May 9, 2022

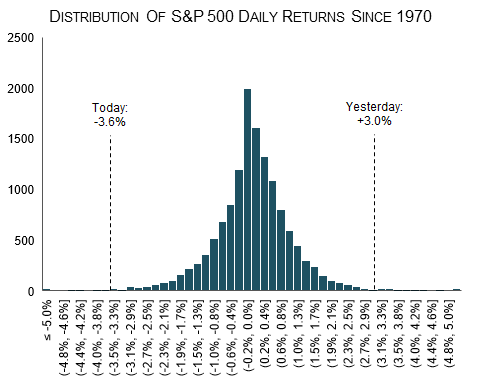

Stocks had another bad day with the S&P 500 falling 3.2% to close below 4,000 for the first time in more than one year. This chart from last Friday shows just how extraordinary today's decline and last week's big moves were compared to what we normally experience.

As a result of today's trading, all of our momentum indicators are now negative suggesting that the correction which began early this year may be eroding into a bear market. Importantly, these longer-term indicators are best evaluated on a monthly basis as markets can be very "noisy" over shorter time periods.

So before you panic, let me offer a couple of observations:

- Today's selling felt a bit more "disorganized" and widespread as it expanded beyond the tech highflyers to energy stocks (many falling 5-10%), industrials, real estate, and commodities which had been stalwarts since the start of the year. This type of price action often marks the end of a downward move - at least temporarily.

- Bonds reversed direction today. After opening down, bonds rallied throughout most of the day. This may simply reflect a flight to the relative safety of US Treasury bonds. However, whatever the reason, some stabilization of interest rates would benefit stocks as well as bonds - at least temporarily.

- Valuations are getting more attractive with prices falling and earnings generally stable to rising (despite notable exceptions like Netflix and Amazon).

So again, I don't think it's time to panic. Quite frankly, I'd be surprised if the market didn't bounce back some in the coming days. However, I do think today is a warning to remain cautious during these uncertain times, keeping your portfolio appropriately diversified and making sure you have an adequate cash reserve.