The bear is snarling.

Is It Time To Panic?

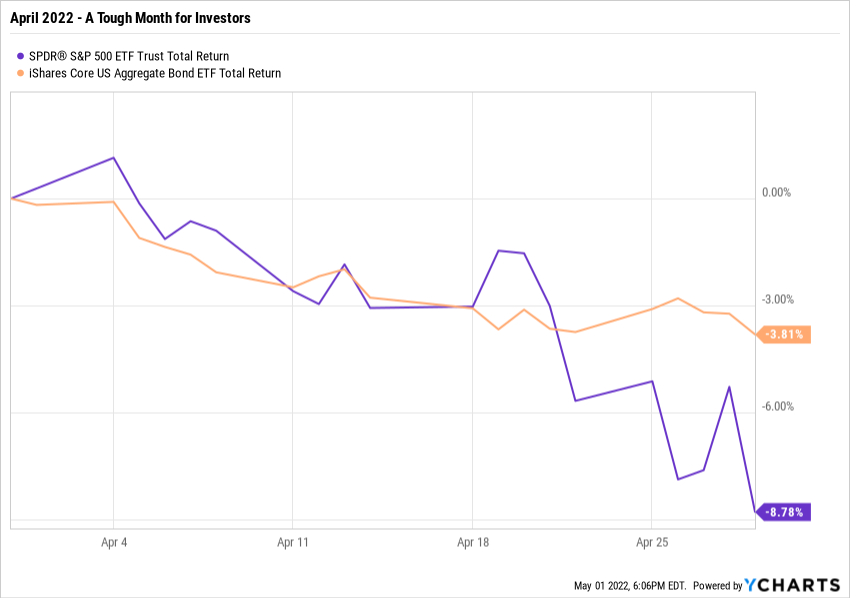

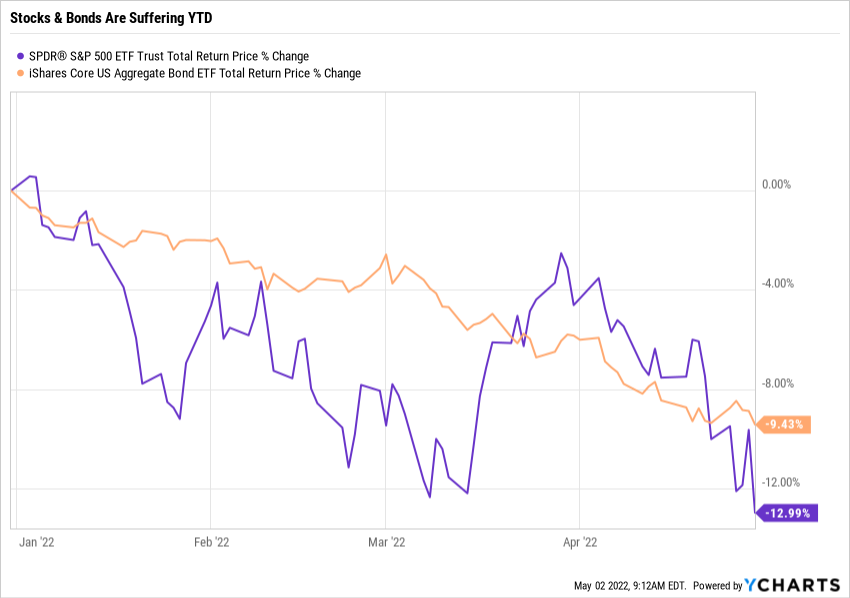

April was a painful month for investors. Stocks had their worst month since the start of the pandemic in early 2020 and bonds continued their slide as inflation and interest rates rose.

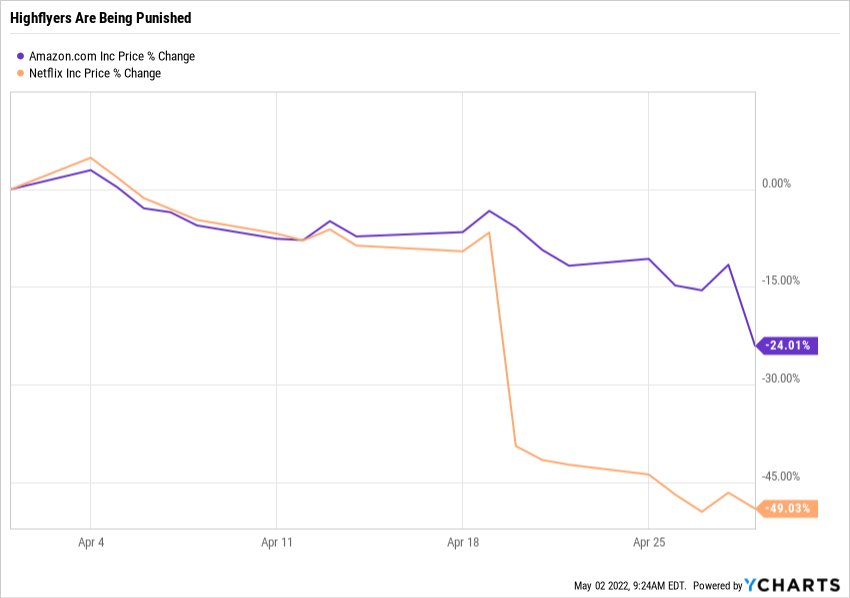

Of course, it didn't help that GDP unexpectedly fell in the first quarter and there were some high profile earnings misses, notably Amazon and Netflix (yikes!).

Stocks (S&P 500) are now down 13% year-to-date and bonds are not much better, down more than 9%. That would leave the classic 60/40 stock/bond portfolio down more than 11% so far this year - so much for diversification.

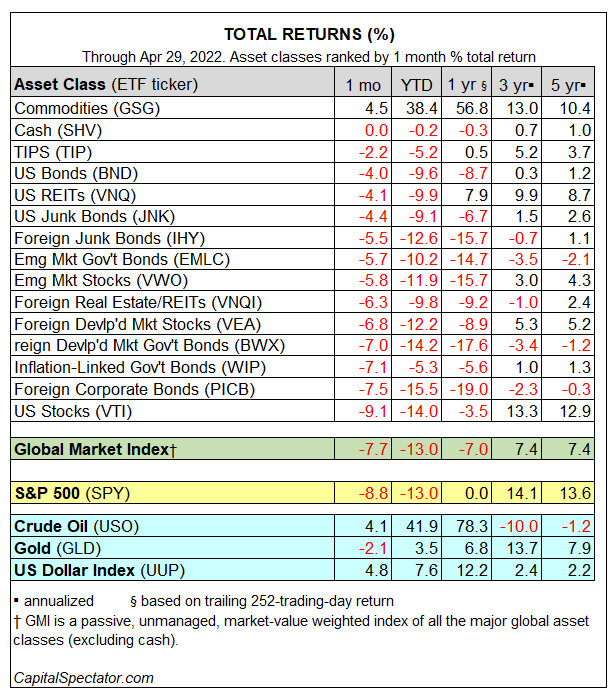

In fact, as you can see from this table, there really hasn't been anywhere to hide except commodities:

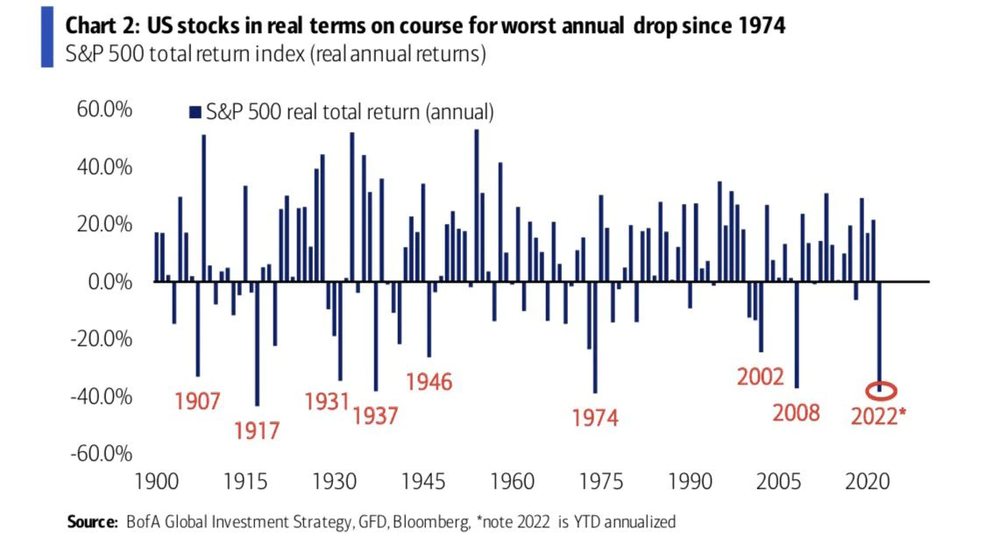

And just to make you feel worse, according to this chart from Bank of America, 2022 could be among the worst years for the market in more than a century on an inflation-adjusted basis should the year-to-date trend continue.

Our market indicators have, not surprisingly, deteriorated. The treasury bond indicator which measures the relative performance of intermediate and long-term US Treasury bonds remains positive although given the volatility of the bond market I'm not so sure it's very helpful. Also, the S&P 500 remains ever so slightly above its 20-month moving average (which we use to gauge the underlying trend of the stock market). However, given that other stock market indexes such as the Russell 2000 (small caps), the tech-heavy NASDAQ 100, and the total market measured by the Vanguard Total Market Index ETF (VTI) are all trading below their respective 20-month moving average, I take little solace in the S&P 500 being above its moving average.

Where does all this leave us? First, we are clearly in a "corrective" phase of the market with investors adjusting their portfolios to reflect the changing environment after years of falling interest rates and stable consumer prices.

Could this correction turn into a bear market? Yes. Last Friday's broad-based sell-off was a reaction to the unexpected and disappointing GDP report (-1.4%) which suggests that stagflation (low growth, high inflation) is a growing likelihood. High inflation, rising interest rates, and mediocre growth all put pressure on equity valuations.

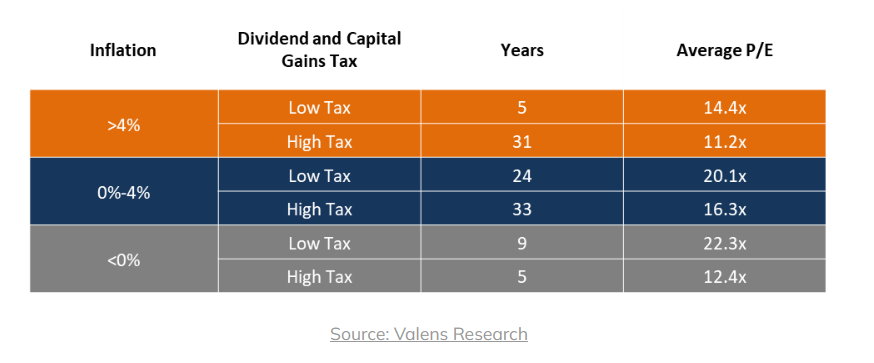

Remember this table?

If we assume the S&P 500 earnings will be in the neighborhood of $225 over the next twelve months and inflation doesn't suddenly reverse and remains north of 5%, we could potentially see the S&P 500 drop another +/- 1000 points or about 25% from current levels.

So there is a risk, perhaps a growing risk, that this correction will turn into a bear market. What should we do? First, don't panic! You don't want to up-end all your plans because the market may or may not decline further. And selling is not without its costs, in particular, capital gains and other hidden taxes or the risk of getting whipsawed by a market rebound which can happen even in a bear market. Here are a few suggestions of what you could do:

- Don't "buy the dip". Let's wait and see what the Fed is going to do (they are meeting this week) and how the market reacts before committing more capital to stocks.

- Avoid long-term bonds for now. Rising interest rates = falling bond prices. Besides a 3% yield doesn't seem that attractive when inflation is at 8%.

- Avoid high growth, highly valued stocks for now. They are the most vulnerable in a bear market.

- Don't think a stock is cheap just because it has fallen sharply during this correction. The company's fundamentals may be deteriorating or the valuation may still be too high. There will be plenty of opportunities to buy these stocks, perhaps at much lower prices.

- Let Uncle Sam feel some of your pain by first selling your losers. Do not wait for your losses to compound. If you have a stock down 10% or more, sell it. You can always buy it back. A 10% loss can be fairly easily recovered by an 11% gain. However, if you lose 25%, you will need a 33% gain to get back to even. Compounding works both ways. It is great when stocks are going up but very destructive when they are falling.

- Keep up-to-date with Chart Attack!

A Plug For Chart Attack!

Chart Attack! is a weekly compilation of charts, graphs, tables, etc., along with very brief commentary on each one. It will provide you with some additional perspective on the markets and economy, particularly important in these turbulent times.

Issues of Chart Attack! can be found on the home page. You have free access if you are a subscriber to this newsletter (also free). If you want to receive Chart Attack! via email every week (or so), send me a quick note at under.a.buttonwood.tree@gmail.com. I'll be happy to add you to the mailing list.

Have You Bought I-Bonds This Year?

In past newsletters, we've discussed the attractiveness (and limitations) of buying I-Bonds from the US Treasury. The current yield, which varies with inflation, is now almost 10%. Here's a link to the TreasuryDirect website should you have any interest (pun intended).

Where's My Refund!

By now you should have filed your 2021 income tax returns. Getting a refund? Want to know where it is? Well, use this link to the IRS Where's My Refund? page on their website to find out your refund status. There's also a smartphone app but I'm just not sure I want the IRS on my iPhone.

By the way, while it can be difficult to avoid overpaying your taxes, given withholding rules, safe harbors, etc., getting a big refund is not a cause for celebration. You just gave the US Treasury an interest-free loan that they can pay back on their own sweet time. I'm pretty sure it doesn't work the other way if you are late paying your taxes. So if you are regularly getting a refund, it might make sense to adjust your withholding and/or your estimated tax payments. Check with your tax preparer.

From The Garden

Well, its not my garden, but in Winter Park, Florida, the magnolias are still in bloom.

And Finally,

Thank you for reading Under A Buttonwood Tree! You can find previous newsletters and more information by heading over to our Home Page. And be sure to visit our Bookstore, Market Laboratory, Resources, and Archive pages.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, just click the subscribe button. A subscription includes access to our weekly Chart Attack! and it's free! (Well, not exactly. After all, it does take several minutes of your valuable time to read. But we hope you will find spending that time worthwhile!)

I'm always interested in your feedback, ideas for topics, and questions. So please click the button below.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com