July 12 - 16

Airline Travel:

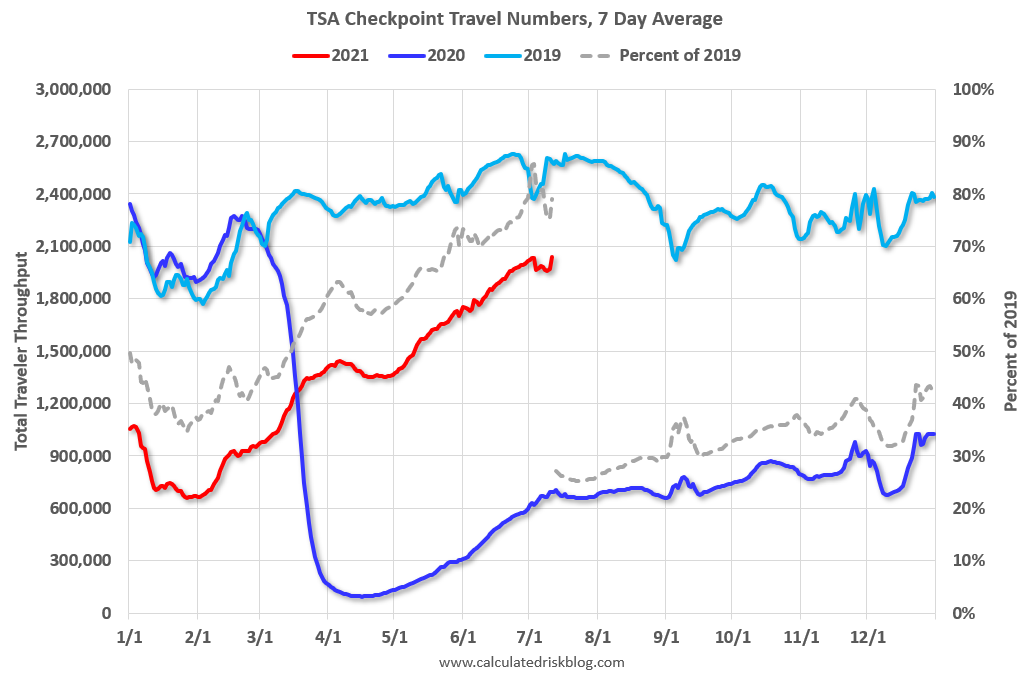

The TSA provides a daily count of passengers passing through their security checkpoints. Here's a graph of passenger counts (seven-day moving average) from 2019, 2020, and so far in 2021. This particular chart is provided by CalculatedRISK.

This is a great concurrent indicator of the willingness of individuals to get out of their homes and back to normal living. We are now about 80% of the passenger counts in 2019. That's a long way back from the pandemic lows of Spring 2020 and it seems to me this could bode well for travel industry stocks if we can get past the "Delta Variant" scare.

Speaking of COVID:

Here's an interesting article on Moderna (MNRA) in Bloomberg Businessweek: Moderna's Next Act.

Inflation:

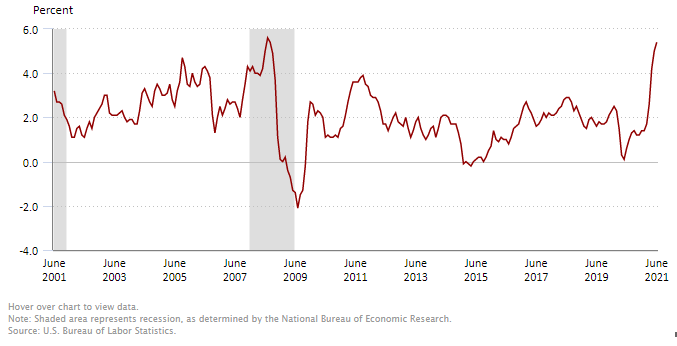

This is taken directly from the July 13, 2021 press release from the Bureau of Labor Statistics (emphasis mine):

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.9 percent in June on a seasonally adjusted basis after rising 0.6 percent in May, the U.S. Bureau of Labor Statistics reported today. This was the largest 1-month change since June 2008 when the index rose 1.0 percent. Over the last 12 months, the all items index increased 5.4 percent before seasonal adjustment; this was the largest 12-month increase since a 5.4-percent increase for the period ending August 2008.

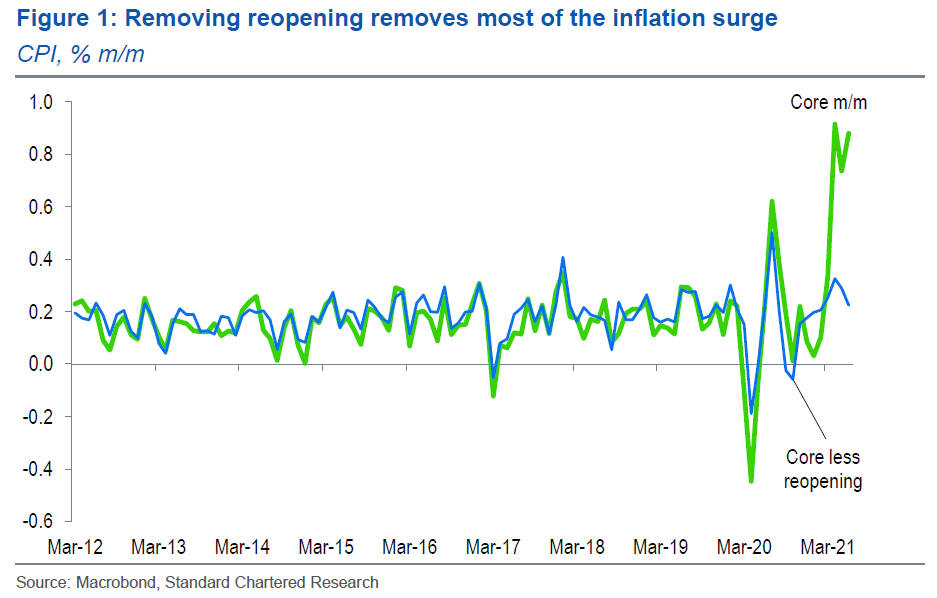

There are a number of reasons for inflation's sudden acceleration. They include temporary factors such as pandemic-induced supply bottlenecks coupled with a post-pandemic rebound in demand for goods and services. The chart below attempts to make adjustments to the CPI to reflect the impact of the economy's reopening/recovery. It suggests that inflation will fall back to a more comfortable level after supply and demand come back into balance.

Here's another look at inflation suggesting the recent spike is likely temporary:

However, my concern is the extreme fiscal and monetary stimulus, both currently occurring and proposed, has the potential to turn a temporary increase into significant long-term inflation with the potential for devastating impacts on the economy.

Either way, inflation will have an impact on interest rates and the financial markets - not all of it good.

Corporate Reports of Note:

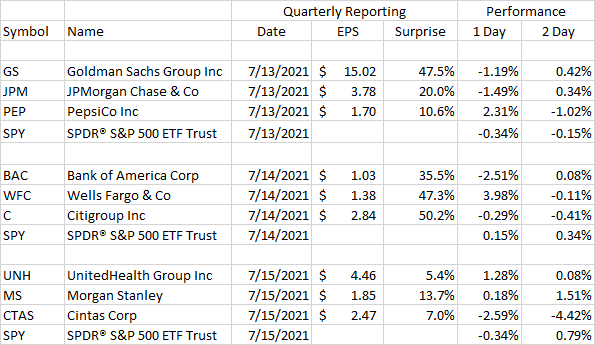

Here's a table of notable earnings reports this week. I've included reported earnings, surprise ( the percentage difference between reported earnings and analyst's estimates), and the stock's performance 1 and 2 days after the report. You will also notice I've included the performance of the S&P 500 for the same dates for comparison.

Earnings reports from the big banks were far better than expected. Other companies' reports were also good albeit less "surprising". The performance picture, however, is mixed with some stocks performing well after their report, others poorly.

We're going to get a lot more reports next week which will hopefully give a better picture of what's going on...

A Note of Caution:

I monitor on a regular basis several "cross-market" indicators, in particular, the relative price of lumber and copper versus gold, the relative price of utility stocks versus the S&P 500, and the price of intermediate versus long term government bonds, to give me an idea of whether or not investors are becoming more or less risk-averse. At a later date, I will describe these indicators in more detail, but for the first time in many months, all are suggesting that investors are becoming more risk-averse.

In addition, for the first time in many months, we are seeing initial signs of change in our momentum indicators. Specifically, the equal-weighted S&P 500 dipped below its 50-day moving average on Friday suggesting the broad-based advance we've been experiencing may be losing steam. The rest of my momentum indicators remain positive at this time (7/16/21).

I just want you to be aware of the potential for a change in the market's direction. Are we are about to have a (much needed) correction? Maybe.

I'm not suggesting you take any particular actions, but perhaps it would be a good idea to add a bit of caution to your investment decision process in case these indicators deteriorate further.

From the Garden:

The daylilies are in bloom! Here's a sample from the garden:

Finally:

Was this newsletter forwarded to you? Get your own subscription for free here!