Christmas is less than two weeks away! Are you ready?

Santa Claus Is Back On Wall Street!

It seems Santa was filling investors' stockings with a gift of gains this past week! The S&P 500 rose almost 4% finishing the week at an all-time high. A welcome relief after the rocky start to December.

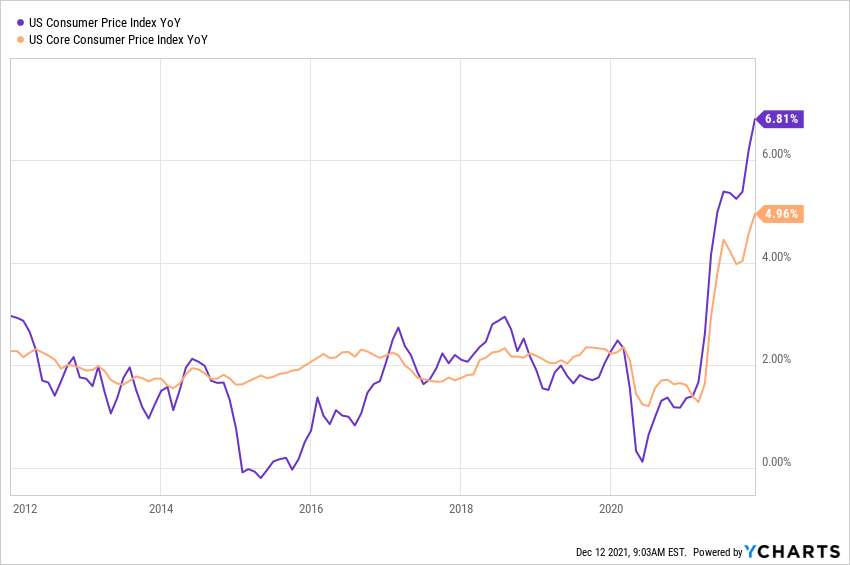

Inflation Update:

I know you must be getting tired of hearing about inflation and I'm getting tired of reporting on it. However, I believe rising inflation will turn out to be one of the most important and disruptive (not in a good way) trends in 2022 and potentially beyond. Inflation will affect our living standards, our society, our politics, and our investments. Here's the latest, rather dismal news on inflation...

Unfortunately, with today's news (12/10) that the Consumer Price Index rose 0.8% in November (an annualized rate of 9.6%!) and 6.8% for the latest twelve months, it becomes increasingly difficult to believe inflation is transitory. The core CPI (excluding food and energy), rose at a slower 4.9% pace for the latest twelve months, but that is still a 30-year high.

12-month price increases in selected categories:

- Fuel Oil: +59.3%

- Gasoline: +58.1%

- Used Cars: +31.4%

- Gas Utilities: +25.1%

- Meats/Fish/Poultry/Eggs: +12.8%

- New Cars: +11.1%

- Overall CPI: +6.8%

- Electricity: +6.5%

- Food at home: +6.4%

- Food away from home: +5.8%

- Apparel: +5.0%

- Transportation: +3.9%

- Shelter: +3.8%

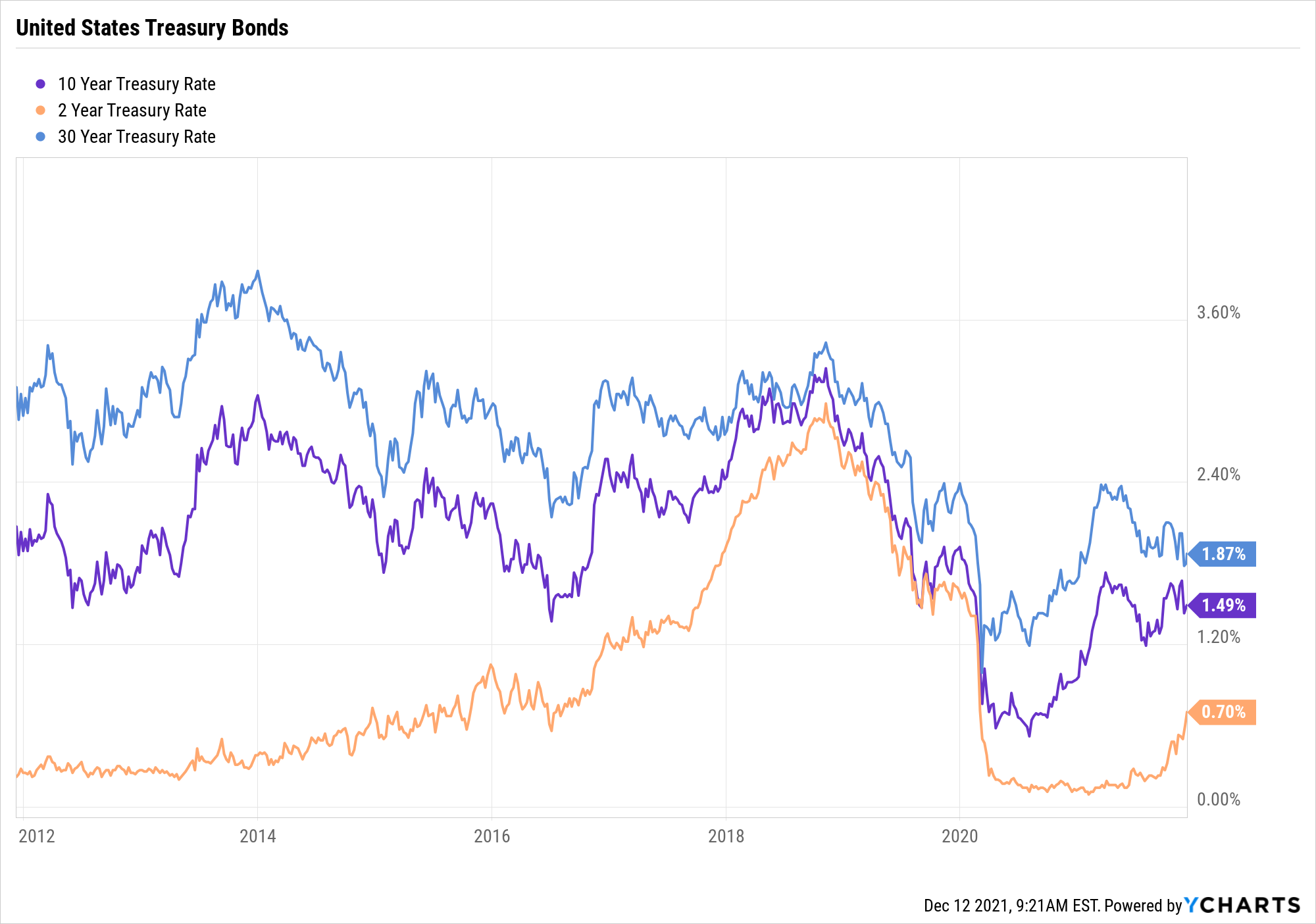

Despite the inflation news, interest rates, while up from their lows, remain remarkably subdued. However, it seems to me, the pressure on the Fed to do something must be increasing. So I think it is prudent to include rising interest rates in your investment planning for 2022.

Here are a couple of recent articles on inflation:

Inflation: What If It Doesn't? by Joachim Klement, CFA, 12/02/21

Inflation’s Warm-Up Act, Wall Street Journal, 12/10/21

"We Expect A Sea Change": Morgan Stanley Admits It Was Wrong..., Tyler Durden, 12/11/21

Running Out Of Time:

With just three weeks left in the year, it is time to stop procrastinating and take those last-minute steps to reduce this year's tax liability such as tax-loss harvesting, charitable gifts, deferring income, etc. Check with your accountant or tax advisor soon!

Here are a couple of helpful links:

2021 Year-End Tax Planning For Individuals, BDO

4 Last-Minute Ways to Reduce Your Taxes, Intuit/TurboTax

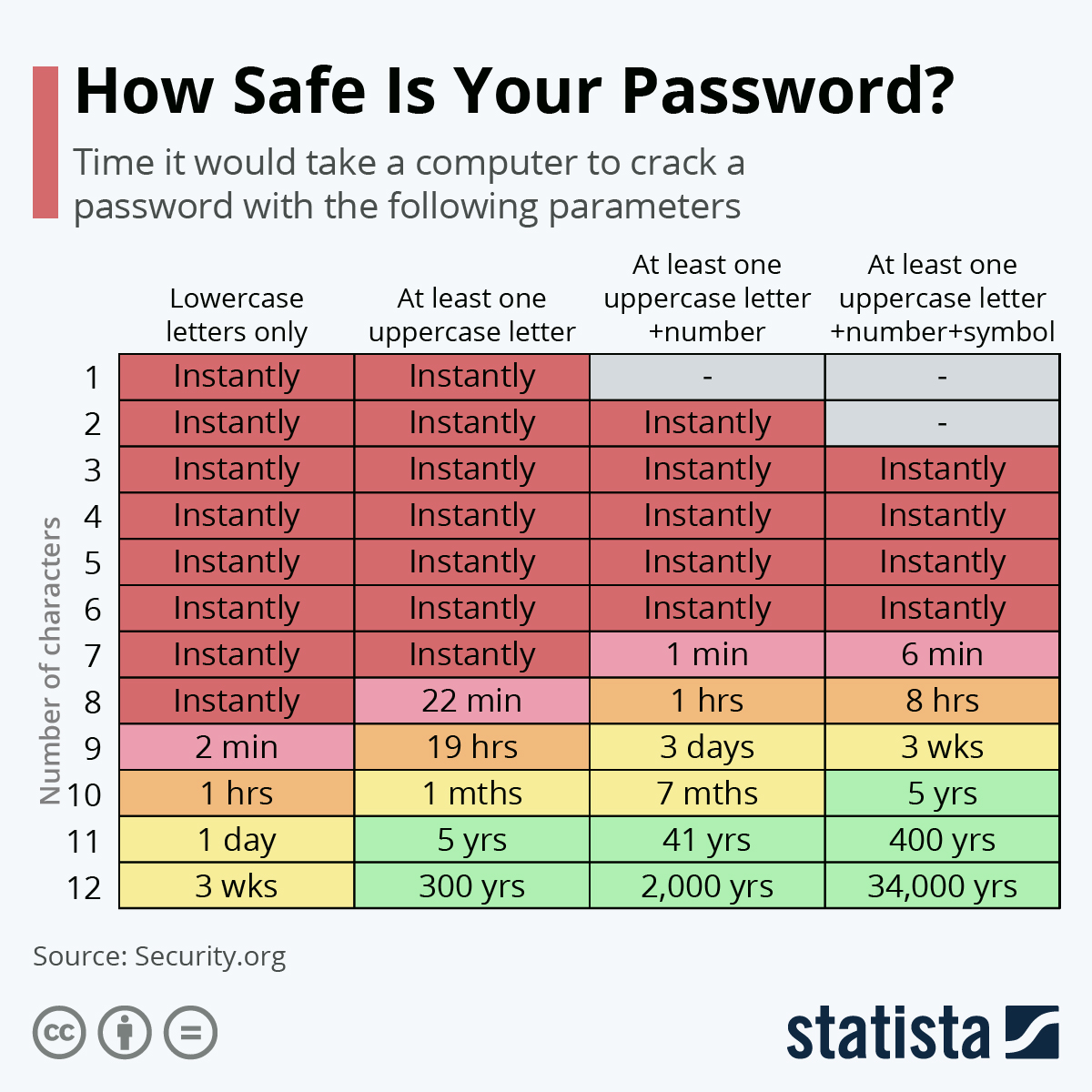

Long&Is#Str0ng!

Since we use our computers to manage our finances, secure passwords are vitally important to protect our assets. I came across this chart from Statista which gives you an idea of how difficult it is to crack a password of various lengths and character types. A password of twelve characters including capital and lowercase letters, a couple of numbers, and a symbol or two offers almost impenetrable security from a brute force attack on your account. Of course, if your password is stolen, it becomes useless no matter how long and complicated. So change your passwords occasionally and never use the same password on more than one account as it increases your vulnerability should one of your passwords ever get stolen.

Security.org has a password strength tool where you can test a password or simply compare your password's length and complexity to the chart below.

Are you having problems remembering all those long passwords? Check out password manager software like LastPass, Dashlane, 1Password, and Nordpass.

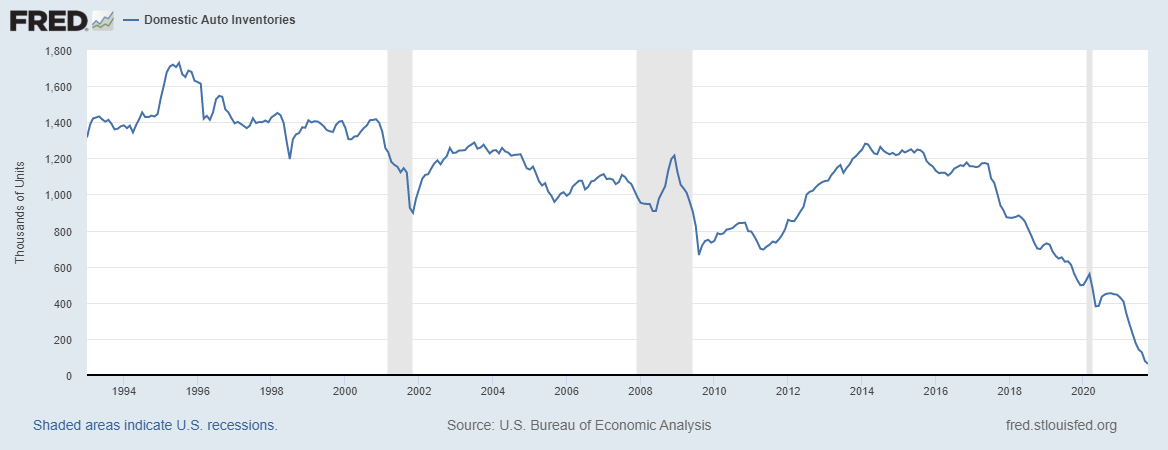

Domestic Auto Inventories Collapse

There is no better illustration of the impact the nation's supply-chain fiasco is having on our economy than this graph of auto inventories:

As of October, there were just 61,700 vehicles on dealer lots! For comparison, October 2020 inventories were 452,400 vehicles. Automakers are simply unable to get parts, particularly semiconductors, to finish and ship vehicles to dealers. The result, thanks to the laws of supply and demand, is higher prices for new and used cars (if you can find one). The silver lining should be a nice bump in GDP growth when supply issues are finally resolved and auto production ramps to rebuild depleted inventories. Of course, when this happens is anyone's guess. In the meantime, take care of that old clunker!

Don't Panic! There's Still Time To Shop For Christmas!

Looking for book ideas? Consider these two timely volumes:

Bad Blood by John Carreyou chronicles the rise and fall of Theranos one of the great frauds in corporate history. Though published in 2018, it is timely once again as its founder, Elizabeth Holmes, is on trial for that fraud right now. It is a great read (or Audible listen) and a reminder of the importance of common sense and skepticism for investors.

The pandemic has made mRNA a household word over the past two years. Walter Isaacson's The Code Breaker is an account of how Nobel Prize winner Jennifer Doudna and her colleagues launched the gene-editing revolution making today's mRNA-based vaccines from Pfizer and Moderna possible.

Or, how about an investment classic, Peter Bernstein's, Against The Gods, The Remarkable Story of Risk.

These books and more can be found at our bookstore!

Books don't work? How about an Amazon.com gift card? They can be packed in gift boxes, in greeting cards, or even sent electronically if you wake up Christmas morning in a panic because you forgot Aunt Sally.

Under A Buttonwood Tree is an Amazon Associate. As such, we earn commissions from qualifying purchases when you use the links to Amazon.com. These commissions help to offset the costs of maintaining our website. Thank you!

And Finally...

Welcome new subscribers. Thank you! You can find previous newsletters and more information by heading over to our Home Page. And be sure to visit our Bookstore Market Laboratory.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, just click the subscribe button. It's free! (Well, not exactly. After all, it does take several minutes of your valuable time to read. But we hope you will find spending that time worthwhile!)

We're always interested in your feedback, ideas for topics, and questions. So please click the button below.

If for some reason the button doesn't work, please email us at: under.a.buttonwood.tree@gmail.com