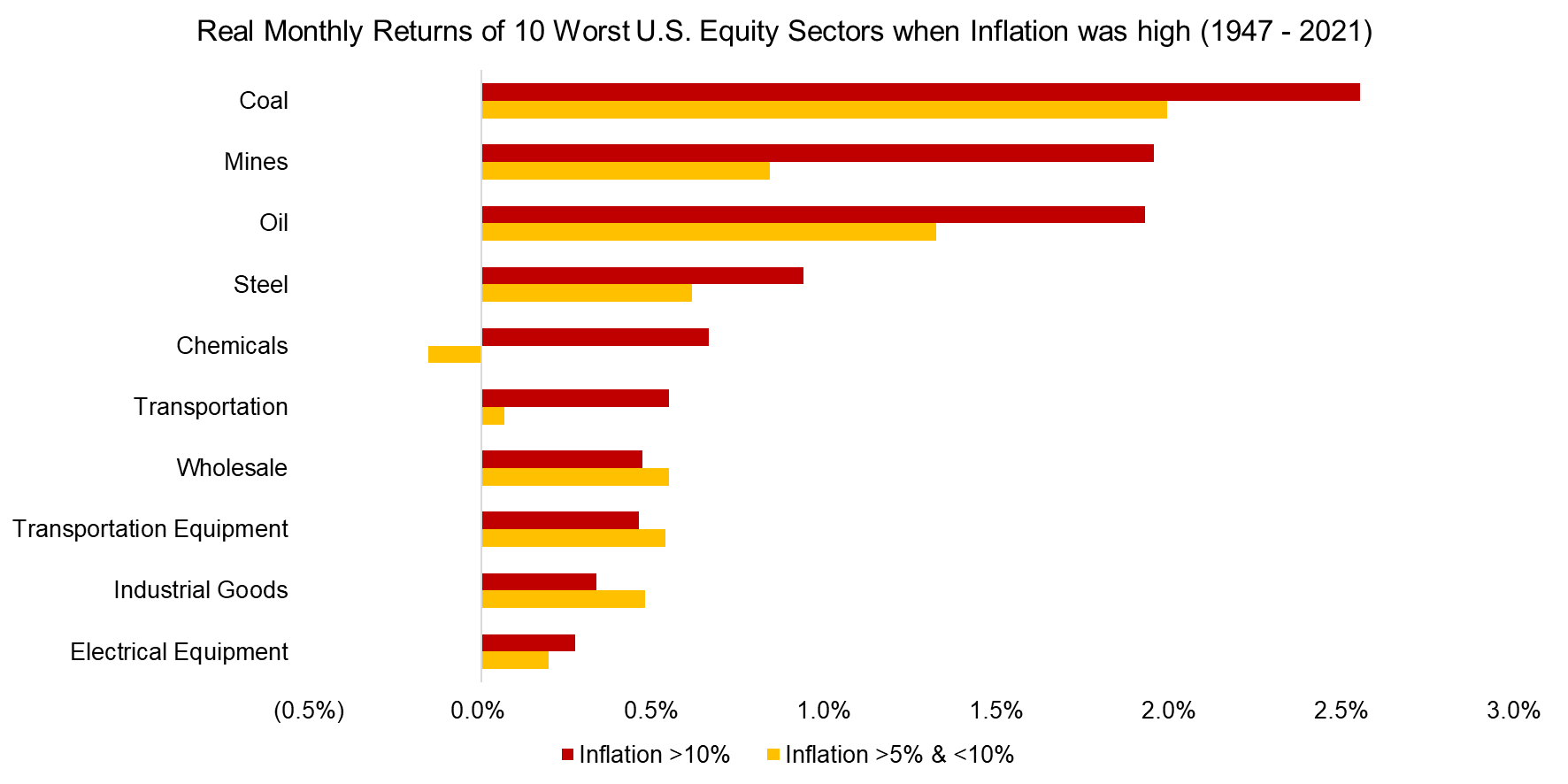

I came across two charts (among several interesting ones) from Factor Research which show the real (after inflation) returns from stocks grouped by industry under two different inflation regimes, 5-10% (where we are today?) and greater than 10% (where we're heading?).

Here are the ten worst industries:

Here are the ten best industries (the title of the chart should read 10 best not 10 worst):

As you think about your portfolio, keep in mind these two charts. The good news is we can still earn a positive real return on stocks but we've got to be in the right industries for an inflationary environment.

Will Commodities Shine?

I thought this chart from Crescat Capital, LLC was interesting.

The blue line is the relative price of commodities versus the S&P 500. When the blue line is rising, commodities are performing better than stocks. Conversely, when the blue line is declining, stocks are performing better. Note that the relative price for commodities peaked in the early 1980's and has been falling ever since.

The white line is the CPI. It too has been falling since the early 1980's - until the last few months.

The chart suggests there is a fairly tight correlation between inflation and the relative price of commodities. Does the recent jump in CPI suggest a change in the relative price of commodities after a 40-year decline? Sure seems plausible.

Check out the charts above. The ten best-performing industries in an inflationary environment are almost all commodity-related.

A Nice Review for Market Geeks:

FTSE Russell produces a quarterly review of US Stocks based on their indexes and sector breakdowns. This link will download the latest Russell US Indexes Spotlight Report.

Second Quarter Earnings Reports:

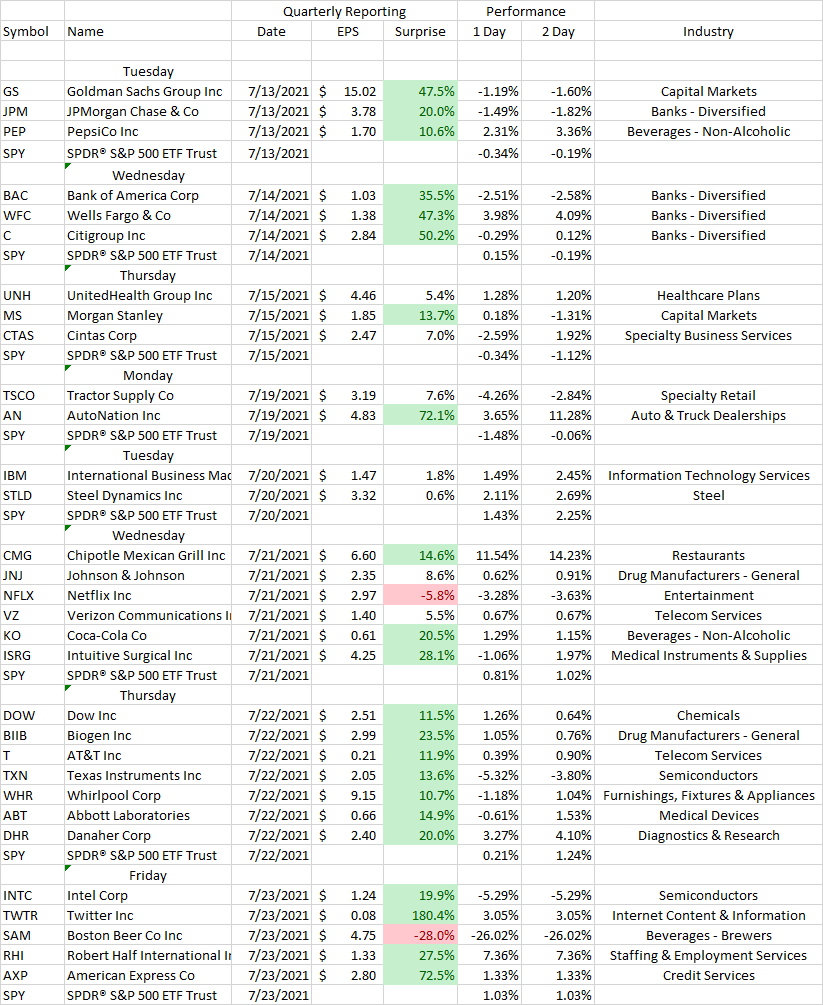

The table below highlights recent earnings reports:

Highlighted in green are reports that significantly (>10%) exceeded estimates. In red are those that missed estimates. A couple of observations: First, there are a lot of greens and very few reds (Boston Beer being the most notable) which speaks to the strength of the economy's recovery (and/or a lot of pessimistic analysts). Second, although banks uniformly beat estimates, they performed poorly (worse than the S&P 500) in the days subsequent to their reports. Third, two leading tech stocks, Texas Instruments and Intel performed poorly despite positive results. We'll get a better read on the tech sector next week when many of the largest tech companies report. Lastly, Netflix disappointed investors suggesting the boom in stay-at-home stocks may be drawing to a close.

An Energy Breakthrough:

One of the problems with generating electricity using solar or wind power is that they often generate surplus power when the sun is shining or the wind is blowing but nothing otherwise. This feast or famine issue can be a big problem for electric grids. Scientists and engineers have been trying to solve this problem by developing battery technology to store the surplus electricity for use when the sun or wind isn't providing power to the grid. However, large-scale battery storage is very expensive and not practical. Except, thanks to Form Energy, that may no longer be the case. Here's a link to a recent article in The Wall Street Journal describing Form Energy and its technology. There's a long road ahead but Form Energy is a private company to watch, in my view.

From the Garden:

Phew!

You've made it to the end. If you've found this newsletter worthwhile, please feel free to forward it to a friend. Thanks!