For the Week Ended July 9, 2021

The second half of 2021 has begun with quarterly earnings reports next up. I'm expecting some pretty big numbers as we continue to recover from the pandemic.

Sector Performance:

Here is an interesting table from Goldman Sachs regarding the performance of the S&P 500 during the first half of 2021:

It describes the performance of the various economic sectors in the S&P 500 and their impact on the index. For instance, while energy was the best performing sector, up 46%(!), it only contributed 1.04% of the S&P 500's 15.25% gain because energy is only 2% of the total value of the S&P 500. Technology, however, while only up 14%, was the biggest contributor to the index's performance, 3.80%, as tech makes up 28% of the benchmark. (For those of you scratching your head, a basis point (bp or bpt) is 1/100 of a percentage point.)

Another Way to Look At Stocks:

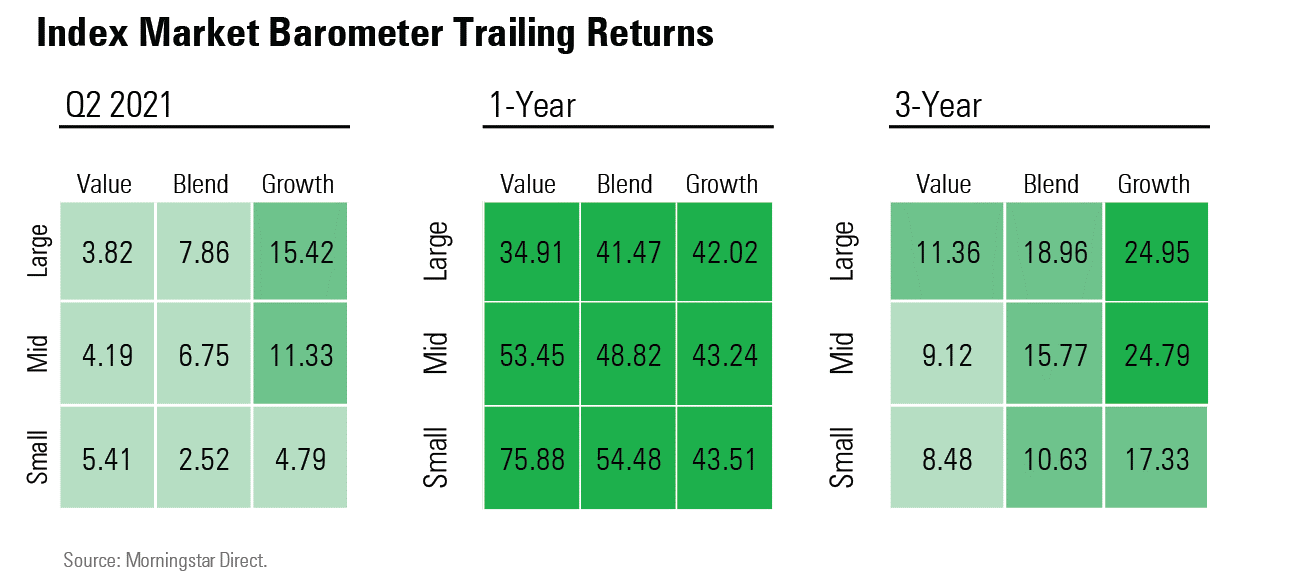

Here is a chart from Morningstar looking at stock performance based on size versus growth/value/blend. I think the information is interesting as a scorecard to you compare the results displayed with your own portfolio.

For Market Junkies:

Every month J.P.Morgan Asset Management produces the Guide to the Markets containing all sorts of charts and graphs about the global financial markets. You can go to their site and look for the Insights tab and select Guide to the Markets. A lot of the material is for clients only. However, you can download the quarterly Guide to the Markets in a pdf format. Here is a link for the most recent quarter-end guide.

Despite Recovery, Below Trend Growth Continues:

This chart clearly shows a trend break in real GDP per capita in the 2007/2008 timeframe. Why has this occurred? Is it permanent? Here's my view:

Take a look at this chart from the St. Louis Fed below. It shows the amount of federal government outlays as a percent of GDP. From the end of World War II to the early 1980's federal outlays remained below 20%. During the Regan years, which included a significant recession and military expense buildup, outlays rose above 20% for a period of time. But, they drifted back down below 20% and by 2000 outlays were about 18% of GDP.

Look what happened in the Great Recession of 2007/2008. Outlays shot up to almost 25% of GDP. While they drifted down as the economy recovered, federal outlays remained above 20%. Then, thanks in large part to the pandemic and our government's response to it, outlays surged again to more than 30% of GDP in 2020.

Excessive government spending is a drag on the economy. It takes resources away from the most productive and often gives those resources to the least productive, lowering the economy's growth potential. Unfortunately, it looks like government spending will remain at very high levels on both an absolute basis and as a percent of GDP. So, I think it is likely per capita GDP growth will remain below trend for some time to come.

Some More Economics:

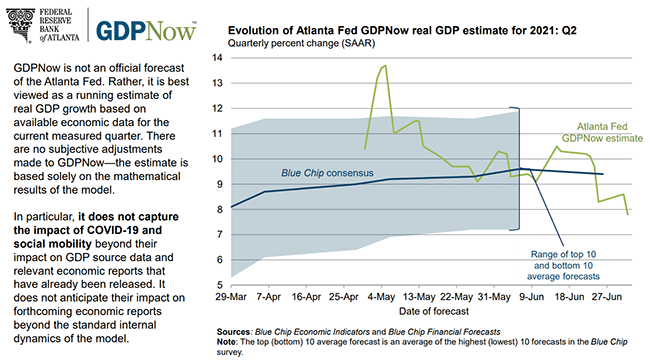

The Atlanta Fed produces a forecast of quarterly GDP which it updates as information is gathered throughout the quarter. You can see from the chart below, their forecast for Q2 has declined in recent weeks.

I'm not overly concerned or surprised by the slowing growth forecast. Second quarter GDP growth of almost 8% is still huge. Besides, as we begin to move beyond the initial recovery from the COVID recession, growth rates will naturally decline to a more sustainable rate. We will likely see a similar slowing pattern in corporate profits as the year progresses. The key for the market is what do other investors expect...

Interest Rates Falling:

The yield on the ten year treasury bond is back down below 1.4% (1.37% to be exact). While more than twice the low in August 2020,the yield is still well below 1.9% seen at the start of 2020.

Why is this happening while the economy is recovering inflation is rising well above recent trends? Pundits have suggested everything from temporary inflation, to looming economic decline, to government market manipulation as reasons for the recent reversal in rates. Quite frankly, I haven't a clue why this is happening now. However, I do know that if the economy continues to recover and inflation stays above the Fed's target of 2%, interest rates will resume their advance. Wait and see...

Finally:

If this newsletter was forwarded to you, get your own free subscription by clicking on the subscribe button or by going to our website and clicking on Subscribe at the top righthand corner of the page. Thanks in advance!