In the last newsletter, I said it looked like clear sailing for the market as we entered December. It now seems I may have been a bit too optimistic. (This is also a good reminder that forecasts are prone to being wrong - even mine.) I did suggest that there might be some unexpected rough seas caused by COVID news. Turns out, news from Fed Chairman Powell was the culprit instead.

First, on COVID, I still think we're going to be ok with the Omicron variant, similar to how we've coped with Delta. Early reports suggest that while it is easily transmitted, the symptoms tend to be mild. Of course, as more information is received, this view may have to be altered. Even so, I think the biggest COVID threat to the economy and the stock market at this point is not the virus itself but actions that may be taken by federal, state, and local officials to deal with it.

Second, while there is a transitory component to inflation, recent Fed comments (see below) lead me to believe there is increasing concern within the Fed that inflation may run "hot" even after supply-chain bottlenecks and other pandemic-induced disruptions are resolved. Accelerating the taper and/or raising interest rates sooner than expected is now more likely. Stocks sold off on the comments, some significantly. As a result, several of our indicators have turned down, suggesting we should expect further downward volatility in the days ahead.

However, the market's underlying trend remains up (for now), the economy is reaccelerating after the Q3 dip, and interest rates remain surprisingly stable, even falling in some cases.

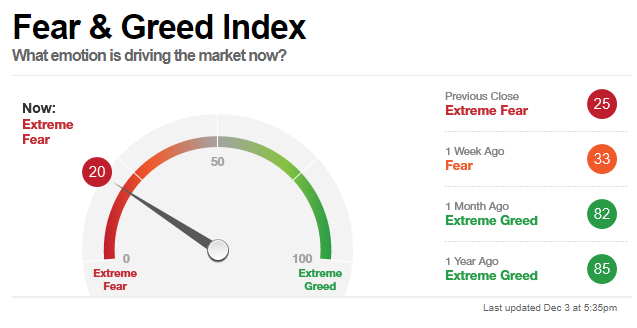

Finally, according to CNN Money, the level of fear in the market is the highest it has been since the pandemic lows of 2020 suggesting that excesses in the market are being worked off perhaps setting the stage for a "Santa Claus rally".

So, I think the greatest risk right now is being whipsawed, selling when we should be buying and buying when we should be selling. Perhaps the best approach is to do as little as possible unless there are significant changes to the underlying trends we track.

Is The Fed Finally Getting Concerned About Inflation?

This headline just popped up on wsj.com today (11/30) just before noon: Powell Warns Elevated Inflation Justifies Faster Reduction of Bond Purchases. Not surprisingly, stocks are now falling sharply while bonds seem to be ok with the news and are rising nicely. Perhaps bond market participants are happy to see the Fed getting more aggressive on inflation or it may be a knee-jerk flight to safety. So it looks like we're going to be dealing with some Fed "whitecaps" in addition to COVID as we finish off the year. As a result, it's beginning to feel like stocks are in the midst of a "correction" right now. While corrections can turn into bear markets, I don't currently see anything in our indicators to suggest that is about to happen. So much for smooth sailing...

November Review:

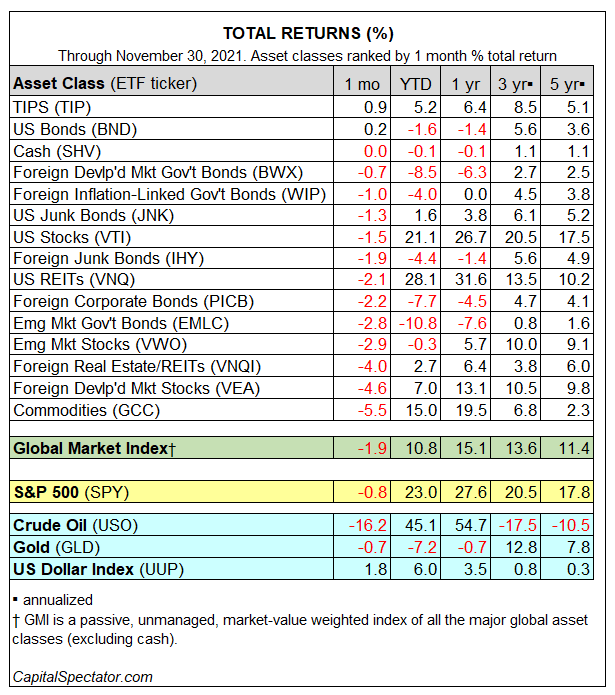

November, thanks largely to the days after Thanksgiving, turned out to be not such a good month with the S&P 500 down 0.8%. Only domestic bonds produced positive returns as you can see in this table from CapitalSpectator.

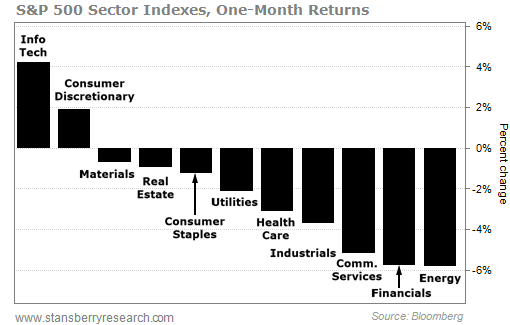

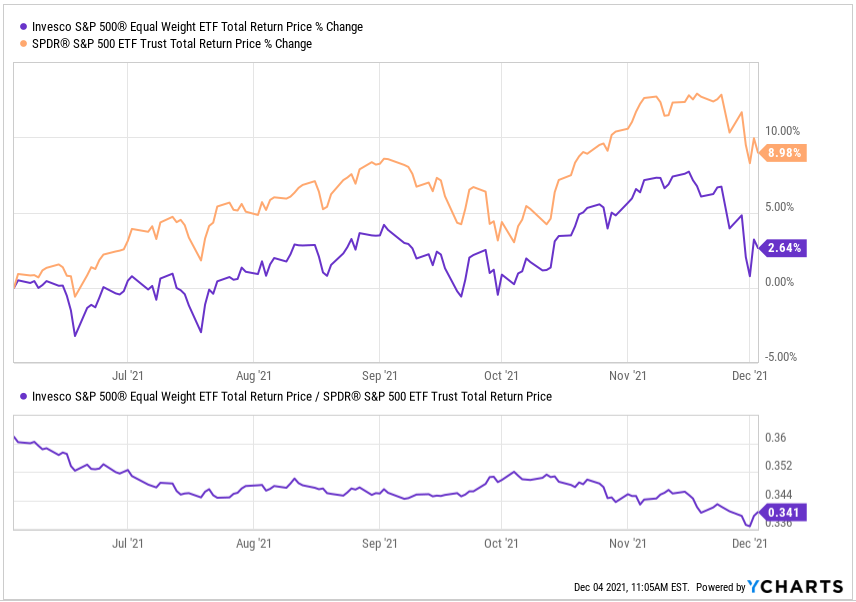

Here's a breakdown of returns by sector in the S&P 500 last month. Only technology and consumer discretionary posted positive returns. Rember that tech stocks dominate the S&P 500, so their strong performance helped keep the decline under 1%. However, RSP, the equal-weighted S&P 500 ETF, fell 2.6%.

Updates InThe Market Lab:

I have updated some of the charts in the Market Lab to reflect recent market action. Remember to click on the caption to get the most up-to-date version of the chart in question.

Needless to say, after this week's market action, it is not a pretty picture in aggregate suggesting that we may be in for a few bumpy weeks.

Remember This From Our Last Issue?

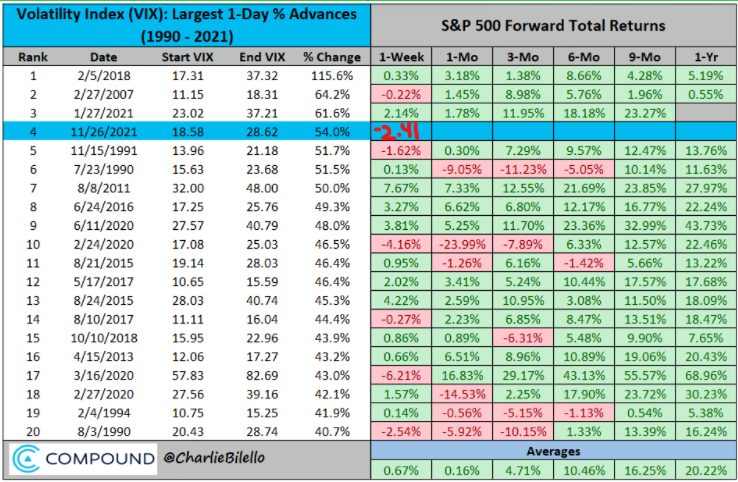

The table above shows the performance of the S&P 500 after a large one-day spike in volatility as measured by VIX. Generally, the changes are positive. Unfortunately, that wasn't the case last week with the S&P 500 falling 2.41%. Let's see how it looks at the end of the month...

COVID-19 Updates:

The CEO of Moderna said in a recent interview that their vaccine may not be as effective on the Omicron variant. I'm not sure this matters if, as it seems from early reports, the symptoms are mild (which would suggest low hospitalization and death rates). We'll just have to wait and see.

Moderna chief predicts existing vaccines will struggle with Omicron, Financial Times, 11/30/21

Oxford University says no evidence yet that vaccines won't protect against severe disease from Omicron, Reuters, 11/30/21

A reason for optimism on Omicron, STAT, 12/01/21

This should not be a surprise: First case of Omicron coronavirus variant identified in the U.S., STAT, 12/01/21. And it seems to be spreading quickly...

Unless something dramatic and/or market-moving occurs, this will likely be the last COVID-19 update for a while.

Some Thoughts On Concentration in the S&P 500

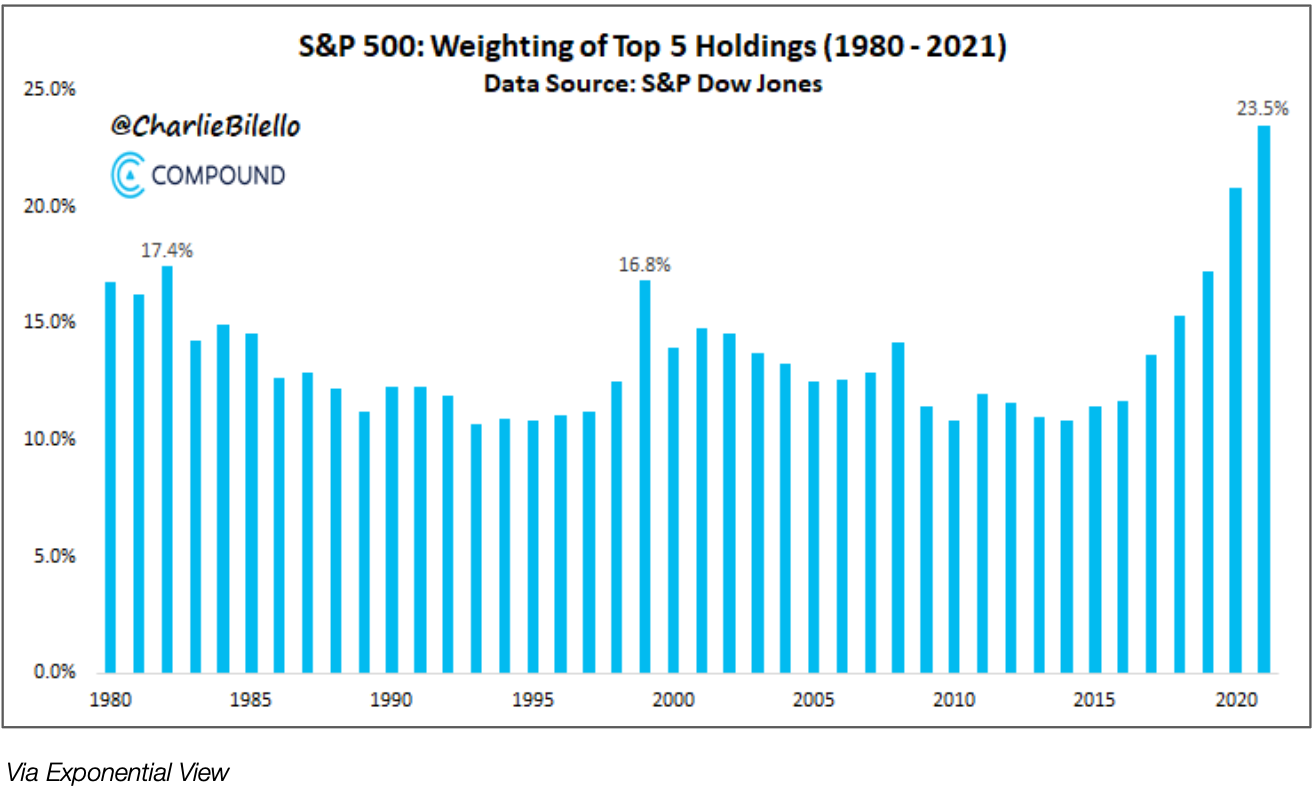

I took note of this chart from Charlie Bilello at Compound Advisors. It shows how top-heavy the S&P 500 has become. The top five holdings now represent almost one-quarter of the total value of the index, far exceeding the prior highs over the past forty years.

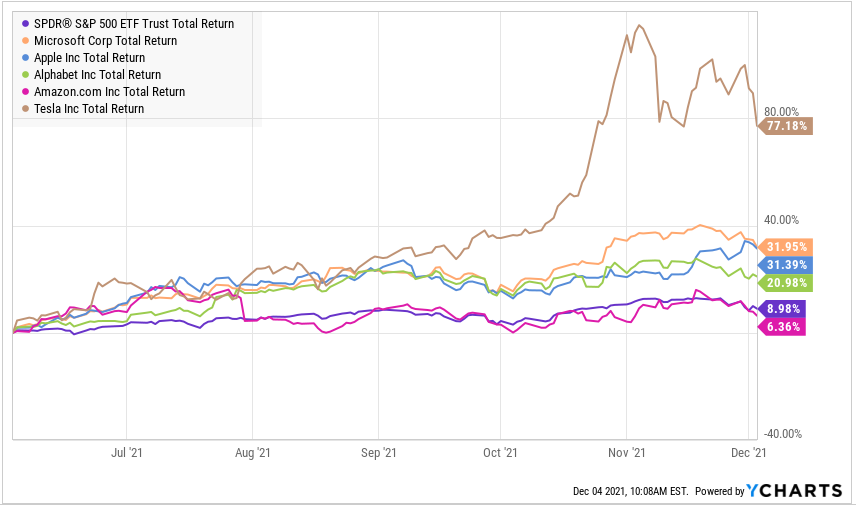

Those five stocks in order of importance are Microsoft, Apple, Alphabet (Google), Amazon, and Tesla. Here's a chart of those top five stocks and the S&P 500 over the past six months. Only Amazon has lagged the S&P 500.

This next chart plots the price of the equal-weighted S&P 500 (RSP) relative to the S&P 500 (SPY) in the lower panel. When that line is falling, it means RSP is doing worse than SPY, more evidence that the largest stocks have been driving the market higher, while smaller stocks lag.

The heavy concentration of just five stocks in the S&P 500 isn't necessarily a reason to sell. After all, it's been that way for several years in this current bull market. However, I do think it is a reason to be wary if you own SPY or one of the other S&P 500 index funds, particularly if a couple of these giant companies start to really slow down.

Growth Is Slower Than It Seems:

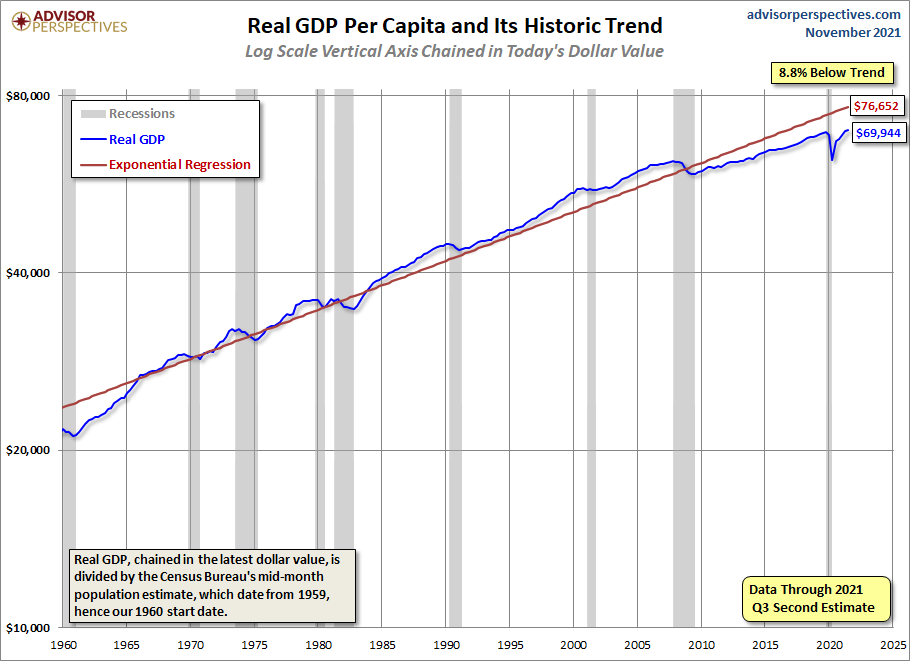

Here's a graph of real GDP on a per capita basis. It looks like we've been growing below trend for more than a decade. So the big gains in GDP we're seeing now are just getting us back to trend. It also suggests to me that all the government spending we've seen over the past decade isn't doing much to boost the economy.

Inflation Update And An Idea:

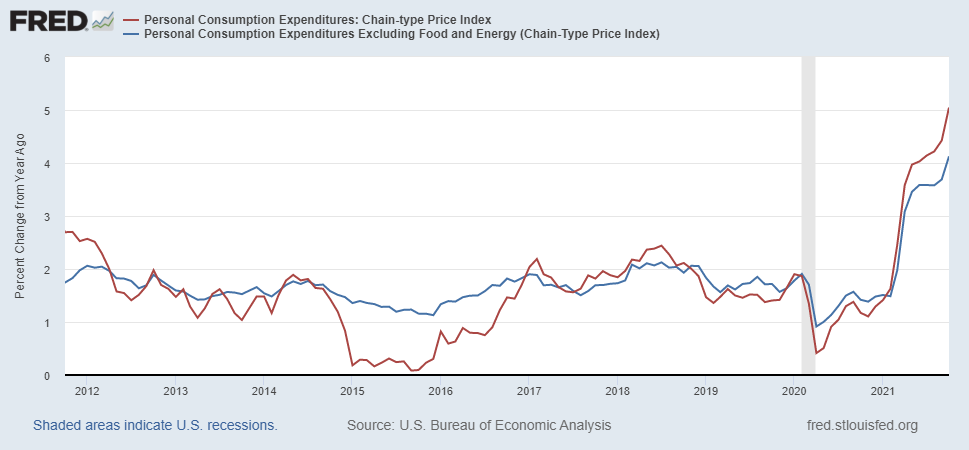

The Federal Reserve's favorite inflation gauge is the core (excluding food and energy) Personal Consumption Expenditures index (PCE) shown below. It had been fairly stable for almost a decade, oscillating between one and two percent. Then the pandemic hit. Now it is soaring. Chairman Powell's comments on Monday suggest that the Fed is beginning to get concerned about the PCE's steady rise.

Here is one firm's take on inflation: The Case for Transitory Inflation Stands—For Now, Olga Bitel, Partner, William Blair & Co., 11/30/21

Some potentially good news for inflation: Supply chain woes could be easing, ISM factory data suggest, MarketWatch, 12/02/21. Good news for GDP as well.

Now here's the idea... I-Bonds:

The United States Treasury, in its never-ending quest to fund our yawning federal deficit, offers to individuals 30-year Series I Savings Bonds (I-Bonds). What's so special? I-Bonds earn interest with both a fixed interest rate set at the time of purchase and an added inflation rate that adjusts every six months. The combined annual rate available now through next April 2022 is 7.12%.

You will need to open an account at TreasuryDirect if you wish to invest. There is a link below.

Here's what I like about I-Bonds:

- The variable rate component provides some protection against inflation.

- It's free from state income taxes.

- You can defer federal income taxes until the bond is sold.

- Interest is compounded semiannually.

- The bonds are backed by the full faith and credit of the United States - about as riskless as you can get.

- There is no market risk. You can redeem at face value plus interest earned at any time (subject to penalties).

Here's what I don't like:

- Each individual is limited to purchasing $10,000 per year. (The minimum purchase is only $25.)

- There are penalties should you decide to sell your bonds within 5 years of purchase. (The penalty is three months of interest.)

Click the link to the TreasuryDirect website where there's a lot more information about the bonds, how to buy and sell them, tax issues, limitations, etc. I've also included this link to a Forbes article on the subject.

Note: this is not a recommendation to buy, sell, or hold this or any security. Check with your investment and/or tax advisor if you are considering a transaction. Please review our complete disclosures here.

A Worthwhile Podcast:

Here's a worthwhile podcast for those of us who want to learn more about the investment process from one of the great investment minds today, Michael Mauboussin. You can find his books in our bookstore should you want to delve further...

Uncle Sam's Helpful Tax Hints:

Steps to Take Now to Get a Jump on Your Taxes

If you haven't already, now is the time to consider tax-loss harvesting and other steps to reduce this year's tax liability. Don't procrastinate! You've got less than a month to take action!

A Christmas Shopping Savings:

If you do a lot of your shopping on the web, you should check out Honey. Once installed on your browser, it automatically searches for coupons and discounts and applies them to your order. In addition, you can earn credits for every dollar you spend on "Honey-enabled" websites which you can convert into gift cards or PayPal credits for further savings. By the way, Honey is owned by PayPal so I think you can feel confident in using this service. Find a link to Honey on our Resources page. And it's not just for Christmas shopping!

And Finally...

Welcome new subscribers. Thank you! You can find previous newsletters and more information by heading over to our Home Page. Be sure to visit our Bookstore Market Laboratory.

Please feel free to forward this newsletter to a friend.

If you're not a subscriber and would like to be, visit the Home Page to sign up. It's free!

Have questions or comments? Email us at under.a.buttonwood.tree@gmail.com.