In This Issue:

- Does the January barometer suggest trouble ahead for the stock market?

- Some high-profile earnings reports and dividend increases.

- Inflation and employment updates.

- Expectations Investing and Money Magic.

- Under A Buttonwood Tree news.

January 2022 Was A Dud!

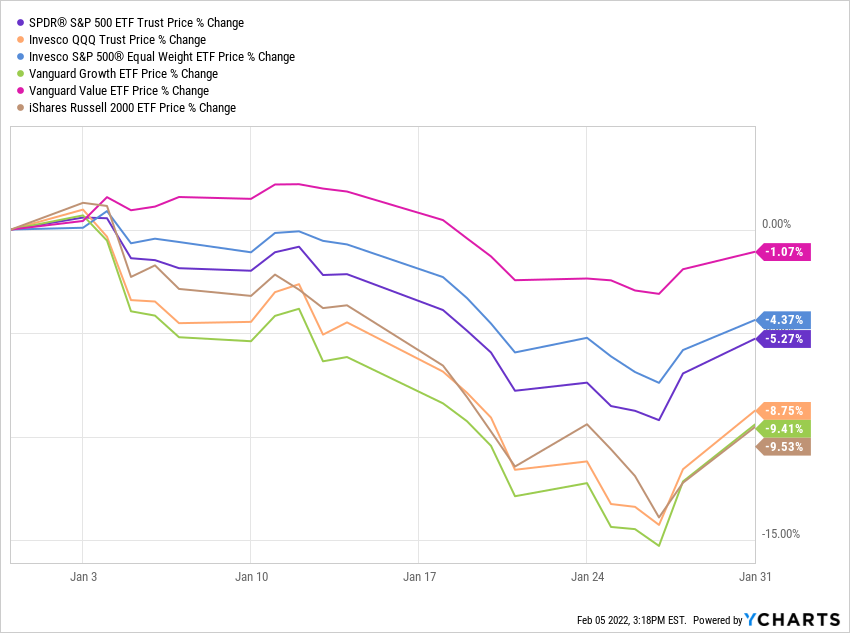

Here are the results for our stock market:

Growth stocks got hammered as concerns about rising interest rates took hold. The NASDAQ 100 (QQQ), Vanguard Growth ETF (VUG), and the Russell 2000 (IWM) were all down about 9%. Vanguard Value ETF (VTV) on the other hand was a champ, down just 1%.

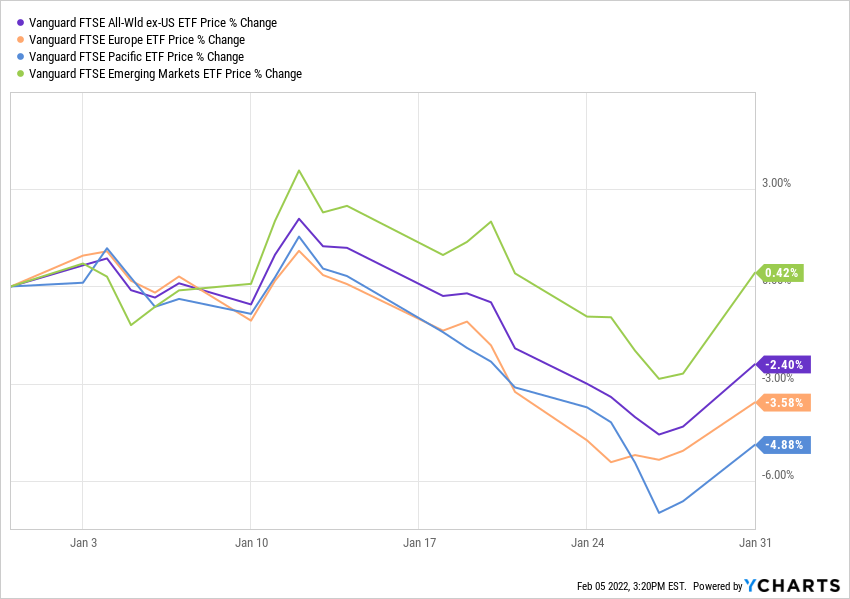

And here are the results for the rest of the world:

Foreign stocks did somewhat better with Vanguard's Emerging Markets ETF (VWO) actually posting a slight gain.

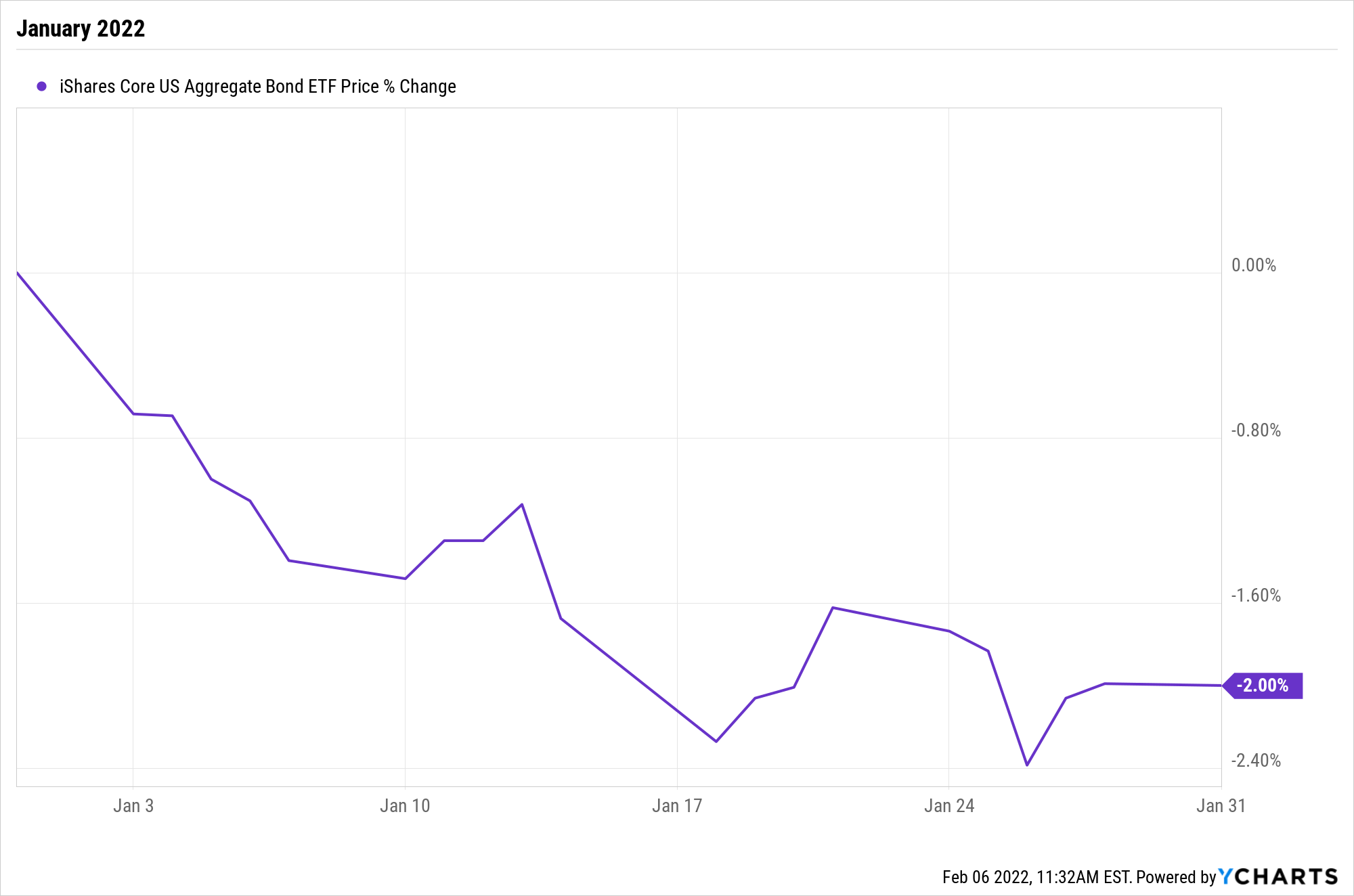

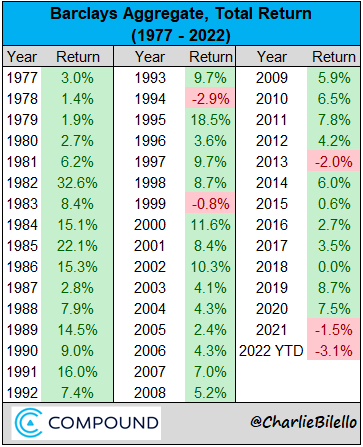

Bonds had a rough month as well. The Barclays US Aggregate Bond Index fell 2%.

And through February 4, 2022, this index is having its worst start ever.

At least it's not as bad as stocks...

You may have heard about the "January barometer", the belief that January's performance is a precursor for the year. Here's why. According to DataTrek Research since 1980:

- The S&P 500 has been up in January 60% of the time (4.1% average gains), and during the years that it’s up, SPX has gone on to finish the year up 15.5% on average.

- The S&P has been down in January 40% of the time (3.5% average loss), and during the years that it’s down, SPX has ended up only 3.6% on average.

Does this mean 2022 is going to be a tough year for the stock market? Perhaps. As Mark Twain said, "history doesn't repeat itself but it often rhymes". However, while the market faces some headwinds - rising interest rates, high valuations, and now the January barometer - there are some reasons for optimism:

- The economy is in decent shape as Friday's employment numbers evidenced.

- Despite some high-profile blow-ups, earnings are still heading in the right direction - up.

- The S&P 500 is as of this moment trading above its still rising 20-month moving average (my favorite indicator of the market's direction).

- The extreme stock valuations are clustered in high growth sectors leaving much of the rest of the market reasonably valued.

So I'm not yet sure history is going to rhyme. Stocks can still have a decent year. And if you have a well-diversified portfolio, there's not much you need to do for now anyway.

Earnings Update:

There were some notable earnings reports during the last week of January. Here is a sampling but if you want to see more head over to Investing.com's Earnings Calendar for a complete listing.

IBM reported results that exceeded expectations for both earnings and revenues. The company has been undergoing a significant transformation recently and last quarter's results are perhaps an indication the changes are having a positive impact. This story from the Wall Street Journal goes into greater depth: IBM Cloud Makeover Shows Results.

Microsoft also bested estimates for revenues and earnings helped by strong sales in their personal computing segment. The company's cloud computing segment was "disappointing" as its growth slowed from 36% to 32%. Boo-hoo.

Not to be outdone, Apple also reported great results with both revenues and earnings well above investors' expectations. Here's the report from the Wall Street Journal: Apple Posts Record Quarterly Results Despite Parts Shortages.

There were also estimate-beating reports from companies as diverse as oil service company Halliburton, healthcare stalwart Johnson & Johnson, defense contractor Lockheed Martin, and energy company Philips 66.

The first week of February contained some fireworks on the earnings front!

On Tuesday (2/1), Google posted strong results, significantly beating expectations and announcing a 20 for 1 stock split (which has little meaning unless you are an options player).

Also on Tuesday, United Parcel Service reported expectations-beating results - a positive sign for the stock and the economy.

Both stocks gained nicely on the news.

Then on Wednesday night Meta Platforms (Facebook), one of the five largest stocks in the S&P 500, disappointed investors with a miss on earnings and perhaps more importantly a miss on user growth. The stock was crushed on Thursday, falling more than 20% and taking the entire market down with it. Here are all the gory details from the Wall Street Journal: Facebook’s Stock Plunges After Profit Declines

Thankfully, Jeff Bezos and his friends at Amazon.com came to the rescue with strong earnings and an Amazon Prime price increase (among other things). The stock took off, rising almost 10% on Friday.

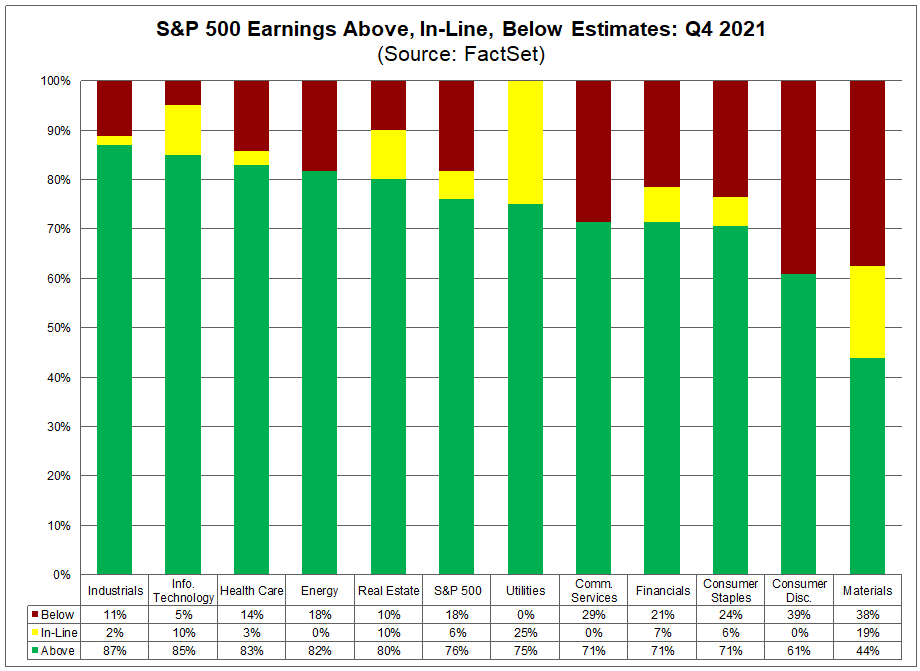

Lastly, Factset charts the number of earnings reports for companies in the S&P500 that have come in above, in-line, or below expectations. Here is their latest as of this Friday (2/4) with 56% of companies reporting:

It looks like companies in the consumer sectors and materials sector could be having more problems with inflation (passing on rising costs to their customers) than those in other sectors.

Pay Raises!

There were some notable dividend increases this past week including these listed below. If you own shares, you got a pay raise!

Dominion Resources up 6%, current yield: 3.3%

Corning Inc. up 13%, current yield: 2.6%

United Parcel Service up 49%! current yield: 2.7%

Note: The links take you to Dividend.com where you will find lots of info on dividend-paying stocks. A subscription is required for some of the more advanced features of the website. Search on your favorite stock to see what's available!

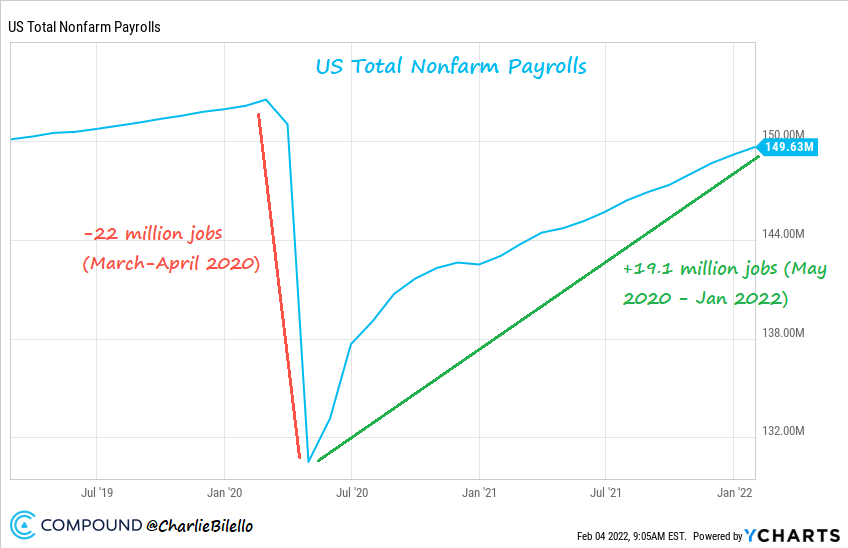

Some Good News On Employment

Earlier this week, we got a scare when ADP announced their January jobs report showing a decline of more than 300,000. Thankfully, Friday's job report from the Bureau of Labor Statistics (BLM) indicated that total nonfarm payroll employment rose by 467,000 in January. The unemployment rate was little changed at 4.0%. I'm not sure why the huge difference between the ADP and BLM reports, however, had ADP been right, we'd have a significant problem.

Inflation Watch

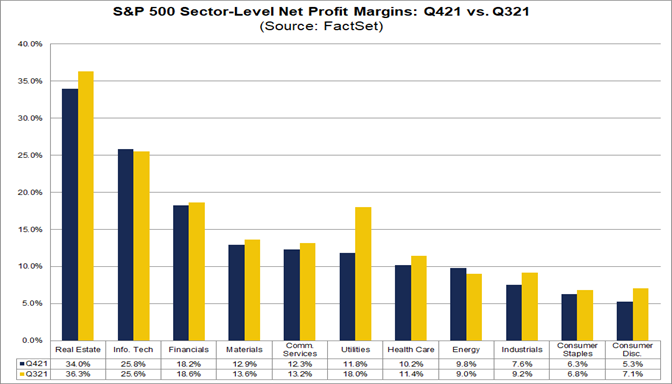

One of my concerns has been the risk that profit margins would be hurt by inflation. This graph from FactSet compares fourth-quarter profit margins so far versus the prior quarter. In all but a couple of sectors, margins are lower suggesting that companies are not able to raise prices fast enough to offset rising costs.

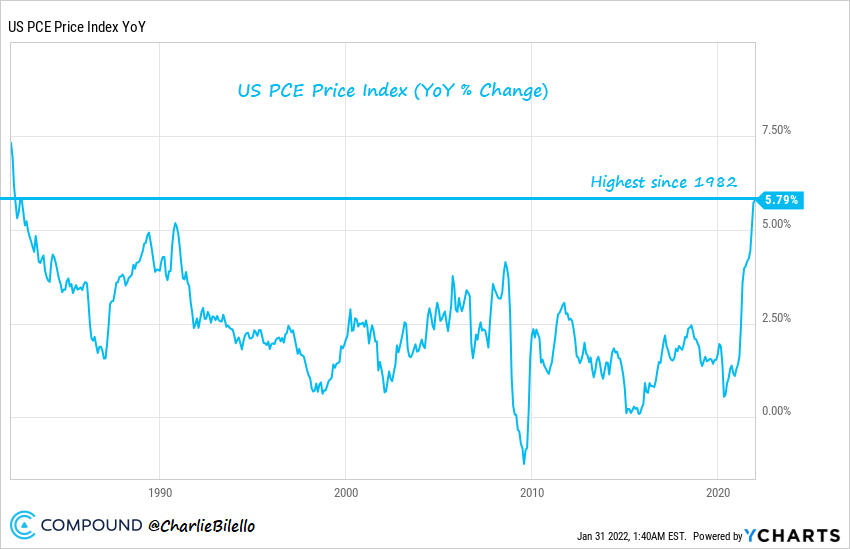

This was the headline on CNBC.com last Friday (1/28):

Key Fed inflation gauge rises 4.9% from a year ago, fastest gain since 1983

And here's the chart of the Fed's favorite inflation gauge thanks to Charlie Bilello at Compound Advisors:

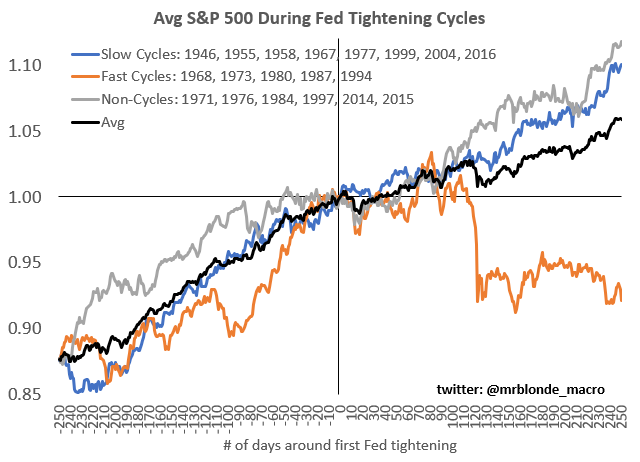

One would have to expect the Fed will be reacting to this soon with an interest rate hike (or two or three). How these rate hikes are implemented is important. As this chart shows, a rapid hike in rates is far more damaging to the stock market than slow, steady increases.

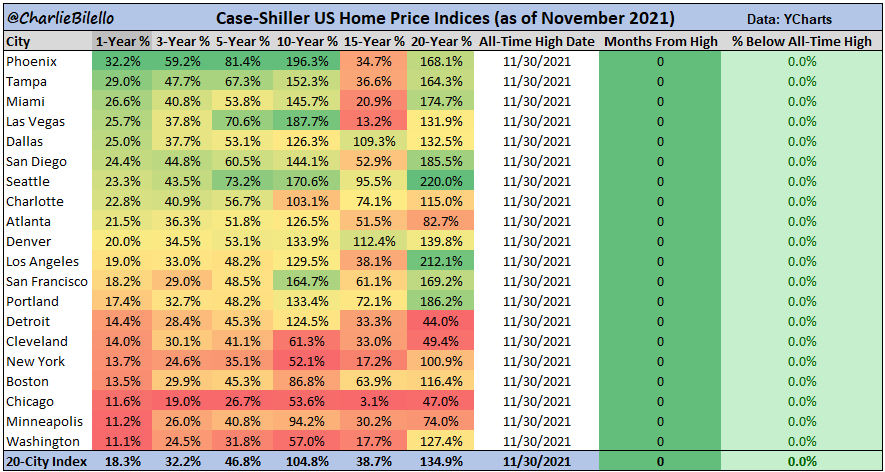

Yet another sign of inflation, housing prices hit all-time highs in every market in the Case-Shiller Home Price Index in November 2021. It's interesting to note that home prices in warmer climates are rising a lot faster than in colder climates. (Or are there other reasons in addition?)

Check out this headline from CNBC today (2/3): Amazon increases the price of Prime nearly 17% to $139 per year.

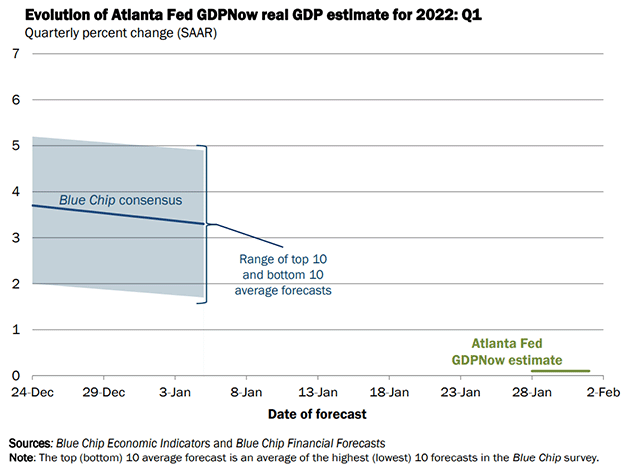

Could we be slipping into stagflation? This very early report from the Atlanta Fed suggests the economy is slowing rapidly and stagflation (slow growth and high inflation) could be here. Or perhaps slower economic growth will cool inflation - let's hope so!

It's early and Friday's employment report is not yet included in the Atlanta Fed's GDP estimate but there are some signs the economy is slowing significantly from last year's rate. What that means for inflation, interest rates and the financial markets remains to be seen.

Expectations Investing

I have mentioned before that I try to read, listen, and/or watch anything by or with Michael Mauboussin. I always learn something interesting and useful. Here is a transcript of an interview with Mauboussin and co-author, Al Rappaport regarding their book Expectations Investing. If you want to learn more from Michael Mauboussin visit The Archives for videos and podcasts or check out Michael's books in The Bookstore.

Money Magic

Laurence Kotlikoff, professor of economics at Boston University, is a prolific author. He has written more than a dozen books, many on the topic of personal finance. His newest book is Money Magic: An Economist's Secrets to More Money, Less Risk, and a Better Life. In this podcast, Kotlikoff and Professor Glenn Loury, professor of economics at Brown University discuss some of the concepts in the book. While the podcast is a bit long and the two economists can g0 off on tangents, I think you'll find it worth your time.

If you are interested in getting a copy of the book click the link above or visit our bookstore.

Wordle!

Are you playing Wordle yet? The New York Times just paid a seven-figure sum to acquire the word game. Here's a link to the official website: Wordle. If you don't know how to play, click on the ? in the upper left corner of the game to get started. Have fun!

What's New!

If you've visited our home page recently, you may have seen posts titled "Chart Attack!". "Chart Attack!" is a weekly email of charts, graphs, and miscellanea I've collected during the week. It started out as a way to keep track of potentially interesting content for the newsletter. However, I thought you might enjoy seeing these charts as well. There's little or no commentary included with the graphs so you are on your own to interpret them. Links to sources are provided in the caption when possible. These posts are only available to subscribers. Here's a link to the latest Chart Attack!

I don't want to add to the clutter in your inbox with unwanted emails. So, if you wish to receive "Chart Attack!", enter your email address and click Subscribe to Chart Attack! below. I'll make sure you get on the distribution list. Or you can check the home page or The Archives for the latest "Chart Attack!".

Did you know that you are a "Charter" subscriber to Under A Buttonwood Tree? Well, you are and it's a big deal! Charter members receive lifetime (yours or mine depending on who goes first) subscription to the newsletter, additional email reports like "Chart Attack!", access to member-only webpages, and more, all for free!

There are now less than 100 charter subscriptions left. Once they run out, access to portions of our website and other features will require a paid subscription. So if there is someone you think might like a free subscription, forward this email to them. And if you're not a subscriber, click the subscribe button. Time's running out!

And Finally!

Welcome new subscribers and old friends. Thank you! You can find previous newsletters and more information by heading over to our Home Page. And be sure to visit our Bookstore, Market Laboratory, Resources, and Archive pages.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, just click the subscribe button. It's free! (Well, not exactly. After all, it does take several minutes of your valuable time to read. But we hope you will find spending that time worthwhile!)

I'm always interested in your feedback, ideas for topics, and questions. So please click the button below.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com

Under A Buttonwood Tree is an Amazon Associate. As such, we earn commissions from qualifying purchases when you use the links to Amazon.com. You will not incur any additional cost using them and the commissions generated will help us to offset the expense of maintaining our website. Thank you!