Week of August 9-13

A Couple of Anniversaries:

On August 12, 1981, IBM introduced the IBM 5150, better known as the IBM PC. Its impact over the last 40 years on businesses and individuals is incalculable.

Here's the link to a Wikipedia article if you want to reminisce about the IBM Personal Computer.

************

This Sunday, August 15, will mark the 50th anniversary of President Nixon officially closing the "gold window" through which the U.S. was obligated to sell its gold to foreign governments at $35 per ounce.

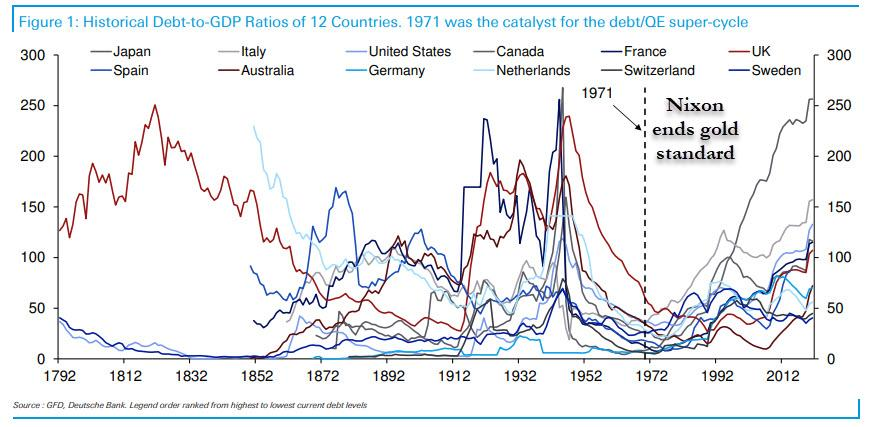

Below is a chart from Deutsche Bank showing the dramatic rise in debt-to-GDP ratios since we ended the gold standard. With many nations running debt-to-GDP ratios of more than 100% and trending higher, I wonder if we're in a better place now, monetarily speaking, than prior to 1971. Yes, there were spikes in the ratio because of the two world wars, but the gold standard forced discipline on governments to reduce their debt levels when the crises were over. Since 1971, there has been little evidence of that kind of discipline (and none in Washington DC these days!).

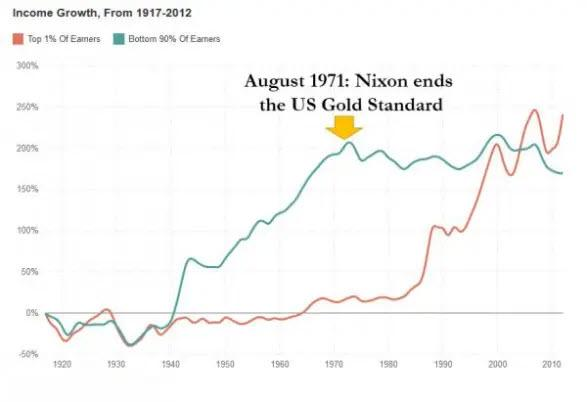

Did Nixon make a good decision? Well, for the top 1% it's worked out great, for most of us though, I'm not so sure:

By the way, gold closed at $1,776.05 per ounce today (8/13) for an 8.17% annual return over the past 50 years.

Finally, if you want to learn more about Modern Monetary Theory (MMT) you might want to read The Deficit Myth by Stephanie Kelton, a leading proponent of MMT. (Note, while I've listened to a couple of her lectures, I have not read her book.)

A Couple of New Highs:

Helped by those blockbuster second-quarter reports, the S&P 500 finished this week at another all-time high - 4,468!

The Dow Jones Industrial Average also hit a new high - 35,515.38!

Wall Street vs. Main Street

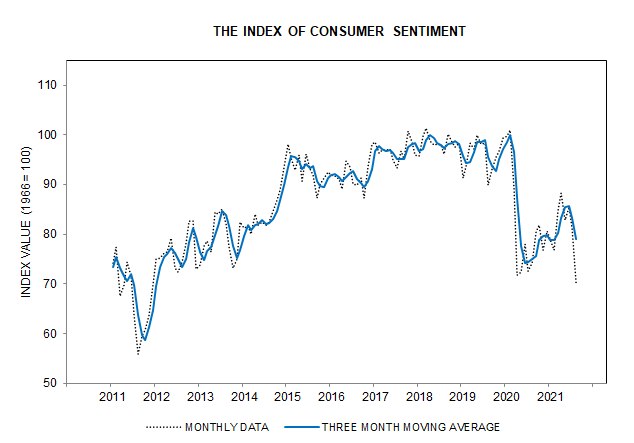

There appears to be a disconnect between Wall St. and Main St. According to the University of Michigan, consumer sentiment fell sharply in the first half of August below the pandemic lows last year. So much for all-time highs!

A New Low:

Lumber prices continue to fall with the futures contract now at $492 down from a high this Spring of $1,734! That's good news for home builders and buyers. However, this decline does raise a yellow flag when it comes to my lumber/gold indicator:

With the 13 week rate of change of this ratio below zero (the top line), it suggests increased risk for the stock market. (This is only one of several indicators I look at regularly. Others remain positive so I wouldn't panic...yet.)

What's Working In The Stock Market:

Here's an interesting chart from CapitalSpeculator which shows the performance of various "factor" ETFs. With the market making new highs, it's interesting to see what kinds of stocks are moving the market. Here's the chart:

I suppose it's not surprising that high beta stocks (stocks that tend to rise or fall at a greater rate than the overall market) are leading the way. It also looks like value and quality are doing well.

What I do find surprising is the poor performance of momentum and growth stocks (small-cap and mid-cap). This may reflect investors switching into stocks expected to benefit from economic recovery and/or inflation and casting out pandemic beneficiaries. We'll see...

Inflation Update:

The inflation numbers this week were "mixed" in my view. On a year-over-year basis, prices rose 5.4% in July, the same as in June. The good news - the monthly increase in July was 0.5%, down significantly from June's scary 0.9% gain. However, 0.5% per month is 6.0% on an annual basis, a number I am not happy about!

I am doing some further research on inflation. Perhaps a separate newsletter is warranted in the next couple of weeks. The timing will depend on the weather...

End Of Summer Reading:

While you are waiting for my essay on inflation, you might want to consider a couple of books:

For car buffs: A Brief History of Motion, Tom Standage

On the CRISPR revolution: The Code Breaker, Walter Isaacson

Looking for income: The Intelligent REIT Investor Guide, Brad Thomas

From The Garden:

Blackberries are starting to ripen!

Wait! I Almost Forgot!

Was this email forwarded to you? You can sign up for your own free subscription by clicking on SUBSCRIBE NOW on the home page.

Got questions, comments, compliments? Send me an email at under.a.buttonwood.tree@gmail.com